The Definitive Guide to a Real Estate Agent Flipping Houses (2026 Playbook)

Feb 19, 2026

Key Takeaways: Real Estate Agent Flipping Houses

- The Opportunity: Getting your real estate license gives you the ultimate unfair advantage by letting you pull raw MLS data directly and pocket the commissions on both sides of the transaction to instantly widen your profit margins.

- The "Trap": The biggest risk you need to watch out for is failing to formally document your transition from an advising agent to a principal buyer in writing, which leaves you completely exposed to lawsuits because courts hold licensed professionals to a much higher expert standard.

- The Strategy: Implement the Dual-Capacity Disclosure Doctrine to cleanly sever your fiduciary obligations before signing any off-market purchase agreement.

What You’ll Learn: The exact contractual frameworks to legally flip homes as an agent or partner with one without triggering a lawsuit.

Becoming a licensed real estate agent gives you a massive, unfair advantage when you want to build an investing portfolio. You get instant access to raw MLS data, a deep network of contractors, and the ability to wipe out thousands of dollars in transaction fees on every single deal.

But here is the catch that most people ignore: the legal reality of a real estate agent flipping houses is an absolute minefield.

The second you approach a distressed homeowner to buy their property, the line between acting as their trusted advisor and acting as a principal buyer instantly blurs. If you get it wrong, you become a prime target for a lawsuit. State commissions and the National Association of Realtors actively penalize professionals who use their insider knowledge to secure off-market equity without bulletproof disclosures.

This guide strips away the generic advice. We are going to break down the exact legal boundaries, the mandatory paperwork you need, and the optimal partnership structures required to aggressively flip properties without risking your license.

How To Make MORE MONEY As A Real Estate Agent

Before diving into the frameworks, watch this breakdown of how licensed agents are ethically stacking buyer commissions, wholesale fees, and listing commissions on a single transaction.

Watch as we demonstrate the technical strategy required to triple your income per deal without chasing retail clients.

Can a Real Estate Agent Flip Houses? (The Legal Reality)

Yes, without a doubt, licensed real estate agents can flip houses. But here is the reality check: you aren't playing by the same rules as an everyday investor.

Because the state considers you a real estate professional, courts hold you to a much higher legal standard. To protect yourself from massive lawsuits or the risk of losing your license, you have to be radically transparent. That means clearly disclosing your active licensed status in writing before you ever let a distressed seller sign a purchase agreement.

- The Legal Baseline: A real estate agent flipping houses is completely legal, provided the agent explicitly discloses their licensed status in writing to all parties prior to signing a purchase agreement, thereby satisfying the National Association of Realtors (NAR) Article 4 requirements.

- Why this might NOT work for you: Keeping your license inactive might actually be safer if your sole business model is aggressively acquiring distressed, off-market properties, as active agents face heightened scrutiny and mandatory disclosures that pure investors bypass.

Related Reading: How To Become A Real Estate Agent: The Ultimate Guide

Most beginners fail here because they assume setting up a separate limited liability company completely isolates their investment activities from their real estate license. The law does not see it that way. When you approach a homeowner, the state automatically presumes you are operating with the specialized knowledge of a licensed professional. To protect yourself, you must implement the Dual-Capacity Disclosure Doctrine.

This doctrine requires you to clearly define your role in the transaction. You are either acting as a fiduciary working for the seller's best interest, or you are acting as a principal buying the property to secure a profit for yourself. You cannot quietly navigate between the two. The hardest part is managing the conversation with a distressed homeowner. You must cleanly sever your fiduciary duty and explain that you are the buyer, effectively shifting the relationship from advisor to adversary.

Failing to execute this transition properly is the leading cause of predatory acquisition lawsuits. If a seller later feels they sold the property below market value, their attorney will immediately target your licensed status, arguing you used your insider knowledge to take advantage of them. Your only defense in front of the state real estate commission is a paper trail proving you disclosed your intent to profit before the contract was ever signed.

Related Reading: How To Flip A House With No Experience + Free Downloadable Guide

Expert Note: Surviving the Principal Transaction

The Messy Reality: Sellers facing financial distress often claim they thought the agent was helping them out of a jam rather than buying the house to flip it for profit. If you do not have a signed, date-stamped disclosure addendum proving you severed your fiduciary duty prior to the purchase agreement, the regulatory board will almost always side with the consumer.

My First Agent-Investor Flip

After the better part of two decades in the real estate investing trenches and overseeing countless transactions as the Co-Founder of Real Estate Skills, I have seen firsthand how an active license can be both your greatest weapon and your biggest liability.

I still remember my very first flip in Poway, California. I was a licensed agent at the time, and I managed to secure a three-bedroom cosmetic fixer for $390,000—well below its $500,000 asking price. Because I held a license, I was able to list that property myself on the back end, saving over $15,000 in commissions that went straight into my $61,000 net profit. However, that "unfair advantage" came with a heavy weight.

Becoming a licensed real estate agent gives you a massive, unfair advantage when you want to build an investing portfolio. You get instant access to raw MLS data, a deep network of contractors, and the ability to wipe out thousands of dollars in transaction fees on every single deal.

But here is the catch that most people ignore: the legal reality of a real estate agent flipping houses is an absolute minefield.

Case Study: My First Agent-Investor Flip

Watch a complete breakdown of how I used my license to find, fund, and flip a property for a $61,000 net profit, including exactly how saving on listing commissions widened my margins.

The Unfair Advantages of Being an Agent-Investor

Getting your real estate license as an investor is essentially unlocking a cheat code for the housing market. By cutting out the middleman, you take complete control of your timeline, keep thousands of dollars in your own pocket, and get direct access to the exact same data the pros use.

When you buy a flip as a licensed professional, you are building a massive safety net into your profit margin. Here is how it works: when you find a property you want to buy, you act as your own agent and waive your buyer's fee. This instantly makes your offer cheaper for the seller to accept, allowing you to easily beat out competing investors. Then, once the rehab is finished, you list the house yourself and keep the selling commission too.

Beyond the instant cash savings, holding a license provides some major tax perks. Actively flipping houses as an agent helps you qualify for real estate professional tax status with the IRS, allowing you to legally deduct your investing losses against your regular, active income.

But above all else, having a license gives you the ultimate advantage of speed. In the distressed property market, the first person to submit a clean contract usually wins the deal. Instead of sitting around waiting for another agent to draft a document or send over an offer, you can execute the paperwork yourself on the spot.

- The Data Advantage: The primary competitive advantage for an agent-investor is direct Multiple Listing Service (MLS) access, allowing them to instantly identify days-on-market (DOM) anomalies and pull precise comparative market analyses (CMAs) without relying on a third-party intermediary.

- Why this might NOT work for you: While having direct data access is powerful, it is becoming less relevant in 2026 as top flippers rely almost entirely on direct-to-seller marketing to find off-market deals, meaning the MLS is no longer the exclusive goldmine it once was.

| Feature/Metric | Agent-Investor | Unlicensed Flipper |

|---|---|---|

| Market Data | Direct, unfiltered MLS access. | Relies on third-party agents or delayed public portals. |

| Acquisition Costs | Waives 2.5% to 3% buy-side fee to lower offer price. | Competes at full retail pricing structure. |

| Exit Costs | Saves 2.5% to 3% by listing the property themselves. | Pays full 5% to 6% broker commissions upon sale. |

| Transaction Speed | Writes and submits non-contingent offers instantly. | Subject to their agent's schedule and availability. |

The "Higher Standard" Trap: Disclosures and Ethical Landmines

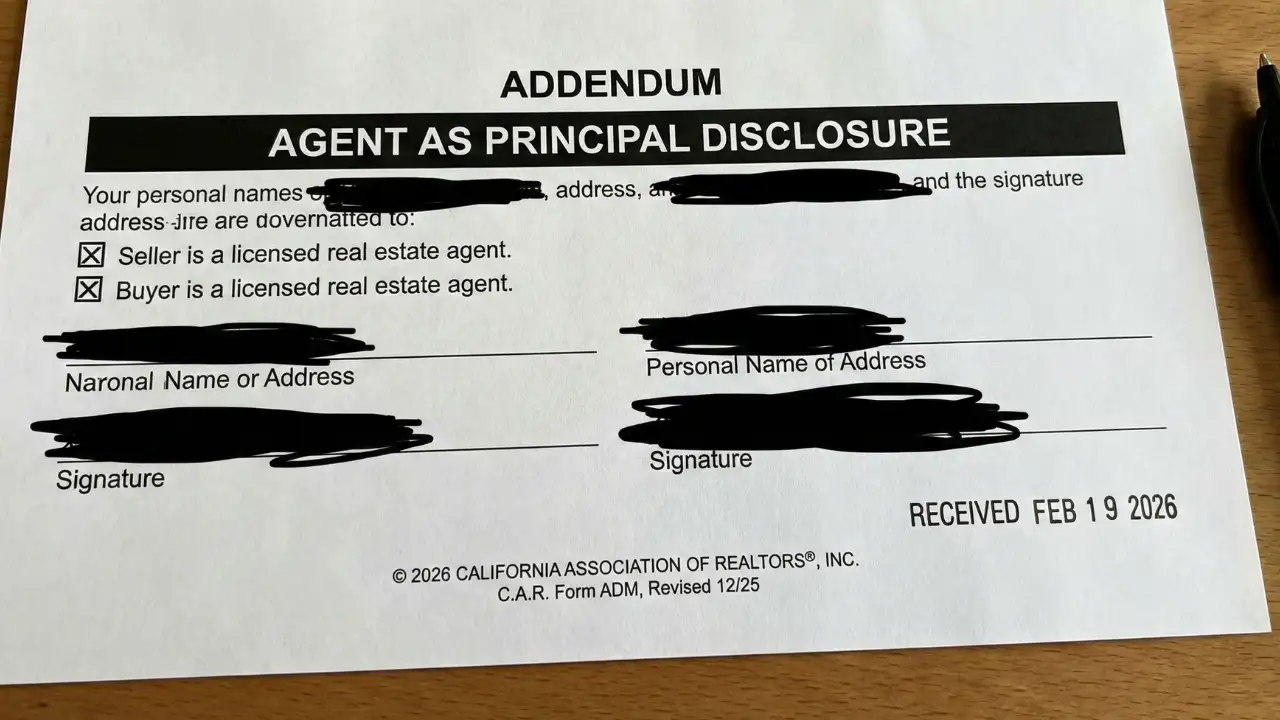

Definition: The Dual-Capacity Disclosure Doctrine is a legal and ethical requirement mandating that licensed real estate agents formally sever their fiduciary duties in writing before purchasing a property directly from a seller as a principal investor.

As a licensed agent, every move you make is scrutinized by the law. When you decide to buy an off-market house for yourself, you have to create a clear paper trail proving you've stepped out of the "helpful advisor" role and are strictly acting as the buyer. If you mess up the timing on these disclosures, you are leaving the door wide open for a disgruntled seller to turn around and sue you for taking advantage of them.

When a homeowner is facing foreclosure or serious financial trouble, the legal system views them as highly vulnerable. If you step in to buy their property off-market, the courts aren't going to look at it as a fair fight between two ordinary people. Because you hold a license, judges and state commissions hold you to an "expert standard." They automatically assume you have the upper hand and know exactly what the property is worth. In heavily regulated states like California, laws like Civil Code § 1695 will absolutely hammer agents who buy equity-rich homes from distressed sellers without an ironclad paper trail to prove they played by the rules.

- The Regulatory Reality: Courts hold licensed real estate agents to an expert standard. When acquiring a flip directly from a distressed seller, agents must formally transition their role from a fiduciary to a principal in writing to avoid predatory acquisition lawsuits.

- Why this might NOT work for you: Over-disclosing your legal obligations using complex, intimidating jargon can instantly kill a lucrative off-market deal by making an already nervous homeowner back out of the transaction entirely.

Most beginners fail here because they rely strictly on verbal conversations. Telling a seller you have a license offers zero protection during a principal transaction. The hardest part is introducing the mandatory paperwork naturally, so you comply with the law without blowing up the negotiation. You must execute a formal disclosure addendum before any money changes hands or contracts are signed.

To safely navigate this transition, follow these mandatory documentation steps:

The Dual-Capacity Disclosure Process

The Verbal Declaration

Bring up your real estate license immediately. The second you begin discussing a potential sale with the homeowner, verbally confirm your active licensed status.

The Contractual Timing

Provide the seller with your official state-approved disclosure addendum at the exact same time you present the initial purchase offer, prior to any signatures.

The Profit Acknowledgment

Require the seller to sign a specific clause confirming they understand your offer may be below retail market value and that your sole intent is to secure a profit.

License or Not: Here is How You Actually Find Profitable Flips

A lot of people think you need a real estate license to be a successful investor, while licensed agents often struggle to transition from selling houses for clients to actually flipping them for themselves. The truth? Whether you are an active agent or a complete beginner starting from scratch, the formula for success is exactly the same: you have to know how to find deeply discounted properties before anyone else does.

Don't let the legal red tape or a lack of experience hold you back from building real wealth. Before you write your first offer, you need a proven roadmap. Download our Ultimate Guide to learn the exact step-by-step process for finding, funding, and flipping real estate the right way.

For Investors: How to Find & Hire an Investor-Friendly Agent

If you're flipping houses without a license, you don't need a retail tour guide—you need a specialized partner who understands the numbers. An investor-friendly agent isn't worried about finding a "dream home"; they are obsessed with speed and margins. They know how to hunt down off-market leads, help you estimate realistic renovation costs, and move fast enough to lock down a deal before you lose out to another buyer.

- The Vetting Standard: You aren’t looking for just any agent; you need someone who can accurately nail the after-repair value (ARV) without guessing. They should know exactly how hard money lenders operate and be ready to blast out multiple aggressive, no-nonsense offers until you get a contract signed.

- Why this might NOT work for you: Hiring a traditional retail agent to find flip properties is a guaranteed way to waste time and lose earnest money, as they are trained to protect buyers with slow, contingency-heavy contracts that sellers of distressed assets immediately reject.

Most beginners fail here because they assume all licenses are created equal. A retail agent evaluates a property based on school districts, emotional appeal, and move-in readiness. An investor-friendly agent evaluates an asset strictly on yield, structural viability, and exit liquidity. The hardest part is breaking a retail agent of their traditional habits. If your agent does not understand how hard money lenders evaluate a deal or how to structure a double-close, they will actively hinder your growth.

To ensure you are partnering with the right professional, execute this vetting checklist before signing a representation agreement:

- Test Their ARV Accuracy: Do not rely on their initial numbers. Ask them to pull a comparative market analysis on a distressed property and justify their after-repair value using only properties flipped within the last 90 days.

- Check Their Hard Money Fluency: Ask how they structure purchase contracts to accommodate private lenders, fast closing timelines, and specific appraisal contingencies required by asset-based lenders.

- Evaluate Their Offer Speed: In the distressed market, speed is everything. You need to make sure your agent is comfortable pumping out multiple "sight-unseen" offers at scale without insisting on a time-consuming physical walkthrough for every single property they find.

Negotiating With Agents on Investment Deals

Stop wasting time with retail Realtors. Learn the exact strategies to identify and communicate with agents who actually understand the investment side of the business.

Watch as we demonstrate the technical analysis required to properly vet an agent's investment acumen and execute winning offers.

Structuring the Partnership: Commissions, Equity, and Roles

When you're setting up a deal with an agent, the goal is to make sure everyone is motivated to hit the highest possible sales price. Most investors do this by offering the agent a flat "finder’s fee" when they first buy the house, along with a guarantee that the same agent gets to list the property for a full commission once it’s renovated.

A huge mistake beginners make is trying to talk the agent down on their commission for both the purchase and the sale. If you do that, you’re basically killing any reason for that agent to bring you their best off-market deals in the future. You have to remember that if an agent finds you a massive discount, you need to make it worth their while. When you pay a flat fee right up front, you keep things (like your budget) more predictable. It should also be noted that when you promise them the listing on the back end of the deal, you can remain confident that they have your best interests in mind.

- Why this might NOT work for you: Offering an agent a percentage of the profits as sweat equity in a joint venture, instead of standard commission, often complicates taxes with complex K-1 filings and severely delays decision-making when partners inevitably disagree on renovation finishes or budget overruns.

Keep it simple—don't fall into the trap of making the partnership more complicated than it needs to be. You want a clear line in the sand between the person putting up the cash and the agent managing the deal, with everyone getting paid only when specific milestones are hit. When you start over-mixing roles, you lose focus, the project drags on, and your profits disappear into high interest and holding costs.

| Compensation Structure | Investor Role | Agent Role |

|---|---|---|

| Buy-Side Acquisition Fee | Funds the purchase and pays a flat assignment or finder's fee at closing. | Sources the off-market deal and waives percentage commission on the buy. |

| Sell-Side Listing Agreement | Manages the renovation entirely and sets the final listing price parameters. | Markets the property on the MLS for a full 2.5% to 3% commission. |

| Joint Venture (Equity Split) | Provides 100% of the capital and assumes total financial liability. | Provides project management for an agreed-upon percentage of net profits. |

Frequently Asked Questions (FAQ)

Navigating the intersection of real estate licensure and property investment generates complex regulatory questions. Below, we address the most common technical inquiries regarding self-representation, legal structures, and commission regulations when an agent decides to flip an off-market asset.

Final Thoughts on Agent-Investor Synergy

To successfully flip houses when you hold a license, it really comes down to two simple things: following the rules to a tee and moving fast. Whether you are using your own license or teaming up with an investor-friendly agent, the goal is exactly the same. You need to lock down deeply discounted properties before they ever hit the open market, and you have to protect yourself from lawsuits by keeping your paperwork completely spotless.

The real money in this business is made when you skip the slow, traditional buying process altogether. As you grow your portfolio, your profit margins will depend entirely on how well you can find these hidden, off-market deals. You can't rely on the old way of doing things anymore. If you want to see exactly how the pros find and buy these highly profitable properties directly from motivated sellers, check out our free training below.

Ready to maximize your commissions and build serious equity?

Our FREE Training teaches you exactly how to flip houses by partnering with experienced real estate investors, or how to safely scale your own portfolio as a licensed agent-investor today.

Access the Free Training Now*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.