Is Wholesaling Real Estate Legal In Canada? A 2026 Guide For Investors

Jan 13, 2026

Key Takeaways: Is Wholesaling Real Estate Legal In Canada?

- What: A fully legal investment strategy where you trade your equitable interest in a purchase contract rather than the physical property itself.

- Why: It provides a low-barrier entry to the 2026 market, allowing you to generate assignment fees without the need for a mortgage, a real estate license, or significant personal capital.

- How: By using the Principal Protocol—securing an assignable Purchase and Sale Agreement as a buyer and transferring those rights to a cash investor before the final closing date.

What You’ll Learn: How to navigate the 2026 Canadian legal landscape, including the impact of the new capital gains inclusion rates and provincial flipping taxes, while staying 100% compliant.

Is wholesaling real estate legal in Canada? Absolutely, and it’s one of the smartest ways to break into the real estate game with low risk and almost no upfront capital.

But here’s the thing: just because wholesaling real estate in Canada is legal doesn’t mean you can do it however you want. Every province has its own rules, and if you’re not careful, it’s easy to step over the line without even realizing it.

That’s why we put this guide together. Whether you're brand new or already doing deals, we’ll walk you through exactly how to wholesale legally, what to avoid, and how to stay compliant no matter where you’re investing. By the end, you'll know how to structure deals the right way and set yourself up for long-term success in the Canadian market.

- Wholesale Buy Zones: Strategic Market Entry for 2026

- What Do You Need To Know About Wholesaling In Canada?

- What Is Wholesaling Real Estate?

- Can You Do Wholesaling In Canada?

- Is Wholesaling Real Estate Legal In Canada?

- Do You Need A License To Wholesale Real Estate In Canada?

- How To Do Wholesale Real Estate In Canada Legally

- What Are The Benefits Of Wholesaling Real Estate In Canada?

- How To Buy A Wholesale Deal In Canada

- Is Wholesaling Real Estate Legal In Ontario?

- Wholesale Real Estate Ontario Contract

- Technical FAQ: 2026 Canadian Compliance & Tax

- Final Thoughts

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

Host and CEO of Real Estate Skills, Alex Martinez, provides a comprehensive, step-by-step guide for beginners to start wholesaling real estate!

Wholesale Buy Zones: Strategic Market Entry for 2026

Determining whether or not wholesaling is legal in Canada is only the first step. If you actually want to close deals in the 2026 market, you need to understand that "legal" looks different depending on which side of the Rockies you’re on. Some provinces have made it incredibly easy to assign contracts, while others have introduced new tax hurdles that can eat your entire assignment fee if you aren't careful. We break the country down into three Buy Zones so you know exactly where to focus your marketing and where to proceed with caution.

| Wholesale Buy Zone | Provinces | Regulatory Climate | Investor Strategy |

|---|---|---|---|

| Aggressive | Alberta, Saskatchewan | High clarity; minimal anti-flipping friction. | High-volume assignments and double closings. |

| Moderate | Ontario, Manitoba | Strict disclosure rules for assignments. | Focus on transparent "Principal" status deals. |

| Hold / Wait | British Columbia | Home Flipping Tax (20% on profit). | Long-term JV or "Assignment-only" to avoid tax. |

Right now, Alberta and Saskatchewan are the easiest places to get deals done. They haven't followed the lead of the coastal markets in creating aggressive anti-flipping laws, so your contracts stay simple. British Columbia is a different story. Wholesaling is legal there, but you have to be careful about taking title. If you own a property for even a single day in BC, the 20% provincial flipping tax hits your bottom line. In that zone, you either need to stick to pure assignments or partner up on a long-term joint venture to stay profitable.

- Aggressive Zone Strategy: Target these markets if you are looking to scale quickly using traditional assignment of contract methods without heavy local tax penalties.

- Moderate Zone Strategy: Focus on building relationships with local real estate lawyers who can ensure your disclosure forms meet the evolving provincial transparency requirements.

- Hold / Wait Strategy: Use this zone for high-equity deals only, ensuring your assignment fee is large enough to absorb any potential 2026 flipping tax implications if a double-close is required.

What Do You Need To Know About Wholesaling In Canada?

The Canadian housing market has gone through some major changes in recent years. After a stretch of skyrocketing home prices, things have started to cool down. Interest rate hikes have slowed appreciation, and in some areas, prices are even beginning to dip.

For those wondering, “Is wholesaling real estate legal in Canada?”—the answer is yes. And right now might be one of the best times to learn how to do it the right way.

When fewer buyers are competing, and sellers are more motivated, wholesalers have a unique opportunity to lock up deals below market value and assign them to investors who are still active. But to stay compliant, you need to understand the legal framework in each province—and that’s where most new wholesalers get stuck.

- Yes, it’s legal: Wholesaling real estate in Canada is 100% legal when done properly within each province’s regulatory guidelines.

- Licensing laws vary by province: Some provinces may require a real estate license if you market properties you don’t own. Others may not, depending on how your contract is structured.

- You must sell your rights, not the property: Legal wholesaling in Canada means assigning your purchase contract, not marketing or selling the actual property.

- Transparency is key: Make sure all parties (including sellers and end buyers) fully understand that you're acting as a wholesaler and not a licensed agent.

- Double closings are an option: If assignment fees are limited or unclear, many Canadian wholesalers use double closes to stay compliant.

- Stay current with market shifts: As home prices stabilize or decline, wholesalers who know the rules can solve real problems for motivated sellers and cash buyers alike.

If you're serious about wholesaling real estate in Canada, now’s the time to sharpen your knowledge and position yourself to help sellers who need a fast solution. Understanding the legal side not only protects you; it builds trust with your buyers, sellers, and partners so you can scale faster with less risk.

A Quick Look Around Canada:

Year-over-year price growth in the Canadian real estate market (according to the Canadian Real Estate Association):

- British Columbia: -1.2%

- Alberta: +2.6%

- Saskatchewan: +7.2%

- Manitoba: -0.4%

- Ontario: -3.8%

- Montreal: +7.3%

- Quebec: +6.3%

- New Brunswick: +2.3%

- Newfoundland & Labrador: +10.9%

Most investors know these growth rates are not only unprecedented but also not sustainable. Likely, the current real estate market will slowly shift to a more balanced position, which means there will be more listings and, thus, more opportunities for investors.

What Is Wholesaling Real Estate?

If you've been researching ways to invest without a ton of capital, you’ve probably asked, “Is wholesaling real estate legal in Canada?” The short answer is yes, but there’s a lot to understand before diving in.

Wholesaling real estate in Canada is a strategy where investors profit by assigning their contractual rights to buy a property, rather than purchasing it themselves. The key legal distinction is that you’re not selling the property; you’re selling your right to buy it. That’s what makes it legal even without a real estate license.

As a wholesaler, your job is to find underpriced properties—usually from motivated sellers—and negotiate a purchase agreement. You’re not flipping houses or managing rentals. Instead, you’re flipping paper.

- Wholesalers legally assign their equitable interest—not the property itself.

- This interest is created when a purchase agreement is signed.

- It’s protected under the Doctrine of Equitable Conversion, recognized in Canadian law.

- You must disclose your intent and rights clearly in contracts to avoid regulatory issues.

Here’s how it works in action. You find a discounted home (maybe a rental, fixer-upper, or foreclosure) and put it under contract with the seller. This agreement gives you the exclusive right to purchase the property.

That contract itself becomes your asset. Before closing, you assign your equitable rights to a cash buyer, often a house flipper or rental investor. The profit you make is the difference between your purchase contract and the amount the end buyer agrees to pay.

- Build a reliable buyer list: Know what your investors are looking for and have them ready.

- Find below-market properties: Look for distressed sellers or underpriced homes.

- Disclose your role: Be clear in contracts that you're assigning the deal, not brokering it.

- Follow provincial laws: Every province has different rules for contract assignments and marketing.

- Avoid representing others in exchange for commission: This would require a real estate license.

Whether you’re sourcing deals from Redfin, Zillow, or word of mouth, your success in wholesaling real estate in Canada comes down to finding motivated sellers and having investors ready to buy. This model works in every province, as long as you understand and follow the rules.

Wholesale real estate Canada investors are using this exact model to flip contracts and build income without flipping houses or holding rentals. It’s not a shortcut; it’s a strategy. And if you want to do it right, knowing the legal side is step one.

Stop Guessing, Start Closing.

While understanding that is wholesaling real estate legal in Canada gives you the green light to start, a legal "yes" won't find your first deal. Most beginners get stuck in the research phase, over-analyzing provincial codes while missing out on the high-equity off-market deals that are sitting right in their own neighborhoods.

You don't need a massive marketing budget or a real estate license to build a six-figure wholesale business. You need a technical blueprint that works in the 2026 Canadian landscape—one that covers everything from pulling distressed lead lists to structuring your contracts for a seamless assignment.

We have already mapped out the entire process for you.

Our Ultimate Guide to Real Estate Investing is the definitive resource for mastering deal flow, negotiation scripts, and creative financing. It is designed to help you secure assets using the same institutional-grade logic we use to build our own portfolios. Whether you are in Alberta or Ontario, this guide provides the exact steps to scale to your first (or fiftieth) unit.

Skip the trial-and-error phase and start building real equity today. Download our Free Ultimate Guide and get the exact system you need to dominate the Canadian market.

Can You Do Wholesaling In Canada?

Wholesaling in Canada is legal; however, a wrong decision may create legal problems for those who are unprepared or inexperienced real estate wholesalers. The primary factor that allows a real estate wholesaler to work within Canadian law is the fact that they are selling/marketing their "equitable interest," not the property itself.

Selling/marketing the real property would require a real estate license, which means becoming a real estate agent or realtor.

On the other hand, selling or marketing your equitable interest is completely within the law. Although it may seem like a distinction without a difference, the difference is quite critical to staying within Canada’s legal limits.

As a wholesaler, you are marketing a property for yourself, not as a representative of another, which requires a license.

Canadian Real Estate License Laws By Province

Education and other requirements for real estate licensing vary by province in Canada.

- Ontario: The Real Estate and Business Brokers Act 2002

- Quebec: The Real Estate Brokerage Act

- Nova Scotia: The Real Estate Trading Act & Regulations

- New Brunswick: The New Brunswick Real Estate Agents Act & Regulations

- Manitoba: The Real Estate Services Act

- British Columbia: The Real Estate Service Act

- Prince Edward Island: The Real Estate Trading Act

- Saskatchewan: The Real Estate Act, Regulations & By-laws

- Alberta: The Real Estate Act

- Newfoundland/Labrador: The Real Estate Trading Act

It should be noted that British Columbia is the one province where the "how" matters more than the "yes." Recently, the powers that be implemented a new tax aimed directly at short-term speculators. If you aren't absolutely sure how to proceed, you could end up handing over more money to the government than you'd like. Herre's what I mean by that:

Alert: The 20% BC Profit Hit

- The 365-Day Rule: Under the BC Home Flipping Tax, any residential property sold within 365 days of purchase is hit with a 20% tax on the profit. This rate only starts to drop after the first year and doesn't hit zero until you've held for two full years.

- Assignment vs. Title: This tax is triggered the moment you "take title" to a property. If you use a double-closing strategy in BC, you become the owner of record for a few hours, which technically subjects your profit to this 20% provincial tax on top of your federal obligations.

- Strategic Pivot: To stay profitable in BC, seasoned wholesalers are moving away from double closings and focusing exclusively on Assignment of Contract. By assigning your equitable interest, you never actually "own" the real estate, which can help you avoid the flipping tax entirely.

The reality in BC right now is that you have to be the "contract holder," not the "property owner." If a deal requires a double close—maybe because of a bank-owned restriction or a sensitive seller—you need to make sure there is enough meat on the bone to cover that 20% hit. For most new investors, sticking to pure assignments is the only way to keep your overhead low and your business compliant with these new provincial rules.

Is Wholesaling Real Estate Legal In Canada?

Yes, if you follow the rules. Wholesaling is legal across Canada when done properly. The main thing to understand is that you're not selling the property itself; you’re selling your contractual right to purchase it. As long as you’re transparent, use assignable contracts, and stay aligned with provincial laws, wholesaling real estate in Canada can be a powerful and legal way to get started in real estate.

Here's why:

- Wholesalers sell contracts, not properties: You’re assigning the right to buy—not acting as a licensed agent.

- Assigning a purchase contract is legal: As long as the contract includes an assignment clause, it can be transferred to another buyer.

- No license required to sell your equitable interest: In most provinces, selling your position in a deal doesn’t require a real estate license.

- Supported by contract law: The doctrine of equitable conversion protects the buyer’s right to assign their interest before closing.

- Legal across provinces: While laws vary slightly by region, wholesaling is not banned in any province.

Being transparent isn’t just smart—it’s necessary. If you're wholesaling real estate in Canada, your end buyer needs to know upfront that you’re not the property owner. You’re assigning your interest in the deal, not selling the property itself or acting as a licensed agent. This kind of honesty helps you avoid misunderstandings and keeps everything above board.

Also, make sure your contract includes the right to assign. That single clause can make or break your wholesale deal. If you’re ever unsure, it’s worth speaking to a local attorney who understands Canadian wholesale real estate laws. It’s a small step that protects you and your business in the long run.

Do You Need A License To Wholesale Real Estate In Canada?

One of the biggest hang-ups for new investors is thinking they need to go through the licensing process just to get started. In reality, you don't need a real estate license to wholesale in Canada, but you have to understand the technical reason why. When you wholesale, you aren't acting as an agent for someone else; you are acting as a Principal in the deal. You are the buyer on the contract, and that gives you specific rights that a middleman doesn't have.

The legal "magic" here is a concept called Equitable Interest. The moment you and the seller sign a purchase agreement, Canadian law views that contract as a piece of personal property—similar to a car or a piece of equipment. Because you own that contract, you have the right to sell it. Now, to be clear, this is not an opportunity for you to market the actual home; that would require a license. Instead, you are simply marketing your interest in the contract. That's an important distinction to make because it's what allows you to operate legally without being a registered Realtor.

Pro Compliance Tip: Avoiding Unlicensed Trading

- Terminate "Agent" Language: Never use phrasing like "finding a buyer for a seller" in your marketing. You are not representing a person; you are selling your equitable interest in a contract.

- Market the Paper: Ensure all advertisements focus on the "purchase agreement for sale" rather than the physical property itself to stay within Canadian legal limits.

- Principal Disclosure: Explicitly state that you are a principal in the transaction and not a licensed Realtor to maintain full transparency with all parties.

If you don't act as a Principal—meaning your name or your company's name isn't actually on the contract as the buyer—then you are effectively acting as an unlicensed broker. That is where people run into trouble. As long as you are the one with the direct legal stake in the deal, you are simply trading your own personal property (the contract) for an assignment fee.

Why You Don’t Need a License to Wholesale in Canada:

- You’re selling a contract, not representing a client.

- No commissions are involved; your profit comes from assigning the deal.

- Wholesaling focuses on equitable interest, which is legal to transfer in Canada.

- Real estate license laws apply to agency relationships, not contract assignments.

Just be sure to stay compliant with local laws, clearly disclose your role in the transaction, and avoid anything that could be seen as impersonating a licensed Realtor. If you’re unsure, a quick conversation with a real estate lawyer in your province can give you peace of mind.

- Ontario (Toronto): The Real Estate Council Of Ontario

- Quebec: The OACIQ

- Nova Scotia: The Nova Scotia Real Estate Commission

- New Brunswick: The New Brunswick Financial and Consumer Services Commission – Real Estate License

- Manitoba: The Manitoba Security Commission

- British Columbia: The British Columbia Financial Services Authority

- Prince Edward Island: Consumer, Corporate & Financial Services

- Saskatchewan: The Financial & Consumer Affairs Authority of Saskatchewan

- Alberta: The Real Estate Council

- Newfoundland/Labrador: Digital Government and Service – Real Estate Regulation

How To Wholesale Real Estate In Canada Legally

It is possible to wholesale real estate Canada residents want to sell legally. In fact, there are several ways to complete a wholesale transaction in Canada, and the most popular are discussed below:

- The Buy & Assign Exit Strategy

- The Double Close Exit Strategy

- The Joint Venture (JV) Wholesaling Strategy

- Wholetailing Strategy

The Buy & Assign Exit Strategy

With a fully executed contract, the wholesaler has the legal option to market/sell their "right to buy the property" to another buyer. Wholesalers can use an Assignment of Contract to accomplish this task.

An Assignment is a legal instrument that transfers the wholesaler’s rights (aka, as the original buyer or assignor) to the new buyer (aka, the assignee).

The assignee is often a cash buyer who may regularly work with the wholesaler.

The Double Close Exit Strategy

Another closing strategy that Canadian real estate wholesalers use is the Double Close. As its name suggests, the double close includes two closings – usually performed back-to-back.

The wholesaler purchases the subject property as the principal buyer in the first closing. However, the real estate wholesaler is the seller in the second transaction.

The difference in the contracted price in each contract is the wholesaler’s gross revenue. That said, a double close includes twice the closing costs. This additional cost offers protection to the wholesaler, as there is no question that a real estate license is not a requirement.

The Joint Venture (JV) Wholesaling Strategy

If you’ve been wondering, “Is wholesaling real estate legal in Canada?”, the answer is yes — but only when done within certain legal boundaries. One of the most common and compliant ways to wholesale real estate in Canada is through a joint venture (JV) agreement.

In a JV deal, two or more parties come together to partner on a real estate transaction. As a wholesaler, you can legally find a deal, structure the opportunity, and then partner with an investor who provides the capital or closes on the property. Rather than assigning a contract — which may be restricted in some provinces without a real estate license — you enter into a legal partnership where each party contributes value and shares in the profits.

Joint venture wholesaling agreements are widely accepted across Canada and are especially useful for new investors who want to legally profit from real estate without violating licensing laws. If you're trying to find out if wholesaling real estate is legal in Canada, JV partnerships are a proven way to stay compliant while still earning income from sourcing deals.

As always, it's wise to consult with a real estate lawyer to properly draft your JV agreement and ensure it meets all provincial requirements. When structured correctly, joint ventures are not only legal — they’re one of the most effective ways to grow your real estate business in Canada.

Wholetailing Strategy

Wholetailing combines two investment strategies – wholesaling and flipping.

Wholetailing goes a step beyond simple wholesaling because the investor purchases the property instead of assigning the right to purchase to another end buyer. Wholetailing a real estate deal is not considered a true flip because there are only a few modifications and repairs to be made as an enhancement to the property’s market value. Conversely, flippers would perform significant renovations.

Another difference is this strategy is that the end buyer of a wholetailing deal can be a retail buyer and not another investor.

This is because the wholetailer chooses to update and modify the property to be able to market it to a wider investor pool and likely generate a larger profit (from a higher price) than simply wholesaling deals.

2026 Tax Compliance Alert: Capital Gains Shifts

- New Inclusion Rate: As of January 1, 2026, the capital gains inclusion rate has increased to 66.7% for all corporations and for individuals on annual gains exceeding $250,000.

- Double Closing Impact: If you use the double closing method, you technically own the property. This means your profit is taxed as a capital gain, and you must factor the higher 66.7% inclusion rate into your spreads to avoid underestimating your tax bill.

- Assignment Advantage: Since pure assignments often result in business income rather than capital gains, this tax shift makes the assignment of contract strategy even more attractive for high-velocity wholesalers in 2026.

What Are The Benefits Of Wholesaling Real Estate In Canada?

Is wholesaling real estate legal in Canada? Yes, it is, and those who navigate the exit strategy within the confines of the law can expect several benefits:

- There Is No Need For A Large Cash Investment or Perfect Credit

- It Is A Short-Term Investment

- Wholesaling Real Estate Offers An On-Ramp For Beginners

- Its Offers Relatively Low-Risk Investments In Terms Of Real Estate Strategies

There Is No Need For A Large Cash Investment or Perfect Credit

The primary reason to consider wholesaling real estate is the fact that it doesn’t require a large cash investment. Additionally, there is no credit review or ongoing mortgage payments as the property is sold quickly.

This investment strategy for Canadian investors does not require you to save a significant cash investment.

It Is A Short-Term Investment

Wholesaling, by its very nature, offers a quick turnaround. The part of the process that takes the most time is researching and finding investment properties that meet your investment criteria.

Wholesaling real estate offers a return on your investment without waiting for a renovation to be complete or the receipt of future rental income.

Wholesaling Real Estate Offers An On-Ramp For Beginners

Wholesaling houses in Canada, at its basics, is a simple process. It offers new investors the opportunity to enter the market without solid credit or large amounts of capital, learn the art of real estate investing, build a list of buyers, and evaluate a viable real estate wholesale deal.

Its Offers Relatively Low-Risk Investments In Terms Of Real Estate Strategies

Prudent investors prefer low-risk investments, which are not always visible for beginners to identify. Wholesaling offers a short-term, low-risk investment, as only a small cash investment (with the provision of an earnest money deposit in escrow) is required.

Most wholesalers also have established relationships with lenders in case they need to access funding.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Buy A Wholesale Deal In Canada

The end buyer in a wholesale deal is typically an investor who plans to hold the property for rental income or further renovate to raise the purchase price for the next buyer.

If you are interested in becoming a cash buyer who takes out the wholesaler, note these important considerations:

- The end buyer saves time (and, therefore, money) because the wholesaler does much of the legwork by sorting through potential properties.

- Wholesalers are on the clock as there is a legally binding contract with a closing deadline. As such, when negotiating, remember that wholesalers are highly motivated property owners (aka sellers).

- Buying a property from an unlicensed individual creates a bit of risk, as there would be no governing oversight body to help should the deal become problematic. Due diligence offers the best defense against this potential risk.

Is Wholesaling Real Estate Legal In Ontario?

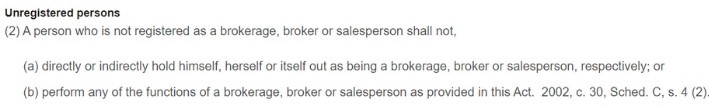

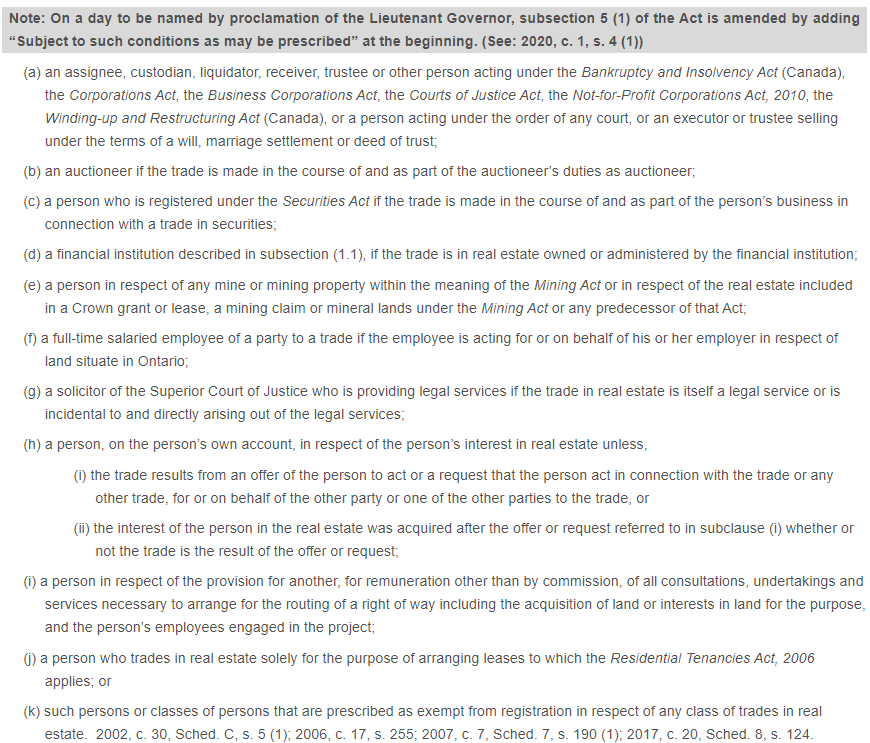

Yes, it is legal to wholesale real estate in Ontario without a real estate license if the transaction stays within the legal lanes of Canadian law. The Ontario law that defines the legal boundaries of real estate licensing is The Real Estate and Business Brokers Act (2002).

Specifically, Ontario law states that no person shall trade in real estate (as a broker or salesperson) unless appropriately licensed and registered.

The salient point in this law is that the asset being sold is "real property", which differs from the asset a wholesaler is marketing – the right to purchase the property according to the terms of the executed contract. As a result, real estate wholesalers must be diligent in their efforts to market their equitable rights, not the property, as if they were owners.

The salient point in this law is that the asset being sold is "real property", which differs from the asset a wholesaler is marketing – the right to purchase the property according to the terms of the executed contract. As a result, real estate wholesalers must be diligent in their efforts to market their equitable rights, not the property, as if they were owners.

However, Ontario real estate law offers these exemptions, noted Subsection 5(1 a-k), and shown below.

A wholesaler should make sure that the wholesale contract does not expressly prohibit assignments or be heavily conditioned with approval from the seller required to assign your equitable interest. Without an explicit clause prohibiting assignments, a wholesaler may assign their rights to another end buyer.

Wholesaling real estate requires an investor to have a working knowledge of the local real estate market and its customs.

This would include knowledge of what actions require a license in Ontario, as well as state real estate laws. In addition, wholesalers must only market or sell their equitable ownership if they avoid those actions requiring an Ontario real estate license.

Wholesale Real Estate Ontario Contract

A Canadian real estate wholesale deal typically employs two legal instruments: a Purchase Agreement and an Assignment of Contract.

If you are unfamiliar with these documents, it is prudent to speak with a real estate attorney who can offer the appropriate legal advice for your wholesale real estate deal.

The Real Estate Contract or Purchase Agreement

The wholesale real estate contract used for Ontario real estate includes a tremendous amount of information that details the terms for each party.

At the very least, a contract will include:

- The Names & Contact Information Of All Relevant Parties: This would include the wholesaler, as the buyer, plus the seller. Lawyer and real estate broker names may also be included, if applicable.

- The Description Of The Subject Property: The street address & the legal description of the property.

- The Condition Of Premises: This section delineates the property’s physical state, including existing damage and necessary repairs, if applicable.

- The Purchase Price And Financing Terms: The agreed-upon price and financing terms are recorded along with where deposits will be held.

- The Deed Type: What type of deed is being used to pass the title?

- The Closing Date: This is the day when the paperwork is executed, and the title changes hands in accordance with the contract terms.

In addition, a contract may also include additional clauses and relevant contingencies, as follows:

- The Financing Contingency: This allows for the cancellation of the real estate transaction if a buyer cannot secure the necessary financing. This is not applicable to cash buyers.

- The Inspection Contingency: This allows for the cancellation of the transaction if the buyers are dissatisfied with the home inspection report.

- The Marketable Title Option: This allows for the cancellation of the transaction if the buyer can’t obtain title insurance through a title company.

- The Buyer And Seller Default Clauses: This clause outlines what happens if either contract party defaults.

- The Risk Of Loss And Damage Clause: This clause protects the buyer if the subject property sustains damage while under contract but not yet closed.

- The Adjustments Clause: This clause may include modifications for property taxes or utilities. The specifics depend on the location of the property.

- The Statement Regarding Lead-Based Paint: This disclosure requires all parties to acknowledge that there is no lead-based paint on the property.

- The Addenda: Offers space for additional contingencies, if applicable. Caution: Sellers or their representatives may use this section to require any assignments to be approved by the seller.

The Assignment Of Contract

A wholesaler uses an Assignment of Real Estate Purchase and Sale Agreement to legally transfer their equitable interest (granted in one contract) to another buyer if the contract does not specifically prohibit this action.

The assignment contract stipulates the name of the new buyer who is assuming the equitable interest until closing.

The Assignment of Real Estate Contract includes a copy of the original purchase and sale agreement. This assignment provides the new buyer with the transaction’s details, including conditions, pricing, and stipulations if they apply.

The Assignment of Real Estate Contract also includes:

- The wholesaler’s payment terms.

- The date of the assignment.

- The date the assignment was executed.

The new buyer will generally provide a small earnest money deposit, with the balance received at or after closing.

Technical FAQ: 2026 Canadian Compliance & Tax

As the Canadian real estate landscape becomes more regulated, wholesalers must navigate specific provincial taxes and civil codes. Here are the most common technical questions regarding whether wholesaling real estate is legal in Canada in the current market cycle.

Final Thoughts

So, is wholesaling real estate legal in Canada? If you've made it this far, you know that, yes, wholesaling real estate is legal in Canada, but it’s important to follow the specific regulations in your province. While you don’t need a real estate license in most cases, you do need to ensure full transparency with all parties and adhere to local laws regarding contract assignments. For those who operate within the legal framework, wholesaling presents a great opportunity to profit in the Canadian real estate market while keeping risks and upfront costs low. Whether you are real estate wholesaling Alberta properties or wholesaling real estate in Ontario, there is a path to success; you just need the right systems.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.