How to Get a House Under Contract for Wholesaling (The 2026 Guide)

Jan 07, 2026

Key Takeaways: How to Get a House Under Contract for Wholesaling

- What: The process of legally securing a property using a Purchase and Sale Agreement (PSA), which grants you "equitable interest" in the home.

- Why: You cannot wholesale a house you don't control. Getting it under contract is the vital step that turns a conversation into a sellable asset without you needing to own the property.

- How: By following our 4-step framework: calculating the MAO (Maximum Allowable Offer), building seller rapport, inserting specific "safety net" contingencies, and signing the paperwork.

What You’ll Learn: We will show you exactly how to lock up properties risk-free using specific 2026-compliant clauses, negotiation scripts, and a simple process to get sellers to say "yes."

Finding a motivated seller is only 10% of the battle; knowing how to get a house under contract for wholesaling is where the actual money is made.

You can have the best lead in the world—a distressed property, a willing owner, and a massive spread—but if you can’t get the paperwork signed, you don’t have a deal. You just have a nice conversation.

For many new investors, this is the scariest part of real estate investing. You might be thinking: "What if I mess up the clauses? What if the seller asks a legal question I can't answer? What if I get stuck buying a house I can't afford?"

I’ve been there. But here is the truth: A wholesale contract isn’t a trap. It is simply a tool that protects you just as much as it protects the seller.

In this guide, we are going to cut through the noise. I’m going to show you the exact 4-step framework to lock up deals risk-free, the specific "weasel clauses" you must include, and the negotiation scripts that make sellers feel comfortable signing on the dotted line.

Let’s get your first deal signed.

Here is what we will cover:

- What Does "Under Contract" Actually Mean?

- The 3 "Must-Have" Clauses in Your Contract

- Step-by-Step: How to Get a House Under Contract

- The "Kitchen Table" Script: What to Say to the Seller

- Handling Seller Objections (The "What Ifs")

- Important Legal Updates (2026 Watchlist)

- Frequently Asked Questions (FAQ)

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Does "Under Contract" Actually Mean?

If you take nothing else from this article, take this: When you get a house under contract, you are not buying the house.

This is the single biggest mental block for new wholesalers. You might be thinking, "I don't have $300,000 in my bank account. How can I sign a document saying I'm going to purchase this property?"

The answer lies in a legal concept called equitable interest.

When you and the seller sign that Purchase and Sale Agreement, you aren't taking the title immediately. You are securing the exclusive right to purchase the property at a specific price within a specific timeframe. You aren't selling the brick-and-mortar house; you are selling the paper that controls it.

| Feature | Buying the House (Traditional) | Under Contract (Wholesaling) |

|---|---|---|

| What You Own | The Legal Title (Deed) | Equitable Interest (The Contract) |

| Cash Required | Full Price or 20% Down | $10 - $100 Earnest Money |

| Your Role | The Final Owner | The Transaction Coordinator |

Think of it like a restaurant reservation.

When you call a high-end steakhouse and reserve a table for Friday night, you don't own the table. You haven't paid for the steak yet. But for that specific block of time, you control that table. Nobody else can sit there.

This distinction is vital because it allows you to control millions of dollars of real estate without using your own cash or credit. As long as your agreement has the right exit clauses (which we will cover next), you are not locking yourself into debt; you are locking yourself into an opportunity.

Once you grasp this concept, the fear disappears. You realize you aren't writing a check; you are securing an asset. Now that the legal definition is clear, let’s look at the specific mechanics of how to get a house under contract for wholesaling so you can lock up that asset without risking a dime.

Free Download: Get Our "Battle-Tested" Wholesale Contract Templates

Don't risk your deal by using a generic contract you found on a forum. If you want to look professional and protect your deposit, you need the right paperwork.

We have packaged the exact Purchase and Sale Agreement and Assignment Contract that we use to close millions of dollars in real estate deals. These are attorney-reviewed, simple to use, and ready for you to download right now.

Click the image below to grab your free PDF templates instantly.

The 3 "Must-Have" Clauses in Your Contract

Now that you know you are securing the right to buy, how do you do it without risking your life savings? The secret is in the contingencies.

A contingency clause is simply a specific condition that must be met for the contract to move forward. If these conditions aren't met, the agreement allows you to back out of the deal and get your earnest money deposit (EMD) back.

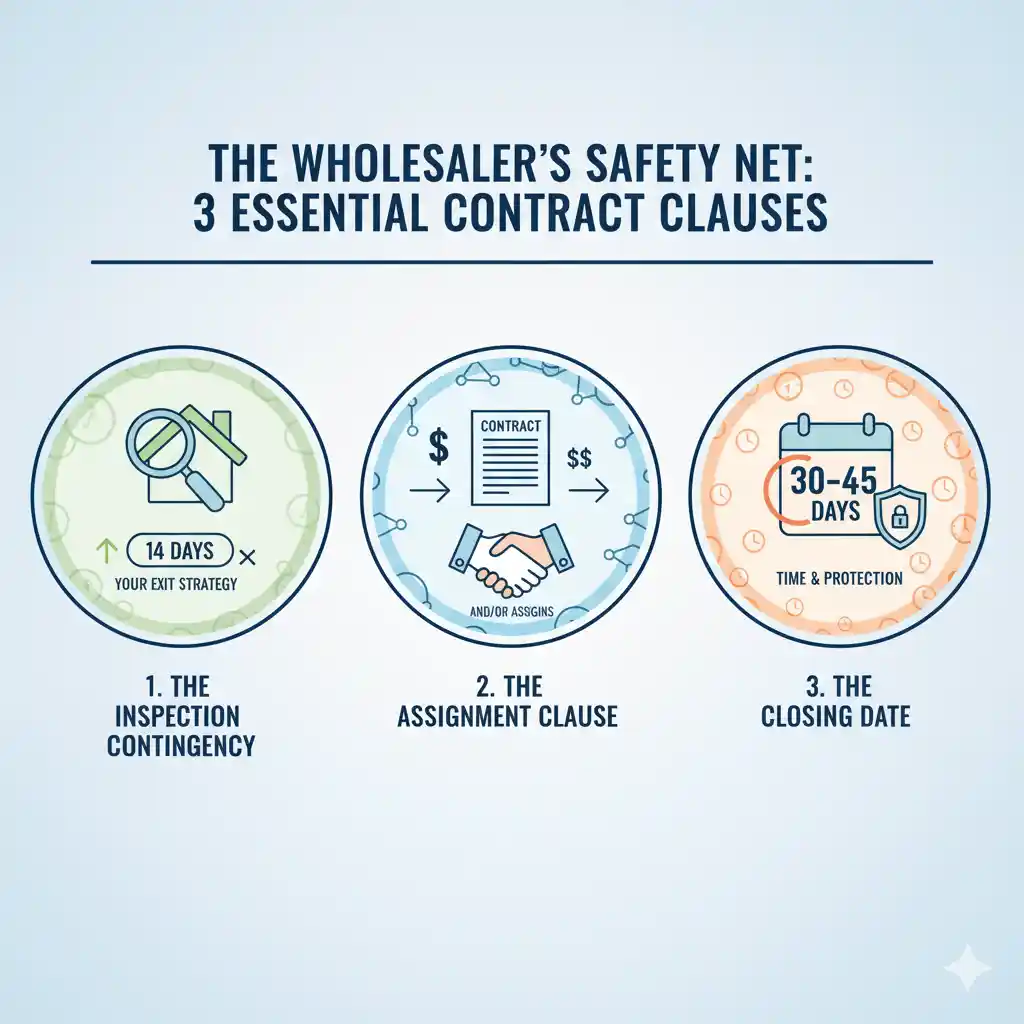

To wholesale risk-free, your agreement must contain these three specific protections:

The Safety Net Clauses

- The Inspection Contingency. This is your ultimate escape clause. It gives you a set timeframe (usually 10 to 14 days) to perform due diligence. During this inspection period, you can assess the property condition or simply verify your numbers. If you find the deal doesn't work, you can cancel the contract in writing and walk away without penalty.

- The Assignment Clause. This language gives you the legal right to sell the deal. It usually appears after the buyer's name as "and/or assigns." Without this clause, you are legally obligated to buy the house yourself rather than transferring it to a cash buyer.

- The Closing Date. You need time to find a buyer and process the title work. Never agree to close in 7 days unless you have cash ready. Set a realistic timeline of 30 to 45 days to give yourself enough runway to market the property.

Two Hidden Details That Save Deals

Beyond the main three clauses, there are two small details that experienced wholesalers never miss.

First, ensure your agreement includes an "Access Clause." The inspection contingency lets you look at the house, but you need permission to show the property to your "partners/contractors" (who are actually your cash buyers). Without clear language granting you access during the contract period, a difficult seller could lock you out, making it impossible to assign the deal.

Second, keep your Earnest Money Deposit low. On a retail deal, you might put down 1% of the purchase price. In wholesaling, the standard is often $10 to $100. This keeps your financial risk near zero while still making the contract legally binding.

With these protections in place, the risk of losing money drops to near zero. You now have the legal safety net required to move forward with confidence, knowing you have a compliant exit strategy. Next, let’s shift gears from the paperwork to the process and walk through the exact steps on how to get a house under contract for wholesaling.

Step-by-Step: How to Get a House Under Contract

You understand the concept, and you have the safety net clauses. Now, let’s break down the actual physical actions you need to take to get that signature.

- Step 1: Calculate Your Maximum Allowable Offer (MAO)

- Step 2: Build Rapport, Don't Just "Sell"

- Step 3: Present the Agreement (Digital vs. Physical)

- Step 4: The Walkthrough

- The Logistics: Where to Get a Contract & How to Fill It Out

Step 1: Calculate Your Maximum Allowable Offer (MAO)

Before you ever talk price with a seller, you must know your ceiling. The biggest mistake beginners make is guessing the value. If you offer too much, you won't be able to find a buyer, and you will have to cancel the wholesale real estate contract, which hurts your reputation.

You need to calculate your Maximum Allowable Offer (MAO). This is the highest price you can pay while still leaving room for the rehabber's profit and your assignment fee.

(ARV × 70%) − Repairs − Your Fee = MAO

(After Repair Value) − (Renovation Costs) − (Profit) = Your Max Offer

Step 2: Build Rapport, Don't Just "Sell"

People do business with people they like. When you meet with a motivated seller, do not pull out the agreement immediately. If you lead with paperwork, you look like a predator.

Spend the first 15-20 minutes just walking the property. Ask them about their situation. Why are they selling? Where are they moving to? Your goal is building rapport and positioning yourself as a problem solver, not a salesperson. Once they trust you, the paperwork becomes a formality.

Step 3: Present the Agreement (Digital vs. Physical)

There are two ways to get the document signed, and the method depends on the seller's comfort level.

- The Kitchen Table Close (Wet Signature): This is best for older sellers or those who aren't tech-savvy. You sit down, pull out two physical copies of the agreement, and walk through it line-by-line. A physical wet signature often feels more "real" to traditional sellers.

- The Digital Close (DocuSign): For out-of-state owners, landlords, or younger sellers, sending the contract via DocuSign is faster and more efficient. It allows them to review it on their phone and sign in seconds.

Step 4: The Walkthrough

Never just say, "Sign here." That creates anxiety. Instead, briefly explain what each section means to lower their defenses. Once they understand that the terms are standard and fair, asking for the signature is easy.

The Logistics: Where to Get a Contract & How to Fill It Out

You might be thinking, "This sounds great, but I don't actually have a contract yet." Do not overcomplicate this. You do not need to draft one from scratch.

Where to Find a Wholesale Contract:

- Local Title Companies: Call an investor-friendly title company in your area. They often have standard "Purchase and Sale" templates they prefer to use.

- Local REIA Groups: Real Estate Investor Associations often share compliant contracts with members.

- Real Estate Skills Mentorship: We provide our students with battle-tested, attorney-reviewed contracts for all 50 states.

The "Cheat Sheet" for Filling It Out:

When you are sitting with the seller, don't get overwhelmed by the fine print. There are really only five "blanks" you need to worry about to make the document valid:

The 5 Essential Fields

- The Parties: Clearly print the seller's name (exactly as it appears on public records) and your name (or your LLC) followed by "and/or assigns."

- The Property Description: The physical address is usually enough, but adding the "Legal Description" (Lot/Block number found on the county assessor site) makes it bulletproof.

- The Purchase Price: The exact dollar amount you agreed upon.

- The Earnest Money: Write in the amount (e.g., $100) and who will hold it (usually "Buyer's Title Company"). Never give the cash directly to the seller.

- The Closing Date: Pick a date 30 to 45 days out (e.g., "On or before December 15th").

The "Kitchen Table" Script: What to Say to the Seller

The moment you slide the contract across the table (or hit "send" on DocuSign) is often the most nerve-wracking part of the entire process. You might worry that the seller will suddenly lawyer up, get cold feet, or ask you a question you don't know the answer to.

If you are scared to talk to sellers, know this: It is not your job to convince them to sell. It is your job to help them solve a problem.

Before you use the script below, you must adopt the "Reluctant Buyer" mindset. If you seem too eager, the seller will pull back. If you seem calm and indifferent, they will lean in.

The "Soft Close" Technique

The key to closing the deal is to treat the agreement as a boring formality, not a major life event. Do not start reading the legal text out loud. That sounds like a robot. Instead, use this motivated seller script to summarize the document in plain English.

The Seller Negotiation Scripts

- The Transition: "Okay, [Seller Name], everything looks good to me. Let's get the paperwork out of the way so we can get this process started for you."

- The Summary (The Important Part): "This is just a standard purchase agreement. It covers the three main points we just discussed: It says I'm buying the property for [Price], we are closing on [Date], and I have [Number] days to verify the condition of the property. Simple as that."

- The Ask: "I'm going to autograph right here at the bottom. If you can just autograph right next to me, we are good to go."

Notice the language used here. We avoid scary words like "sign," "contract," or "legally binding." Instead, we use "paperwork," "agreement," and "autograph." These psychological tweaks lower the pressure and make negotiation scripts much more effective.

Mastering this "Soft Close" is often the difference between leaving with a signature and leaving with an excuse. Once you can deliver these lines naturally, you solve the hardest part of the puzzle. However, even with the perfect script, sellers will still have questions. To fully master how to get a house under contract for wholesaling, you must be prepared to handle the three specific objections that stop most deals dead in their tracks.

What If They Hesitate?

If you present the paper and they freeze or say, "I don't know, this seems fast," do not argue. Agree with them. This is called "pattern interruption."

Say this: "Totally understand. Take your time. Honestly, I’m looking at three other houses in this neighborhood today, but I liked you, and I wanted to give you priority. If you aren't ready, just let me know so I can move on to the next one."

This is the "Takeaway Method." By showing them you are willing to walk away, you regain all the leverage, and usually, they will sign right then and there because they don't want to lose the offer.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

Handling Seller Objections (The "What Ifs")

Even with the best rapport, sellers will have questions. Do not view these as rejections. An objection is usually just a sign that they are interested but need reassurance.

When you are overcoming objections, the goal is not to argue logic; it is to lower their anxiety. You must remain calm and answer as if you hear these questions every single day.

Here are the top three barriers to signing and exactly how to handle them.

| The Objection | The "Pro" Rebuttal |

|---|---|

| "I need to show this to my attorney first." | "I completely understand, and I encourage you to do whatever makes you comfortable. However, attorneys charge by the hour. Why don't we agree on the price and terms right now? That way, you aren't paying for an attorney review on a deal that we might not even agree on yet." |

| "Why is the deposit only $100?" | "Great question. In a traditional sale, you might see higher deposits because you are waiting months for a mortgage approval. Since I am buying the property 'as-is' and paying for 100% of the closing costs (saving you thousands), I keep the earnest money objection nominal. It’s standard for cash investors." |

| "What does 'and/or assigns' mean?" | "That is just a standard partner clause. I have several different LLCs and funding partners I work with. That language simply gives me the flexibility to close under the specific entity that is funding this particular deal. It doesn't change your price or the closing date at all." |

The "Attorney Approval" Hack to Save the Deal

If the seller is adamant about their lawyer seeing the contract, do not leave the house without a signature. If you leave, the excitement fades, and the deal usually dies.

Instead, use the "Subject To" close. Take a pen and handwrite this sentence in the "Additional Terms" section of your contract:

"This agreement is subject to the approval of Seller's attorney within 48 hours."

Then say: "Tell you what, let's sign this now so I can lock in this price for you. I'll add a clause that says your lawyer has 48 hours to approve it. If they don't like it, we tear it up. Fair?"

This works 90% of the time because it removes the risk. You walk out with a signed contract, and usually, the attorney just suggests a minor change rather than killing the deal.

Important Legal Updates (2026 Watchlist)

Wholesaling is legal in all 50 states, but the rules are changing. In 2024 and 2026, several states introduced specific regulations to crack down on "predatory" practices.

If you are operating in these markets, you cannot just use a generic contract downloaded from the internet. You must be aware of these specific statutes to stay compliant and keep your deal alive.

- Pennsylvania (Act 52): Effective January 2026, wholesalers in PA are required to obtain a real estate license to market equitable interest publicly. Additionally, contracts now require a mandatory 30-day cancellation right for sellers. If you are wholesaling in Philly or Pittsburgh, you must consult a local attorney to update your cancellation clauses.

- Oklahoma (The Predatory Real Estate Wholesaler Prohibition Act): As of November 1, 2025, Oklahoma has banned the practice of "clouding title" (filing an affidavit of equitable interest) to block a seller from selling to someone else. They also require specific wholesale disclosures in bold type at the top of your agreement.

- South Carolina: South Carolina now requires a specific wholesaling license for anyone marketing a contract. Operating without one is a misdemeanor. The workaround? Double closing (buying the property yourself) usually exempts you from this, as you are selling the property, not the contract.

- Illinois (The "1-Deal" Rule): Illinois continues to enforce its strict limit: You can only wholesale one property per 12-month period without a broker's license. If you plan to do volume in Chicago, you need to get licensed or double-close your deals.

These laws don't ban wholesaling; they ban secret wholesaling. The safest play in 2026? Always include a bold disclosure in your contract that states: "Buyer is a real estate investor and intends to assign this contract for a profit." Transparency is your best legal defense.

Frequently Asked Questions (FAQ)

You likely still have a few specific questions about the logistics. The good news is that while the paperwork seems intimidating, the rules are actually quite straightforward once you understand the basics.

Here are the answers to the most common questions we get from students regarding contracts, licensing, and deposits.

Do I need a license to get a house under contract?

No, you do not need a real estate license to sign a purchase agreement. Anyone can sign a contract to buy a home. However, you must be careful when marketing that contract. In most states, you are legally allowed to market your "equitable interest" in the property, but you cannot market the property itself (e.g., posting photos on the MLS) without a license. Always check your specific state laws.

Can I back out of a wholesale contract?

Yes, but only if you have included the proper contingencies. If your agreement includes an inspection contingency, you have the legal right to cancel the deal within the inspection period (usually 10-14 days) for any reason. If you do not have this clause and you try to back out, the seller could technically sue you for specific performance or keep your deposit.

Does a wholesale real estate contract need to be notarized?

In most states, no. A Purchase and Sale Agreement does not typically require a notary to be legally binding; it just requires the signatures of all buyers and sellers. However, if you are recording a "Memorandum of Contract" or an "Affidavit of Equitable Interest" to protect your deal on public records, that specific document will need to be notarized.

Who pays the closing costs in a wholesale deal?

In a standard wholesale transaction, the investor (you) usually agrees to pay 100% of the seller's closing costs. This is a major selling point. You tell the seller, "I will pay all title fees and transfer taxes, so the price we agree on is the net amount you walk away with." Ultimately, your cash buyer will cover these costs at closing.

How much should my Earnest Money Deposit be?

For off-market wholesale deals, the standard deposit amount is between $10 and $100. Unlike traditional retail sales, where 1-3% is common, distressed sellers are usually more concerned with the speed and convenience of the sale than the deposit size. As long as legal consideration (money) changes hands, the contract is valid.

Can I get a house under contract virtually (without seeing it)?

Yes. "Virtual Wholesaling" is becoming the standard. You can send contracts via DocuSign and use your inspection period to send a local contractor or photographer to the property later. Just ensure your contract has an "Access Clause" that allows you to grant access to third-party inspectors so you don't have to be there physically.

What happens if I get a house under contract and can't find a buyer?

If you cannot find a cash buyer before your inspection period expires, you have two options. First, you can renegotiate the price with the seller to make the deal more attractive. Second, you can exercise your inspection contingency to cancel the agreement and walk away. This is why the inspection clause is critical—it ensures you are never forced to buy a bad deal.

Final Thoughts: The Contract Is Your Inventory

Real estate wholesaling often feels complicated, but it boils down to one simple truth: You are not in the business of buying houses. You are in the business of generating contracts.

That piece of paper is your inventory. Without it, you have nothing to sell. With it, you control a valuable asset that can pay you $10,000, $20,000, or more—all without using your own cash or credit.

You now have the complete blueprint on how to get a house under contract for wholesaling. You understand that "equitable interest" gives you control without ownership. You have the three "safety net" clauses—Inspection, Assignment, and Closing Date—that make the process virtually risk-free. And you have the exact kitchen table scripts to get the seller to say "yes."

The only thing left to do is take action. Do not let the fear of the paperwork stop you. Print out a standard agreement, practice the soft close script in the mirror, and go make an offer.

If you want to see exactly how we find these motivated sellers and negotiate these deals live, check out our brand new FREE training. We break down the entire wholesaling system from start to finish so you can close your first deal in the next 30 days.

I’ll see you on the inside.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.