How To Sell A House FAST & For TOP DOLLAR (2025)

Aug 18, 2025

The Final Punch List

As we near the end of the renovation, it’s time to get the property listing-ready.

At this stage, we need to create a final punch list. No matter how good your contractor is, there are usually a few items left to address. This could include a cracked tile, plastic left in appliances, or small nicks in the walls that need repainting.

The final punch list ensures all these details are polished off, leaving the property looking its best. Walk through the house with your contractor and make sure everything is completed.

These last steps are critical if you want to master how to sell a house fast once your flip hits the market.

- Staging and Cleaning the Property

- Importance of Professional Photos

- Listing the Property and Agent Responsibilities

- Handling and Negotiating Multiple Offers

- Offer Acceptance and Inspection Period

- Final Walkthrough and Day of Closing

- Disbursement of Funds and Final HUD Statement

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

Staging and Cleaning the Property

Once the punch list is finished, the next step is staging and cleaning. The property must be spotless and ready for buyers to walk through.

Staging is especially important if the comps in your area have staged homes.

It helps buyers visualize themselves living in the space—imagining their family in the living room, the kitchen, or the main bedroom.

While staging is usually an expense covered by the real estate agent, it’s a valuable tool to make your property more appealing.

Importance of Professional Photos

After staging, professional photos are a must. Even if you decide not to stage, never use an iPhone or take photos yourself.

Hire a professional photographer who can make your renovated home stand out online.

One great resource is RanchoPhotos.com, a company that has been used for over a decade to create stunning real estate photos.

High-quality images help your property shine on the MLS and ultimately sell for top dollar.

Listing the Property and Agent Responsibilities

The goal is to sell the property for its ARV of $545,000. To achieve this, your listing agent needs to handle several key responsibilities.

First, they must put up a “For Sale” sign so neighbors know the house is on the market.

Next, the property should be listed on the MLS with a detailed description and syndicated to sites like Realtor.com, Zillow, and Redfin.

Your agent should also schedule open houses and ensure maximum exposure by marketing the property across multiple platforms.

Open Houses, Mailers, and Social Media Marketing

Open houses—often held on weekends—are essential for bringing buyers into the home. The more open houses your agent hosts, the more traffic the property gets.

Beyond that, agents should use mailers, flyers, and even door knocking to spread the word in the neighborhood.

Social media marketing is also a must—your agent should leverage Instagram, Facebook, Twitter, and email lists to showcase your new listing.

Broker Caravans and Maximizing Exposure

Another effective strategy is attending broker caravans. These are events where real estate brokers and agents preview new listings together.

By getting your property in front of as many agents as possible, you increase the chances they’ll bring their buyers to your home.

The goal is maximum exposure—more eyes on the property means more offers, better negotiations, and ultimately, a higher sale price.

Listing Strategy Using Price Ranges

Here’s a pro tip: instead of listing your property at a fixed price, consider using a price range.

For example, instead of listing directly at $545,000, you might set the range at $519,000 to $559,000.

This strategy masks your target price and encourages more offers.

Buyers who submit at the lower end can be countered, creating competition and driving offers closer to—or even above—your ARV.

Not all MLS systems allow this, but if yours does, it can be a powerful tool to generate multiple offers.

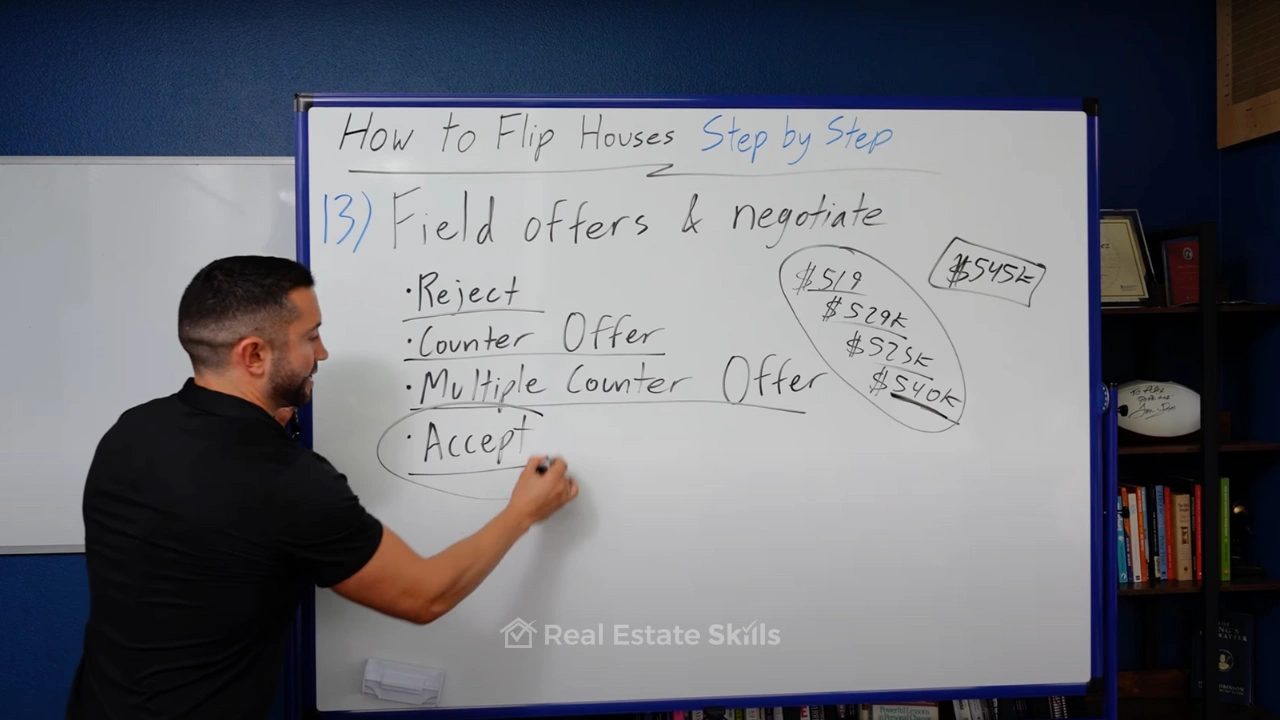

Handling and Negotiating Multiple Offers

When offers start coming in, you have options: reject, counter, counter multiple, or accept. However, flat-out rejecting offers is usually a mistake.

Every offer is an opportunity, even if it starts low.

If priced correctly, you may receive several offers within your range.

For example, you might get offers at $525,000, $540,000, and $545,000.

By issuing multiple counteroffers, you can ask all buyers to submit their “highest and best.” This often drives the final price to your target—or higher.

Offer Acceptance and Inspection Period

Once you’ve negotiated and accepted the best offer, the property enters the inspection period. For most conventional or first-time homebuyer loans, this period lasts 10–17 days.

During this time, the buyer’s home inspector will verify that everything is up to code and in good condition.

The buyer will also submit their earnest money deposit (EMD) within three days, signaling good faith.

Appraisal Process and Value Justification

Next comes the appraisal. An appraiser will confirm the property’s value by comparing it to comps in the area.

If you’ve done your analysis correctly, the appraised value should align with your ARV of $545,000.

A smart tip is to attend the appraisal (or have your agent attend) with a packet of comps that justify your asking price.

Handing these directly to the appraiser can help ensure your property is valued appropriately.

Request for Repairs and Handling Buyer Concerns

The home inspector may still flag minor issues the contractor missed—such as loose fixtures or cabinets not closing properly. Buyers may submit a request for repairs.

At this point, you can either have your contractor fix the items or provide the buyer with a credit (e.g., $500–$2,000) so they can address them themselves.

The goal is to keep the buyer happy and keep the deal moving forward.

Final Walkthrough and Day of Closing

Before closing, the buyer and their agent will conduct a final walkthrough—usually a day or two before. This ensures the property is in the agreed-upon condition.

On closing day, funds are wired to escrow or the closing attorney. The buyer’s mortgage lender brings in the funds, real estate agents receive commissions, and your private or hard money lenders are paid back their principal plus interest.

Disbursement of Funds and Final HUD Statement

Finally, you’ll receive the HUD statement, which breaks down all expenses and shows your net profit.

And that’s how a house flip comes full circle—from renovation to resale—using smart strategies and execution.

By following these steps, you’ll have a clear blueprint for how to sell a house fast while maximizing your profit.

If you want to build a hyper-profitable wholesaling and flipping business, check out our full training at Real Estate Skills.

Happy flipping!

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.