Real Estate Agent Salary (2026): How Much Do Realtors REALLY Make?

Dec 12, 2025

Key Takeaways: Real Estate Agent Salary

- What: The realistic breakdown of what agents actually earn in 2026 versus what TV suggests.

- Why: To understand the difference between "Gross Commission" and "Net Income" after broker splits and fees.

- How: By comparing the linear income of an agent against the exponential growth of a real estate investor.

What You’ll Learn: Why the "average" salary is misleading and how to use your license to build wealth, not just earn a paycheck.

The actual real estate agent salary often shocks new licensees, and not in a good way.

If you have been watching shows like Million Dollar Listing or Selling Sunset, you might think every agent is driving a Range Rover and taking home six figures a month. The reality, however, is much different. According to recent data, the average realtor income fluctuates wildly, with the median often hovering closer to $50,000 or $60,000 per year, depending on the market.

Why is there such a massive gap between perception and reality? It comes down to the "Broker Haircut."

New agents often forget that a $10,000 commission check is not $10,000 in your pocket. After you pay your broker split, desk fees, E&O insurance, marketing costs, and set aside 30% for taxes, that "huge" check might barely cover your rent. When you look at realtor earnings 2026 projections, you have to look at the net, not the gross.

But here is the truth most brokers won't tell you: Being an agent is a job. Being an investor is a business.

In my experience, the people who make the real money in this industry aren't just showing houses on Sundays; they are the ones buying the houses. While an agent's income is capped by how many hours they can work, an investor's income is uncapped. In this guide, we are going to break down the hard numbers and show you how you can potentially use a license as a stepping stone to become a true deal-maker.

Here is what we will cover:

- Real Estate Agent Salary in 2026 (The Hard Numbers)

- The Hidden Costs: Why "Salary" Isn't Net Income

- The Pivot: Agent vs. Investor (The Wealth Gap)

- The "Hybrid" Model: Why Investors Should Get Licensed

- How to Transition to an Investor Mindset

- Frequently Asked Questions (FAQ)

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

Real Estate Agent Salary in 2026 (The Hard Numbers)

When you Google "how much do real estate agents make," you will usually see a broad range, typically between $49,991 and $202,334 (on the high end, according to Indeed) annually. But if you are planning your career based on these numbers, you need to pause. These averages are heavily skewed by the top 1% of "super agents" who earn millions, dragging the mathematical average up while the median agent earns significantly less.

The reality for a new licensee is sobering. An entry-level real estate agent salary is often less than $30,000 in the first year. Why? Because in this industry, you don't get paid for effort; you get paid for results. You spend your first 6-12 months building a pipeline from scratch, and since you only eat what you kill, there is no bi-weekly paycheck to float you while you learn the ropes.

The "Hourly Wage" Trap

Most people enter real estate for "freedom," but they often end up working 60+ hours a week for that $45,000 check. When you do the math, many first-year agents are effectively earning $14-$18/hour—often less than a shift manager at Starbucks, but with significantly more stress and zero benefits.

The Impact of the NAR Settlement on 2026 Earnings

To make matters more complex, real estate commission rates in 2026 are facing the biggest shift in decades due to the National Association of Realtors (NAR) settlement. While commissions haven't "crashed" as some predicted (they are holding steady around 2.4% - 2.5% per side), the workflow friction has skyrocketed.

In my experience, the money is still there, but it is harder to access. You now have to negotiate your fee directly with the buyer—who is often already cash-poor—before you even show a house. This creates income volatility that the generic "average salary" statistics simply don't account for. You aren't just selling houses anymore; you are constantly selling your own paycheck.

Location Matters: High Cost vs. High Reward

Your specific location dictates your potential cap. A salary in California looks higher on paper than one in Ohio, but remember that the cost of living eats up that difference fast. Furthermore, markets with lower price points (like Florida) often have a saturation of agents, driving the average income surprisingly low.

Here is a breakdown of projected 2026 income ranges across key markets to give you a realistic baseline:

| State / Market | Avg Entry-Level Income (Year 1) | Avg Top Producer Income (Top 10%) |

|---|---|---|

| Washington (Highest Avg) | $42,000 - $185,000 | $280,000+ |

| New York (Metro/Luxury) | $45,000 - $199,000 | $300,000+ |

| California (High Cost) | $53,000 - $256,000 | $256,000+ |

| Texas (Volume Market) | $42,000 - $212,000 | $220,000+ |

| Florida (High Saturation) | $50,000 - $201,000 | $210,000+ |

| Ohio (Midwest Avg) | $41,000 - $185,000 | $190,000+ |

The Hidden Costs: Why "Salary" Isn't Net Income

The biggest mistake aspiring agents make is confusing Gross Commission Income (GCI) with Net Income. When you see a top producer on social media claiming they "made $100,000" this month, that is almost always their GCI—before the business takes its massive cut.

As a real estate agent, you are generally not an employee. You are an Independent Contractor (1099). This means you have no health insurance, no 401(k) matching, and crucially, no taxes withheld from your checks. You are the CEO of your own startup, and startups have significant overhead before they ever turn a profit.

The "Burn Rate" Checklist

Before you ever sell a house, you will face a barrage of monthly fees just to keep your license active. In my experience, most new agents burn through their savings in months 1-6 because the expenses start on Day 1, but the "salary" doesn't start until Closing Day.

Here are the non-negotiable costs you must budget for:

The Cost of Doing Business

- Self-Employment Tax (The Silent Killer): Unlike a W-2 job, you pay both the employer and employee portion of Social Security and Medicare. That is an immediate 15.3% tax on every dollar you earn, before income tax.

- MLS & Board Dues: You cannot operate without MLS access. Between the National Association of Realtors (NAR), state boards, and local MLS fees, expect to pay $1,000 - $1,800 per year.

- Supra Key (Lockbox Access): To physically enter homes, you rent a digital key. Cost: $20 - $50/month.

- Brokerage Desk Fees: Many brokerages charge a monthly "tech fee" or "desk fee" ranging from $50 to $300/month, even if you sell zero homes.

- Marketing & Gas: Leads don't appear by magic. You will spend $300 - $500/month minimum on gas, mailers, coffee meetings, and lead generation tools just to get your first client.

The "Broker Haircut": A $10,000 Case Study

To illustrate net income vs gross income, let's walk through the math of a standard commission check. Let's assume you close a deal that generates a $10,000 commission. A new agent typically starts on a 50/50 split in exchange for leads and mentorship.

Here is how that $10,000 shrinks before it hits your personal bank account:

- Gross Commission: $10,000

- Broker Split (50%): -$5,000 (Goes to the brokerage)

- Taxes (30% Safe Harbor): -$1,500 (Must be set aside for IRS)

- Marketing Recoup: -$500 (Cost to acquire the client)

- Fixed Monthly Costs: -$200 (Amortized MLS/Desk fees)

Actual Take-Home Pay: ~$2,800

You generated $10,000 in revenue, but your agent's net income is less than $3,000. This means to earn a "salary" of $60,000 a year, you don't need to generate $60,000 in commissions—you need to generate nearly $200,000. This financial pressure forces many agents into a "hamster wheel" where they must constantly chase the next deal just to cover basic living expenses.

The Pivot: Agent vs. Investor (The Wealth Gap)

If all of this seems discouraging, here is the good news: You don't have to be trapped by the "hours-for-dollars" trade. The fundamental difference between the average agent and the wealthy real estate pro is the difference between Linear Income and Exponential Income.

As an agent, you have Linear Income. If you sell a house, you eat. If you take a month off, your income drops to zero. You are essentially "buying a job" with high overhead. You are limited by how many showings you can do and how many hours are in a day. While the average real estate agent salary is capped by time, investor income is uncapped.

When you are real estate investing, you generate Exponential Income. You are building a business that generates cash chunks (Wholesaling/Flipping) or recurring revenue (Rentals) that isn't tied to a broker's schedule.

The Wholesaling Arbitrage

Let's look at the math of Wholesaling Real Estate compared to acting as a standard agent. This is often the "lightbulb moment" for industry newcomers.

If you list a $300,000 house as an agent, you might spend months on open houses, inspections, and client hand-holding, only to walk away with that ~$2,800 net check we calculated earlier.

However, if you find that same $300,000 house as a Wholesaler (meaning you find an off-market deal at a discount), you can put it under contract and assign that paper to a flipper for a $10,000, $15,000, or even $20,000 assignment fee. You didn't have to fix a toilet, host an open house, or split that fee with a broker. One wholesale deal often equals the net profit of 3 to 4 agent closings.

Comparison: The Effort vs. Reward Matrix

Here is the breakdown of why many agents eventually transition into becoming full-time investors:

| Metric | Real Estate Agent | Wholesaler (Investor) | House Flipper (Investor) |

|---|---|---|---|

| Avg. Net Profit Per Deal | $2,500 - $5,000 | $10,000 - $25,000+ | $40,000 - $70,000+ |

| Broker Splits? | Yes (20% - 50%) | NO (Keep 100%) | NO (Keep 100%) |

| Timeline to Payday | 45 - 90 Days | 14 - 30 Days | 4 - 6 Months |

| Barrier to Entry | Exam + Licensing Fees | Knowledge + Hustle | Capital + Credit (or Private Money) |

The "No Cap" Advantage

When you are an agent, your broker likely restricts you to a specific territory or state. If you want to sell a house in another state, you can't—you aren't licensed there.

As an investor, there are no territories. You can wholesale a house in Florida while sitting in your living room in Texas. You can flip a house in Ohio without ever seeing it in person. There is no boss to tell you where you can work, and there is no "commission cap" on how much profit you can make on a single deal.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

The "Hybrid" Model: Why Investors Should Get Licensed

After seeing the math in the previous section, you might be thinking: "Okay, so I should just ignore the license and go straight to investing."

Not necessarily. The most dangerous competitor in 2026 is the Investor-Agent. This is someone who holds a real estate license, not to work a job, but to sharpen their investing business. They don't want the "salary"—they want the access, the speed, and the savings.

Here is why getting your license is arguably the highest ROI investment you can make as a beginner investor:

1. The "3% Rule" (Instant Equity)

The biggest friction in any deal is transaction costs. When you buy a flip or a rental property as an unrepresented buyer, the seller’s agent typically keeps the full commission (often 5-6%).

However, if you are licensed, you represent yourself. This means you are entitled to the "Buyer's Agent Commission" (typically 2.5% - 3%). You can often apply this commission toward your closing costs or simply lower the purchase price. On a $400,000 purchase, that is $12,000 in instant equity just for having a plastic card in your wallet.

The 3% Rule: How to Pay Yourself

- Scenario: You are buying a fixer-upper listed for $200,000.

- Without a License: You pay $200,000. The seller's agent keeps the full 6% ($12,000).

- With a License: You act as your own agent. You earn the 3% buyer commission ($6,000).

- The Result: You can instruct escrow to credit that $6,000 toward your down payment. You effectively bought the house for $194,000, instantly increasing your profit margin.

2. MLS Access: The Ultimate Data Tool

Zillow and Redfin are for the public; they are delayed and often inaccurate. The MLS (Multiple Listing Service) is for pros. It gives you access to data that is critical for investors:

- True Comps: See exactly what comparable homes sold for, down to the concessions and repair credits (which Zillow hides).

- Private Remarks: Read agent notes like "Seller motivated," "Cash only," or "Mold present"—clues that scream opportunity.

- Speed: You get notified the second a distressed property hits the market, hours before it aggregates to public sites.

3. Pocket Listings & Networking

Real estate is a "who you know" business. Many of the best deals never hit the open market; they are sold as "pocket listings" within brokerages. By hanging your license with an investor-friendly brokerage, you get access to these internal deals during weekly office meetings before the general public even knows they exist.

4. The Legal Shield (SC, OK, IL Laws)

In 2026, wholesaling laws are tightening. States like South Carolina, Oklahoma, and Illinois have passed strict regulations effectively banning the practice of "marketing a contract" without a license.

If you are unlicensed, you are walking a legal tightrope in these states. If you are licensed, the path is clear. You aren't "brokering without a license"—you are simply a licensed agent marketing a property (with proper disclosures). The license removes the target from your back and allows you to scale your marketing without fear of state crackdowns.

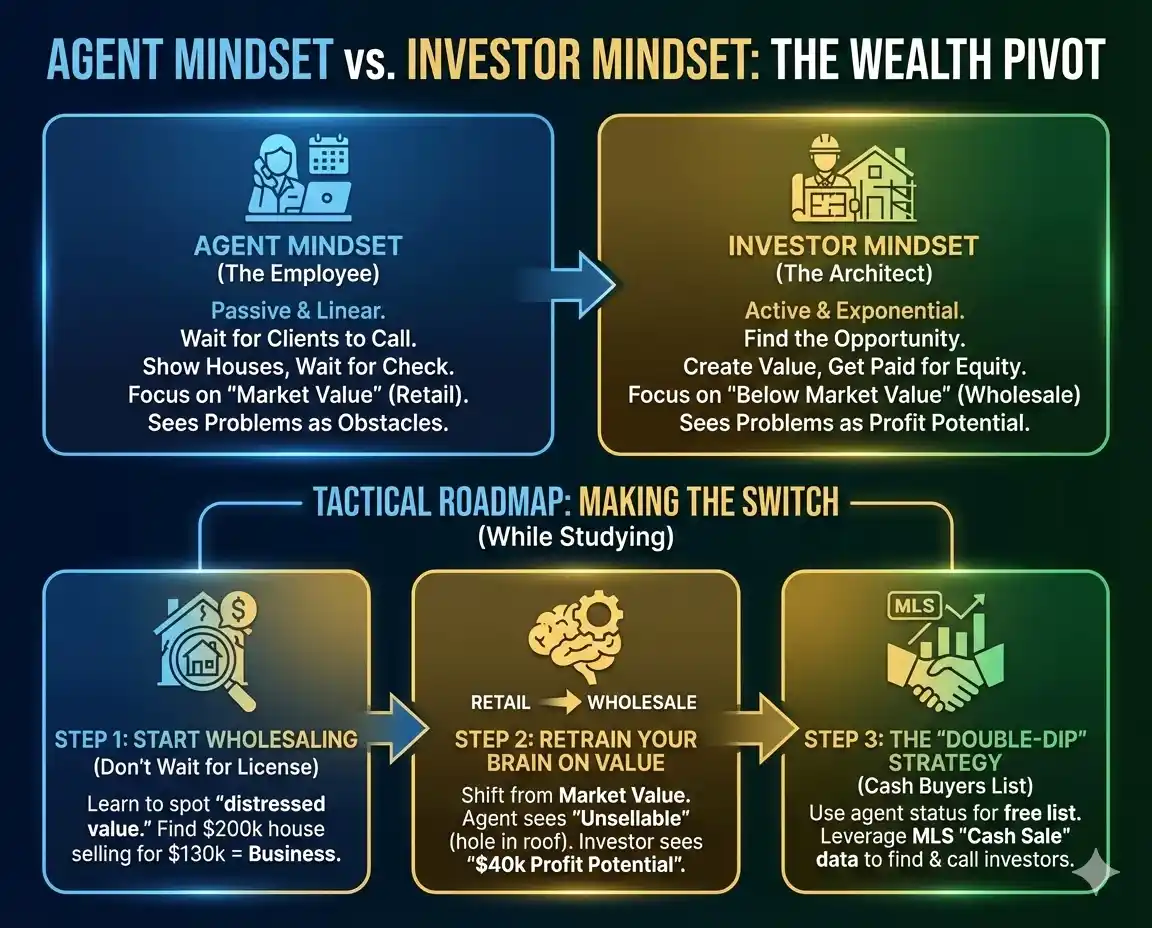

How to Transition from "Agent Mindset" to "Investor Mindset"

The hardest part of this transition isn't the mechanics; it's the mindset. Agents are trained to be employees of the transaction—you wait for a client to call, you show a house, you wait for a check. Investors are architects of the transaction—you find the opportunity, you create the value, and you get paid for the equity you created.

In my experience, the agents who fail to transition are the ones who keep looking for "clients." Stop looking for clients. Start looking for deals. If you find a great deal, the money (and the clients) will automatically follow.

Here is your tactical roadmap to making the switch while you are still studying for your license:

- Step 1: Don't Wait for the License (Start Wholesaling)

You do not need a license to understand deal analysis. While you are memorizing fair housing laws for your exam, spend your evenings learning Wholesaling. This is the low-barrier entry point where you learn to spot "distressed value." If you can find a house worth $200k selling for $130k, you have a business. You don't need a license to find that math; you just need hustle. - Step 2: Retrain Your Brain on Value

Agent training teaches you to price homes at "Market Value" (Retail). Investor training teaches you to find homes below Market Value (Wholesale).

The Pivot: When you walk into a house with a hole in the roof, your Agent Brain will say, "This is unsellable." Your Investor Brain must learn to say, "This is a $40,000 profit potential." Use your license classes to master the wholesale real estate contracts, but use your investor studies to master the math. - Step 3: The "Double-Dip" Strategy (Cash Buyers List)

Here is a "Super Section" hack most newbies miss: Use your agent status to build your investor buyers list for free.

The Tactic: When you join a brokerage, pull up every "Cash Sale" in your zip code from the last 6 months on the MLS. The agents on the buying side of those transactions represent cash investors. Call those agents and say: "I see you represented a buyer on [Address]. I'm an agent/investor finding similar off-market deals. Is your buyer looking for more properties?" You will build a massive Cash Buyers list in one week using data only agents have access to.

The Blueprint: Stop Guessing and Start Closing

Transitioning from a standard agent to a high-income investor doesn't happen by accident. You need a proven system. We have seen too many agents get their license and then freeze because they don't know the actual mechanics of finding a distressed property or analyzing a rehab budget.

That is why we created the Ultimate Guide to Start Real Estate Investing. It is not just theory; it is the exact playbook we use to navigate every market cycle.

Whether you want to generate quick cash through wholesaling, tackle your first massive fix and flip project, or build long-term wealth with buy-and-hold rentals, this guide covers it all. It is the missing link between "getting licensed" and "getting paid."

Ready to get started? Click the image below to download your FREE copy of the Ultimate Guide now.

Frequently Asked Questions (FAQ)

Here are the direct answers to the most common questions regarding the real estate agent salary, market trends, and career path decisions in 2026.

Final Thoughts: Don't Just Earn a Salary, Build an Empire

At the end of the day, chasing a commission check is still trading your time for money. While there is nothing wrong with earning a living as an agent, you didn't get into this industry just to have another job.

Remember, the real estate license is just a piece of plastic. It gives you access to the game, but it doesn't guarantee you will win. The true skill—the one that builds generational wealth—is the ability to find, analyze, and control deals.

You don't have to choose between the two paths. You can get your license to gain credibility and access, but keep your mindset focused on equity. Use the commission checks to keep the lights on, but use your investing profits to buy your freedom.

So, stop stressing about the average real estate agent salary and start focusing on your net worth. The market is waiting for you to make your move.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.