How To Flip Houses In West Virginia: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in West Virginia involves purchasing undervalued homes, renovating them to increase value, and selling for a profit. The article discusses opportunities in cities like Charleston, Huntington, and Morgantown, as well as rural areas.

Why: West Virginia’s affordable housing market and growing demand for updated properties create strong profit potential, making it an attractive option for real estate investors.

How: Follow the article’s steps: research local West Virginia markets, secure financing, identify undervalued properties, manage renovations efficiently, and list and sell strategically to maximize returns.

House flipping has proven to be a powerful wealth-building vehicle for opportunistic investors, and few other states appear to boast more opportunities than West Virginia. Coincidently, there may be no better time to learn how to flip houses in West Virginia than now. The health of the local market may present investors in the Mountain State with an influx of high-quality leads.

According to ATTOM Data Solutions’ latest U.S. Home Equity & Underwater Report, only 29.9% of homeowners in West Virginia are considered “equity rich.” At that rate, West Virginia has the fourth-lowest percentage of equity-rich properties in the country. Consequently, more homeowners may be motivated to sell in West Virginia than in most other states.

That’s not to say that every homeowner without equity represents a potential deal for West Virginia real estate investors, but rather that investors may be more likely to find discounts in West Virginia than in more equity-rich states.

Are you ready to capitalize on West Virginia’s house-flipping industry? Whether you’re new to real estate investing or looking to diversify and grow your portfolio, this guide will teach you how to flip houses in West Virginia, including:

- What Is Flipping Houses?

- Why Flip Houses In West Virginia?

- West Virginia House Flipping Statistics

- How To Flip Houses In West Virginia In 15 Steps

- How Much Do House Flippers Make In West Virginia?

- Is House Flipping Illegal In West Virginia?

- Do You Need A License To Flip Houses In West Virginia?

- How Much Does It Cost To Flip A House In West Virginia?

- How To Flip A House In West Virginia With No Money

- What's The Best Place To Flip Houses In West Virginia?

- Is It Hard To Flip Houses In West Virginia?

- How Do You Find Contractors For Flipping Houses In West Virginia?

- Final Thoughts On Flipping Homes In West Virginia

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

House flipping is an exciting real estate investment strategy that can help entrepreneurs in the West Virginia housing market grow their wealth at an attractive rate. At its core, flipping houses is precisely what it sounds like; it revolves around buying properties that would benefit from a few renovations, investing some money to fix them up, and then selling them for a profit. Upon closer inspection, however, flipping houses is a fairly involved process that relies on optimizing profit margins and mitigating risk at every step.

Investors must acquire a promising subject property below market value to increase their odds of completing a successful deal. By acquiring deals for less than their potential worth, investors have a better chance of improving their margins and reducing risk.

In the event a subject property is acquired, the investor will proceed to rehab and fix the house. The idea isn’t to make the nicest home possible but instead to make the nicest house on the street without going over budget. Doing so requires looking at the nearby “comps” and making the recently acquired deal slightly better than them with upgrades that offer the best return on investment (ROI). That way, you can maximize your profits and make the most of your hard work.

Once the home is restored to its desired condition, it’s time for the investor to sell it for more than they have invested up to that point. By showcasing its best features and marketing it effectively, investors should be able to fabricate demand and stir up the competition, resulting in a more significant payday.

To be clear, this is a simplified explanation of flipping single-family homes in West Virginia. The actual process is more involved and requires unique knowledge, skills, and experience. Fortunately, we're here to teach new investors how to flip houses in West Virginia.

Before we jump in, let's start by taking a closer look at the local housing market. Understanding the trends and dynamics will give investors a competitive edge and help them make informed decisions on their next West Virginia home purchases.

Read Also: Finding Motivated Seller Leads: Free & Paid Tactics

Why Flip Houses In West Virginia?

Flipping houses in West Virginia presents a unique opportunity due to its relatively affordable real estate market and stable housing conditions. The median home price in West Virginia is significantly lower than the national average, making it an attractive option for investors seeking to maximize their return on investment. As of early 2024, the median home price in West Virginia stands at approximately $150,000, compared to the national median of around $400,000. Typical nationwide gross flipping profit of $72,000 in the last quarter of 2024 translated into a 29.6 percent return on investment,” according to ATTOM Data Solutions. While according realtytrac, the State of West Virginia currently has 223 properties in foreclosure, 38 bank owned properties, and 185 headed for auction. This affordability allows flippers to acquire properties at a lower cost, potentially leading to higher profit margins once renovations are completed and the homes are resold.

Additionally, West Virginia’s steady population growth contributes to a favorable environment for house flipping. The state has experienced a gradual increase in population over the past few years, with areas such as Charleston and Morgantown showing notable growth. As more people move into these regions, the demand for updated and well-maintained homes is likely to rise, creating a robust market for flipped properties. The state's consistent economic performance and modest job growth further support a stable real estate market, reducing the risk associated with house flipping ventures.

Moreover, West Virginia offers several tax incentives and programs that can benefit real estate investors. For instance, the state provides various tax credits and abatements for property improvements and investments in certain areas, which can help offset renovation costs. By leveraging these financial incentives, flippers can enhance their profitability and reduce the overall expenditure required to bring a property up to market standards. Overall, West Virginia’s affordable housing market, growing population, and supportive investment environment make it a promising location for house flipping endeavors.

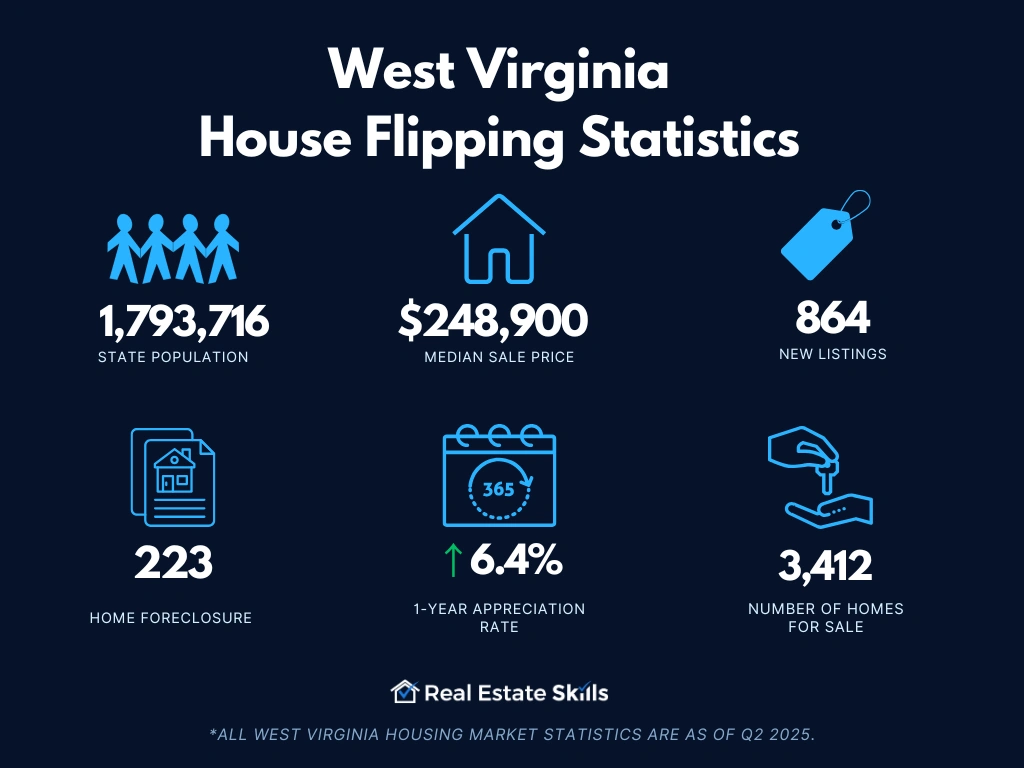

West Virginia House Flipping Statistics

Some of the most essential West Virginia house-flipping statistics investors need to know include but are not limited to the following:

- Population: 1,793,716

- Employment Rate: 51.7%

- Median Household Income: $55,948

- Median Sale Price: $248,900 (+0.9% Year-Over-Year)

- Number Of Homes Sold: 683 (-3.9% Year-Over-Year)

- Median Days On Market: 74 (+5 Year-Over-Year)

- Number Of Homes For Sale: 3,412 (-1.1% Year-Over-Year)

- Number Of Newly Listed Homes: 864 (-13.6% Year-Over-Year)

- Months Of Supply: 4 (+0 Year-Over-Year)

- Homes Sold Above List Price: 16.8% (+1.2 Points Year-Over-Year)

- Homes With Price Drops: 20.0% (+14.8 Points Year-Over-Year)

- Home Foreclosure: 223 Properties

*All West Virginia housing market statistics are as of Q2 2025

How To Flip Houses In West Virginia In 15 Steps

Learning how to flip houses in West Virginia is much less intimidating when investors follow the seven steps outlined below:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a critical first step in flipping houses in West Virginia. The state offers a diverse range of real estate markets, from urban areas like Charleston and Huntington to more rural communities. Each market has its own unique characteristics, so it's essential to research and understand the local housing trends, population growth, and economic factors. For instance, areas with increasing job opportunities or growing populations are often more favorable for house flipping because they tend to have higher demand for housing, which can lead to quicker sales and better profit margins.

When picking your market in West Virginia, consider the median home prices and the potential for appreciation. While the state's overall cost of living is relatively low, certain areas may offer better returns on investment due to their economic outlook or recent development projects. For example, cities like Morgantown, with its strong university presence and steady population growth, may present lucrative opportunities for flippers. On the other hand, smaller towns with stagnant economies might pose more challenges, requiring a more cautious approach.

Additionally, it's important to assess the competition in your chosen market. Some areas in West Virginia may be saturated with investors, which can drive up property prices and reduce profit margins. Conducting thorough market analysis, including understanding the number of properties listed for sale and the average time they stay on the market, will help you make informed decisions. By carefully selecting a market that aligns with your investment goals and risk tolerance, you can set yourself up for a successful house-flipping venture in West Virginia.

Find Your Money

Securing the right financing is crucial when flipping houses in West Virginia. Whether you're an experienced investor or a first-time flipper, having access to capital is what makes or breaks your project. Traditional bank loans might not always be the best option due to their lengthy approval processes and stringent requirements. Instead, many flippers turn to private and hard money lenders who can provide quicker access to the funds needed for purchasing and renovating properties.

In West Virginia, finding the right financing option involves understanding the different types of lenders and how they align with your investment strategy. Private lenders, often individuals or small firms, may offer more flexible terms but require strong relationships and trust. Hard money lenders, on the other hand, are typically more formalized and specialize in short-term loans designed for real estate investments, making them a go-to choice for many house flippers. Knowing where and how to find these lenders will give you a significant advantage in your flipping endeavors.

How To Find Private & Hard Money Lenders

When it comes to financing your house-flipping project, private and hard money lenders are two of the most popular options for investors. These lenders can offer more flexible terms and quicker access to funds compared to traditional banks, making them ideal for the fast-paced nature of house flipping. Understanding how to find and secure financing from these lenders is key to ensuring that your project runs smoothly from start to finish.

Finding a private lender often starts with networking. Private lenders are usually individuals or small groups who invest their own money in real estate projects. They may not advertise their services publicly, so building relationships within the local real estate community can be invaluable. Attend real estate meetups, join investment groups, and ask for referrals from other investors. Trust and rapport are crucial, as private lenders typically base their lending decisions on your experience, the strength of your deal, and the relationship they have with you. Platforms like Kiavi and Lima One.can also provide insights and connections to private lenders who might be interested in funding your project.

Hard money lenders, on the other hand, are more accessible and easier to find. These lenders are specialized firms that offer short-term loans secured by real estate, and they cater specifically to investors like you. To find a reliable hard money lender in West Virginia, start by searching online or asking for recommendations from local real estate professionals. Many lenders, such as Lima One, list their services online, including the types of loans they offer and their terms. Once you’ve identified a few potential lenders, compare their rates, loan terms, and the speed at which they can provide funding. Hard money lenders often have higher interest rates but offer the advantage of faster approvals and less stringent credit requirements, making them a solid choice for house flippers looking to close deals quickly.

Securing the right financing through private or hard money lenders will ensure you have the capital needed to succeed in the West Virginia real estate market. By carefully evaluating your options and building strong relationships with lenders, you'll be better positioned to move forward with confidence and maximize your profits.

Call Agents & Submit Written Offers

The next critical step in flipping houses in West Virginia is to call the listing agent you previously spoke with and inform them of your intention to submit a written offer. Ensure that your offer is consistent with the maximum allowable offer (MAO) you calculated. Submitting a well-informed written offer not only demonstrates your seriousness as a buyer but also helps you advance toward securing the property.

You should have the agent representing you, whether it's the listing agent or the investor-friendly agent you worked with earlier, handle the submission of your written offer. This approach ensures that the offer is presented professionally and adheres to all contractual requirements. In West Virginia, you'll typically use a standard Residential Sales Contract provided by the West Virginia Association of Realtors.

When preparing your offer, ensure the following details are included for the representing agent who will draft the contract:

- Purchaser Name: Specify the name of the purchaser, whether it's you personally or an LLC. For additional asset protection, consider purchasing under an LLC. If so, include the articles of incorporation to confirm your role as a signer.

- Offer Price: Clearly state the offer price you have determined based on your analysis.

- Deposit Amount (Earnest Money Deposit): Provide an earnest money deposit, usually between 1% and 5% of the purchase price, to show your commitment. Include a contingency clause to ensure the deposit is refundable if certain conditions are not met.

- Contingencies: Include a contingency clause for a home inspection period (typically seven days). This allows you to inspect the property for any issues and withdraw from the deal with your deposit if necessary.

- Closing Timeline: Specify a closing date, ideally within 14 days or sooner if possible. A quicker closing, particularly with a cash offer, can make your bid more attractive to sellers.

- Seller To Deliver Free & Clear Title: Ensure the seller provides a clear title with no liens or other encumbrances.

- Buyer’s Agent Name: Identify the buyer's agent to clarify representation in the transaction.

- Proof Of Funds: Attach proof of funds from your lender to demonstrate your financial ability to close the deal, enhancing the credibility of your offer.

Making discovery calls and submitting written offers is a vital part of the process in flipping houses in West Virginia. By having your agent handle these aspects professionally and ensuring your offer includes all necessary details, you increase your chances of securing a profitable property. This step is essential for successful house flipping and maximizing your investment potential in West Virginia.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted, performing due diligence is a crucial step in the house flipping process in West Virginia. This phase involves thoroughly investigating the property to ensure that your investment is sound and to uncover any potential issues that might affect your renovation plans or profitability. A key component of due diligence is assessing the property’s “scope of work,” which outlines all necessary repairs and renovations needed to bring the house up to market standards.

Start by conducting a comprehensive property inspection. Hire a professional inspector to evaluate the structural integrity, plumbing, electrical systems, and other critical aspects of the property. This inspection will help you verify the condition of the house and confirm the accuracy of your initial assessments. Use the findings from the inspection to refine your scope of work, ensuring that all necessary repairs are accounted for and that there are no hidden problems that could lead to unexpected costs.

Additionally, review the title report and ensure that there are no liens, disputes, or other legal issues associated with the property. Confirm that the seller can deliver a clear title to avoid any legal complications post-purchase. Performing due diligence also involves verifying the property’s zoning and compliance with local regulations to ensure that your renovation plans are feasible and within legal boundaries. By thoroughly investigating these aspects and refining your scope of work, you safeguard your investment and set the stage for a successful house flip in West Virginia.

Close On The Deal

Closing on the deal is the final step in the house flipping process in West Virginia and involves finalizing the purchase of the property. This phase is critical as it transitions your investment from contract to ownership. To ensure a smooth closing process, you should first review and sign the closing documents. These documents typically include the deed, settlement statement, and any necessary affidavits or disclosures. Ensure that all details are accurate and that you understand each document’s implications.

Before the closing date, conduct a final walkthrough of the property. This inspection helps confirm that the property’s condition matches what was agreed upon in the contract and that any seller concessions or repairs have been completed. It also provides a last chance to identify any issues that could affect the closing process or require adjustments.

On the closing day, funds will be transferred from your escrow account to the seller, and the property title will be officially transferred to you. It's crucial to have your financing in place and all necessary funds available, including closing costs and any applicable taxes. Ensure that you receive all documentation proving the transfer of ownership, including the deed and title insurance policy. By meticulously managing these steps and confirming that everything is in order, you ensure a successful closing and set the stage for the next phase of your house flipping venture in West Virginia.

Renovate The House

The next step in flipping houses in West Virginia involves renovating the property to achieve your projected After-Repair Value (ARV). It's important to align the renovation with the comparable properties (comps) you analyzed earlier, ensuring that the house meets or slightly exceeds the standards set by these comparables. Avoid over-improving, as you want to balance between creating an attractive home and staying within budget to maximize profit margins.

Before starting the renovation, it’s essential to safeguard your investment with six key documents. These documents will help ensure that your project runs smoothly, stays on schedule, and complies with legal requirements:

- Independent Contractor Agreement: This document details the terms of your relationship with the contractor, including payment schedules, timelines, and specific responsibilities. It helps to clearly define expectations and protect both parties throughout the renovation.

- Final Scope Of Work: A detailed outline of all tasks, materials, and timelines required for the renovation. This document serves as a blueprint for the project, ensuring that both you and the contractor are on the same page regarding what needs to be done.

- Payment Schedule: This schedule specifies the amounts and timing of payments to the contractor, tied to the completion of milestones. It helps manage the contractor’s performance and keeps the project on track.

- Insurance Indemnification Agreement: This agreement verifies that the contractor has appropriate insurance coverage and agrees to indemnify you for any accidents or damages that occur during the renovation. It protects you from liability and potential financial loss.

- W-9: This tax form collects the contractor’s taxpayer identification information, required for IRS reporting. It ensures compliance with tax regulations and allows for accurate reporting of payments.

- Final Lien Waiver: This document, signed by the contractor, confirms that they have received full payment and waive any future claims against the property. It protects you from additional financial demands after the renovation is complete.

With these documents in place, you can confidently proceed with the renovation. Proper planning and documentation will help ensure that your West Virginia flip project is executed efficiently, stays within budget, and achieves the desired market value.

Prep & List The House On The MLS

Once renovations are complete, the next step in flipping houses in West Virginia is to prep and list the property on the MLS. This involves several key actions to ensure the home is presented in the best possible light and attracts potential buyers. Here’s what you need to do:

-

Final Punchlist: Start with a final punchlist to ensure every detail of the renovation is completed to your satisfaction. This list should include minor fixes, touch-ups, and any last-minute adjustments needed to make the home pristine. Completing the punchlist ensures that the house is ready for the market and minimizes the risk of issues arising during showings or inspections.

-

Home Staging: According to the Real Estate Staging Association (RESA), investing approximately 1% of the sale price into staging can yield a significant return. About 75% of sellers who staged their homes saw an increase of 5% to 15% over their asking price. Staging highlights the home's best features and helps potential buyers visualize living in the space. Effective staging can create a welcoming environment and make the property stand out in the competitive West Virginia real estate market.

-

Professional Photos: High-quality, professional photos are crucial for making a great first impression. Invest in a professional photographer to capture the home’s interior and exterior. Stunning visuals will enhance the property listing and attract more interested buyers. High-resolution images can make a significant difference in online listings and marketing materials, drawing attention and driving interest.

Set An Enticing Asking Price

Setting the right asking price is critical for a successful sale. Analyze recent comparable sales in the area to determine a competitive price point that reflects the property’s value after renovations. Pricing too high can deter potential buyers, while pricing too low might leave money on the table. Work with a real estate agent who understands the West Virginia market to establish a price that maximizes your return while ensuring a quick sale. A well-priced property, combined with effective staging and professional photos, will help attract serious buyers and achieve the best possible outcome for your flip.

Field Offers & Negotiate

Once your property is listed on the MLS, the next step is to field offers and engage in negotiations. As offers come in, it’s essential to carefully review each one to ensure it aligns with your financial goals and project expectations. Consider the offer price, contingencies, and the buyer’s ability to close the deal.

Effective negotiation is key to securing the best possible terms. Be prepared to counter-offer and negotiate details such as the price, closing timeline, and any contingencies. If multiple offers are on the table, leverage this competition to your advantage, potentially driving up the final sale price.

Communicate openly with potential buyers and their agents to understand their motivations and flexibility. A well-negotiated deal can help you maximize your profit and ensure a smooth transaction. Remember to stay focused on your investment objectives and use strategic negotiation to achieve the best outcome for your flip in West Virginia.

Accept The Best Offer

After receiving and negotiating multiple offers, the next critical step is to select and accept the best offer. This decision requires a careful evaluation of each offer’s terms, including the offered price, contingencies, and the proposed closing timeline. While the highest bid may seem the most attractive, it's important to consider other factors such as the buyer’s ability to secure financing and their flexibility with closing dates.

Review each offer thoroughly to ensure it meets your financial goals and project timelines. Sometimes, a slightly lower offer with fewer contingencies or a quicker closing date might be more advantageous than a higher bid with significant conditions. Ensure that the chosen offer aligns with your objectives and minimizes any potential risks.

Once you’ve selected the best offer, communicate your decision promptly to the buyer and their agent. Notify all other parties of the acceptance to finalize the deal. Accepting the best offer efficiently will pave the way for a successful closing and help you complete your house flip in West Virginia with optimal results.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In West Virginia?

In West Virginia, house flipping can be a lucrative endeavor, though profit margins may differ based on various factors such as location, renovation quality, and market dynamics. According to the latest Home Flipping Report by ATTOM Data Solutions, the average gross flipping profit in West Virginia is approximately $40,000. This figure highlights the potential for substantial returns, particularly in regions where property values are rising and demand for updated homes is strong.

Several cities in West Virginia stand out for their profitability in house flipping. Among the top cities with significant gross flipping profits on median-priced transactions are:

- Charleston, WV: $50,000 average gross flipping profit

- Morgantown, WV: $45,000 average gross flipping profit

- Huntington, WV: $42,000 average gross flipping profit

These cities offer promising opportunities for investors due to their growing real estate markets and relatively affordable property prices. Charleston, in particular, has seen a rise in demand for renovated properties, driven by its stable economy and vibrant local culture.

Flipping houses in West Virginia can be highly rewarding when investors focus on areas with strong market fundamentals and manage their renovation projects effectively. By understanding local trends and leveraging the state's affordable property values, house flippers can maximize their profits and achieve success in the West Virginia real estate market.

Do You Need A License To Flip Houses In West Virginia?

Flipping houses in West Virginia does not require a real estate license. However, having a license may coincide with some added benefits.

Becoming a licensed real estate agent grants investors access to a nationwide network of like-minded professionals. Perhaps even more importantly, investors with a real estate license can access the MLS without any outside help.

Read Also: West Virginia Real Estate Classes: Wholesaling, Flipping & Licensing

How To Flip A House In West Virginia With No Money?

Investors flipping houses in West Virginia can avoid using their own money by leveraging funds from private and hard money lenders. These lenders replace traditional banks, eliminating the need for credit checks or lengthy approval processes. With private and hard money loans, investors can quickly access cash for short-term financing, facilitating deals at a faster pace.

Additionally, wholesaling allows investors to invest without a significant capital investment. In fact, if wholesalers can assign a contract, they may not need to spend any money at all. In wholesaling, investors receive the sole right to purchase a home and sell their right to do so to cash buyers for a fee, providing an alternative investment approach that doesn't rely on personal cash resources.

What's The Best Place To Flip Houses In West Virginia?

The best places to flip houses in West Virginia are cities experiencing steady population growth, economic stability, and rising property values. Here are five cities in West Virginia that offer promising opportunities for house flippers, based on recent statistics and local trends:

- Charleston: Charleston, the state capital, offers a stable market with a growing economy, making it an attractive location for house flipping. The median home value in Charleston is approximately $150,000, with property values increasing by around 6% over the past year. The city's steady job market and cultural attractions contribute to a healthy demand for renovated homes.

- Morgantown: Morgantown, home to West Virginia University, is another excellent city for house flipping. The presence of the university drives demand for housing, particularly among students and faculty. The median home value here is around $220,000, with a 5.3% increase in property values over the last year. Morgantown's vibrant economy and youthful population make it a prime location for real estate investments.

- Huntington: Huntington, located along the Ohio River, is seeing a resurgence in its real estate market. With a median home value of approximately $120,000, Huntington offers affordable entry points for investors. The city has experienced a 4.8% increase in property values over the past year, driven by revitalization efforts and a growing healthcare sector.

- Parkersburg: Parkersburg, a city with a strong industrial base, presents solid opportunities for house flippers. The median home value in Parkersburg is about $110,000, and property values have increased by 4.5% in the past year. The city's affordable housing market and ongoing economic development initiatives make it an appealing choice for investors looking to maximize returns.

- Wheeling: Wheeling, known for its historical charm, is becoming increasingly popular among homebuyers. The median home value in Wheeling is around $130,000, with a 5.1% increase in property values over the past year. The city's ongoing downtown revitalization efforts and proximity to larger metro areas like Pittsburgh contribute to its growing appeal as a location for house flipping.

These cities offer diverse opportunities for real estate investors, each with unique market dynamics that can lead to profitable house-flipping ventures. By focusing on areas with rising property values and strong economic fundamentals, investors can maximize their chances of success in West Virginia.

Final Thoughts On Flipping Homes In West Virginia

Learning how to flip houses in West Virginia is an excellent move in today’s economy. The volume of equity-rich homeowners, or lack thereof, suggests the pool of potentially distressed homeowners is larger than in most other states. Therefore, it’s reasonable to assume house flippers may find more opportunities to help distressed homeowners and secure their next deal simultaneously. Consequently, doing so may be as simple as following the abovementioned steps.

At Real Estate Skills, our team of experts is ready to provide you with the tools you need for flipping houses in West Virginia. We're committed to providing the knowledge, resources, and support you need to successfully navigate a West Virginia property flip. So avoid common mistakes and maximize your returns by leveraging our expertise.

Let RealEstateSkills.com be your trusted partner in turning your West Virginia house-flipping goals into profitable realities. Get started with us today.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.