Real Estate Broker Salary (2026): How Much Do Brokers REALLY Make?

Dec 12, 2025

Key Takeaways: Real Estate Broker Salary

- The Salary Reality: While brokers typically earn ~15-20% more than agents on paper, the net profit gap is often slimmer due to overhead and legal liability.

- Associate vs. Designated: The crucial difference between "having the license" (Associate) to get better splits vs. "running the firm" (Designated) and managing adult employees.

- The "Split" Advantage: How upgrading to a broker license can save you $20,000+ per year in commission splits—even if you never hire a single agent.

What You’ll Learn: A complete breakdown of 2026 broker income data and how to use the license as a high-leverage tool for your investing business.

There is a natural hierarchy in the real estate world. You start as a salesperson, you grind for a few years to hit your volume requirements, and then you look up at the real estate broker salary and think: "That’s the next level. That’s where the real money is."

But here is the secret most industry veterans won't tell you: The title of "Broker" is often a liability magnet disguised as a promotion.

Yes, the data shows that brokers earn more than agents. But when you peel back the layers of overhead, office leases, compliance audits, and the "vicarious liability" of managing junior agents who make mistakes, the profit margins can be shockingly thin.

However, there is a third path. The smart pros are getting their broker license not to become a manager, but to become an Investor-Broker. They use the license to capture 100% of the equity in their deals, bypassing the "broker split" entirely. In this guide, we are going to break down the hard numbers of the 2026 broker market and show you how to position yourself for profit, not just prestige.

Here is what we will cover:

- What Does a Real Estate Broker Do? (Revenue Streams Explained)

- Real Estate Broker Salary in 2026 (The Hard Numbers)

- The "Boss Tax": Hidden Costs of Running a Brokerage

- The Pivot: Broker Owner vs. Real Estate Investor

- The "Hybrid" Model: The Investor-Broker Strategy

- How to Transition from Salesperson to Deal Architect

- Frequently Asked Questions (FAQ)

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Does a Real Estate Broker Do? (And How They Get Paid)

Before we analyze the salary data, you must understand that "Broker" is a legal term, not just a job title. To become a broker, you typically need 2-3 years of full-time experience as an agent. You must pass a state licensing exam that is significantly harder than the salesperson exam (covering deep contract law, trust fund accounting, and fair housing compliance).

Once licensed, a broker makes money through three primary buckets. Understanding these buckets is critical to understanding why the income varies so wildly:

- 1. Personal Production (Sales): Just like an agent, brokers list and sell homes. The difference? They generally keep 100% of the commission because they don't have to pay a "broker split" to anyone above them.

- 2. Overrides (The "Split"): If a broker hires agents, they take a cut of every deal those agents close. For example, if an agent sells a home and earns a $10,000 commission, the broker might keep $3,000 (30%) for providing the brand, office, and legal shield.

- 3. Desk & Tech Fees: Many brokers charge their agents a monthly "rent" (e.g., $100 - $300/month) to cover software, E&O insurance, and office space, creating a baseline of recurring revenue.

The Two Types of Brokers: Associate vs. Designated

This is where the confusion lies. Not all brokers are "Bosses." Most are actually "Super Agents."

| Role | Definition | Primary Income Source |

|---|---|---|

| Real Estate Agent (Salesperson) | Must work under a broker. Cannot work independently. | Commissions (minus splits). |

| Associate Broker | Has a broker license but chooses to work under another firm to avoid liability. | Commissions (with better splits). |

| Designated / Managing Broker | The "Boss." Legally responsible for the firm and all agents. | Agent Splits + Desk Fees. |

Real Estate Broker Salary in 2026 (The Hard Numbers)

So, what does this upgrade actually pay? According to 2026 industry data, the gap between agents and brokers is real, but it varies heavily by your role.

While the national average for real estate agents hovers around $100,573 (depending heavily on the market), the average real estate broker salary typically lands around $82,392. However, averages are misleading. We need to look at the "Why."

Associate Brokers: The "Split" Arbitrage

Most Associate Brokers earn more than agents, not because they sell more houses, but because they keep more of the pie. An experienced agent might be on a 70/30 split (keeping $7k of a $10k deal). An Associate Broker, leveraging their higher credential, often negotiates a 90/10 or even a 95/5 split. That is an instant 20% raise for doing the exact same work.

Managing Brokers: The Volume Game

Managing Brokers generally have the highest ceiling but the highest floor of expenses. Their income is driven by the volume of their team. A Managing Broker with 50 agents closing deals can easily clear $250,000+ annually, but a Managing Broker with five unproductive agents might earn less than a solo producer because the office overhead eats the profits.

Here is a breakdown of the projected 2026 income data:

| Role / Experience | Est. Annual Income Range | Primary "Multiplier" |

|---|---|---|

| Associate Broker (Top Producer) | $120,000 - $180,000 | High Commission Split (90%+) |

| Managing Broker (Small Firm) | $85,000 - $130,000 | Personal Sales + Small Team Overrides |

| Managing Broker (Large Firm) | $200,000 - $500,000+ | Volume Overrides (50+ Agents) |

The "Boss Tax": The Hidden Costs of Running a Brokerage

Many agents dream of opening their own brokerage to escape the split. They imagine a scenario where they hire 20 agents, sit back, and collect 20% of everyone else's work. This is the "Passive Income Myth."

In reality, the cost to open a real estate brokerage and maintain it is staggering. In 2026, we are in the middle of the "Split Wars." To attract top talent, brokerages are forced to offer higher and higher splits (80/20, 90/10, or even 100% commission models). This has compressed brokerage profit margins down to razor-thin levels, often hovering between 5% and 10%.

Running a brokerage is often just adult babysitting. You spend more time managing compliance, settling disputes between agents, and worrying about lawsuits than you do finding deals or making money.

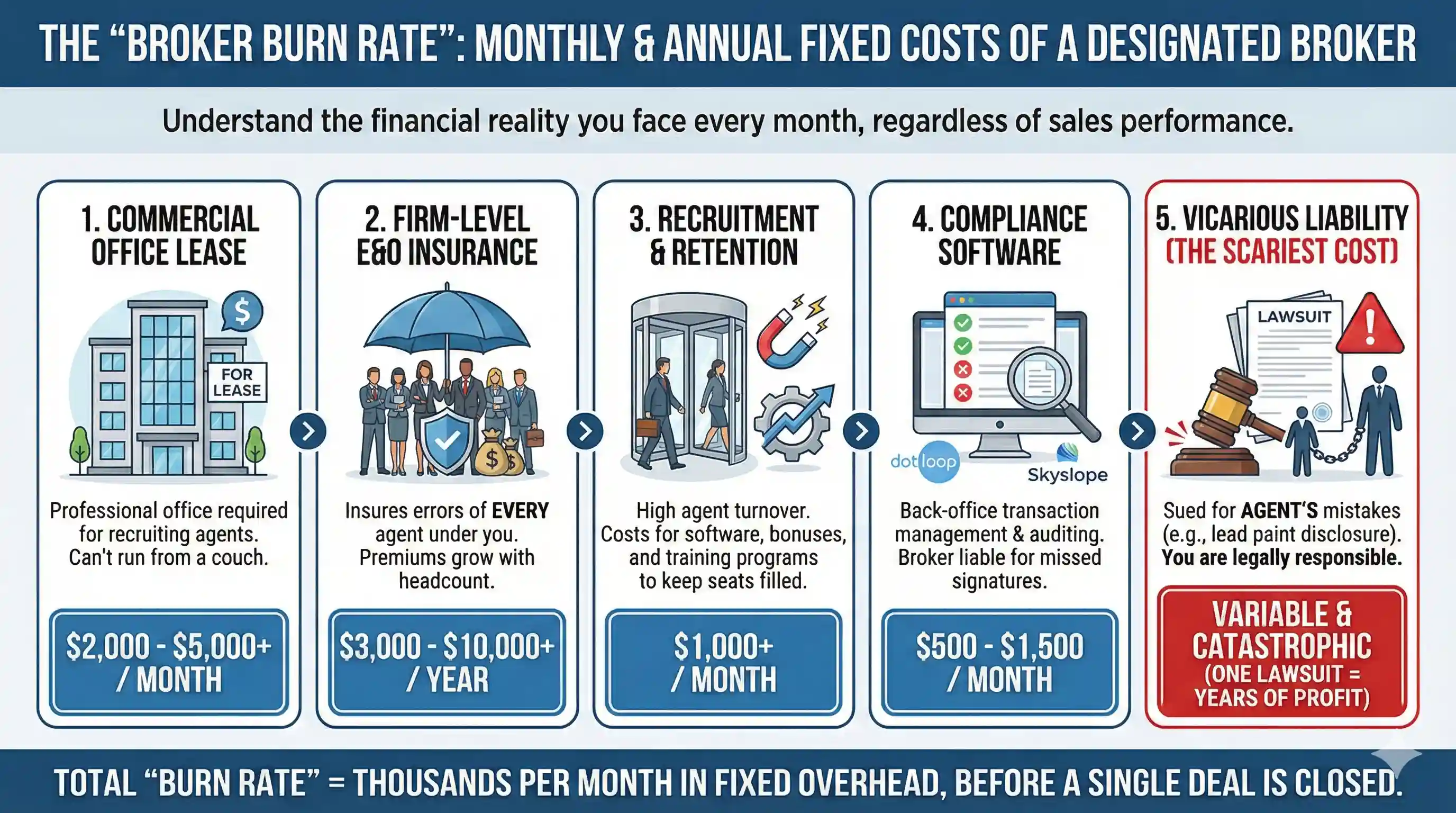

If you are considering becoming a designated broker, you must understand the "Broker Burn Rate" you will face every month, regardless of whether your agents sell a house:

The "Broker Burn Rate" Checklist

- Commercial Office Lease: You generally can't run a legitimate brokerage from your couch. Recruiting agents requires a professional office. Cost: $2,000 - $5,000+ per month.

- Firm-Level E&O Insurance: You don't just pay for yourself; you pay to insure the errors of every agent under you. As your headcount grows, so does your premium. Cost: $3,000 - $10,000+ per year.

- Recruitment & Retention: Agents leave constantly. To keep seats filled, you need recruitment software, retention bonuses, and training programs. Cost: $1,000+ per month.

- Compliance Software: You need back-office transaction management software (like Dotloop or Skyslope) to audit files. If an agent misses a signature, you are liable. Cost: $500 - $1,500 per month.

- Vicarious Liability: This is the scariest cost. If your newest agent forgets a lead paint disclosure, real estate broker liability laws mean you get sued, not just them. One bad lawsuit can wipe out five years of profits.

When you add up the overhead, the "boss" often takes home less net income than their top-producing agent. The agent has freedom; the broker has a lease. This realization leads many ambitious real estate pros to look for a different vehicle—one where they control the asset, not the employees.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

The Pivot: Broker Owner vs. Real Estate Investor

If the "Boss Tax" sounds exhausting, it is because the traditional brokerage model is built on Linear Income. To make more money as a broker, you generally need to hire more agents. More agents mean more liability, more office space, and more overhead. You are scaling your problems as fast as you are scaling your income.

The alternative path—and the one many industry veterans eventually pivot to—is Real Estate Investing. Investing allows you to generate Exponential Income. Instead of managing people (who are unpredictable), you manage assets (which are controllable).

The "Override" Myth: Doing the Math

The primary allure of becoming a broker is the "override"—the small percentage you take from your agents' deals. It sounds like passive income, but let's run the numbers against a standard investor deal.

- Scenario A: The Broker Override

Let's say your agent sells a $400,000 house. The gross commission is $12,000. On a generous 80/20 split, you (the broker) keep $2,400. To make $50,000 in net profit, you need your agents to close roughly 21 transactions a month (while you manage the compliance for all of them). - Scenario B: The Investor Flip

You find a distressed property for $250,000, put $50,000 into repairs, and sell it for $400,000. After closing costs, your net profit is roughly $50,000. You made the same amount of money in one transaction that the broker made in 21 transactions.

This is the "Effort-to-Reward" gap. As a broker, you are working in a volume game with thin margins. As an investor, you are playing a value game with deep margins.

Comparison: Managing Agents vs. Managing Assets

Here is the breakdown of why many designated brokers eventually stop recruiting and start buying:

| Metric | Broker Owner (People Business) | Real Estate Investor (Asset Business) |

|---|---|---|

| Primary Leverage | Other People's Time (OPT) | Other People's Money (OPM) |

| Scalability Constraint | Recruitment & Retention. You are constantly replacing agents who quit. | Capital & Deal Flow. Once you solve these, you can scale infinitely. |

| Profit Margin | Low (5-15%) due to splits/overhead. | High (20-30%+) on Flips/Wholesale. |

| Liability Risk | Vicarious Liability. You are sued for your agents' mistakes. | Asset Liability. Risk is generally limited to the specific property/LLC. |

The "Hybrid" Model: The Investor-Broker Strategy

If you take nothing else from this guide, remember this: You do not need to hire agents to be a successful broker. In fact, the highest margin business model in 2026 is arguably the "Firm of One."

This is the Investor-Broker model. You get your broker license, open your own LLC, and hire exactly zero employees. You are the designated broker, the only agent, and the primary client. By doing this, you eliminate the "middleman tax" entirely and unlock a level of deal control that standard agents simply don't have.

1. The "Coming Soon" Data Advantage

Zillow and Redfin are great, but they are often 24-48 hours behind the real data. As a designated broker, you have direct admin access to the MLS. This allows you to see "Coming Soon" and "Incomplete" listings that are being prepped for market but haven't been syndicated to the public yet.

For an investor, this is insider information. You can spot a distressed property being listed by another agent before it hits Zillow, call that agent, and potentially put it under contract before the general public even knows it exists.

2. The Legitimacy Factor

When you are negotiating a $500,000 commercial deal or talking to a hard money lender, title matters. "Real Estate Agent" sounds like a salesperson. "Managing Broker" sounds like a principal. In my experience, lenders and private equity partners take you significantly more seriously when they see "Broker/Owner" on your business card. It signals that you understand the law, the liability, and the asset class at a higher level.

3. The Zero-Split Strategy (100% Commission)

The most tangible benefit, however, is the math. As a standard agent, you always pay a split (e.g., 20-30%) to your broker. As an Investor-Broker, you are the broker. You pay yourself.

The Zero-Split Strategy

Here is how a 100 percent commission real estate broker model changes your ROI on a single flip:

- The Deal: You buy a fixer-upper for $300,000.

- The Acquisition Commission (3%): As the buyer-broker, you earn a $9,000 commission. You keep 100% of this ($9,000).

- The Resale Commission (Listing Side - 3%): After fixing it, you sell it for $450,000. As the listing broker, you earn a $13,500 commission. You keep 100% of this ($13,500).

- The Net Result: On top of your flip profit, you generated an additional $22,500 in commission income that would have otherwise been split with a brokerage. That $22,500 covers your renovation costs, holding costs, or becomes pure profit.

How to Transition from "Salesperson" to "Deal Architect"

The hardest part of this transition isn't the mechanics; it's the identity shift. Salespeople are employees of the transaction—waiting for a client to call, showing houses on weekends, and praying the financing goes through. Deal Architects are owners of the transaction—finding the opportunity, creating the value, and getting paid for the equity they control.

To make this jump, you need to stop acting like a manager and start acting like an investor. Here is your step-by-step career upgrade plan:

- Step 1: Get the License for the Savings, Not the Ego

Do not get your broker license to open a Re/Max franchise and recruit 50 agents. That is a trap. Get the license solely to eliminate your split.

The Tactic: Register your own LLC as a brokerage. Your only "agent" is you. This instantly increases your income by 20-30% on every deal you do, giving you the capital reserves you need to start funding your own flips. - Step 2: Stop Recruiting Agents; Recruit "Bird Dogs"

Traditional brokers spend all day recruiting sales agents who whine about leads. Instead, recruit Bird Dogs (property scouts). These are wholesalers, mail carriers, or contractors who are on the streets every day.

The Tactic: Tell every wholesaler in your market: "I am a principal broker with cash. Bring me your off-market deals. I can close in 14 days, and I will never cut your assignment fee because I don't have a boss to answer to." You will get first look at deals that never hit the MLS. - Step 3: The "Peer-to-Peer" Pocket Listing Strategy

Top producers often sit on "pocket listings" (off-market deals) because they don't want to deal with inexperienced agents. As a designated broker, you have peer-level status.

The Tactic: Call the top 10 listing agents in your county. Say this: "I’m the broker-owner of [Your Firm]. I’m looking to acquire 2-3 fixers this quarter for my own portfolio. Do you have anything upcoming that needs a cash offer before you go through the hassle of staging and listing it?" You are speaking their language: speed and certainty.

The Blueprint: Stop Guessing and Start Closing

Transitioning from a broker to a high-income investor doesn't happen by accident. You need a proven system. We have seen too many agents get their license and then freeze because they don't know the actual mechanics of finding a distressed property or analyzing a rehab budget.

That is why we created the Ultimate Guide to Start Real Estate Investing. It is not just theory; it is the exact playbook we use to navigate every market cycle.

Whether you want to generate quick cash through wholesaling, tackle your first massive fix-and-flip project, or build long-term wealth with buy-and-hold rentals, this guide covers it all. It is the missing link between "getting licensed" and "getting paid."

Ready to get started? Click the image below to download your FREE copy of the Ultimate Guide now.

Frequently Asked Questions (FAQ)

Here are the direct answers to the most common questions regarding the real estate broker salary, licensing requirements, and the financial reality of running a brokerage in 2026.

Final Thoughts: Don't Climb the Wrong Ladder

Becoming a broker is a massive achievement, and the potential real estate broker salary is certainly attractive on paper. But before you commit to the extra liability, overhead, and "adult babysitting" of running a firm, ask yourself what your actual goal is.

If your goal is status, go ahead and build a traditional brokerage. But if your goal is freedom and net worth, the traditional path might be a trap. The smartest players in this game aren't trying to manage 50 agents; they are trying to control 50 assets.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.