How To Flip Houses In Florida: 15-Step Home Renovation Guide

Oct 21, 2025

What: Flipping houses in Florida means buying properties below market value, renovating them to increase appeal and value, and selling them for a profit. It’s a proven strategy that helps investors grow wealth through real estate.

Why: Florida’s booming population, strong housing demand, and thriving tourism industry make it one of the hottest markets for house flippers. With year-round buyer activity and diverse neighborhoods, investors have numerous opportunities to earn strong returns.

How: Follow the steps in this guide to succeed in Florida’s market—research local housing trends, find undervalued properties, secure financing, plan your renovation budget, and sell strategically. By mastering these steps, you can confidently flip houses in Florida and maximize your investment potential.

There may be no better time to learn how to flip houses in Florida than today. Not only is activity in the current market expected to pick up when interest rates come back down to earth, but The Sunshine State is experiencing an unprecedented rate of positive net migration.

"Our estimates suggest that over the next five years, our population will grow by almost 300,000 new residents per year, over 800 per day. That is like adding a city slightly smaller than Orlando, but larger than St. Petersburg every year," wrote Senate President Kathleen Passidomo in a memo to all senators.

We have carefully crafted this article for aspiring investors to take advantage of this impending Florida activity. To get you ready, we’ll cover everything you need to successfully research, purchase, renovate, and sell homes in Florida. We'll also touch on the legalities of flip properties, the best cities to invest in, and how to finance this investment (even if you have no money or poor credit).

Do you want to learn how to flip houses in Florida? If so, you have come to the right place at the right time. In this article, we'll cover:

- What Is Flipping Houses?

- Why Flip Houses In Florida?

- Florida House-Flipping Statistics

- How To Flip Houses In Florida In 15 Steps

- How Much Do House Flippers Make In Florida?

- Is Flipping Houses In Florida Profitable?

- Is House Flipping Illegal In Florida?

- Do You Need A License To Flip Houses In Florida?

- What Are The Requirements To Flip Houses In Florida?

- How Much Does It Cost To Flip A House In Florida?

- How To Flip Houses In Florida With No Money?

- What's The Best Place To Flip Houses In Florida?

- How To Start Flipping Houses In Florida As A Beginner?

- Is It Hard To Flip Houses In Florida?

- How Do You Find Contractors For Flipping Houses In Florida?

- Final Thoughts on House Flipping In Florida

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses involves buying a property, renovating it to increase its value, and then selling it for a profit. The goal is to find undervalued or distressed homes, make strategic upgrades, and capitalize on favorable market conditions to achieve a higher sale price.

In Florida, this strategy is particularly effective due to the state's growing population, diverse real estate market, and strong economy. Cities like Miami, Tampa, and Orlando offer numerous opportunities for house flippers, driven by high demand and ongoing urban development. Additionally, Florida's booming tourism industry enhances the market for short-term rental properties, providing further investment potential.

Flipping houses in Florida allows investors to leverage the state’s dynamic real estate landscape, making it a lucrative avenue for achieving financial gains.

Read Also: How To Wholesale Real Estate In Florida: Step-By-Step (2024)

Why Flip Houses In Florida?

Flipping houses in Florida is an appealing venture for investors due to the state's strong real estate market and high demand for housing. Florida's warm climate, stunning beaches, and tourist attractions draw a continuous influx of new residents and vacationers, driving housing demand. This makes it easier for flippers to find buyers once renovations are complete.

The financial rewards in Florida are notable. In 2024, the average gross profit from flipping a home in the U.S. was around $72,000, according to ATTOM Data Solutions. That said, homes in the Florida real estate market are relatively high compared to most other markets, making net profits higher. Adding to the opportunity based from RealtyTrac, the State of Florida currently has 56,988 properties in foreclosure, 871 bank-owned properties, and 2,835 headed for auction, creating a large pool of potential off-market deals.

Florida's favorable tax environment is another advantage for house flippers. The state has no personal income tax, which can result in significant savings and higher net profits for investors. Additionally, Florida's relatively affordable property prices compared to other coastal states provide a more accessible entry point for real estate investment.

The state's population growth further fuels the house-flipping market. With many people relocating to Florida for its job opportunities, lower cost of living, and quality of life, there is a consistent demand for renovated homes. This steady influx of new residents ensures a robust market for house flippers.

Therefore, Florida offers a compelling environment for house flipping, with strong demand, high-profit potential, and favorable economic conditions. Investors who understand the local market and make strategic improvements can capitalize on these opportunities and achieve substantial financial gains.

Read Also: How To Invest In Real Estate In Florida: Top Strategies In 2025

Florida House-Flipping Statistics

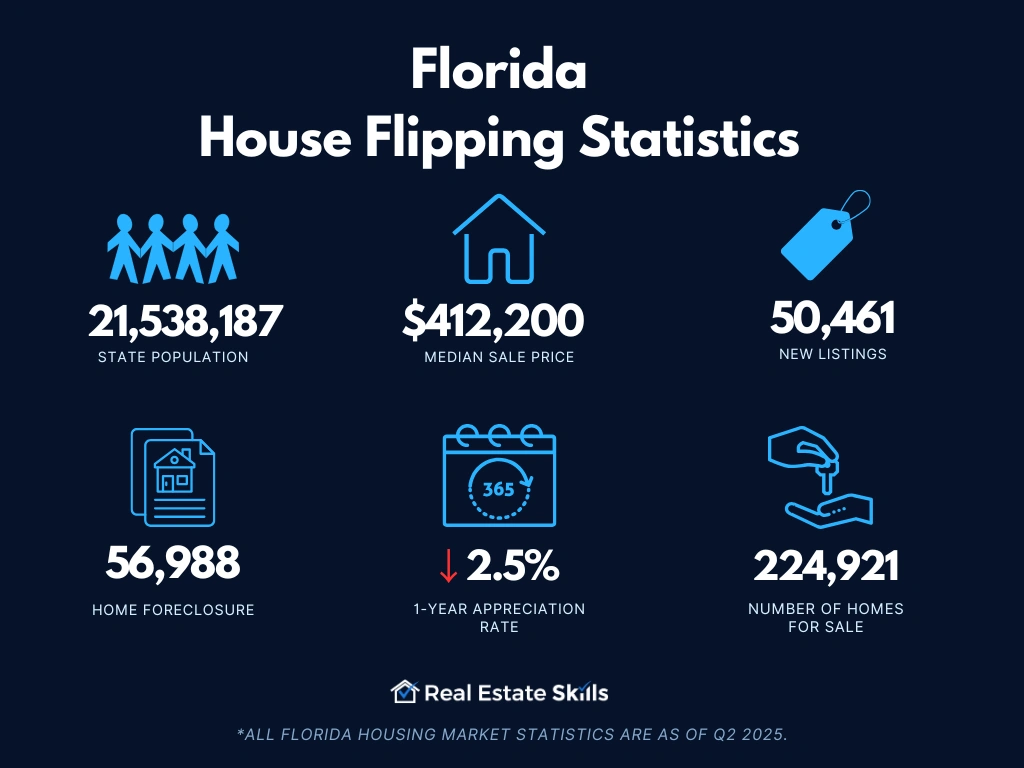

An investor's success is often dependent on the quality and reliability of their data. Accordingly, anyone learning how to flip houses in Florida should prioritize recent and dependable housing indicators, not unlike those listed below (data provided by the U.S. Census Bureau, RedFin, and Sofi):

- Population: 21,538,187

- Employment Rate: 57.2%

- Median Household Income: $73,3111

- Median Sale Price: $412,200(+1.0% Year-Over-Year)

- Number Of Homes Sold: 25,209 (-10.2% Year-Over-Year)

- Median Days On Market: 75 (+13 Year-Over-Year)

- Number Of Homes For Sale: 224,921 (+18.5% Year-Over-Year)

- Number Of Newly Listed Homes: 50,461 (-0.78% Year-Over-Year)

- Months Of Supply: 7 (+2 Year-Over-Year)

- Homes Sold Above List Price: 9.3% (-1.6 Points Year-Over-Year)

- Homes With Price Drops: 32.1% (+2.2 Points Year-Over-Year)

- Home Foreclosure: 56,988 Properties

*All Florida housing market statistics are as of Q2 2025

Similar to what you’d learn in a Flipping Houses 101 course, it's crucial to equip yourself with comprehensive market data, monitor economic trends, and understand the prices within the Florida market. This knowledge will guide house-flipping strategies Florida investors implement and assist them in learning how to flip houses in Florida.

How To Flip Houses In Florida In 15 Steps

Flipping houses in Florida can be broken down into 15 steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Selecting the right market is a crucial first step when flipping houses in Florida. Your choice can significantly influence the success of your investment, so it's essential to consider several factors, including local economic conditions, housing demand, and property values.

One of the most important considerations is proximity to the market where you plan to invest. While it's not mandatory to live close to your investment property, being nearby can simplify many aspects of the flipping process. It allows for easier meetings with contractors, real estate agents, and other professionals. Additionally, living in or near the area helps you gain a deeper understanding of the local neighborhoods, which is critical for making informed investment decisions.

Investing in a market where you do not reside can introduce challenges. Remote management of renovations, coordinating with contractors, and staying informed about local market trends can become cumbersome. Moreover, not being familiar with the area may make it harder to assess key factors affecting property values, such as neighborhood amenities, schools, and potential issues like noise from nearby train tracks or airports.

Being close to the market enables you to better evaluate these aspects firsthand and make more informed decisions. Thus, choosing the right market is fundamental to flipping houses in Florida and lays the groundwork for a successful investment.

Find Your Money

Once you’ve identified your target market in Florida, the next step is securing financing for your house-flipping venture. Finding a reliable lender is crucial, as having funds lined up is essential to seize profitable opportunities quickly. Without prearranged financing, you risk missing out on attractive deals.

Contrary to popular belief, finding lenders and obtaining funding doesn’t necessarily require substantial personal capital. There are numerous lenders ready to finance real estate deals, allowing you to leverage their resources instead of using your own money.

Two common types of lenders for house flipping are hard money lenders and private money lenders. Hard money lenders provide short-term loans based on the value of the property and its potential return. They typically finance 70% to 90% of the loan-to-cost (LTC), which includes the purchase price and renovation costs. You’ll need to cover the remaining amount.

Private money lenders are individuals looking to invest their money for higher returns. They generally charge around 10% interest and can provide additional funding once you’ve utilized hard money lenders. Private money lenders offer flexibility and can help cover the gap left by hard money financing.

Using other people’s money (OPM) rather than your own allows you to stay financially agile and scale your flipping operations more effectively. By leveraging these lenders, you can manage multiple projects and minimize personal financial risk, enhancing your ability to grow and adapt in Florida’s competitive real estate market.

Finding and working with the right lenders is a key component of successful house flipping in Florida. With a range of options available, you can secure the necessary funding to turn potential deals into profitable investments.

How To Find Private & Hard Money Lenders

Finding private and hard money lenders in Florida involves a different approach than traditional lenders, but it is manageable with the right strategies.

To locate hard money lenders, consider attending local Real Estate Investor Association (REIA) meetings. These gatherings are valuable for networking with experienced investors and lenders who are actively seeking investment opportunities. Additionally, a simple online search for "hard money lenders in [your city]" will yield a list of local and national lenders. This method helps you find potential partners quickly. Notable lenders in Florida include Kiavi and Lima One, which are known for their reliable services.

Private money lenders focus on building relationships with individuals who may be interested in investing. Start with your personal network—friends, family, and acquaintances—who might be open to real estate investment opportunities. Networking events, seminars, and local investment clubs are also excellent venues to connect with potential private lenders. By presenting a compelling investment plan and demonstrating potential returns, you can attract private investors interested in funding your projects.

Securing financing from these lenders allows you to obtain a proof of funds (POF) letter, which is crucial for making competitive offers on properties. A POF letter indicates that you have the financial backing necessary to close a deal, enhancing your credibility and increasing your chances of success in Florida’s real estate market.

Find Three Contractors

The next step in flipping houses in Florida is hiring the right contractors. While DIY renovations might seem appealing, they often come with risks, such as underestimated costs, extended timelines, and unforeseen issues. Professional contractors are equipped with the skills and efficiency needed to complete projects quickly and to a high standard. Moreover, as an investor, your time is better spent on strategic activities like finding new deals rather than managing renovations yourself.

To ensure you get the best results, seek out at least three general contractors. General contractors are valuable because they manage the entire renovation process and coordinate with subcontractors for specific tasks. This approach ensures that every aspect of the project is handled professionally and efficiently. By evaluating multiple contractors, you can compare their expertise, pricing, and work quality to select the best fit for your house flipping project in Florida.

How To Find A General Contractor

Finding a reliable general contractor is a critical step in flipping houses in Florida. Start by reaching out to at least three general contractors to obtain quotes and gain different perspectives on your project. This will help you compare prices and select the best option for your budget and specific needs.

To find reputable contractors, consider attending local Real Estate Investor Association (REIA) meetings. These events offer valuable networking opportunities where you can connect with experienced investors who can recommend trusted contractors. Additionally, drive through neighborhoods with ongoing renovations and note the contractors working on these sites. You can approach the workers or check project signs for contact information.

Visiting local home improvement stores such as Lowe’s or Home Depot can also be effective. Contractors frequently shop at these stores, so you might encounter them directly or receive recommendations from store employees.

By carefully selecting competent contractors, you ensure that your renovation projects in Florida are completed efficiently and professionally, allowing you to concentrate on growing your real estate business.

Find An Investor-Friendly Agent

The next step in flipping houses in Florida is to find an investor-friendly real estate agent. These professionals are crucial due to their extensive local knowledge, networking capabilities, and negotiation skills, which can significantly impact the profitability of your deals.

It's important to seek out an agent who specializes in working with investors. Not all real estate agents have the same focus; some may prioritize high-end residential properties or multimillion-dollar transactions. An investor-friendly agent, however, will be enthusiastic about working with investors and accustomed to handling multiple offers and transactions.

Since the majority of home sales involve real estate agents, it’s beneficial to work with one who understands the investor's perspective. According to the National Association of Realtors, 89% of sellers are assisted by real estate agents when selling their homes. Therefore, having an agent who is well-versed in the local market and has access to the MLS (Multiple Listing Service) is essential for finding and securing profitable deals.

Investor-friendly agents typically charge a commission of around 2.5% of the sale price, but this is usually covered by the seller, so you won’t need to pay this fee until your rehabbed property is sold. Working with such an agent ensures you get the best possible deals and maximize your investment opportunities in Florida’s competitive real estate market.

How to Find an Investor-Friendly Agent

To find an investor-friendly real estate agent in Florida, start by attending local Real Estate Investment Association (REIA) meetings. These events are ideal for networking with agents who have experience working with investors and understand the unique needs of house flippers.

Another effective method is to explore the MLS (Multiple Listing Service) for distressed properties in your area. The agents listing these properties are often familiar with working with investors and may be interested in collaborating on future deals.

By partnering with an investor-friendly agent, you can benefit from their local market knowledge, connections, and expertise, making your house-flipping efforts in Florida more efficient and successful.

Read Also: How To Get MLS Access In Florida

Find A House To Flip

Finding the right house to flip in Florida involves several strategies, such as driving for dollars, browsing public records at local courthouses, and direct mail campaigns, but using the Multiple Listing Service (MLS) is among the most effective methods. The MLS is a comprehensive database of properties for sale that real estate agents use to list and manage homes. It provides detailed information on each property, making it an invaluable tool for locating potential flips.

To maximize your success, look for properties that are undervalued, in need of repairs, or situated in high-demand areas. The MLS simplifies the search by allowing you to filter listings based on criteria such as price, location, and property condition. Access to the MLS typically requires working with a real estate agent, which underscores the importance of collaborating with an investor-friendly agent as mentioned earlier.

An investor-friendly agent can help you navigate the MLS effectively by setting up customized searches and identifying properties that align with your flipping strategy. This targeted approach streamlines your search process, allowing you to focus on homes with the greatest potential for profit.

Alternative Strategies to Find a House

Finding houses to flip in Florida can be achieved through several alternative methods, each offering unique advantages. While the Multiple Listing Service (MLS) is a popular choice due to its extensive listings and detailed property information, other strategies can also uncover valuable opportunities.

To start, consider searching for properties that have been on the market for an extended period. These homes often belong to motivated sellers eager to close a deal, making them prime candidates for flipping. Look for properties that are listed as "as is" or in need of repairs. Such homes can be purchased at a lower price, providing a greater potential for profit after renovations.

Utilize specific keywords in your MLS search to identify distressed properties. Terms like "handyman special," "needs TLC," "fixer-upper," and "diamond in the rough" can help you find homes that may be undervalued and in need of significant work.

Here are three effective strategies to locate houses to flip in Florida:

- The Day Zero Strategy: Start by monitoring new listings on the MLS to identify homes that have just become available. Properties listed within the last 24 hours are likely to attract less competition, giving you a first-mover advantage. Quickly assess these new listings for potential flips by looking for signs of distress or significant renovation needs. Acting fast can help you secure deals before other investors even see them.

- The Old Listing Strategy: Look for properties on the MLS that have been listed for 60 days or more. These older listings may indicate motivated sellers who are more willing to negotiate on price. Homes that have been on the market for a while might be priced too high or require substantial repairs, making them ideal candidates for flipping. Contact the sellers or their agents to explore potential deals.

- The Wholesaler Strategy: Partner with real estate wholesalers who specialize in finding undervalued properties. Wholesalers often have access to exclusive deals and distressed properties that may not yet be listed on the MLS. Attend local real estate investment meetings, join Florida-based investor groups, or reach out to wholesalers directly to tap into their network and discover hidden opportunities.

Close On The Deal

The next step in flipping houses in Florida is to finalize the purchase and take ownership of the property, provided that all due diligence has been completed successfully. If the inspection or other evaluations reveal issues that render the investment unfeasible, use the contingencies in your contract to withdraw from the deal. However, if you’re confident in the property's potential and your projected profits, proceed with closing.

During the closing process, you will officially take ownership of the property, which allows you to begin the renovation work. At this stage, the title company, escrow agent, and closing attorney will handle the necessary paperwork and legal requirements. They will record promissory notes, which are legal agreements stating that you must repay any private and hard money lenders, plus interest, once the property is sold. These notes serve as collateral for the lenders, securing their investment and ensuring their interests are protected.

As part of closing, a title search will be conducted to confirm that the property’s title is clear. This search ensures there are no outstanding liens or legal issues associated with the title, providing you with undisputed ownership. A clear title is essential for avoiding potential legal complications and facilitating a smooth resale once the property has been renovated.

Executing these steps diligently will help you successfully complete the closing process, safeguard your investment, and proceed with confidence in your house-flipping venture in Florida.

Renovate The House

The next step in flipping houses in Florida is renovating the property to align with your projected after-repair value (ARV) and comparable properties in the area. It’s crucial to avoid over-renovating; instead, aim to bring the home up to the standard of nearby properties or slightly exceed them. This strategy will help you create an appealing home, stay within budget, and maximize your profit margins.

Before diving into renovations, it's essential to safeguard your investment with six key documents:

- Independent Contractor Agreement: This legally binding document outlines the terms and conditions of your relationship with the contractor. It specifies payment terms, timelines, and responsibilities, ensuring both parties are clear on expectations and protected throughout the renovation.

- Final Scope of Work: This detailed document lists all tasks, materials, and timelines required for the renovation. It serves as a blueprint for the contractor, helping to keep the project on schedule and within budget while meeting your quality standards.

- Payment Schedule: This document outlines the payment amounts and timelines for the contractor. By tying payments to specific milestones, it ensures that the contractor completes work as planned and helps manage project cash flow.

- Insurance Indemnification Agreement: This agreement confirms that the contractor has the necessary insurance coverage and agrees to protect you from liability for any accidents or damages occurring on the property. It shields you from financial loss due to incidents during renovation.

- W-9: This tax form collects the contractor's taxpayer identification information, necessary for IRS reporting. It ensures compliance with tax regulations and allows you to issue a 1099 form for payments made to the contractor at the end of the year.

- Final Lien Waiver: This document, signed by the contractor, confirms that they have received full payment and relinquishes any future claims against the property. It protects you from contractors seeking additional compensation after the renovation is complete.

With these documents in place, you can confidently proceed with renovations, knowing that your project is legally protected and well-managed.

This is a lot of information to take in, and navigating the complexities of flipping houses in Florida can be challenging. If you're interested in learning how to flip houses in Forida successfully, please enroll in our free training program. Our program will provide you with everything you need to confidently and profitably flip homes in Florida.

Prep & List The House On The MLS

The next step in flipping houses in Florida is to prepare the home for listing and post it on the MLS. This phase is critical for showcasing the property effectively and attracting potential buyers. Proper preparation and listing will maximize the home's visibility and enhance your chances of a successful sale.

To get the house ready for the MLS, focus on these three key tasks:

- Final Punch List: A punch list outlines the final tasks and minor repairs that need to be completed before listing the property. Ensuring all these details are addressed will make the home more appealing and ready for showings, helping you avoid any last-minute issues that could affect the sale.

- Home Staging: Staging involves arranging furniture and décor to make the home more attractive to buyers. Effective staging can boost the resale value significantly. According to the National Association of Realtors, investing about 1% of the sale price into staging can lead to a return on investment of 5% to 15% over the asking price. This makes the home more appealing and can help it sell faster.

- Professional Photos: High-quality professional photos are essential for making a strong first impression online. Research from Redfin shows that homes with professional photos sell faster and for higher prices than those with amateur images. Investing in professional photography ensures the property is presented in the best light, increasing buyer interest and potentially leading to higher offers.

Once the home is prepared, work with your real estate agent to market it effectively. Your agent will list the property on the MLS, which provides maximum exposure to potential buyers. A yard sign will attract local interest, and posting on popular online platforms like Zillow and Realtor.com will reach a broader audience. Hosting open houses allows buyers to view the property in person, while email campaigns and social media promotions target specific buyer groups. Leveraging these marketing strategies will help ensure a quick and profitable sale.

Set An Enticing Asking Price

Setting the right asking price is crucial in marketing a property, especially when flipping houses in Florida. To determine your asking price, base it on the After Repair Value (ARV) you calculated during your property analysis. A strategic approach is to set your asking price within a range of about 5% above and below your target sale price.

This pricing strategy offers several advantages. First, it attracts a broader pool of potential buyers, including those who might have initially considered the property out of their budget. By pricing slightly lower than your ideal target, you create room for negotiations and encourage more offers. With multiple offers, you can foster a competitive bidding environment, which often leads to a higher final sale price than initially expected.

A well-considered pricing strategy can significantly impact your ability to sell quickly and profitably. By positioning your asking price within a competitive range, you leverage market dynamics to potentially drive up the sale price and achieve a higher return on your investment. This approach ensures that your property stands out and maximizes your chances of securing the best possible deal.

Field Offers & Negotiate

Once your property is listed and marketed in Florida, you’ll begin receiving offers from prospective buyers. This stage involves evaluating and negotiating these offers to maximize your return. Here’s how to effectively handle this process:

Start by reviewing all incoming offers with your real estate agent. Pay close attention to not only the offered price but also the terms and contingencies attached to each bid. Evaluate the financial qualifications of the buyers and their readiness to close. Offers may come in below your asking price, but they can serve as a basis for negotiation.

Utilize counteroffers to move buyers closer to your target price. If you have multiple offers, leverage this by informing buyers of the competitive nature of the situation. This can trigger a bidding war, potentially driving up the final sale price above your initial expectations.

Effective negotiation involves more than just price. Consider other factors such as closing timelines, inspection contingencies, and financing terms. By strategically negotiating these elements, you can secure the most favorable deal and ensure a successful and profitable flip. Mastering this step is crucial for achieving your investment goals and optimizing the outcome of your Florida property flip.

Accept The Best Offer

After receiving offers on your Florida property, the next step is to accept the best one. Evaluate each offer carefully, considering not just the offer price but also the terms and conditions. Choose the offer that offers the best overall value and is most likely to close successfully. Once an offer is accepted, the buyer's timelines, including inspections and appraisals, will begin.

The buyer will first submit an earnest money deposit, which shows their commitment to the purchase. They will then carry out their due diligence, including a home inspection and appraisal. The inspection helps identify any potential issues, while the appraisal confirms that the property’s value aligns with the agreed purchase price. The buyer may request repairs or negotiate concessions based on the inspection findings.

Following due diligence, the buyer will perform a final walkthrough of the property. This allows them to ensure that any agreed-upon repairs have been completed and that the property is in the condition expected before closing. The final walkthrough is a crucial step for the buyer to verify that everything is as agreed.

By effectively managing this process, you can ensure a smooth transition from accepting an offer to closing, achieving a successful and profitable sale in your Florida property flip.

Sell The House & Get Paid

The final step in flipping houses in Florida is selling the property and collecting your proceeds. Once the buyer’s due diligence is completed and any agreed-upon repairs are finished, you will move into the closing phase, typically managed through an escrow process. During escrow, a neutral third party holds all funds and documents related to the transaction until all conditions of the sale are met.

The escrow process starts with both parties signing the closing documents, including the deed transfer and settlement statement. The buyer deposits the purchase funds into the escrow account, and if applicable, their lender provides the loan funds. The escrow agent then ensures all contractual obligations have been met, including any contingencies and required repairs.

Once everything is confirmed, the escrow agent disburses the funds. The proceeds are first used to repay your lenders, including any accrued interest, as outlined in your promissory notes. Any remaining funds, after settling these obligations, represent your profit.

Receiving the proceeds marks the successful conclusion of your house flip. This profit can be reinvested into your next project, helping you continue to grow your real estate portfolio.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Florida?

House flipping in Florida can be highly lucrative, with gross profits varying significantly based on location, renovation costs, and market conditions. According to the latest Home Flipping Report by ATTOM Data Solutions, Florida features prominently among the top states for house flipping profitability, offering some of the highest gross flipping profits in the nation.

In 2023, the average gross flipping profit for Florida real estate investors was approximately $75,000. However, this figure can be much higher in certain cities. Notably, three of Florida's cities are among the top five in the nation for the largest gross flipping profits on median-priced transactions:

- Miami, FL: $145,000 average gross flipping profit

- Tampa, FL: $110,000 average gross flipping profit

- Orlando, FL: $95,000 average gross flipping profit

These cities provide excellent opportunities for house flippers due to their dynamic real estate markets and growing demand for housing. Miami, for instance, attracts both domestic and international buyers, driving up property values and potential profits. Tampa and Orlando also benefit from strong population growth, robust local economies, and thriving tourism industries, all of which contribute to the high demand for renovated homes.

Understanding local market trends and developing a solid renovation plan is crucial for maximizing profits when flipping houses in Florida. Additionally, purchasing properties at lower prices and effectively managing renovation costs can significantly impact the net profit from each flip. With careful planning and strategic investment, house flippers in Florida can achieve impressive returns on their investments.

Is Flipping Houses In Florida Profitable?

Flipping houses in Florida can be profitable when approached with a strategic plan and market awareness. Successful house flipping in Florida involves careful property selection, strategic rehabilitation to enhance value, and astute financial management. Understanding how to finance a flip, considering market trends, and executing effective selling strategies are key elements in maximizing profitability. While risks exist, well-informed investors who navigate the unique dynamics of the Florida real estate market can capitalize on opportunities for lucrative returns.

Read Also: Is Wholesaling Real Estate Legal In Florida?

Is House Flipping Illegal In Florida?

House flipping is entirely legal in Florida. However, it is essential to understand the legal boundaries and regulations to ensure compliance and avoid engaging in illegal practices. Many of Florida's real estate laws are designed to protect both buyers and sellers, ensuring fair transactions in the market. The primary concern is not the act of flipping itself but rather the potential for mortgage or loan fraud.

Mortgage or loan fraud involves using deceptive practices to overinflate a property's value to secure a higher loan amount. This can happen if an appraiser is manipulated to provide an inaccurate assessment of the property’s worth. If homeowners default on these inflated loans, the lending institution faces significant losses, unable to recoup the funds lent.

Similarly, illegal property flipping occurs when the property’s price is artificially inflated through dishonest means, such as collaboration with a corrupt appraiser or mortgage broker. The flipper then sells the home at an overvalued price to an unsuspecting buyer, resulting in financial harm to the buyer and potential legal repercussions for the seller.

It is not illegal to sell a property at a high price in Florida, provided the value reflects genuine market conditions and honest appraisals. However, it is unlawful to misrepresent the property’s value through fraudulent appraisals or misleading information to potential buyers.

Florida enforces stringent laws against real estate fraud to maintain integrity in the housing market. Understanding and adhering to these laws is crucial for anyone involved in house flipping. This includes working with reputable appraisers and mortgage brokers and ensuring all transactions are transparent and fair.

By following legal guidelines and maintaining ethical practices, house flippers in Florida can operate successfully and profitably while contributing to a healthy real estate market.

Read Also: Is Wholesaling Legal In Florida? A Guide for 2024 Investors

Do You Need A License To Flip Houses In Florida?

You do not need a license to flip houses in Florida. You do not need a contractor's license to flip houses or a real estate license to buy or sell a house.

If you decide to hire one, the contractor you hire does not have to be licensed, though this is generally a good idea. You'll also need access to a licensed real estate agent to buy and sell the home.

These licenses are handy, especially if you plan to make real estate flipping a regular investment strategy. Getting your contractor license allows you to save money on labor, work when you want, get a higher return for your investment via more significant sweat equity, and network with fellow contractors, locally and globally.

What Are The Requirements To Flip Houses In Florida?

Flipping houses in Florida doesn’t require a substantial budget or a specific license. When it comes to Florida flippers the industry offers everything you need. Unique options to fund deals, such as assuming an existing mortgage or participating in a subject-to-transaction, make acquiring properties without significant funds or an impeccable credit score possible. Understanding these strategies is essential for those wondering how to start flipping houses in Florida with no money.

To be clear, all the requirements to flip houses in Florida are more intangible than tangible. While you may not need a license or a substantial bank account, you will need determination, a willingness to learn, and a commitment to improvement—these are the things that set the stage for a successful entry into the Florida real estate market.

How Much Does It Cost To Flip A House In Florida?

Flipping a house in Florida can be a profitable venture, but it is essential to understand the various costs involved to ensure a successful project. From acquisition and renovation costs to carrying and selling expenses, we'll outline the key financial considerations for house flippers in the Sunshine State.

The Home Purchase Price

The first major cost in house flipping is the purchase price of the property. In Florida, the median home price varies by location but averages around $398,077. For instance, properties in high-demand areas like Miami can be significantly higher, while homes in smaller cities or rural areas may be more affordable. A down payment typically ranges from 5-20% of the purchase price, with the remainder financed through a mortgage or paid in full with cash.

The Home Repair Costs

Renovation costs are a significant part of the house flipping budget. The expense of repairing a distressed property in Florida can vary widely depending on the extent of the renovations required. On average, flippers can expect to spend between $20,000 to $50,000 for a standard rehab of a three-bedroom, one-bathroom home. These costs can be broken down to about $20 to $35 per square foot, though they can range from as low as $10 to as high as $150 per square foot, depending on the complexity and quality of the renovations.

To get an accurate estimate, it’s advisable to consult with multiple general contractors and have them inspect the home before purchasing it. This step helps in understanding the full scope of necessary repairs and budgeting accordingly.

The Carrying Costs

Carrying costs can often be overlooked but are essential to account for in the overall budget. These include:

- Property taxes

- Homeowners insurance

- General liability insurance

- Utilities (gas, water, electricity)

- Maintenance (e.g., lawn care, cleaning)

These costs accrue during the period the flipper owns the property and can add up quickly, especially if the home takes longer to sell than anticipated.

Closing, Marketing, and Sales Costs

Finally, the costs associated with selling the home must be considered. These include:

- Real estate agent commissions (typically 5-6% of the sale price)

- Listing fees

- Notary fees

- Marketing costs

- Closing costs

- Title transfer fees

- Legal fees for consulting with a real estate attorney

By understanding and planning for these various expenses, house flippers in Florida can better manage their budgets and maximize their profits. Careful financial planning and thorough market research are key to a successful house flipping venture in Florida.

Read Also: Best Places To Buy Rental Property In Florida For 2025

How To Flip Houses In Florida With No Money?

Certainly, flipping houses in Florida without relying on your cash or credit is made possible through various methods. Some prominent strategies include:

- Wholesaling Real Estate: Engage in wholesaling by securing properties at a lower price and assigning the contract to another investor for a fee, eliminating the need for substantial cash or credit.

- Private Money Lenders: Explore private lenders willing to finance your house-flipping projects without stringent credit requirements, leveraging their capital to fund your investments.

- Subject-To Mortgages: Utilize subject-to mortgages, where you acquire a property "subject to" the existing mortgage, enabling you to take ownership without needing significant cash or undergoing a credit check.

- Seller Financing: Opt for seller financing arrangements, allowing you to negotiate favorable terms directly with the property seller, potentially avoiding the need for traditional financing.

- Lease Options: Implement lease options, providing the flexibility to lease a property with an option to buy, enabling you to control and potentially profit from the property with minimal upfront costs.

By incorporating these methods, you can flip Florida houses with limited or no reliance on your cash or credit. Whether it's wholesaling, leveraging private money, utilizing subject-to mortgages, exploring seller financing, or employing lease options, each strategy offers a distinct approach to navigating the house-flipping landscape in Florida.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

What's The Best Place To Flip Houses In Florida?

Choosing the best location for flipping houses in Florida hinges on factors like property values, market trends, and growth potential. Florida's diverse real estate landscape offers various opportunities depending on your investment strategy, whether you're targeting affordable neighborhoods or high-growth areas. Here are some top locations to consider:

- Orlando: Orlando, a hub for tourism with its world-renowned theme parks, also boasts a robust job market. Investors can strategically flip Orlando houses to cater to the local workforce and the constant influx of tourists, tapping into diverse housing demands and maximizing returns.

- Sarasota: Sarasota's appeal lies in its cultural attractions, beautiful beaches, and a thriving arts scene. House flippers can capitalize on the demand for renovated homes in neighborhoods that offer a vibrant lifestyle, making it an attractive market for those looking to profitably engage in flipping houses in Florida.

- Cape Coral: Cape Coral's allure lies in its waterfront lifestyle and rapid population growth. House flippers can focus on properties that cater to the demand for modernized homes in this waterfront community. The city's unique charm and growing residential needs make it an ideal location for profitable house flipping in Florida.

- Tampa: Tampa's ongoing urban renewal projects present lucrative opportunities for house flippers. The city's diverse neighborhoods and economic growth create a dynamic market for flipping homes. Savvy investors can strategically choose properties in revitalizing areas to capitalize on the city's transformation.

- Lakeland: Lakeland's strategic location between Tampa and Orlando and its affordability make it a hotspot for house flipping in Florida. Investors can target the growing population seeking affordable housing options, enhancing properties to meet the rising demand in this central Florida city.

With this in mind, we invite you to join our FREE training on house flipping in Florida. We'll guide you through the ins and outs of finding the perfect property, performing the right renovations, and, ultimately, flipping for a profit. Don't miss out on the chance to turn Florida's real estate opportunities into your financial success story. Sign up for our free training today!

How To Start Flipping Houses In Florida As A Beginner?

For those new to house flipping in Florida, actively seeking guidance through mentorship or apprenticeship programs is the most valuable advice. Joining a coach, mentor, or skills group offers invaluable insights into the intricacies of the Florida real estate market. Additionally, consider apprenticing with an experienced real estate investor to gain practical knowledge and hands-on experience.

Expand your knowledge base by immersing yourself in literature, online resources, and educational content. Read books, follow blogs, and explore articles that delve into the specifics of successful house flipping in Florida. Tune in to podcasts and YouTube channels hosted by seasoned real estate flippers to absorb their wisdom and learn from their experiences.

Explore intensive real estate house-flipping programs for those committed to an accelerated learning path. A noteworthy option is our newly launched free training program, designed to guide you on effectively finding and flipping houses in Florida within 30 days or less.

However, the most crucial aspect is to be proactive and engage in hands-on learning. Whether embarking on your own investment or serving as an apprentice or intern under an experienced flipper, the practical experience gained in the dynamic Florida market is invaluable. Embrace the learning curve, immerse yourself in the process, and actively participate in the real-world challenges of house flipping to accelerate your understanding and success in the Florida real estate arena.

Is It Hard To Flip Houses In Florida?

Flipping houses in Florida can be challenging, but it's manageable with the right approach. The competitive real estate market, especially in popular cities like Miami, Tampa, and Orlando, can drive up property prices and create bidding wars. This competition may force flippers to act quickly or purchase properties without a thorough inspection.

Another challenge is the availability of skilled labor. With the booming real estate market, contractors are often in high demand, which can lead to delays and increased costs. Building relationships with reliable contractors early can help mitigate this issue.

Additionally, Florida's unique environmental factors, such as hurricanes, can lead to higher repair and insurance costs. Navigating local building codes and permitting processes is essential to avoid legal complications.

Despite these hurdles, Florida's strong housing demand and potential for high resale values offer significant opportunities for house flippers who are well-prepared and informed.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In Florida?

Finding reliable contractors is crucial for a successful house flipping project in Florida. Whether you’re new to the area or simply looking to expand your network, there are several effective ways to connect with quality professionals.

Online platforms are a valuable resource for finding contractors.

- HomeAdvisor: HomeAdvisor is a comprehensive tool that allows you to search for professionals based on reviews and pricing. It’s a great way to find contractors for various aspects of your project, from general contractors to specialized trades.

- Thumbtack: Thumbtack is another useful site that connects you with local contractors. Similar to HomeAdvisor, it provides a range of services and allows you to compare quotes and reviews. Checking both sites can broaden your search and help you find the best fit for your needs.

- Angi: Angi formerly Angie’s List) offers a curated list of contractors based on specific project types. This platform is useful for finding professionals with the right expertise for your renovation needs.

- Houzz: Houzz not only helps with finding renovation professionals but also offers design inspiration and a range of products through its eCommerce store. This can be particularly useful for both planning and executing your renovation.

- Facebook: For a more localized approach, Facebook can be helpful. Look for local neighborhood groups or ask for referrals in community forums to find contractors with good reputations in your area.

- Craigslist: While Craigslist can be a resource, it requires extra caution. Thoroughly vet any contractors you find there to ensure they have a solid track record and proper credentials.

By utilizing these resources and doing due diligence, you can find dependable contractors to help bring your Florida house flipping project to fruition.

Final Thoughts On House Flipping In Florida

Florida is a great place to live or flip real estate. The economy is strong, the population growth is some of the best in the country, and the location is generally good, with a desirable lifestyle, many opportunities, and the potential to make a healthy profit. Regardless of whether you want to rent or resell your flipped property, you will learn a lot, make good money, and make many helpful connections along the way.

To help you navigate this dynamic market, we invite you to join our FREE training on flipping houses in Florida. We'll equip you with the right strategies and insights to ensure you're well-prepared to turn a profit on your next investment. Sign up today and take the first step towards your Florida house-flipping success story!

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.