How To Flip Houses In Washington: Step-By-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in Washington involves buying undervalued properties, renovating them to boost market value, and selling for a profit. The article covers strategies for major cities like Seattle, Spokane, and Tacoma, as well as opportunities in smaller towns.

Why: Washington offers lucrative real estate opportunities due to strong housing demand, growing populations, and high resale potential, making it ideal for investors seeking profitable flips.

How: Follow the steps in the article: research Washington’s local housing markets, secure financing, find and evaluate undervalued properties, manage renovations effectively, and sell strategically to maximize returns.

House flipping in Washington holds tremendous potential for investors. With the eighth-fastest growth rate in the country and limited inventory, demand for housing is near all-time highs. Therefore, if you're intrigued by the promise of turning a profit through strategic property renovations and resales, this is the time to learn how to flip houses in Washington.

This article will explore the intricacies of flipping houses in Washington, providing invaluable insights and step-by-step guidance. From understanding the nuances of the Washington real estate market to implementing effective strategies that yield impressive returns, we'll equip you with the knowledge and tools needed to learn how to flip houses in Washington, including:

- What Is Flipping Houses?

- Washington House Flipping Statistics

- How To Flip Houses In Washington (7 Steps)

- How To Find Houses To Flip In Washington

- Do You Need A License To Flip Houses In Washington?

- How To Flip A House In Washington With No Money

- Best Cities To Flip Houses In Washington

- Final Thoughts On Flipping Homes In Washington

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses has become synonymous with exceptional opportunities for real estate investors, attracting them with remarkable income potential. According to ATTOM Data Solutions' latest Year-End Home Flipping Report, the average flipped home in the U.S. yielded a gross profit of $67,900, representing an impressive return on investment of 26.9%.

Outside of its impressive potential, what is house flipping? In addition to being an investment strategy that involves purchasing, renovating, and selling properties, flipping houses is an involved process. Investors must thoroughly understand each step and learn how they all work together to flip a home.

Successful house flipping is a dynamic and demanding venture that requires meticulous planning, market analysis, renovation expertise, effective project management, and countless other skills. By embracing these core principles and leveraging the opportunities presented by the real estate market, investors can use this guide to learn how to flip houses in Washington. Let’s get started.

Why Flip Houses In Washington?

Flipping houses in Washington presents a promising opportunity for investors seeking strong returns in a competitive yet rewarding market. The state's diverse economy, growing population, and desirable locations like Seattle, Spokane, and Tacoma create a consistent demand for housing and renovation-ready properties. According to RealtyTrac, Washington currently has 1,735 properties in foreclosure, 183 bank-owned properties, and 1,314 headed for auction—offering a wide range of prospects for those ready to flip. Perhaps most appealing is the profit potential. ATTOM Data Solutions' latest Home Flipping Report shows the average gross flipping profit nationwide is $72,000, translating to a 29.6% return on investment. While this figure represents the national average, it still demonstrates the lucrative nature of flipping, often outperforming more traditional investments like the S&P 500. With the right strategy, flipping houses in Washington can be a smart, high-yield investment choice in today’s real estate landscape.

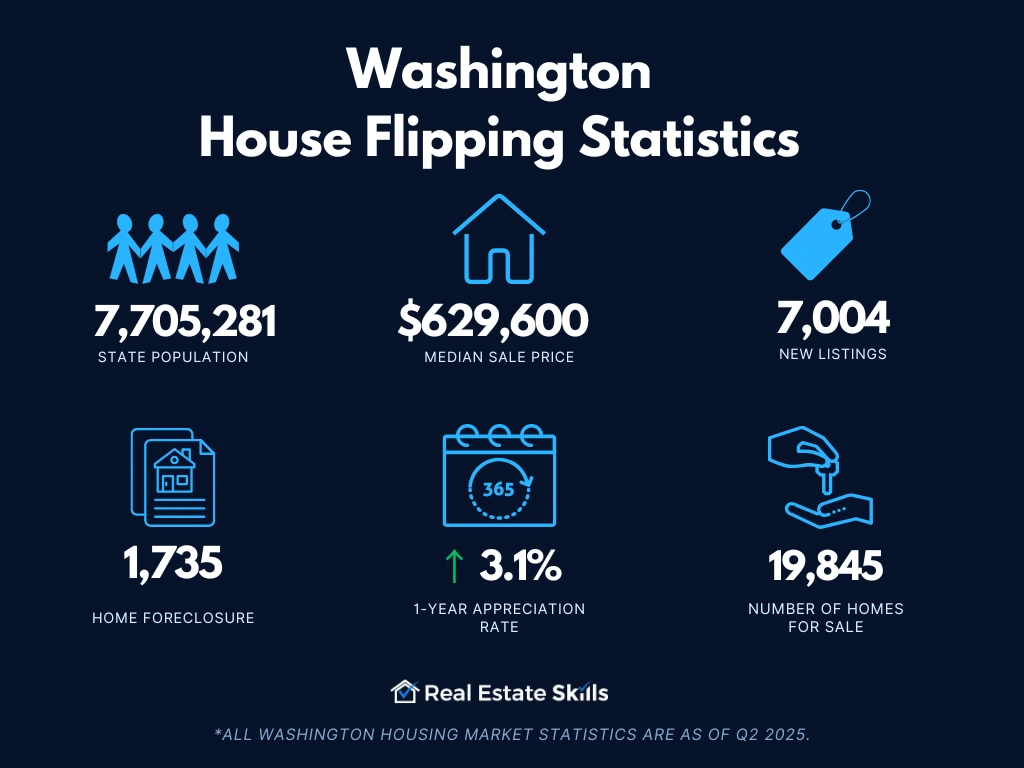

Washington House Flipping Statistics

Achieving success as a house flipper in Washington hinges upon a comprehensive understanding of the data that make up the local real estate market. Familiarizing yourself with these key factors can significantly enhance your chances of achieving your house-flipping goals:

- Population: 7,705,281

- Employment Rate: 61.1%

- Median Household Income: $94,605

- Median Sale Price: $629,600 (+1.8% Year-Over-Year)

- Number Of Homes Sold: 5,594 (+2.2% Year-Over-Year)

- Median Days On Market: 35 (+4 Year-Over-Year)

- Number Of Homes For Sale: 19,845 (+13.3% Year-Over-Year)

- Number Of Newly Listed Homes: 7,004 (-7.5% Year-Over-Year)

- Months Of Supply: 2 (+0 Year-Over-Year)

- Homes Sold Above List Price: 31.6% (+0.8 Points Year-Over-Year)

- Homes With Price Drops: 22.5% (+1.9 Points Year-Over-Year)

- Home Foreclosure: 1,735 Properties

*All Washington housing market statistics are as of Q2 2025.

Similar to what you’d learn in a Flipping Houses 101 course, it's crucial to equip yourself with comprehensive market data, monitor economic trends, and understand the prices within the California market. This knowledge will guide house-flipping strategies California investors implement and assist them in learning how to flip houses in California.

How To Flip Houses In Washington (7 Steps)

Mastering the art of flipping houses in Washington involves following seven steps. By understanding and implementing these steps, investors can navigate Washington’s unique real estate landscape and increase their chances of success:

- Find A House-Flipping Mentor

- Research The Local Housing Market

- Find & Analyze Distressed Properties

- Raise Capital To Fund The Deal

- Close On The House

- Renovate The Property

- Resell The House

Find A House-Flipping Mentor

New investors can flip houses alone, yet the guidance of a mentor holds tremendous advantages. Drawing upon their expertise offers real-world insights, valuable strategies, and a supportive network for growth. Moreover, a mentor instills confidence, turning obstacles into opportunities for untapped potential.

Whether through networking, paid services, or seeking recommendations, finding a mentor doesn’t have to be complicated. New investors simply need to take a few minutes to find someone who can be of assistance. If for nothing else, investing in a mentor is an investment in your future. Actively asking for help can go a long way in creating the foundation of a very successful career in the flipping industry.

Research The Local Housing Market

The best resources for researching the Washington real estate market include, but are not limited to, the following:

- Zillow Housing Data Research

- Zillow’s Washington Market Overview

- Redfin’s Washington Housing Market Overview

- Realtor.com’s Washington Market Overview

- ATTOM Data Solutions’ Washington Real Estate & Property Data

- Federal Reserve Bank of St. Louis’ Washington Data

- SoFi’s State Foreclosure Data

- U.S. Census Bureau’s Washington Data

- Bureau Of Labor Statistics’ Washington Economic Data

Find & Analyze Distressed Properties

When it comes to finding and analyzing distressed properties in Washington, various approaches are available to investors. One method that can provide a solid starting point, particularly for new investors, is the 70% rule.

First, investors must determine the property's after-repair value (ARV); this entails evaluating recent sales data of comparable properties in the area to estimate the property's potential value after it has been renovated. The ARV is a crucial indicator of the property's future selling price.

Once the ARV is established, investors can apply the 70% rule. Multiply the ARV by 70% (or 0.70) and subtract the estimated rehab costs. The resulting figure represents the maximum allowable offer (MAO), a guideline for investors to ensure sufficient room for profitable margins.

Here is the formula:

ARV - Fixed Cost - Rehab Costs - Desired Profit = Maximum Allowable Offer (MAO)

While the 70% rule should not be solely relied upon for a comprehensive analysis, it can provide a quick snapshot of the deal's feasibility.

As investors gain experience, they can refine their analysis and better understand the market dynamics that shape each deal.

Nevertheless, the 70% rule offers a valuable starting point for investors venturing into the world of house flipping in Washington.

Raise Capital To Fund The Deal

When it comes to flipping houses in Washington, securing the necessary funds to finance the deal is a critical step for investors. While some may consider using personal funds, exploring borrowing options is often more advantageous.

Utilizing external funding has several benefits. Firstly, it helps investors avoid depleting their savings and facing financial constraints. Secondly, it allows for scalability, as consecutive loans can enable investors to take on multiple deals simultaneously, expanding their business.

Private and hard money loans are popular choices among house flippers. Although they come with higher interest rates, the advantages outweigh the costs. By accepting higher rates, investors gain quick access to funds, giving them a competitive edge in Washington's real estate market.

Conducting thorough research, due diligence, and understanding the terms, conditions, fees, and repayment requirements of various funding options are essential for investors in their pursuit of flipping houses in Washington.

Close On The House

Closing on a house in Washington involves a series of important steps to ensure a smooth and successful transaction:

- Purchase Agreement: The buyer and seller agree to the terms of the sale, including the purchase price, contingencies, closing date, and other milestones. This agreement serves as a legally binding contract.

- Escrow Arrangement: Washington is an escrow state, meaning a neutral third party, such as an escrow agent or title company, facilitates the transaction. The buyer or their agent will establish an escrow arrangement to handle the transfer of funds and necessary documents.

- Due Diligence: The buyer conducts due diligence, including a thorough property inspection, title search, appraisals, and addressing any contingencies outlined in the purchase agreement. This step ensures the buyer's interests are protected.

- Document Handling: The escrow agent or title company manages all the necessary documents and ensures their accuracy. They ensure everything is in order for the transaction to proceed.

- Document Review & Signing: All parties involved in the transaction, including the buyer, seller, and their respective agents, meet to review and sign the required documents; this includes the finalization of any financing arrangements.

- Funds In Escrow: The buyer places the funds in escrow once the documents are signed. The funds remain in escrow until all agreed-upon prerequisites are met. Once the escrow terms are fulfilled, the funds are disbursed to the seller, and the buyer receives the keys to the house.

- Title Transfer: Following the closing, the local Recorder's Office documents the transfer of title to reflect the completion of the transaction officially.

By following these steps, investors can navigate the process effectively and successfully close on a house in Washington, ensuring a smooth ownership transition for their investment property.

Renovate The Property

When renovating a property for a successful house flip in Washington, it's important to approach the renovations strategically to maximize the investment potential. Prioritize renovations that offer a high return on investment without overspending. Focus on areas significantly impacting the property's value, such as the kitchen, bathrooms, flooring, and curb appeal. By carefully selecting renovations, investors can increase their profit margins.

According to Remodeling Magazine, the renovations that return the most money to investors at the time of a sale in Washington (and the rest of the Pacific region) are:

- Electric HVAC Conversion: Recoups 104.8% of the original cost

- Vinyl Siding Replacement: Recoups 98.3% of the original cost

- Garage Door Replacement: Recoups 96.8% of the original cost

- Steel Entry Door Replacement: Recoups 88.7% of the original cost

- Fiber-Cement Siding Replacement: Recoups 86.9% of the original cost

Resell The House

Once the renovations are complete, it's time to resell the house and aim for a profitable return on investment. Consider the following key strategies:

- Timely Sale: Selling the house quickly is essential to maximize profit margins. The longer the property remains unsold, the more costs accumulate, including holding costs, property taxes, repair expenses, and missed opportunities. By selling the house as soon as it's restored to its desired condition, investors can minimize additional expenses and optimize returns.

- Profitable Selling Price: The primary objective is to sell the property at a price that exceeds the total investment. If the property was acquired at a significantly lower cost than its fair market value and the renovations have substantially increased its worth, investors should be well-positioned to generate a profit. Careful analysis of the local market and setting a competitive selling price are crucial factors for success.

- Real Estate Professional: Collaborating with a real estate professional, such as a Realtor or agent, can prove beneficial, despite the higher upfront costs. These professionals possess the expertise, a vast network, and knowledge of the local market dynamics. They can provide valuable insights, help navigate the selling process, and utilize effective marketing strategies to attract interested buyers. Their expertise often leads to a faster sale and a higher selling price—more than compensating for their fees.

- Repaying Obligations: After a successful sale, it's important to prioritize repaying any outstanding obligations, such as repaying the lender and covering any accrued interest. Clearing these financial obligations ensures a clean and complete final step in house-flipping.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In Washington

Employing effective strategies is crucial when searching for houses to flip in Washington. Here are several proven methods to help investors discover potential properties:

- Collaborate With Local Real Estate Professionals: Network with real estate agents and Realtors with extensive local market knowledge. Their insights and connections can provide valuable information for on- and off-market properties.

- Utilize the Multiple Listing Service (MLS): Gain access to the MLS, the largest database of real estate listings in Washington. This platform provides comprehensive information about properties for sale and allows investors to identify potential investment opportunities.

- Attend Foreclosure Auctions: Participate in foreclosure auctions organized by banks and lending institutions. These auctions often offer properties at discounted prices, allowing investors to secure deals below market value.

- Research Public Records: Visit the local Recorder's Office to access public records related to distressed properties and motivated sellers. Investors can identify homeowners open to selling their properties under favorable terms by analyzing the information they find.

- Implement Direct Mail Campaigns: Launch targeted direct mail campaigns to reach distressed homeowners directly. Investors can identify potential opportunities and engage with sellers who may be interested in selling their properties by sending marketing materials to a targeted audience.

- Explore Neglected Properties: Otherwise known as driving for dollars, investors should get in their cars and try to find neglected homes. While not always the case, neglected homes may indicate motivated sellers.

Read Also: Finding Motivated Seller Leads: Free & Paid Tactics

Do You Need A License To Flip Houses In Washington?

In Washington, flipping houses does not require a real estate license. However, obtaining a license can offer certain advantages to investors. While it is not mandatory, having a real estate license provides access to a broad network of professionals in the industry. Additionally, licensed individuals can directly access the MLS without relying on external assistance.

It's important to remember that the requirements and regulations may vary in different states. In Washington, a real estate license is not mandatory for flipping houses. However, it's always advisable to consult local laws and regulations to comply with specific licensing requirements.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How To Flip A House In Washington With No Money

Flipping a house in Washington without using personal funds is possible by leveraging alternative financing options. Private and hard money lenders can provide the necessary funds, bypassing traditional banks and avoiding credit checks and lengthy approval processes. These lenders offer short-term financing solutions, enabling investors to access cash quickly and expedite their deals.

Wholesaling is another viable strategy for flipping houses in Washington with no money. Wholesalers can secure a property under contract and assign it to cash buyers for a fee. This approach allows investors to earn income without making a significant capital investment upfront.

Investors must explore these financing options and determine the most suitable approach based on their specific circumstances and goals.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

Best Cities To Flip Houses In Washington

The best cities to flip houses in Washington include, but are not limited to:

- Seattle: With a median home value of $831,738, the Seattle real estate market isn’t exactly “affordable.” However, with insufficient inventory and plenty of pent-up demand, flippers shouldn’t have difficulty finding buyers for their projects—at high-profit margins, nonetheless.

- Tacoma: As the more affordable alternative to Seattle, Tacoma is a great place to learn how to flip houses in Washington because of its demand. More and more people are turning to Tacoma for affordability, driving up profits for investors in the meantime.

- Spokane: Even more affordable than Tacoma, Spokane became a popular destination during the pandemic. As more people could “work from home,” many Washington residents decided to move to Spokane to avoid the higher prices of Settle. The added attention has made Spokane the perfect place to learn how to flip houses in Washington.

Final Thoughts On Flipping Homes In Washington

Learning how to flip houses in Washington requires careful planning, strategic decision-making, and leveraging the available resources. From identifying profitable opportunities to conducting cost-effective renovations and finding suitable financing options, investors can navigate the house-flipping process successfully. Those who do so by following the steps outlined above should enjoy a lucrative career.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Washington. We're committed to providing the knowledge, resources, and support you need to successfully navigate a Washington property flip. So avoid common mistakes and maximize your returns by leveraging our expertise.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.