How To Flip Houses In South Dakota: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses in South Dakota means buying properties below market value, renovating them to increase appeal and equity, and selling them for profit. The article highlights opportunities across both larger cities like Sioux Falls and Rapid City as well as smaller towns.

Why: South Dakota can be profitable for investors due to affordable property prices, stable housing markets, and growing demand in key regions, providing good potential for return on investment.

How: Follow the steps outlined: research local market trends, understand state-specific real estate regulations, assemble your renovation team, secure financing, identify undervalued properties, manage renovations efficiently, and list and sell strategically for maximum profit.

Flipping houses has long been regarded as one of the best ways to build wealth, offering the potential for substantial profits without the need for a college degree. If you're interested in seeing what flipping can do for you and your financial future, there's one state that should be on your radar: South Dakota.

Beyond its picturesque landscapes and welcoming communities, South Dakota presents a unique opportunity for aspiring real estate investors. With its remarkably low unemployment rate and robust demand for housing, the state offers a promising environment for house-flipping success.

This favorable combination of factors makes South Dakota a hotspot for house flippers seeking to capitalize on the growing need for well-maintained homes. In this article, we will teach you everything you need to know about how to flip houses in South Dakota, including:

- What Is Flipping Houses?

- Why Flip Houses In South Dakota?

- South Dakota House-Flipping Statistics

- How To Flip Houses In South Dakota In 15 Steps

- How Much Do House Flippers Make In South Dakota?

- Is House Flipping Illegal In South Dakota?

- Do You Need A License To Flip Houses In South Dakota?

- How Much Does It Cost To Flip A House In South Dakota?

- How To Flip A House In South Dakota With No Money

- What's The Best Place To Flip Houses In South Dakota?

- Is It Hard To Flip Houses In South Dakota?

- How Do You Find Contractors For Flipping Houses In South Dakota?

- Final Thoughts On Flipping Homes In South Dakota

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses often referred to as rehabbing, involves purchasing properties to renovate and improve them before reselling them for a profit. This real estate strategy entails three pivotal stages: acquisition, rehabilitation, and resale.

In the buying phase, investors aim to secure properties at advantageous prices, often distressed or undervalued homes. Subsequently, the rehabilitation phase focuses on renovating and upgrading the property to enhance its market value and appeal. The final step is reselling the property, ideally at a higher price point, to capitalize on the improved value and attract potential buyers.

Profits in house flipping are maximized by carefully managing each stage of the process, from selecting properties with potential to negotiating favorable purchase prices and conducting cost-efficient renovations.

Amid South Dakota's thriving real estate market, learning the art of flipping houses can be particularly rewarding. The state's low unemployment rate translates into strong housing demand, further boosting the potential for lucrative returns on investment. As a result, now is as good of a time as any to learn how to flip houses in South Dakota.

Why Flip Houses in South Dakota?

South Dakota presents a compelling opportunity for house flippers due to its stable real estate market and affordable property prices. With a median home price significantly lower than the national average—hovering around $300,000 compared to the national median of over $400,000—flippers can find undervalued properties that offer substantial potential for profit.

According to RealtyTrac, the state currently has 34 properties in foreclosure, 9 bank-owned properties, and 25 headed for auction, providing a steady stream of distressed properties for investors to consider. Rapidly growing cities like Sioux Falls and Rapid City provide even more opportunities, as they experience consistent population growth and increasing demand for housing, which can drive up property values. Additionally, ATTOM Data Solutions' latest Home Flipping Report shows that the average gross flipping profit nationwide is $72,000, underscoring the strong profit potential even in smaller markets like South Dakota.

Additionally, South Dakota's real estate market benefits from relatively low competition compared to more saturated markets. This lower competition can lead to less aggressive bidding wars and more favorable purchase prices. The state's favorable property tax rates and business-friendly environment further enhance the attractiveness for investors. With property taxes among the lowest in the nation, flippers can maximize their returns on investment by keeping holding costs down.

Economic stability and growth in South Dakota also play a crucial role in making it an appealing state for house flipping. The state enjoys a low unemployment rate and a diverse economy that includes agriculture, manufacturing, and tourism, contributing to a steady housing demand. This economic stability helps ensure that property values remain resilient, making South Dakota a promising market for those looking to invest in real estate and achieve profitable flips.

Read Also: How To Wholesale Real Estate In South Dakota

South Dakota House-Flipping Statistics

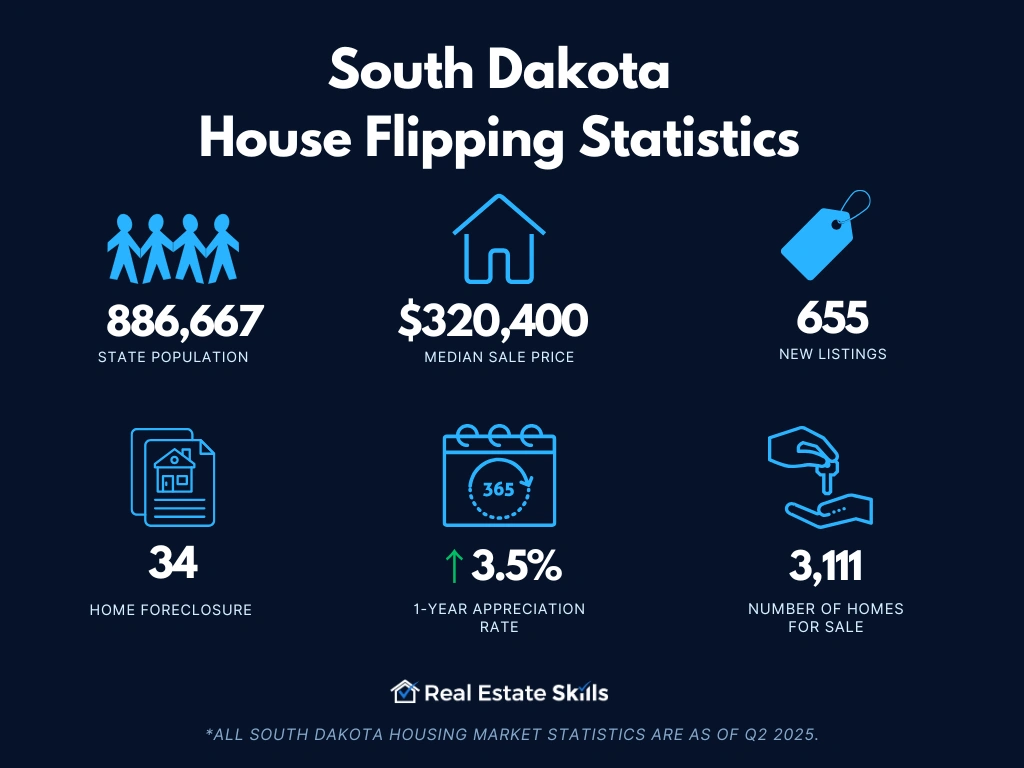

Understanding how to flip houses in South Dakota starts with learning the most fundamental indicators of the local market. As a result, we’ve provided some of the most critical South Dakota house-flipping statistics investors should know before making any deals of their own (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 886,667

- Employment Rate: 65.1%

- Median Household Income: $71,810

- Median Sale Price: $320,400 (+3.5% Year-Over-Year)

- Number Of Homes Sold: 460 (+3.1% Year-Over-Year)

- Median Days On Market: 93 (+10 Year-Over-Year)

- Number Of Homes For Sale: 3,111 (+10.9% Year-Over-Year)

- Number Of Newly Listed Homes: 655 (-6.3% Year-Over-Year)

- Months Of Supply: 5 (+0 Year-Over-Year)

- Homes Sold Above List Price: 13.5% (-0.42 Points Year-Over-Year)

- Home Foreclosure: 34

*All South Dakota housing market statistics are as of Q2 2025.

How To Flip Houses In South Dakota In 15 Steps

New investors flipping homes in South Dakota should follow these steps closely:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Selecting the right market is crucial for successful house flipping in South Dakota. Start by researching various cities and neighborhoods to identify areas with strong potential for appreciation and demand. Focus on locations with rising property values and stable economic conditions. For instance, Sioux Falls and Rapid City are known for their growing economies and increasing home prices, making them attractive options for investors looking to maximize returns.

Consider also the demographic trends and local development plans when choosing your market. Areas with expanding populations, improving infrastructure, and planned commercial developments often offer better opportunities for profit. For example, Brookings benefits from its proximity to South Dakota State University, which helps drive demand for rental and for-sale properties. Understanding these factors can help you choose a market with high growth potential.

Finally, assess the competition and saturation levels within your chosen market. Areas with fewer investors or less competition may provide better opportunities to find undervalued properties and secure favorable purchase prices. On the other hand, markets with high competition may require more strategic planning and negotiation skills to succeed. Balancing market potential with competition levels will help you make an informed decision and set the stage for a successful house-flipping venture in South Dakota.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make in South Dakota?

In South Dakota, the average gross flipping profit has been notably attractive for real estate investors. As of the latest data, house flippers in South Dakota are seeing an average gross profit of approximately $45,000 per flip. This figure reflects a combination of affordable property prices and steady demand for renovated homes. Flipping houses in South Dakota offers a compelling opportunity for investors looking to capitalize on lower initial investment costs while still achieving significant returns.

Among the cities in South Dakota, several stand out for their substantial gross flipping profits. According to the Home Flipping Report by ATTOM Data Solutions, three cities in South Dakota where flippers have seen the highest median-priced transaction profits are:

- Sioux Falls, SD: $50,000 average gross flipping profit

- Rapid City, SD: $47,000 average gross flipping profit

- Aberdeen, SD: $42,000 average gross flipping profit

These cities offer some of the best prospects for house flippers in the state, driven by their growing real estate markets and relatively affordable property prices. To maximize profits, it’s crucial for investors to understand local market trends, manage renovation costs effectively, and select properties with strong potential for appreciation.

Is House Flipping Illegal in South Dakota?

House flipping is legal in South Dakota, and the state has no specific laws prohibiting this real estate investment strategy. Investors can freely buy, renovate, and sell properties for profit as long as they comply with general real estate regulations and local ordinances. It is essential, however, to adhere to zoning laws, obtain necessary permits for renovations, and ensure all property transactions are conducted transparently and legally.

South Dakota’s real estate market supports house flipping with its straightforward regulatory environment. While there are no unique restrictions against flipping houses, investors should be aware of standard practices such as reporting capital gains and adhering to state and federal tax requirements. Ensuring compliance with these regulations will help avoid legal issues and facilitate a smooth investment process.

Read Also: Is Wholesaling Real Estate Legal In South Dakota?

Do You Need A License To Flip Houses In South Dakota?

In South Dakota, investors looking to flip homes are not required to hold a real estate license. However, obtaining a real estate license can offer several advantages. With a license, investors gain access to the Multiple Listing Service, a comprehensive database of property listings that can provide valuable insights and investment opportunities for potential deals.

Additionally, having a license grants investors entry into a broader network of real estate professionals, fostering connections with agents, brokers, and other investors, which can prove invaluable for sourcing properties, partnerships, and market insights.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How Much Does It Cost to Flip a House in South Dakota?

Flipping a house in South Dakota involves several key expenses, including acquisition, renovation, and carrying costs. Understanding these costs can help investors better predict their potential profits and manage their budgets effectively. Here’s a breakdown of the typical costs associated with house flipping in South Dakota.

The Home Purchase Price

In South Dakota, the median home purchase price is significantly lower than in many other states, typically around $250,000. This affordability provides a solid foundation for house flipping, with the potential for substantial returns. For instance, distressed properties in cities like Sioux Falls or Rapid City can sometimes be acquired for under $150,000, while more upscale properties might approach the $350,000 mark. Depending on the property’s condition and location, the initial purchase price will vary, impacting your overall investment strategy.

The Home Repair Costs

Renovation costs in South Dakota also tend to be lower than the national average. On average, investors can expect to spend between $20,000 and $40,000 on repairs and upgrades for a typical three-bedroom home. Costs can vary widely based on the extent of renovations needed, with basic cosmetic updates costing less and major structural repairs or extensive remodels pushing costs higher. For accurate estimates, it is advisable to get quotes from multiple contractors to ensure a reasonable budget for the renovation phase.

Carrying Costs

Carrying costs include property taxes, insurance, utilities, and general maintenance while the property is under renovation. In South Dakota, these costs are relatively low compared to many other states. Property taxes might average around $1,500 to $3,000 annually, and insurance can range between $800 and $1,500. Utilities and maintenance costs will vary depending on the property size and condition but should be factored into your overall budget to avoid unexpected expenses.

Closing, Marketing, & Sales Costs

When selling the flipped property, anticipate costs such as real estate agent commissions, closing fees, and marketing expenses. Real estate commissions in South Dakota typically range from 5% to 6% of the sale price, while closing costs can add another 1% to 2%. Marketing costs, including listing fees and staging expenses, should also be considered to effectively attract potential buyers and secure a sale at a desirable price.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How To Flip A House In South Dakota With No Money?

One of the notable aspects of flipping homes in South Dakota is that investors don't necessarily have to rely on their funds to finance deals. Instead, they can tap into various external funding sources, primarily hard money lenders and private money lenders. These lenders provide quick and short-term financing for real estate investment projects.

These financing options can prove crucial for investors who may not have substantial capital but still want to participate in the lucrative house-flipping business. Moreover, those new to house flipping can use these funding sources to learn the ropes and build their portfolios.

Additionally, wholesaling presents a compelling opportunity for investors seeking ways to flip houses without using their capital. Wholesaling involves entering into contracts to purchase investment properties, and then assigning or selling those contracts to other buyers at a higher price. This approach allows investors to earn a fee for facilitating the transaction, acting as intermediaries between sellers and buyers.

What's the Best Place to Flip Houses in South Dakota?

When considering house flipping in South Dakota, certain cities stand out due to their property price trends, population growth, and local economic conditions. Here are five top cities in South Dakota for house flipping:

- Sioux Falls: Sioux Falls is South Dakota's largest city and offers a dynamic market for house flippers. With a median home price of approximately $280,000, Sioux Falls has experienced a steady increase in property values, with a growth rate of around 7% over the past year. The city's robust economic development and population growth make it a prime location for profitable flips.

- Rapid City: Rapid City is another excellent choice for house flippers in South Dakota. The median home price here is about $260,000, reflecting a moderate increase of 6% over the past year. Rapid City's growing tourism industry and expanding job market contribute to its appeal for real estate investors seeking solid returns.

- Aberdeen: Aberdeen, known for its affordable housing market, has a median home price of roughly $220,000. The city has seen a modest increase in property values, around 5% over the past year. Aberdeen's stable economy and low cost of living make it an attractive option for house flippers looking for budget-friendly investments with potential for steady appreciation.

- Brookings: Brookings offers a promising market for house flippers with a median home price of $250,000. The city has experienced a notable 8% increase in home values recently. Brookings benefits from its proximity to South Dakota State University, contributing to a stable demand for housing and making it a favorable market for investors.

- Mitchell: Mitchell, with a median home price of about $200,000, provides an affordable entry point for house flippers. The city has seen a moderate increase of 4% in property values over the past year. Mitchell's low cost of living and strong local economy make it an appealing choice for investors seeking potential flips with lower upfront costs.

Choosing the right city for flipping houses in South Dakota involves evaluating local market conditions and understanding regional growth trends. Each of these cities offers unique advantages that can contribute to a successful house-flipping venture.

With this in mind, we invite you to join our FREE training on house flipping in South Dakota. We'll guide you through the ins and outs of finding the perfect property, performing the right renovations, and, ultimately, flipping for a profit. Don't miss out on the chance to turn California's real estate opportunities into your financial success story. Sign up for our free training today!

Read Also: 17 Best Cities To Wholesale Real Estate [UPDATED 2025]

Is It Hard to Flip Houses in South Dakota?

Flipping houses in South Dakota is generally considered manageable due to the state's relatively stable real estate market and lower property prices compared to more competitive states. The affordability of homes, with median prices around $250,000, makes it easier for investors to acquire properties and manage renovation costs. Additionally, South Dakota's straightforward regulatory environment and lower competition contribute to a more accessible market for house flippers.

However, challenges can arise, such as the need to navigate local zoning regulations and obtain the necessary permits for renovations. While these requirements are less complex than in some larger states, they still require attention to detail to avoid delays and ensure compliance. Overall, the lower cost of entry and favorable market conditions generally make house flipping in South Dakota less daunting compared to more volatile real estate markets.

Final Thoughts On Flipping Homes In South Dakota

Learning how to flip houses in South Dakota looks like a smart move in 2023. Following the comprehensive steps outlined above, aspiring house flippers in South Dakota can position themselves for success while minimizing risks. A strategic approach can enhance their chances of achieving profitable outcomes in the competitive real estate market.

Are you eager to learn how to flip houses in South Dakota? Don't navigate the complexities of the real estate market alone. Reach out to Real Estate Skills today for expert guidance and support. Our experienced team will provide the knowledge and tools you need to flip houses successfully in South Dakota. Contact us now to embark on your flipping journey with confidence and purpose.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.