How To Flip Houses In North Carolina: 15-Step Home Renovation Guide

Apr 29, 2025

Those who learn how to flip houses in North Carolina may be able to generate a profit of their own. If you want to start flipping homes in the Tar Heel State, this guide will teach you everything you need to know, including:

- Why Flip Houses In North Carolina?

- North Carolina House Flipping Statistics

- How To Flip Houses In North Carolina In 15 Steps

- How Much Do House Flippers Make In North Carolina?

- Is House Flipping Illegal In North Carolina?

- Do I Need A Real Estate License To Flip Houses In North Carolina?

- How Much Does It Cost To Flip A House In North Carolina?

- How To Flip A House In North Carolina With No Money

- What's The Best Place To Flip Houses In North Carolina?

- Is It Hard To Flip Houses In North Carolina?

- How Do You Find Contractors For Flipping Houses In North Carolina?

- Final Thoughts On Flipping Homes In North Carolina

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

What Is Flipping Houses?

Flipping houses is a real estate investing strategy where investors buy an undervalued home, improve its value by making upgrades, and sell the asset for more than their total investment.

The best investors optimize profit margins at every stage, buying low, upgrading on a strict budget, and selling high.

Read Also: Is Wholesaling Real Estate Legal In North Carolina?

Why Flip Houses In North Carolina?

North Carolina is an attractive destination for house flippers due to its robust real estate market, driven by consistent population growth and a strong economy. The state has seen a population increase of over 9% in the past decade, with major cities like Charlotte and Raleigh experiencing even more significant growth. This influx of residents has led to a heightened demand for housing, creating lucrative opportunities for real estate investors. The state's diverse economy, anchored by industries such as technology, finance, and education, ensures a steady job market, further fueling the demand for residential properties.

Another compelling reason to flip houses in North Carolina is the state's affordability compared to other hot real estate markets. As of 2024, the median home price in North Carolina is around $335,760, which is considerably lower than the national median. This affordability, combined with the state's favorable tax environment, allows flippers to purchase properties at competitive prices and achieve substantial returns on investment. Moreover, according to RealtyTrac, the state currently has 3,106 properties in foreclosure, 201 bank-owned properties, and 1,280 headed for auction—offering a broad inventory of distressed homes ideal for flipping. Additionally, ATTOM Data Solutions reports that the gross flipping profit in North Carolina is $72,000, highlighting the strong earning potential in the state's real estate market. North Carolina also offers a variety of neighborhoods, from urban centers to suburban and rural areas, each presenting unique opportunities for different flipping strategies.

Finally, North Carolina's real estate market is supported by strong appreciation rates, making it an ideal location for house flipping. Over the past few years, home prices in the state have consistently outpaced national averages, with some areas experiencing annual appreciation rates of 10% or more. This trend is expected to continue as more people relocate to the state for its quality of life, mild climate, and employment opportunities. For house flippers, this means the potential for significant profits as property values rise, particularly in high-demand areas like the Research Triangle and the greater Charlotte metro area

Read Also: North Carolina Real Estate Classes Online

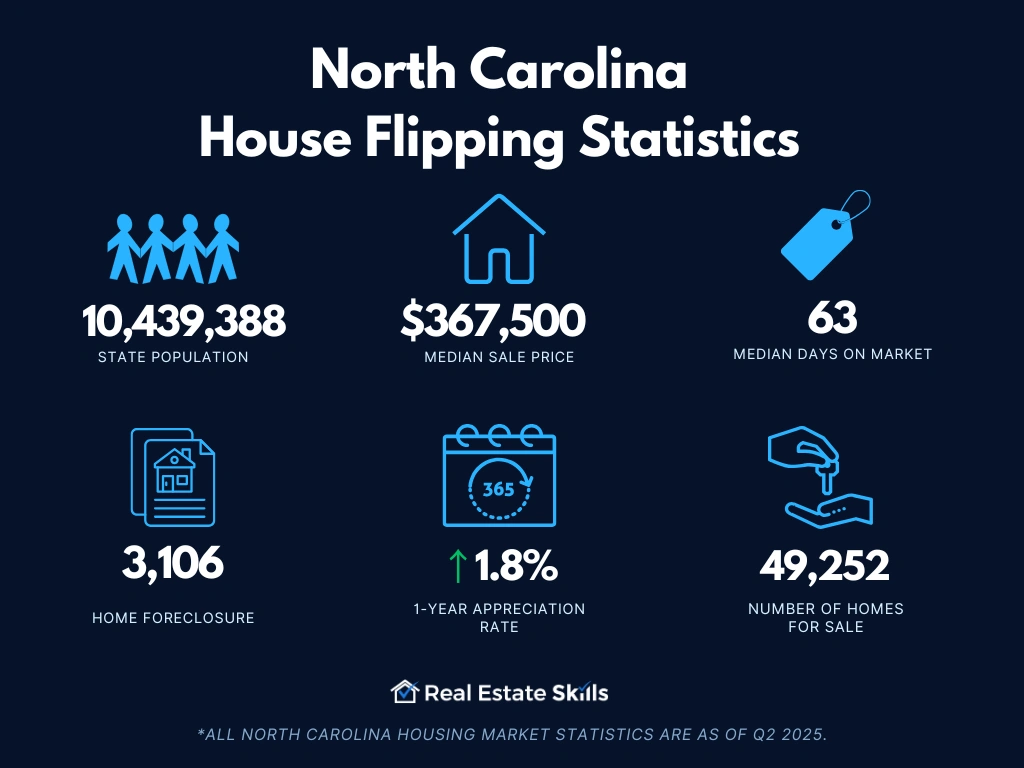

North Carolina House Flipping Statistics

Despite negative sentiment surrounding the U.S. economy, home flipping remains a lucrative investment strategy in every state, and North Carolina is no exception. (Data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 10,439,388

- Employment Rate: 59.5%

- Median Household Income: $70,804

- Median Sale Price: $367,500 (+1.8% Year-Over-Year)

- Number Of Homes Sold: 9,497 (-7.0% Year-Over-Year)

- Median Days On Market: 63 (+12 Year-Over-Year)

- Number Of Homes For Sale: 49,252 (+17.0% Year-Over-Year)

- Number Of Newly Listed Homes: 13,729 (-3.2% Year-Over-Year)

- Months Of Supply: 4 (+1 Year-Over-Year)

- Homes Sold Above List Price: 17.0% (-4.7 Points Year-Over-Year)

- Homes With Price Drops: 27.0% (+4.8 Points Year-Over-Year)

- Home Foreclosure: 3,106

*All North Carolina housing market statistics are as of Q2 2025

To succeed in the North Carolina market, mastering the fundamentals of real estate investing is essential. Flipping Houses 101 in North Carolina starts with gaining a deep understanding of local market dynamics, tracking economic indicators, and staying informed about property values across the state. This knowledge forms the backbone of effective house-flipping strategies tailored to North Carolina, helping investors make informed decisions and maximize their returns in this thriving market.

How To Flip Houses In North Carolina In 15 Steps

To maximize profits when flipping houses in North Carolina, it's crucial to understand local market trends and carefully plan renovations. Acquiring properties at below-market prices, budgeting accurately for renovations, and choosing desirable neighborhoods can significantly impact the net profit from each flip. To increase the likelihood of a profitable house flip, follow these 15 steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is crucial when flipping houses in North Carolina. The state's real estate landscape varies significantly from one region to another, with urban centers like Charlotte, Raleigh, and Durham offering different opportunities compared to more suburban or rural areas like Greensboro or Asheville. Each market has its own dynamics, including property prices, demand, and competition levels. For instance, Charlotte and Raleigh have seen substantial population growth and economic development in recent years, making them attractive markets for house flipping. However, higher competition in these cities can drive up prices, requiring a more strategic approach to find profitable deals.

When picking your market, it's essential to consider factors such as population growth, job market strength, and local economic conditions. Areas experiencing population booms or job growth tend to have higher demand for housing, which can lead to quicker sales and potentially higher profits. For example, Raleigh's population grew by 2.3% in 2023, driven by the tech industry and an influx of new residents, making it a hot market for flipping. On the other hand, smaller cities or towns in North Carolina might offer lower entry costs, allowing for higher profit margins, albeit with a potentially longer selling period.

Additionally, understanding the local buyer demographic is key to tailoring your renovations and marketing strategy. In urban markets like Charlotte, young professionals and families might be looking for modern, move-in-ready homes with proximity to work and amenities. In contrast, more rural or suburban markets might attract retirees or second-home buyers, who may prefer traditional or ranch-style homes. By carefully analyzing the market, you can make informed decisions that align with buyer preferences and maximize your chances of a successful flip in North Carolina.

Find Your Money

Securing financing is a crucial step in flipping houses in North Carolina. The ability to access the right funds can determine the success of your project, from acquiring the property to covering renovation costs and managing other expenses. It's essential to explore various financing options and choose the one that best fits your investment strategy and financial situation. Whether you're using personal savings, traditional mortgages, or alternative funding sources, having a clear understanding of your financial resources will help you effectively budget and plan for your house flipping venture.

In North Carolina, two popular sources of funding for house flipping are private lenders and hard money lenders. Each option offers different advantages, so it's important to evaluate which one aligns with your project goals and financial needs. Private lenders often provide more flexible terms and can be a good option for investors looking for a more personalized approach. Hard money lenders, on the other hand, typically offer faster access to capital but may come with higher interest rates and shorter repayment periods. Understanding these options will help you make informed decisions and secure the necessary funds for a successful house flip.

How To Find Private & Hard Money Lenders

Finding the right private or hard money lender involves researching and networking to identify potential sources of funding. Private lenders are often individuals or small investment groups who offer loans based on their assessment of your project and financial situation. For those learning how to invest in real estate in North Carolina, securing financing through private lenders can be a flexible and effective way to fund investment opportunities. To find private lenders, start by attending real estate investment meetups, joining local real estate investment groups, or leveraging online platforms that connect investors with private lenders. Building relationships with these lenders can lead to more favorable loan terms and a better understanding of their lending criteria.

Hard money lenders are typically companies or institutional investors that provide short-term loans secured by real estate. These lenders are more focused on the value of the property rather than your credit score. To locate hard money lenders, you can use online resources like Kiavi and Lima One, which offer lists of both local and national lenders along with their contact information. Additionally, networking within real estate investment circles and seeking referrals from experienced investors can help you find reputable hard money lenders with competitive rates and terms.

By exploring these financing options and leveraging available resources, you can secure the funding needed to successfully flip houses in North Carolina. Whether you choose private or hard money lenders, ensuring you have a solid financial plan will set you up for success in your house flipping endeavors.

Find Three Contractors

Finding reliable contractors is essential for a successful house-flipping project in North Carolina. When choosing contractors, it’s important to select at least three different professionals for key roles, such as general contractor, electrician, and plumber. This allows you to compare their estimates, availability, and work quality. Start by conducting thorough research and obtaining referrals from local real estate networks or previous investors. This will give you a shortlist of contractors who have proven experience and a good reputation.

Once you have identified potential contractors, schedule interviews and request detailed estimates for the work required. Be sure to check their references and past projects to ensure they have the experience needed for your specific renovation needs. Comparing these contractors based on their bids, professionalism, and project timelines will help you make an informed decision. Effective communication and a clear contract outlining the scope of work and payment terms will set the stage for a successful collaboration and timely completion of your house flip.

How To Find A General Contractor

Finding a general contractor who aligns with your house-flipping goals involves a few key steps. Begin by seeking recommendations from local real estate investment groups, real estate agents, or other property flippers who have worked with reputable contractors in North Carolina. You can also utilize online platforms like HomeAdvisor, Thumbtack, and Angi, which provide lists of vetted contractors along with reviews and ratings from previous clients.

When evaluating general contractors, prioritize those with experience in house flipping and a solid track record of completing projects on time and within budget. Review their portfolios to assess the quality of their past work and ensure they are familiar with the specific type of renovations you plan to undertake. It's crucial to have a clear and detailed contract that outlines the project scope, payment schedule, and deadlines to avoid misunderstandings and ensure the project runs smoothly. By carefully selecting a general contractor, you can significantly enhance the likelihood of a successful and profitable house flip.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is a crucial step in flipping houses in North Carolina. An agent who understands the specific needs of real estate investors can provide invaluable assistance throughout the process, from identifying promising properties to negotiating deals and facilitating transactions. These agents are familiar with the local market trends and property values and can often provide insights into areas with high potential for appreciation and profitability. They also help streamline the buying and selling process, ensuring that you can move quickly and efficiently on investment opportunities.

To select an investor-friendly agent, look for someone with experience working with real estate investors, particularly in the North Carolina market. Such an agent will have a deep understanding of what investors need, including knowledge of investment property financing, market analysis, and renovation costs. They will also be skilled in identifying properties that offer good value and potential for profit, which is essential for making informed investment decisions and achieving successful outcomes in your house-flipping projects.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent, start by seeking recommendations from other real estate investors or property flippers who have successfully navigated the North Carolina market. Networking at local real estate investment groups, attending property auctions, and joining online forums can also provide valuable leads. Additionally, use real estate platforms like Zillow, Realtor.com, and Redfin to research agents with experience in investment properties and read reviews from previous clients.

When interviewing potential agents, ask about their experience working with investors and their familiarity with the specific areas you're interested in. Look for agents who can provide a track record of successful transactions and who demonstrate a proactive approach to finding and evaluating investment properties. An investor-friendly agent will not only assist in finding suitable properties but also offer advice on market conditions, potential returns, and strategies for maximizing your investment. By selecting the right agent, you can enhance your house flipping efforts and achieve greater success in the North Carolina real estate market.

Find A House To Flip

Finding the right house to flip in North Carolina involves several key strategies to locate properties with the potential for high returns. One effective method is driving for dollars, which involves exploring neighborhoods and looking for distressed properties or homes with "For Sale" signs that may be potential candidates for flipping. This hands-on approach allows you to personally inspect properties and assess their condition before making any investment decisions.

Another method is using direct mail campaigns, where you send targeted letters or postcards to property owners who might be looking to sell. This approach can be particularly effective for reaching owners of distressed properties or those who might not have listed their homes yet but are open to selling. Combining these tactics with a search on the Multiple Listing Service (MLS) can also yield valuable opportunities. The MLS provides access to a wide range of listings, including properties that are actively being sold and those that have been on the market for an extended period.

Alternative Strategies to Find a House

In addition to the traditional methods, several alternative strategies can help you find investment properties through the MLS and other channels.

- The Day Zero Strategy: This involves targeting new listings as soon as they hit the market. By being among the first to see and act on these properties, you increase your chances of securing a good deal before competition from other buyers intensifies. Set up alerts on MLS platforms to get notified immediately when new properties are listed.

- The Old Listing Strategy: Look for properties that have been on the market for a long time. Sellers of these homes might be more motivated to negotiate and reduce their asking price, giving you an opportunity to purchase at a lower cost. Analyze why these listings haven’t sold and assess if there’s potential for improvement.

- The Wholesaler Strategy: Partnering with real estate wholesalers who specialize in finding and negotiating properties can be beneficial. Wholesalers often have access to off-market deals and distressed properties that can be ideal for flipping. They usually have a network of sellers and buyers, which can be advantageous for locating properties with high-profit potential.

In conclusion, using a combination of traditional and alternative strategies to find a house to flip in North Carolina can enhance your chances of success. By employing methods like driving for dollars, direct mail campaigns, and leveraging MLS listings, along with exploring strategies such as The Day Zero Strategy, The Old Listing Strategy, and The Wholesaler Strategy, you can effectively identify properties that offer strong potential for profitable house flipping.

Having said that, some investors may not have access to the MLS for various reasons. Fortunately, these strategies can be applied to alternative listing platforms like RedFin, Zillow, and Realtor.com, which are also widely used in North Carolina. By adapting the strategies outlined above to these websites, you can effectively find potential properties for flipping. However, it's important to note that the MLS remains the preferred tool due to its more comprehensive data and detailed contact information, offering a broader scope of property listings and valuable insights.

Make Discovery Calls To Listing Agents

When flipping houses in North Carolina, making discovery calls to listing agents is a crucial step in ensuring you have all the necessary information before pursuing a property. These calls help you assess the viability of a potential investment and streamline your decision-making process. Here are key questions to ask listing agents:

- Is the listing still active?: Confirming whether the property listing is still active is essential to avoid wasting time on deals that may already be under contract. This question helps you focus only on properties that are currently available for purchase, saving you from pursuing properties that are no longer accessible.

- Are the listing’s photos up to date?: Ensuring that the photos provided are current gives you a true picture of the property’s condition. Outdated or misleading photos can result in unexpected surprises during property visits, so verifying the current state of the home is crucial for accurate cost estimation and planning.

- What is the current condition of the home?: Inquiring about the property's condition helps you understand if it’s distressed and suitable for flipping. This question also uncovers any hidden issues that may not be immediately visible, allowing you to better estimate repair costs and potential challenges associated with the property.

- Are you willing to work with an investor?: Determining if the listing agent is open to working with investors is important for establishing a clear line of communication. This also presents an opportunity to potentially enlist the agent’s services for future transactions, building a beneficial relationship and facilitating smoother negotiations.

- What is the owner’s reason for selling?: Understanding the seller’s motivation can provide insight into their urgency and flexibility. While not all agents may disclose this information, any details you can obtain can help you tailor your offer to meet the seller's needs and negotiate a better deal.

- Is there a lot of competition for the property?: Asking about the level of interest and competition for the property helps you gauge the urgency and competitiveness of the deal. Knowing whether there are multiple offers or high demand enables you to adjust your bidding strategy and avoid overpaying for the property.

By asking these questions, you can gather critical information to make informed decisions and enhance your house-flipping strategy in North Carolina.

Analyze The Property

The next crucial step in flipping houses in North Carolina is analyzing the property. This involves assessing key metrics to determine whether a property is a worthwhile investment. Focus on "the big three": the after-repair value (ARV), repair costs, and purchase price. These elements are essential in evaluating the potential profitability of a flip.

After-Repair Value

Calculating the ARV, or after-repair value, is pivotal in assessing a property for investment. The ARV is the projected market value of the home once all renovations are completed. To determine the ARV, use comparable sales, or "comps," which are recently sold properties similar to the one you are considering flipping. For accurate comps, look for properties with the same number of bedrooms and bathrooms, within 20% of the subject property's square footage, located in the same neighborhood, within a half-mile radius, and sold within the last six months. Calculate the average sale price of these comparable properties to estimate the ARV of your investment property. This estimate will help guide your investment decisions and assess potential profitability.

Repair Costs

Estimating repair costs involves a thorough property inspection and consultations with experienced contractors. Begin by listing all necessary repairs and renovations, then obtain quotes from multiple contractors to get a realistic estimate of labor and material costs. It's also wise to include a contingency budget, typically around 10-15% of the total repair costs, to cover unexpected expenses. With a detailed and professional estimate, you can ensure your budget is accurate and avoid surprises that could affect the profitability of your flip.

Purchase Price

Once you have the ARV and repair costs, you need to calculate your maximum allowable offer (MAO). The MAO is the highest price you can pay for the property while ensuring a profitable return. To determine the purchase price, factor in:

- The ARV: The estimated value after repairs.

- Hard Money Loan Costs: Total cost, including interest rates, origination fees, points, and loan duration.

- Private Money Loan Costs: Costs related to private money loans, including interest and loan term.

- Front-End Closing & Holding Costs: Include closing costs (about 2% of the purchase price) and holding costs such as insurance, utilities, and taxes.

- Backend Closing Costs: Typically around 1% of the ARV.

- Realtor Fees: Generally 6% of the purchase price, though some investor-friendly agents may offer reduced fees.

- Projected Profit: Desired profit margin based on current market trends.

Subtract all these costs from the ARV to determine your MAO. This figure represents the maximum price you can pay for the property while still ensuring a profitable investment.

Call Agents & Submit Written Offers

The next crucial step in flipping houses in North Carolina is to call the listing agent and inform them of your intention to submit a written offer. Ensure your offer aligns with the maximum allowable offer you calculated. By presenting a well-informed written offer, you demonstrate seriousness and move closer to securing the property.

You’ll want the agent representing you—whether it's the listing agent or an investor-friendly agent you’ve previously engaged—to acknowledge your terms and submit a written offer on your behalf. This approach ensures professionalism and accuracy, as the agent will bring the appropriate contract and follow the correct procedures. In North Carolina, you'll use the North Carolina Association of Realtors' Standard Offer to Purchase and Contract form.

For clarity, here are the details to provide for the agent who will draft the contract:

- Purchaser Name: Specify the purchaser’s name, which could be your personal name or an LLC. Using an LLC is advisable for added asset protection. If buying through an LLC, include the articles of incorporation to prove you are authorized to sign on behalf of the company.

- Offer Price: State the offer price you have determined based on your calculations.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit (usually 1% to 5% of the purchase price) to show seriousness. Earnest money deposits are typically refundable but include a contingency clause to safeguard your interests.

- Contingencies: Include a seven-day inspection contingency to allow for a thorough inspection of the property. This provides an option to back out of the deal and reclaim your deposit if unforeseen issues arise.

- Closing Timeline: Request a closing timeline that suits your needs, typically around 14 days or sooner. Cash offers can expedite the process, which can be advantageous to the seller.

- Seller To Deliver Free & Clear Title: Ensure the contract includes a clause requiring the seller to provide a free and clear title, preventing issues like liens or unexpected mortgages.

- Buyer’s Agent Name: Clearly state the buyer’s agent representing you in the deal.

- Proof Of Funds: Include proof of funds from your lender to demonstrate your financial capability to complete the transaction, making your offer more credible to the seller.

Calling agents and submitting written offers is a critical step in the house-flipping process in North Carolina. By having your agent professionally handle your offer and include all necessary details, you increase your chances of securing a profitable deal. Mastering this step is essential for successfully flipping houses and maximizing your investment potential. Remember, a well-structured written offer is the key to closing the deal.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted, performing due diligence is a critical step in the house flipping process in North Carolina. This phase involves thoroughly investigating the property to ensure that your initial assessment and financial projections remain accurate. Conducting a comprehensive due diligence review helps uncover any potential issues that could impact the profitability of your investment.

Start by arranging a detailed property inspection conducted by a qualified inspector. This inspection should cover all major home systems, including the electrical, plumbing, and HVAC systems, as well as the foundation and roof. The inspector will provide a report detailing any existing or potential issues, which allows you to reassess your repair estimates and make any necessary adjustments to your budget. Additionally, verify that all required permits for past renovations were obtained and that they comply with local building codes.

Next, review the property's title history to ensure there are no legal encumbrances, such as liens or disputes, that could complicate the transaction. This step is crucial for confirming that the seller has the legal right to transfer ownership and that the property can be sold free and clear of any issues. If any concerns arise during this review, address them promptly with the seller or seek legal advice to resolve the matter.

Performing thorough due diligence helps mitigate risks and ensures that you’re making a well-informed investment decision. By uncovering potential issues early, you can adjust your strategy, renegotiate terms if necessary, or decide to walk away if the risks outweigh the potential rewards. This careful approach is essential for successfully flipping houses and achieving your investment goals in North Carolina.

Close On The Deal

Closing on the deal is the final step in the house flipping process and marks the transition from purchasing the property to beginning your renovation work. In North Carolina, this process involves several key steps to ensure that the transaction is completed smoothly and legally.

First, coordinate with your real estate attorney or closing agent to review and finalize all necessary documents. This includes the purchase agreement, closing disclosure, and any other paperwork required for the transaction. Make sure to double-check that all terms and conditions are accurately reflected in the documents and that there are no discrepancies. The closing agent will facilitate the transfer of funds and ownership from the seller to you.

Next, ensure that you have the required funds available for closing costs. In North Carolina, closing costs typically include title insurance, transfer taxes, attorney fees, and any additional fees associated with the transaction. These costs usually amount to 2% to 5% of the purchase price. Prepare to bring a certified check or arrange for a wire transfer to cover these expenses.

Finally, attend the closing meeting to sign the final documents and complete the transaction. At this meeting, you will review and sign the closing disclosure, which details all financial aspects of the deal, including the purchase price, closing costs, and adjustments. Once everything is signed and the funds have been transferred, the property’s title will be officially transferred to you.

Successfully closing on the deal is crucial for moving forward with your house-flipping project. By carefully managing each step of the closing process, you ensure that the property is legally and financially yours, paving the way for the renovation and eventual sale of the property.

Renovate The House

Renovating the house is a critical step in the house-flipping process in North Carolina. This phase focuses on enhancing the property to meet your projected after-repair value (ARV) while aligning with comparable properties in the area. The key is to strike a balance—upgrading the home to make it appealing without exceeding the standards set by similar properties. Over-renovation can lead to unnecessary expenses and lower your profit margins, so aim to enhance the property to match or slightly exceed local comps.

Before starting renovations, it’s essential to have the proper documentation to protect your investment and ensure a smooth process. Six crucial documents for the renovation phase include:

-

Independent Contractor Agreement: This document defines the terms and conditions of your working relationship with the contractor. It specifies payment terms, deadlines, and responsibilities, ensuring both parties are clear on expectations and legal protections throughout the renovation.

-

Final Scope Of Work: A detailed scope of work outlines the specific tasks, materials, and timelines required for the project. This document helps the contractor understand precisely what needs to be done and assists in keeping the renovation on track and within budget.

-

Payment Schedule: This schedule details the contractor's payment amounts and timing. It ties payments to the completion of specific milestones, helping to ensure that work progresses as planned and providing a clear financial structure.

-

Insurance Indemnification Agreement: This agreement ensures the contractor has adequate insurance coverage and agrees to protect you from liability for any accidents or damages that occur during the renovation. It shields you from financial loss related to incidents on the property.

-

W-9: The W-9 form collects the contractor's taxpayer identification information, which is necessary for tax reporting. This ensures compliance with IRS regulations and allows you to issue a 1099 form for payments made throughout the year.

-

Final Lien Waiver: This document confirms that the contractor has been paid in full and releases any future claims against the property. It protects you from additional financial demands once the renovation is complete.

With these documents in place, you can confidently move forward with the renovation, transforming the property into a desirable home that meets market expectations. Proper planning and documentation will help ensure a successful flip and maximize your investment returns.

Prep & List The House On The MLS

Preparing and listing the house on the MLS is a vital step in the house-flipping process in North Carolina. This phase involves finalizing the property’s condition and ensuring it is presented attractively to potential buyers. Your goal is to highlight the property’s best features and create a compelling listing that stands out in the competitive market. Here’s how to effectively prep and list your house:

-

Final Punchlist: Before listing the house, complete a final punchlist to address any remaining minor repairs or touch-ups. This includes fixing small issues like paint touch-ups, adjusting doors and windows, and ensuring all systems are functioning correctly. A thorough final inspection ensures the property is in top condition and ready for showings.

-

Home Staging: Staging the home can significantly enhance its appeal to potential buyers. Arrange furniture and decor to showcase the property’s best features and create a welcoming atmosphere. Effective staging helps buyers visualize themselves living in the space and can lead to quicker sales and higher offers.

-

Professional Photos: High-quality professional photos are crucial for making a strong impression in the MLS listing. Invest in a professional photographer to capture the property in its best light, highlighting key features and creating a visually appealing presentation. Great photos attract more potential buyers and can lead to increased interest and offers.

Set An Enticing Asking Price

Setting an enticing asking price is a strategic step in listing your property on the MLS. Start by researching recent sales of comparable properties in the area to determine a competitive price point. Consider factors such as the property’s condition, location, and the current market trends in North Carolina. Setting the right price involves balancing the need to attract buyers with the desire to achieve a profitable return on your investment. By pricing your property competitively and aligning with market expectations, you increase your chances of a successful sale.

Field Offers & Negotiate

Once your house is listed on the MLS, you’ll start receiving offers from potential buyers. This stage is critical as it involves evaluating each offer and negotiating to secure the best possible deal. Begin by reviewing each offer carefully to understand the terms, including the offered price, contingencies, and closing timelines. Pay attention to factors like the buyer's financial qualifications and their ability to close quickly, as these can impact the overall transaction process.

Negotiation is a key aspect of this stage. Engage with the buyers or their agents to discuss any terms or conditions you’d like to adjust. Common negotiation points include the purchase price, repair requests, and closing dates. Aim to balance getting the best price with accommodating reasonable buyer requests to keep the transaction on track. Effective negotiation not only helps you maximize your return but also ensures a smoother closing process, ultimately leading to a successful flip.

Accept The Best Offer

After fielding and negotiating offers, the next step in flipping houses in North Carolina is to select and accept the best offer. This decision should be based on several factors beyond just the highest price. Evaluate each offer’s terms, including the buyer's financial stability, proposed closing date, and any contingencies that might impact the deal. For instance, an all-cash offer may be preferable to a financed one, as it typically involves fewer complications and a faster closing process.

Once you’ve identified the best offer, formally accept it by signing the purchase agreement and notifying the buyer or their agent. Ensure that all terms are clearly outlined and agreed upon in the final contract. Promptly communicate your acceptance to facilitate the next steps in the closing process. By carefully selecting the most favorable offer, you can optimize your return on investment and move forward with confidence towards a successful sale.

Sell The House & Get Paid

The final step in flipping houses in North Carolina is to finalize the sale and receive payment. Once you have accepted an offer and completed the necessary paperwork, coordinate with the closing agent to ensure all contractual obligations are met. This involves addressing any last-minute issues, ensuring that all legal and financial requirements are satisfied, and confirming that the buyer has fulfilled their part of the agreement.

On the day of closing, all parties will meet to sign the final documents, including the transfer of ownership and financial settlement. Ensure that you have completed all required documentation and are prepared for the financial transaction. After the paperwork is signed and the funds are transferred, you will receive your payment, completing the sale process. By carefully managing the final stages of the sale, you ensure a smooth transaction and a successful conclusion to your house flipping project.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In North Carolina?

In North Carolina, house flippers can expect to see substantial returns, with average gross flipping profits reaching around $75,000 in 2024, according to ATTOM Data Solutions. However, this figure varies widely depending on location, renovation costs, and market conditions. Flipping houses in North Carolina offers significant profit potential, but success hinges on strategic investments in the right areas and careful management of renovation budgets.

North Carolina is home to some of the most profitable house-flipping markets in the nation. The state features three of the top five cities with the nation's largest gross flipping profits on median-priced transactions:

- Charlotte, NC: $95,000 average gross flipping profit

- Raleigh, NC: $85,000 average gross flipping profit

- Durham, NC: $82,000 average gross flipping profit

These cities stand out due to their strong housing demand, steady population growth, and rising property values, making them prime locations for house flippers looking to maximize their returns. Flipping houses in these North Carolina cities can be particularly lucrative, thanks to their robust real estate markets and the ongoing influx of new residents.

To maximize profits in North Carolina, it's essential to stay informed about local market trends and carefully analyze each property's potential. By securing properties at favorable prices and managing renovation costs effectively, flippers can significantly increase their net profits and capitalize on the thriving real estate opportunities in the state.

Is House Flipping Illegal In North Carolina?

House flipping is not illegal in North Carolina, but it is subject to state regulations and legal considerations that every investor should be aware of. The state does not have laws that specifically prohibit the practice of buying, renovating, and reselling properties for profit. However, flippers must comply with general real estate laws, including disclosure requirements, zoning regulations, and building codes. Violating these regulations can lead to legal issues, fines, or even lawsuits, so it’s crucial to stay informed and adhere to all applicable laws during the flipping process.

Additionally, North Carolina has consumer protection laws that investors need to follow to avoid engaging in fraudulent or deceptive practices. For example, full disclosure of any known property defects is required when selling a flipped house. Flippers must also ensure that all renovation work meets the state's building standards and that proper permits are obtained. By staying compliant with these regulations, house flippers can operate legally and successfully in North Carolina’s thriving real estate market.

Read Also: Is Wholesaling Real Estate Legal In North Carolina?

Do I Need A License To Flip Houses In North Carolina?

There is no need to go through the process of becoming a licensed real estate professional if you want to learn how to flip homes in North Carolina.

Rehabbers and flippers can carry out their exit strategies without a real estate license — as long as they are not acting as a real estate broker or agent.

How Much Does It Cost To Flip A House In North Carolina?

Flipping a house in North Carolina can be a profitable venture, but understanding the associated costs is essential for maximizing returns. The expenses involved in house flipping generally fall into several categories: the home purchase price, renovation costs, carrying costs, and closing, marketing, and sales costs. Each of these factors can vary significantly depending on the location, property condition, and market conditions in North Carolina.

The Home Purchase Price

In North Carolina, the median home price as of 2024 is approximately $320,000, although this can vary widely depending on the city and neighborhood. For instance, homes in Charlotte and Raleigh often command higher prices due to strong demand, while properties in smaller towns or rural areas may be more affordable. When purchasing a home to flip, you typically need to provide a down payment ranging from 5-20% of the purchase price, with the rest financed through a mortgage or purchased outright with cash.

The Home Repair Costs

Renovation costs in North Carolina can range from $20,000 to $60,000 for a typical three-bedroom home, depending on the extent of the repairs needed. On average, flippers can expect to pay between $20 and $40 per square foot for standard rehabs, though these costs can vary based on the scope of the project, materials used, and contractor fees. To get an accurate estimate, it’s advisable to consult with several contractors before purchasing the property and budgeting for potential unforeseen expenses.

The Carrying Costs

Carrying costs include expenses such as property taxes, homeowners insurance, utilities, and general upkeep. In North Carolina, property taxes are relatively moderate, averaging around 0.77% of the property's assessed value. Homeowners insurance typically ranges from $800 to $1,500 annually, depending on the location and coverage level. Utilities and maintenance, like lawn care and snow removal (if applicable), should also be factored into your budget as they can accumulate quickly, especially if the property takes longer than expected to sell.

Closing, Marketing, & Sales Costs

Closing, marketing, and sales costs in North Carolina can add up to a significant portion of your overall expenses. Real estate agent commissions typically range from 5-6% of the selling price, while closing costs, including title transfer fees and attorney fees, can range from 2-5% of the property’s sale price. Marketing expenses, such as listing fees and promotional activities, should also be included in your budget to ensure the property is effectively marketed and sold quickly.

By carefully managing and anticipating these costs, house flippers in North Carolina can improve their chances of a successful and profitable flip.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How To Flip A House In North Carolina With No Money?

Real estate transactions require capital, but it doesn’t have to be your own. It is possible to flip a house using other people’s money with the following strategies:

- Private Money Lenders: A private money lender is anyone with excess capital willing to fund your flip. Private lenders are not associated with a financial institution and can be anyone from a family member to an acquaintance. Regardless of where the money comes from, it will coincide with a high interest rate — anywhere from 6% to 12% (or more). While a lot higher than traditional loans, the interest associated with private money is often worth the price of admission, especially if it helps fund a profitable deal.

- Hard Money Loans: Hard money loans operate similarly to their private money counterparts. Most of their terms and underwriting are the same, but hard money lenders are a bit more organized, meaning they are more professional than most private money lenders. They are still not associated with any financial institution, but they may exhibit more of a propensity to lend regularly than private money lenders.

- Wholesaling: Wholesaling real estate is a way for investors to make money without buying a property. The investor signs a contract with the owner, giving the investor the right to buy the property. The investor then sells this right to another buyer for a fee without ever buying the property.

What's The Best Place To Flip Houses In North Carolina?

North Carolina offers a diverse range of cities that present excellent opportunities for house flippers. The state’s growing population, favorable economic conditions, and rising property values make it an attractive market for real estate investors. Here are five of the best places to flip houses in North Carolina:

- Charlotte: Charlotte, the largest city in North Carolina, is a prime location for house flippers due to its rapidly growing population and thriving economy. The city saw a 1.6% increase in population from 2022 to 2023, and home values have steadily risen by 5.8% over the past year. With a robust job market and an influx of new residents, Charlotte's real estate market is hot, making it a top spot for flipping houses.

- Raleigh: Raleigh, the capital of North Carolina, is another excellent city for house flipping. The city's population grew by 2.3% in 2023, driven by its status as a tech hub and strong educational institutions. Home prices in Raleigh have increased by 6.2% over the past year, reflecting the city's strong demand for housing. With its thriving economy and high quality of life, Raleigh offers lucrative opportunities for flippers.

- Durham: Durham, part of the Research Triangle, has seen a significant surge in both population and home values. The city's population grew by 1.9% in 2023, and home values have jumped by 7.1% over the past year. Durham’s growing tech industry and vibrant cultural scene make it an attractive location for young professionals and families, offering house flippers a strong market to tap into.

- Greensboro: Greensboro is an emerging market for house flippers, with a more affordable median home price compared to Charlotte and Raleigh. The city experienced a 1.4% population growth in 2023, and home values have increased by 4.7% over the past year. Greensboro’s affordable housing market and steady population growth make it an appealing option for investors looking to maximize their returns.

- Wilmington: Wilmington, a coastal city, offers unique opportunities for house flippers, particularly in the vacation and second-home markets. The city's population grew by 1.8% in 2023, and home values have risen by 5.4% over the past year. Wilmington's coastal charm and booming tourism industry make it a desirable location for buyers, ensuring a strong demand for renovated properties.

Each of these North Carolina cities presents its own unique advantages for house flippers. Whether you’re looking for high-growth areas like Charlotte and Raleigh or more affordable markets like Greensboro, North Carolina, offers a range of opportunities for successful real estate investments.

Read Also: Best Places To Buy Rental Property In North Carolina For 2025

Is It Hard To Flip Houses In North Carolina?

Flipping houses in North Carolina can be both challenging and rewarding, depending on your experience level and knowledge of the local market. The state's diverse real estate landscape, ranging from booming urban centers like Charlotte and Raleigh to more affordable areas like Greensboro, presents unique opportunities and obstacles. Navigating the complexities of the market requires a deep understanding of property values, renovation costs, and local regulations. For example, the median home value in North Carolina has increased by 5.2% over the past year, which can impact your budget and potential profits.

Moreover, competition among investors can make it difficult to find profitable deals, especially in high-demand areas. With North Carolina’s population growing by 1.3% in 2023, more investors are entering the market, driving up prices and reducing inventory. However, with the right strategies and a solid understanding of the market, flipping houses in North Carolina can be a lucrative venture. Being well-prepared and staying informed on market trends are key factors in overcoming these challenges.

Read Also: How To Find Off-Market Properties In North Carolina (4 Methods)

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In North Carolina?

Finding reliable contractors is essential to successfully flipping houses in North Carolina. The quality and timeliness of the work done on your property can significantly impact your project's overall success and profitability. Given the state's diverse real estate market, you'll want to ensure you're working with contractors who are familiar with local building codes, climate considerations, and market expectations.

Here are some of the best websites to find contractors for your house-flipping projects in North Carolina:

-

HomeAdvisor: HomeAdvisor allows you to search for pre-screened, customer-rated contractors in your area. The platform is particularly useful for finding specialists, such as plumbers or electricians, who have experience with the specific renovations your flip may require.

-

Thumbtack: Thumbtack offers a broad range of professionals, from general contractors to niche specialists. The platform provides detailed profiles, customer reviews, and even price estimates, making it easier to compare options and select the best fit for your project.

-

Angi: Formerly known as Angie’s List, Angi is a well-established platform that connects homeowners with vetted contractors. You can find detailed reviews and ratings, ensuring you choose a contractor with a proven track record in the North Carolina market.

-

Craigslist: Craigslist remains a popular option for finding local contractors, particularly in smaller towns and rural areas of North Carolina. While it requires more diligence in vetting potential candidates, it can be a great way to find affordable options.

-

Facebook: Utilizing Facebook groups and community pages can be an effective way to find contractors. Recommendations from locals who have had positive experiences can be invaluable, especially when you're flipping houses in less familiar areas of the state.

By leveraging these platforms, you can find the right contractors to help ensure your house-flipping project in North Carolina is both efficient and profitable.

Final Thoughts On Flipping Homes In North Carolina

Flipping houses in North Carolina can be a lucrative venture due to the state’s thriving real estate market and pent-up demand across the entire sector. As a result, now may be as good a time as any to learn how to flip houses in North Carolina.

Nevertheless, investors can’t overlook the importance of due diligence, risk management, and hard work, as these factors are critical to success in any state. Before making investment decisions, thorough research and careful consideration of these aspects are essential.

Ready to Take the Next Step in Real Estate Investing? Join our FREE live webinar and discover the proven strategies to build lasting wealth through real estate.

Whether you're just getting started or ready to scale, we'll show you how to take action today. Don't miss this opportunity to learn the insider tips and tools that have helped thousands of investors succeed! Seats are limited—Reserve Your Spot Now!

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.