How To Flip Houses In Wisconsin: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in Wisconsin involves buying undervalued properties, renovating them to increase their market value, and selling for a profit. The article highlights opportunities in cities like Milwaukee, Madison, Green Bay, and other local markets.

Why: Wisconsin’s affordable housing market and steady demand for updated homes make house flipping a potentially lucrative investment for both new and experienced investors.

How: Follow the article’s guidance: research Wisconsin real estate markets, secure funding, identify undervalued properties, manage renovations efficiently, and sell strategically to maximize returns.

Wisconsin boasts an active and growing housing market that investors may want to pay closer attention to. In particular, the state's strong economy, relative affordability, and diverse industries have led to steady population growth. Millennials, in particular, have chosen to call Wisconsin home, which bodes well for local investors.

“The median age of the population residing in the state of Wisconsin is approximately 39.1 years of age,” according to World Population Review. That’s important on many levels, but primarily because older millennials (33 to 42 years old) have represented the largest population of buyers for the better part of a decade.

The Badger State’s largest age population is in its prime homebuying years, and those who learn how to flip houses in Wisconsin may be in line to benefit from a massive tailwind. Whether you are new to investing or simply want to further your real estate knowledge, this guide will teach you everything you need to know about how to flip houses in Wisconsin, including:

- What Is Flipping Houses?

- Why Flip Houses In Wisconsin?

- Wisconsin House Flipping Statistics

- How To Flip Houses In Wisconsin In 15 Steps

- How Much Do House Flippers Make In Wisconsin?

- Is House Flipping Illegal In Wisconsin?

- Do You Need A License To Flip Houses In Wisconsin?

- How Much Does It Cost To Flip A House In Wisconsin?

- How To Flip A House In Wisconsin With No Money

- What's The Best Place To Flip Houses In Wisconsin?

- Is It Hard To Flip Houses In Wisconsin?

- How Do You Find Contractors For Flipping Houses In Wisconsin?

- Final Thoughts On Flipping Homes In Wisconsin

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

House flipping is one of the most popular real estate exit strategies used by today’s most successful investors, and for a good reason: the income potential is hard to ignore. According to ATTOM Data Solutions’ latest Year-End Home Flipping Report, the average home flipped as recently as last year “typically generated a gross profit of $67,900 nationwide.”

Flipping houses has proven it belongs in investors’ portfolios, which begs the question: What is house flipping? On the surface, it’s an investment strategy that has investors buy, rehab, and resell homes for a profit. Beneath the surface, however, home flipping is an involved process that requires a unique synergy between each stage to mitigate risk and maximize returns.

Investors must buy subject properties below their market value to succeed as house flippers. Typically, doing so will require buying homes from motivated sellers or those at risk of foreclosure. Securing deals below the home’s actual value simultaneously mitigates risk and increases profit margins.

Once the homes are acquired, investors will spend money to rehab and fix them. Renovations must be specific and cost-effective, as their sole purpose is to increase the home's value as much as possible without exceeding a predetermined budget. A good rule of thumb most investors abide by is to make the home slightly better than those it will be compared to in the same neighborhood. That way, the property will receive the most attention when placed on the market.

Investors will proceed to sell the house when all the necessary renovations have been made, and the property has reached its desired condition. If done correctly, the sale price will be high enough to cover the expenses of the flip (everything from the construction costs to the loan) and provide the investor with an attractive payday.

Why Flip Houses in Wisconsin?

Flipping houses in Wisconsin offers lucrative opportunities due to the state's strong real estate market and affordable property prices. According to recent data, the median home price in Wisconsin is approximately $270,000, significantly lower than the national average, making it an attractive market for investors looking to buy low and sell high.

According to RealtyTrac, the state currently has 1,446 properties in foreclosure, 155 bank-owned properties, and 371 headed for auction—highlighting a healthy pipeline of potential deals for house flippers. Wisconsin's steady economic growth and diverse job market contribute to a stable housing demand, particularly in metropolitan areas like Milwaukee, Madison, and Green Bay.

Additionally, the state's relatively low property taxes compared to neighboring states further enhance the profitability of house flipping. ATTOM Data Solutions' latest Home Flipping Report supports this potential, showing that the average gross flipping profit nationwide is $72,000.

Another compelling reason to flip houses in Wisconsin is the state's favorable market conditions for first-time homebuyers and rental investors, which helps sustain a steady pool of potential buyers. The state's homeownership rate is around 67%, reflecting a strong preference for owning homes among residents. This demand, combined with Wisconsin’s housing market trends, indicates that well-renovated homes can sell quickly and at competitive prices. Investors can take advantage of this by targeting properties in desirable neighborhoods where renovation can significantly increase the home's market value, ensuring a solid return on investment.

Wisconsin also boasts a relatively low cost of living, making it an appealing destination for both local and out-of-state buyers. The state's economy is bolstered by industries such as manufacturing, agriculture, and healthcare, which continue to provide job stability and attract new residents. Moreover, recent statistics show that home sales in Wisconsin have increased by about 6% year-over-year, signaling a robust demand for housing. These factors, coupled with the availability of distressed properties that can be acquired below market value, create a prime environment for house flippers to thrive in Wisconsin's real estate market.

Read Also: How To Wholesale Real Estate In Wisconsin

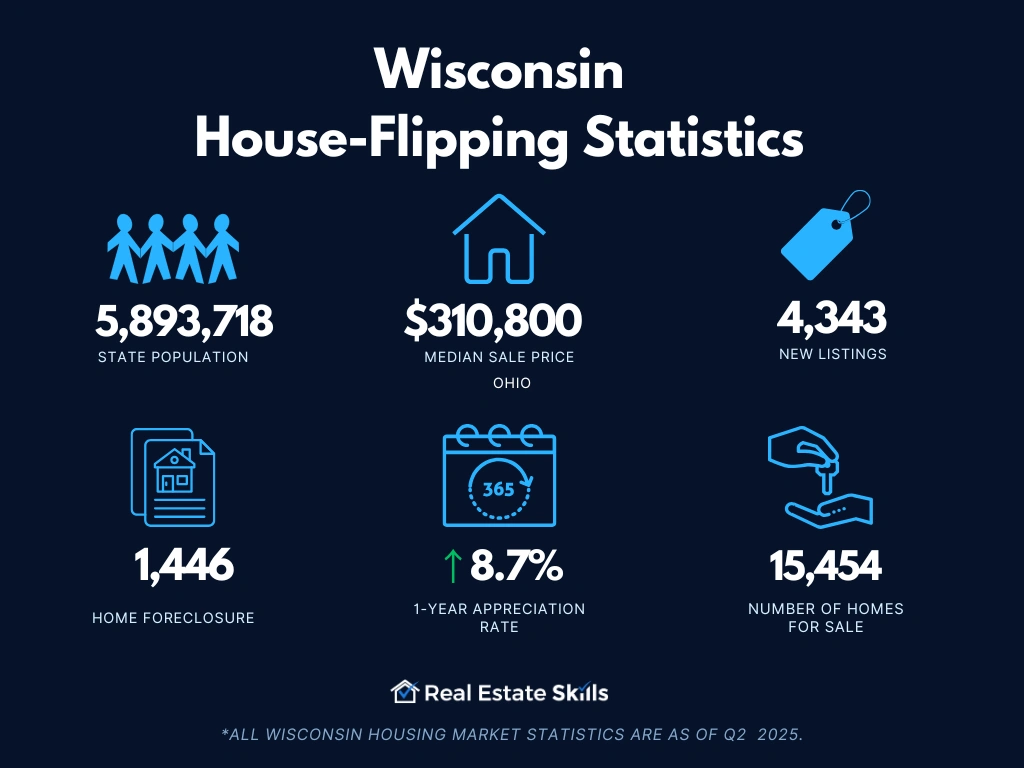

Wisconsin House Flipping Statistics

Here’s an overview of the vital data and metrics that every aspiring house flipper in Wisconsin must know:

- Population: 5,893,718

- Employment Rate: 63.4%

- Median Household Income: $74,631

- Median Sale Price: $310,800 (+8.7% Year-Over-Year)

- Number Of Homes Sold: 3,591 (+2.3% Year-Over-Year)

- Median Days On Market: 61 (+2 Year-Over-Year)

- Number Of Homes For Sale: 15,454 (+1.1% Year-Over-Year)

- Number Of Newly Listed Homes: 4,343 (-12.6% Year-Over-Year)

- Months Of Supply: 3 (+0 Year-Over-Year)

- Homes Sold Above List Price: 33.3% (-1.5 Points Year-Over-Year)

- Homes With Price Drops: 13.1% (+1.3 Points Year-Over-Year)

- Home Foreclosure: 1,446

*All Wisconsin housing market statistics are as of Q2 2025.

How To Flip Houses In Wisconsin In 15 Steps

Investors who want to learn how to flip houses in Wisconsin should start by following the seven steps outlined below:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is one of the most critical steps in flipping houses in Wisconsin. The state offers a diverse range of markets, from bustling urban areas like Milwaukee and Madison to quieter, smaller cities and rural towns. When picking your market, consider factors such as property price trends, demand for housing, economic growth, and the local job market. For instance, areas with growing populations, new business developments, and improving infrastructure often present the best opportunities for profitable flips. Understanding these local dynamics can significantly impact your success in the house-flipping business.

In Wisconsin, focusing on up-and-coming neighborhoods or areas undergoing revitalization can provide the potential for higher returns. These neighborhoods often offer lower purchase prices with the promise of appreciation as the area improves. Researching market data, such as recent sales trends, average days on market, and rental rates, can help you identify which areas are on the rise. Additionally, connecting with local real estate agents and investors can provide insights into which neighborhoods have the most potential for growth and profitability in the near future.

Another crucial aspect of picking your market is understanding the local competition. In Wisconsin, some markets may be saturated with investors, which can drive up property prices and reduce potential profit margins. On the other hand, less competitive markets might offer more opportunities to secure properties at a discount. It’s also essential to assess the type of properties that perform well in your chosen market—whether it’s single-family homes, multi-family units, or condos. By carefully evaluating the local market conditions, competition, and property types, you can select a market that aligns with your investment goals and maximizes your chances of success in flipping houses in Wisconsin.

Find Your Money

Securing financing is a pivotal step in the house-flipping process, and it requires careful planning and research. In Wisconsin, as with any real estate market, having access to sufficient funds can determine the success of your project. You will need to consider various financing options, including traditional mortgages, private lenders, and hard money loans. Each option has its benefits and drawbacks, and the right choice will depend on factors like your financial situation, the scope of your project, and the terms of the loan.

Traditional loans from banks or credit unions are common, but they can be slow and may have stringent requirements. For quicker access to funds, especially if you’re looking to close on properties quickly, private and hard money lenders are often preferred. Understanding how to navigate these options and where to find reliable lenders is essential for efficiently funding your house-flipping ventures in Wisconsin.

How To Find Private & Hard Money Lenders

Finding the right private and hard money lenders can significantly impact your house-flipping success. Private lenders are individuals or groups who lend their own money to investors. They are often more flexible than traditional banks and can offer faster approval processes. To find private lenders, network with real estate investment groups, attend local meetups, and leverage online platforms that connect investors with potential lenders. Personal referrals and recommendations from other real estate professionals can also be valuable resources.

Hard money lenders, on the other hand, are usually institutional investors or companies that offer short-term loans secured by real estate. These loans are typically used for quick funding and have higher interest rates compared to traditional loans. To find hard money lenders, consider using platforms like Kiavi and Lima One, which provide comprehensive lists of local and national lenders along with their contact information. Additionally, reaching out to real estate investment groups and attending industry events can help you connect with reputable hard money lenders in Wisconsin.

Understanding and securing the right type of financing is crucial to successfully flipping houses. Whether you opt for private lenders for their flexibility or hard money lenders for their speed, ensure you carefully evaluate the terms and conditions to make informed financial decisions.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is a crucial step in flipping houses in Wisconsin. An agent who understands the needs of investors can provide valuable insights into the local market, help identify lucrative properties, and navigate the complexities of real estate transactions. Look for agents with experience working with real estate investors, as they will be familiar with the nuances of property flipping, including identifying potential deals, negotiating prices, and understanding market trends.

Investor-friendly agents are skilled in spotting properties that fit your investment criteria, whether they are fixer-uppers or properties in emerging neighborhoods. They can also offer advice on the best areas for flipping based on current market conditions and future growth potential. Their expertise in handling transactions efficiently can save you time and money, ensuring that your flipping ventures are both profitable and smooth. Building a strong relationship with a knowledgeable agent can be a key factor in achieving success in the competitive Wisconsin real estate market.

How To Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent involves several key steps to ensure that you partner with someone who aligns with your house-flipping goals. Start by seeking recommendations from fellow real estate investors or local investment groups. These individuals can often refer you to agents who have a proven track record of working with investors and understanding their specific needs. Networking at real estate events and meetups can also lead you to agents experienced in property flipping.

Online resources are another valuable tool. Platforms like Zillow, Realtor.com, and Redfin allow you to search for agents with expertise in investment properties by filtering for those who specialize in or have experience with real estate investing. Additionally, look for agents who actively promote themselves as investor-friendly or who have a history of working with flippers. Once you have a shortlist of potential agents, schedule interviews to discuss your investment goals and assess their knowledge of the local market, negotiation skills, and ability to handle complex transactions. Choosing an agent who understands and supports your investment strategy is crucial for a successful house-flipping venture.

Find A House To Flip

Finding the right property is one of the most critical steps in flipping houses in Wisconsin. Start by utilizing various strategies to identify potential houses that fit your investment criteria. Driving for dollars involves driving through neighborhoods and looking for properties that appear distressed or vacant. This method allows you to spot opportunities that might not be listed on traditional real estate platforms. Take note of properties with overgrown lawns, boarded-up windows, or "For Sale" signs that could indicate motivated sellers.

Direct mail campaigns are another effective strategy for finding houses to flip. By sending targeted mailers to homeowners in specific areas or those who may be facing foreclosure, you can reach potential sellers directly. Crafting personalized letters or postcards can help you stand out and increase your chances of receiving responses from motivated sellers who might be open to selling their properties at a discount.

Additionally, utilizing the Multiple Listing Service (MLS) is essential for finding properties listed by real estate agents. The MLS provides comprehensive data on available properties, including details on price, condition, and location. Working with a knowledgeable real estate agent can further enhance your ability to identify good deals and access properties before they hit the general market.

Alternative Strategies to Find a House

When looking for houses to flip, exploring alternative strategies can be highly beneficial. Here are a few approaches to consider:

-

The Day Zero Strategy: This approach involves identifying properties as soon as they hit the market. By acting quickly on new listings, you can capitalize on opportunities before other investors become aware. Set up alerts on real estate websites and work with your agent to stay informed about new listings in your target areas.

-

The Old Listing Strategy: Look for properties that have been on the market for an extended period. These listings may have become stale, and sellers might be more willing to negotiate on price. Analyzing these properties can reveal potential deals that others have overlooked.

-

The Wholesaler Strategy: Wholesalers are individuals or companies that find and contract properties and then sell the contract to other investors. Establishing relationships with local wholesalers can provide access to off-market deals that are not publicly listed. Networking within real estate investment groups can help you connect with wholesalers in your area.

In conclusion, finding the right house to flip in Wisconsin requires a multi-faceted approach. By combining traditional methods like driving for dollars and direct mail campaigns with alternative strategies such as monitoring the MLS and leveraging wholesaler networks, you can increase your chances of discovering profitable investment opportunities. Each method has its strengths, and utilizing a variety of strategies will help you identify the best properties for your flipping projects.

Make Discovery Calls To Listing Agents

When flipping houses in Wisconsin, making discovery calls to listing agents is an essential step in evaluating potential properties. These calls help you gather critical information that can impact your investment decisions. Here are key questions to ask listing agents during these calls:

-

Is the listing still active?: Confirming whether the property listing is still active ensures you’re not pursuing a home already under contract with another buyer. This step helps prevent wasting time on deals that are no longer available, allowing you to focus on viable opportunities.

-

Are the listing’s photos up to date?: Inquire if the photos provided are current. Up-to-date photos give you a more accurate picture of the property's present condition. This helps in assessing the extent of repairs or renovations needed and aids in accurately estimating potential costs and profit margins.

-

What is the current condition of the home?: Ask about the current state of the home to understand if it’s distressed or if there are any hidden issues. This information is crucial for evaluating the suitability of the property for a flip and estimating repair costs and potential challenges.

-

Are you willing to work with an investor?: Find out if the listing agent is open to working with investors. This can foster honest communication and clear expectations. Additionally, if you don’t have a dedicated agent, this could be an opportunity to negotiate representation, allowing the agent to earn commissions on both sides of the transaction and potentially build a beneficial relationship for future deals.

-

What is the owner’s reason for selling?: Understanding the seller’s motivation can provide valuable insights into their urgency and circumstances. While this information might not always be fully disclosed, any details gathered can be leveraged to negotiate a better deal and structure your offer in a way that meets the seller's needs.

-

Is there a lot of competition for the property?: Ask about the level of interest or competition the property is receiving. Knowing if there are multiple offers or significant interest can help you gauge the urgency of the situation and adjust your bidding strategy accordingly, preventing you from overpaying or missing out on a profitable opportunity.

Remember, this step is for gathering information, not making deals. When ending the call, leave communications open by suggesting you'll get back to the listing agent after consulting your team and confirming whether this is a home you want to move forward with. This approach ensures a thorough and strategic evaluation process, which is vital for successfully flipping houses in Wisconsin.

Analyze The Property

Analyzing the property is a crucial step in the house flipping process in West Virginia. This involves assessing the property’s potential through key metrics, including the after-repair value (ARV), repair costs, and purchase price. By thoroughly evaluating these aspects, you can determine whether the property will be a profitable investment.

After-Repair Value

The after-repair value (ARV) is a fundamental metric for evaluating a property. It estimates the property's value after all renovations are complete. In calculating the ARV , you’ll need to look at comparable sales, or “comps,” which are recently sold properties similar in size, style, and location to your investment property.

For accuracy, choose comps that match the following criteria:

- Similar number of bedrooms and bathrooms

- Within 20% of the subject property’s square footage

- Located in the same neighborhood or nearby

- Sold within the last six months

- Recently renovated or in similar condition

Average the sale prices of these comps to get a realistic estimate of the property’s potential market value post-renovation. This ARV will help guide your investment decisions and assess the potential profitability of the flip.

Repair Costs

Estimating repair costs involves a detailed inspection and consultation with contractors. Start by listing all necessary repairs and renovations, then obtain quotes from multiple contractors to estimate labor and material expenses accurately.

It’s wise to include a contingency budget for unexpected costs, generally around 10-15% of the total repair budget. By carefully planning and leveraging professional expertise, you can estimate repair costs more precisely, which is essential for ensuring a profitable flip.

Purchase Price

To determine the purchase price, use the ARV and repair costs to calculate the maximum allowable offer (MAO). This formula helps you identify the highest price you can pay for the property while ensuring profitability. Key factors to consider include:

- The ARV: The estimated value of the property after repairs.

- Hard Money Loan Costs: Include interest rates (usually between 10% and 15%), origination fees, and points.

- Private Money Loan Costs: Factor in the interest and duration of the loan.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus ongoing costs like insurance, utilities, and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Generally 6% of the purchase price, though this can be negotiable.

- Projected Profit: Desired profit margin based on your investment goals.

Subtract all these costs from the ARV to determine the MAO, which will help you ensure a profitable investment while flipping houses in West Virginia.

Call Agents & Submit Written Offers

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Wisconsin?

House flipping in Wisconsin offers profitable opportunities, with recent data indicating that the average gross flipping profit for real estate investors in the state is around $65,000, according to ATTOM Data Solutions. However, profits can vary widely depending on factors such as property location, purchase price, renovation expenses, and the overall market conditions at the time of sale. In some cases, savvy investors who buy properties at significant discounts and manage renovation costs effectively can see returns well above the state average.

Wisconsin has some of the most profitable house flipping markets in the country, particularly in cities where demand for renovated homes is strong. The state boasts three of the top five cities with the nation's largest gross flipping profits on median-priced transactions:

- Milwaukee, WI: $75,000 average gross flipping profit

- Madison, WI: $68,000 average gross flipping profit

- Green Bay, WI: $62,000 average gross flipping profit

These cities provide attractive opportunities for house flippers due to their growing populations, robust local economies, and increasing demand for updated homes. Flippers who are well-versed in Wisconsin’s real estate market can capitalize on these trends by selecting the right properties, executing cost-effective renovations, and timing their sales to maximize returns.

Understanding the local market dynamics and employing strategic approaches, such as focusing on up-and-coming neighborhoods or targeting homes in need of cosmetic improvements, are essential for maximizing profits in Wisconsin. In addition, building a reliable network of contractors, agents, and lenders can streamline the flipping process, helping investors to boost their returns in the competitive Wisconsin housing market.

Is House Flipping Illegal In Wisconsin?

House flipping is not illegal in Wisconsin; however, investors must comply with state and local regulations to ensure their activities are lawful and ethical. Flipping houses involves purchasing properties, renovating them, and selling them for a profit. In Wisconsin, as in most states, this practice is perfectly legal as long as investors adhere to laws governing real estate transactions, such as obtaining the necessary permits for renovations, adhering to building codes, and following proper disclosure practices when selling a property. Violating these regulations can result in fines, legal action, or delays in the flipping process.

It's also important for house flippers in Wisconsin to be aware of potential legal issues related to financing and property acquisition, such as fraud or misrepresentation. Flippers should ensure that all transactions are transparent and conducted in good faith, especially when dealing with distressed properties or foreclosures. Working with licensed professionals, including real estate agents, contractors, and attorneys, can help investors navigate the legal landscape and avoid common pitfalls. By following the rules and operating with integrity, investors can successfully and legally flip houses in Wisconsin.

Do You Need A License To Flip Houses In Wisconsin?

Holding and maintaining a real estate license is not necessary to flip homes in Wisconsin.

However, acquiring a real estate license can offer valuable advantages. Although it entails paying annual fees and passing regular exams to maintain professional status, investors gain access to a nationwide network of agents and their best tool: the MLS.

Read Also: Wisconsin Real Estate Classes: Wholesaling, Flipping & Licensing

How Much Does It Cost To Flip A House In Wisconsin?

Flipping a house in Wisconsin can be a profitable venture, but it’s crucial to understand the various costs involved to ensure a successful project. From acquisition and renovation expenses to carrying and selling costs, accurately estimating these expenditures will help you plan your investment and maximize returns. Below, we break down the key cost components associated with flipping a house in Wisconsin.

The Home Purchase Price

In Wisconsin, the median home price is around $270,000, making it more affordable than many other states. Prices can vary widely depending on the location, with homes in urban areas like Milwaukee or Madison costing more than those in smaller towns or rural regions. A portion of the purchase price will typically be your down payment, which can range from 5-20% if financed through a mortgage, or you may choose to purchase outright with cash. It’s important to research local markets and target neighborhoods where property values are likely to rise, as this will impact your overall profit potential.

The Home Repair Costs

Renovation costs in Wisconsin can vary significantly based on the extent of the work required. On average, investors can expect to spend between $20,000 and $50,000 on standard rehabs, depending on the size and condition of the property. For a basic cosmetic renovation, costs might range from $15 to $30 per square foot, while more extensive structural or mechanical repairs can push costs upwards of $60 per square foot or more. To get the most accurate estimates, it's advisable to consult with several contractors to assess the property and provide detailed quotes before committing to the purchase.

The Carrying Costs

Carrying costs are ongoing expenses that accrue while you own the property and prepare it for sale. In Wisconsin, these costs typically include property taxes, homeowners insurance, utilities, and maintenance such as lawn care and snow removal. Property taxes in Wisconsin average around 1.68% of the home's assessed value, which is higher than the national average. These costs can add up quickly, especially if the property takes longer to sell than anticipated, so it's essential to budget for them when planning your flip.

Closing, Marketing, & Sales Costs

When it’s time to sell, you’ll need to account for closing, marketing, and sales costs. These include real estate agent commissions (usually around 5-6% of the sale price), listing fees, title transfer fees, and other legal expenses. Additionally, you might incur costs for staging the home or marketing it to potential buyers. Together, these expenses can represent a significant portion of your budget, so it’s important to factor them into your overall cost analysis to ensure that your flip remains profitable.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How To Flip A House In Wisconsin With No Money?

Flipping houses in Wisconsin doesn't require investors to use their own money. Instead, they can leverage funds from private and hard money lenders who are actively seeking profitable opportunities themselves. This eliminates the need for dealing with traditional banking institutions, credit checks, and lengthy approval processes.

Using private and hard money loans provides quick access to cash and speeds up the deal-making process. Additionally, investors can explore alternative strategies like wholesaling, which involves acquiring property rights and selling them to end buyers for a fee, requiring minimal capital investment.

What's The Best Place To Flip Houses In Wisconsin?

The best places to flip houses in Wisconsin are often those experiencing significant growth, economic development, and increasing property values. These locations offer potential for profitable investments due to rising demand and favorable market conditions. Here are five cities in Wisconsin that stand out for house flipping:

- Milwaukee: As Wisconsin’s largest city, Milwaukee offers a dynamic real estate market with diverse investment opportunities. The city has seen a 4.8% increase in home values over the past year, and its ongoing downtown revitalization and development projects continue to attract new residents and businesses. With a median home value of $244,000, Milwaukee presents a balanced mix of affordable entry points and strong profit potential for flippers.

- Madison: The state capital, Madison, is a thriving market with a robust economy, largely driven by the University of Wisconsin and a growing tech sector. The city’s population growth rate of 1.4% per year and a median home value of $390,000 create a favorable environment for real estate investors. Madison's strong demand for housing and relatively low inventory levels make it an attractive market for house flippers looking to capitalize on quick sales.

- Green Bay: Known for its affordability and steady growth, Green Bay is another excellent market for house flipping in Wisconsin. The median home value in Green Bay is around $235,000, and the area has seen a 6% increase in property values over the past year. The city’s expanding job market and affordable cost of living continue to draw new residents, creating ongoing demand for updated and renovated homes.

- Kenosha: Situated between Milwaukee and Chicago, Kenosha benefits from its strategic location and growing appeal as a commuter city. The median home value in Kenosha is approximately $285,000, with an annual increase of 5.2% in property values. The city’s expanding business sector and attractive lakefront properties make it a solid choice for house flippers looking to tap into a market that offers both affordability and potential for growth.

- Eau Claire: With a median home value of $270,000, Eau Claire offers house flippers a market characterized by affordability and rising demand. The city has experienced a 4.5% increase in home values over the past year, supported by a growing local economy and an influx of new residents attracted by its quality of life. Eau Claire’s vibrant downtown and ongoing development projects make it a promising location for flipping houses in Wisconsin.

Choosing the right city is crucial for maximizing your house-flipping profits in Wisconsin. These locations offer promising opportunities due to their economic growth, rising home values, and strong market demand, making them excellent choices for both new and experienced investors.

Final Thoughts On Flipping Homes In Wisconsin

Flipping homes in Wisconsin has emerged as a highly profitable venture for numerous investors but demands diligent attention to detail. Those who approach it with thoroughness and follow the necessary steps can optimize profits while minimizing risks.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in Wisconsin. We're committed to providing the knowledge, resources, and support you need to navigate a Wisconsin property flip successfully. So avoid common mistakes and maximize your returns by leveraging our expertise.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.