How To Flip Houses In New Jersey: 15-Step Home Renovation Guide

Oct 22, 2025

What: Flipping houses means buying a property—often at a discount or in need of repair—rehabbing or renovating it to increase its value, and then reselling it for profit. The article outlines how that process applies in New Jersey.

Why: Because in New Jersey the housing market can offer lucrative opportunities: high demand in key suburban and commuter markets, potential for value-add through renovation, and good resale potential when executed properly.

How: Follow the step-by-step plan provided: research your New Jersey market, build a local team, secure financing, locate and analyze properties, purchase at the right price, manage renovations efficiently, and list and sell for maximum return.

When it comes to real estate investing, flipping houses is a fantastic way to generate income. As the American population grows, the demand for housing will continue its upward trend.

Families, individuals, and young couples across every state have continued to move into houses in cities and suburban areas at a rapid pace.

Flipping houses is a fantastic way to tap into that trend and profit handsomely. In this article, we'll discuss how to flip houses in New Jersey.

- What Is Flipping Houses?

- Why Flip Houses In New Jersey?

- New Jersey House Flipping Statistics

- How To Flip Houses In New Jersey In 15 Steps

- How Much Do House Flippers Make In New Jersey?

- Is House Flipping Illegal In New Jersey?

- Do You Need A License To Flip Houses In NJ?

- How Much Does It Cost To Flip A House In New Jersey?

- How Much Money Do I Need To Flip My First House?

- How To Flip Houses In New Jersey With No Money

- What's The Best Place To Flip Houses In New Jersey?

- Is It Hard To Flip Houses In New Jersey?

- How Do You Find Contractors For Flipping Houses In New Jersey?

- Final Thoughts On Flipping Homes In New Jersey

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses is the act of buying a home, generally at a discount to market value, renovating its interior and/or improving its exterior, and then relisting the house for a profit. There are many ways to invest in the real estate market.

You could flip a single-family residence, a short-term rental, or even a multi-family property. There is no shortage of opportunities across America—and specifically New Jersey—to buy, renovate, and resale houses.

Why Flip Houses in New Jersey?

New Jersey offers a dynamic real estate market with diverse opportunities for house flippers. The state’s proximity to major metropolitan areas like New York City and Philadelphia drives demand for housing, making it an attractive location for real estate investors. The median home value in New Jersey is around $548,338, reflecting a steady increase in property values over recent years. This upward trend, combined with the state's high population density, provides a robust market for house flippers looking to capitalize on rising home prices. In fact, New Jersey currently has 24,124 properties in foreclosure, 278 bank-owned properties, and 2,020 headed for auction—presenting ample opportunities to acquire distressed homes at a discount. Based also from ATTOM Data Solutions', latest Home Flipping Report Nationwide, the gross profits on typical home flips in 2024 increased to $72,000, translating into a 29.6 percent return on investment, further highlighting the profitability of flipping houses in today’s market.

Another compelling reason to flip houses in New Jersey is the state's strong economy and job market, which have been pivotal in sustaining property demand. With an unemployment rate consistently below the national average and sectors like finance, healthcare, and technology thriving, New Jersey’s workforce continues to grow, fueling the need for quality housing. Areas such as Jersey City, Newark, and Hoboken are particularly appealing due to their rapid urban development and accessibility to major employment hubs. For flippers, these cities offer a mix of older properties ripe for renovation and a buyer market eager for updated homes.

Additionally, New Jersey's relatively favorable tax policies for real estate investors can enhance profitability. The state's real estate market is supported by various programs and incentives that encourage redevelopment and revitalization of older neighborhoods, which can significantly reduce renovation costs. Combined with the strong appreciation rates in many parts of the state, New Jersey is an ideal location for investors aiming to maximize their returns through house flipping.

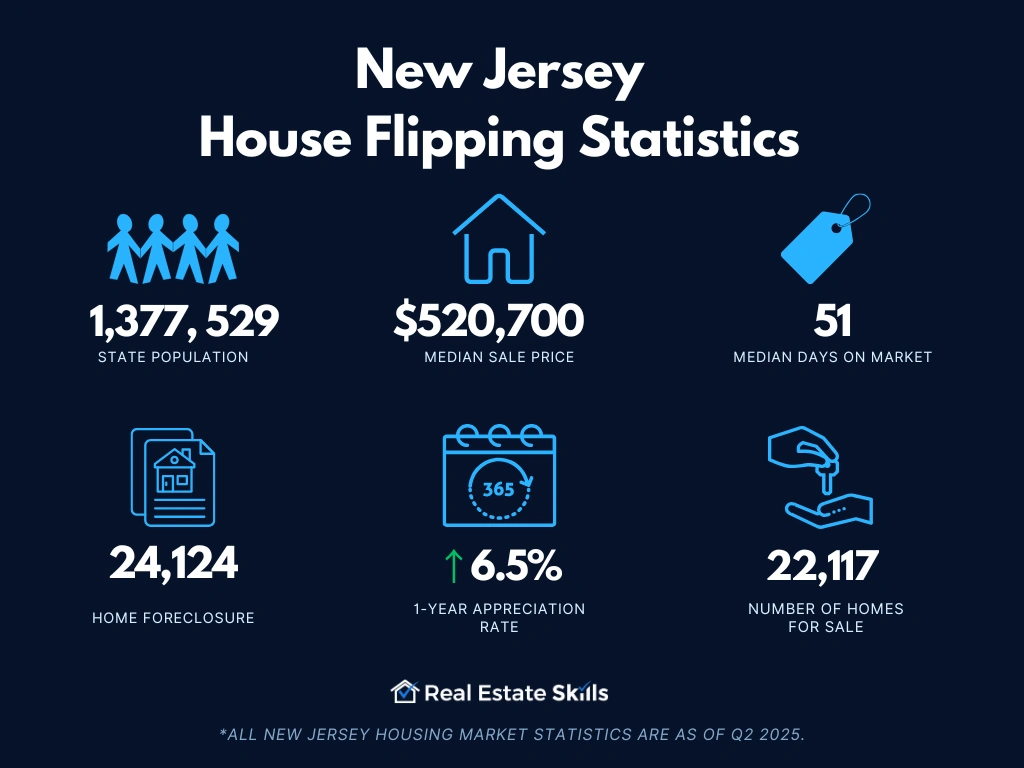

New Jersey House Flipping Statistics

According to the 2021 New Jersey census, there are 3,780,004 housing units across the state, and of those units, 63.8% are owner-occupied. Meaning that there are a large number of individuals in New Jersey who desire to own, instead of rent, their own homes. Because there is such a large demand for housing in the Garden State, these home buyers are generally willing to pay top dollar for themselves and their families - netting large cash flow for the fix and flip investor.

According to ATTOM, a leading curator of real estate data, over the past year, flipping activity has only increased across the nation. However, while the rest of the nation saw a slight decrease in profits, New Jersey saw an increase. A testament to the strength of the market.

In 2020, over 1,600 houses were flipped. Of those flip projects, the average revenue house flippers generated was over $120,000 per house. Though those numbers might have been a one-time Covid fluke due to the rapid rise in housing prices, expect an increase in house flipping as the industry expands.

Accordingly, anyone learning how to flip houses in New Jersey should prioritize recent and dependable housing indicators, not unlike those listed below (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 1,377, 529

- Employment Rate: 64.7%

- Median Household Income: $96,838

- Median Sale Price: $520,700 (+9.2% Year-Over-Year)

- Number Of Homes Sold: 4,951 (-4.5%Year-Over-Year)

- Median Days On Market: 51 (+5 Year-Over-Year)

- Number Of Homes For Sale: 22,117 (-0.47% Year-Over-Year)

- Number Of Newly Listed Homes: 7,312 (-8.2% Year-Over-Year)

- Months Of Supply: 3 (+0 Year-Over-Year)

- Homes Sold Above List Price: 44.8% (-1.9 Points Year-Over-Year)

- Homes With Price Drops: 14.2% (+2.0 Points Year-Over-Year)

- Foreclosure: 24,124

*All New Jersey housing market statistics are as of Q2 2025

Mastering the art of flipping houses in New Jersey requires a solid understanding of the local market, from property values to neighborhood dynamics. By immersing yourself in Flipping Houses 101 principles, you'll gain the essential knowledge to navigate New Jersey’s unique real estate landscape. Armed with this expertise, you can develop effective strategies tailored to the state’s diverse regions, ensuring you make informed decisions that lead to successful and profitable flips.

How To Flip Houses In New Jersey In 15 Steps

To maximize profits when flipping houses in New Jersey, it's crucial to understand local market trends and carefully plan renovations. Acquiring properties at below-market prices, budgeting accurately for renovations, and choosing desirable neighborhoods can significantly impact the net profit from each flip. To increase the likelihood of a profitable house flip, follow these 15 steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Choosing the right market is a critical first step when flipping houses in New Jersey. The state offers a diverse range of real estate markets, from urban areas near New York City to more suburban and rural locations. To maximize your chances of success, you should carefully analyze market trends, including property values, demand for housing, and local economic conditions. For example, areas with strong job growth, good schools, and upcoming development projects are likely to see increased demand, making them ideal for house flipping.

In New Jersey, popular markets for house flipping often include cities like Newark, Jersey City, and Paterson, where revitalization efforts and proximity to New York City contribute to strong buyer interest. However, don't overlook smaller towns and suburban areas, which may offer more affordable properties with potential for significant appreciation. Researching market dynamics, such as recent home sales, price per square foot, and the average time properties spend on the market, can help you identify the most promising areas to invest in.

Additionally, it's important to consider the level of competition in your chosen market. High-demand areas can be more competitive, requiring quicker decision-making and potentially higher upfront costs. On the other hand, emerging markets or neighborhoods that are just beginning to experience growth may offer better deals and less competition. By thoroughly researching and picking the right market in New Jersey, you'll set the foundation for a successful house-flipping project.

Find Your Money

Securing financing is a crucial step in the house-flipping process in New Jersey. Before you dive into a renovation project, you need to determine how you will fund the purchase and renovation of the property. This typically involves evaluating various financing options, including traditional mortgages, private loans, and hard money loans. Each option comes with its own set of advantages and considerations, so it’s important to choose one that aligns with your financial situation and project goals.

Traditional mortgages may offer lower interest rates but can be more difficult to obtain for investment properties. On the other hand, private lenders and hard money lenders provide more flexibility and faster approval processes, which can be beneficial for house flipping. It’s essential to understand the terms and conditions of each financing option and how they will impact your overall profitability. By carefully evaluating your options and securing the right funding, you’ll be better positioned to successfully flip houses in New Jersey.

How To Find Private & Hard Money Lenders

Finding the right private or hard money lender is key to financing your house-flipping project effectively. Private lenders are individuals or small groups who provide loans based on the property’s value rather than your creditworthiness. To find a private lender, network within real estate investment groups, attend local real estate events, and leverage platforms like LinkedIn. Building relationships with private lenders can provide you with more flexible terms and potentially lower costs.

Hard money lenders, on the other hand, are specialized financial institutions or companies that offer short-term loans secured by real estate. These lenders are particularly useful for house flippers due to their quick approval times and ability to finance properties that might not qualify for traditional loans. Platforms such as Kiavi and Lima One offer lists of local and national hard money lenders, providing you with a range of options to find the best fit for your needs. These lenders are experienced in working with real estate investors and can offer tailored solutions for your flipping projects.

Securing the right type of financing is essential for a successful house flip. Whether you opt for private lenders or hard money loans, ensure you fully understand the terms and conditions to optimize your investment and maximize your returns.

Find Three Contractors

Finding reliable contractors is crucial for the success of your house-flipping project in New Jersey. A well-chosen contractor can make a significant difference in the quality of your renovation and the timeliness of your project. To ensure you get the best results, it's advisable to vet at least three contractors before making your selection. This allows you to compare their bids, assess their experience, and evaluate their past work. Start by seeking recommendations from local real estate investors, checking online reviews, and looking at portfolios of previous projects.

When evaluating contractors, consider their expertise in the specific type of renovation work you need, whether it's plumbing, electrical work, or general remodeling. Ensure they have the necessary licenses and insurance to protect you from potential liabilities. By obtaining detailed quotes and understanding each contractor’s proposed timeline, you can make an informed decision that aligns with your project budget and schedule. This thorough approach will help you select contractors who are capable and reliable, setting the stage for a successful flip.

How To Find A General Contractor

Finding a skilled general contractor is a pivotal step in the house-flipping process. Start by utilizing reputable online platforms such as HomeAdvisor, Thumbtack, and Angi, which offer directories of general contractors along with customer reviews and ratings. These platforms can help you identify local professionals with experience in house renovations and flipping projects. Additionally, you can reach out to real estate investment groups or attend local real estate networking events to get personal recommendations from other investors.

Once you have a list of potential general contractors, schedule interviews to discuss your project in detail. Evaluate their experience, ask for references, and review their past work to gauge their capability and reliability. A good general contractor will provide a clear, detailed estimate and be transparent about their process and timelines. By carefully selecting a general contractor who meets your standards and aligns with your project needs, you’ll set the foundation for a successful renovation and a profitable house flip.

Find An Investor-Friendly Agent

Finding an investor-friendly real estate agent is essential for a successful house-flipping project in New Jersey. An agent with experience in working with real estate investors will understand your specific needs, including finding undervalued properties and navigating the nuances of the local market. They can provide valuable insights into the best neighborhoods for flipping, help you negotiate better purchase prices, and offer guidance on market trends and property values. Their expertise can also streamline the buying and selling process, making your overall project more efficient.

Look for agents who have a proven track record of working with investors, as they are more likely to offer the type of support and resources that can enhance your flipping success. An investor-friendly agent will not only assist in property acquisition but also help you with pricing strategies and market analysis to ensure you maximize your profit. They can also connect you with other professionals in the industry, such as contractors and lenders, which can further facilitate your flipping venture.

How To Find An Investor-Friendly Agent

To find an investor-friendly real estate agent, start by conducting research in your target area. Use platforms like Zillow and Realtor.com to identify agents with high ratings and reviews, focusing on those who highlight experience with investment properties. Additionally, seek recommendations from local real estate investment groups or networks where you can get referrals from other successful investors.

Once you have a list of potential agents, arrange meetings to discuss your flipping goals and assess their familiarity with the local market. Ask about their past experience with investor clients, their approach to finding profitable properties, and their knowledge of renovation costs and market trends. An effective investor-friendly agent will demonstrate a deep understanding of the real estate market and provide valuable advice tailored to your flipping needs. By selecting the right agent, you'll gain a partner who can significantly contribute to the success of your house-flipping endeavors in New Jersey.

Find A House To Flip

Finding the right property to flip is a crucial step in the house-flipping process in New Jersey. Several strategies can help you identify potential investment properties. One effective method is "driving for dollars," where you drive through neighborhoods looking for distressed properties or those with signs of neglect. This hands-on approach allows you to spot potential flips that may not be listed on the market. Additionally, direct mail campaigns can target homeowners who might be considering selling their property. By sending postcards or letters offering to purchase their homes, you can generate leads on potential flips before they hit the MLS.

The Multiple Listing Service (MLS) is another valuable tool for finding properties to flip. The MLS provides comprehensive listings of homes for sale, including details on price, condition, and time on the market. Working with a real estate agent who has access to the MLS can help you find properties that meet your investment criteria and are potentially undervalued. By utilizing these methods, you can increase your chances of finding a suitable house to flip and ensure a successful project.

Alternative Strategies to Find a House

When exploring alternative strategies to find a house to flip, consider focusing on the MLS with specific approaches.

-

The Day Zero Strategy involves targeting newly listed properties that have just come on the market. These homes might be priced lower to attract quick offers, giving you a chance to secure a deal before other investors.

-

The Old Listing Strategy targets properties that have been on the market for an extended period. These listings may have become stale, leading sellers to be more open to lower offers, making them potential candidates for flipping.

-

The Wholesaler Strategy involves connecting with real estate wholesalers who specialize in finding distressed properties and then selling them to investors. Wholesalers often have a network of property leads that can provide you with off-market opportunities.

By employing these alternative strategies, you can enhance your ability to find profitable houses to flip in New Jersey. Each method offers unique advantages and can be tailored to fit your specific investment goals. Exploring multiple approaches will increase your chances of discovering the ideal property for your flipping project.

That said, some investors might not have access to the MLS for various reasons. Fortunately, these strategies can be applied to alternative listing platforms like RedFin, Zillow, and Realtor.com when flipping houses in New Jersey. Adapting the Day Zero, Old Listing, and Wholesaler strategies to these websites can still help you find promising properties. However, it’s important to remember that the MLS often provides more comprehensive data and contact information, making it the preferred resource for many investors.

Make Discovery Calls To Listing Agents

Making discovery calls to listing agents is a crucial step in evaluating potential properties for flipping in New Jersey. These calls help you gather essential information that can influence your decision to pursue a property further. By asking the right questions, you ensure that you're targeting properties that align with your investment goals and avoid wasting time on unsuitable options. Here are some key questions to ask during these calls:

-

Is the listing still active? It's important to confirm with the listing agent whether the property is still available. Ensuring that the listing is not already under contract helps you avoid pursuing deals that are no longer accessible. This step helps you focus on properties that are viable opportunities for investment.

-

Are the listing’s photos up to date? Inquire whether the photos provided in the listing are current. Up-to-date images give you a clear understanding of the property's condition and allow you to better assess the extent of repairs and renovations required. Accurate visuals are crucial for estimating costs and potential profits.

-

What is the current condition of the home? Ask the agent about the present condition of the property. This question helps determine if the home is distressed and suitable for flipping. It also uncovers any hidden issues that might not be evident from photos alone, aiding in a more precise evaluation of repair costs and challenges.

-

Are you willing to work with an investor? It's essential to find out if the listing agent is open to working with investors. This transparency sets clear expectations and can also lead to a beneficial working relationship. If you don’t have your own agent, this could be an opportunity to engage the listing agent for both sides of the transaction, potentially enhancing your deal-making process.

-

What is the owner’s reason for selling? Understanding the seller’s motivation can provide insight into their urgency or flexibility in negotiations. Although agents may not always divulge this information, any details about the seller’s situation can help you craft a more attractive offer and strengthen your negotiating position.

-

Is there a lot of competition for the property? Asking about the level of interest or competition can inform your bidding strategy. Knowing if there are multiple offers or significant interest allows you to adjust your approach, helping you avoid overpaying or missing out on a potentially lucrative deal.

By making these discovery calls, you'll be better equipped to identify and evaluate properties that fit your house-flipping criteria, ultimately leading to more successful investments in New Jersey.

Analyze The Property

Analyzing the property is a crucial step in the house-flipping process in New Jersey. This involves assessing key financial metrics to determine the viability of an investment. The three main elements to focus on are the after-repair value (ARV), repair costs, and the purchase price. These factors collectively help evaluate whether a property is a profitable investment opportunity.

After-Repair Value

Calculating the ARV is essential for understanding a property's potential market value after renovations are completed. The ARV represents the estimated value of the property once all repairs and upgrades are made. When calculating the ARV, start by finding comparable properties, or "comps," which are recently sold homes similar to the one you're considering. For accurate comparisons in New Jersey, select properties that are:

- In the same neighborhood

- With similar bed and bath counts

- Within 20% of the property's square footage

- Sold within the last six months

- Recently renovated

Average the sale prices of these comps to derive a realistic ARV for your property. This estimate helps you gauge the potential resale value and guides your investment strategy.

Repair Costs

Estimating repair costs involves a detailed property inspection and consultations with contractors. Create a comprehensive list of required repairs and renovations, then obtain multiple contractor quotes to get an accurate estimate of labor and material costs. It's also wise to set aside a contingency budget, typically around 10-15% of the total repair costs, to cover unexpected expenses. Thorough planning and professional advice are key to ensuring your repair budget is realistic and aligns with your investment goals.

Purchase Price

To determine a suitable purchase price, you need to integrate the ARV and repair costs into a formula for calculating your maximum allowable offer (MAO). This formula accounts for several factors:

- ARV: The estimated post-repair value of the property.

- Hard Money Loan Costs: Include interest rates, origination fees, points, and the loan duration.

- Private Money Loan Costs: Consider interest and project duration.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price, plus ongoing expenses like insurance and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Typically around 6% of the purchase price, but potentially negotiable.

- Projected Profit: Factor in your desired profit margin based on current market returns.

Subtract all these costs from the ARV to determine your MAO. This figure represents the maximum price you should pay for the property to ensure a profitable flip. By carefully analyzing these elements, you can make informed decisions and optimize your house-flipping strategy in New Jersey.

Call Agents & Submit Written Offers

The next step in flipping houses in New Jersey involves reaching out to the listing agent to communicate your intention to submit a written offer. Ensure your offer is in line with the maximum allowable offer (MAO) you calculated previously. By submitting a well-prepared written offer, you present yourself as a serious buyer and take a significant step toward securing the property.

Engage with either the listing agent or an investor-friendly agent who is familiar with your requirements. Having an agent handle the submission of your offer adds a level of professionalism and ensures that all necessary documentation and procedures are correctly followed. In New Jersey, you will typically use the New Jersey Association of Realtors' standard Purchase and Sale Agreement.

When preparing your offer, include the following essential details:

- Purchaser Name: Specify whether the purchaser is an individual or an LLC. If using an LLC, include the articles of incorporation to verify you are authorized to sign on behalf of the company.

- Offer Price: State the offer price based on your MAO calculations.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit, usually between 1% and 5% of the purchase price, to demonstrate your commitment. This deposit is generally refundable, but ensure a contingency is included to protect your interests.

- Contingencies: Include a standard inspection contingency, typically seven days, allowing you to inspect the property and back out if necessary without losing your deposit.

- Closing Timeline: Propose a closing date, ideally 14 days or sooner, to streamline the process. Cash offers often close faster than those involving traditional financing.

- Title Requirements: Request that the seller provides a free and clear title to avoid issues such as liens or additional mortgages.

- Agent Information: Include the name of the agent representing you to clarify who is handling the transaction.

- Proof of Funds: Attach proof of funds from your lender to validate your ability to close the deal, enhancing the credibility of your offer.

Calling agents and submitting written offers is a critical step in flipping houses in New Jersey. By ensuring your offer is well-structured and professionally presented, you improve your chances of securing a favorable deal. This process is essential for mastering the art of house flipping and achieving success in the New Jersey real estate market.

Perform Due Diligence When The Offer Is Accepted

Once your offer has been accepted, performing due diligence is a crucial step in the house-flipping process in New Jersey. This phase involves thoroughly investigating the property to ensure that there are no hidden issues or complications that could affect your investment. Conduct a comprehensive inspection of the property to identify any structural problems, safety concerns, or needed repairs. Hiring a professional inspector can provide an expert assessment and uncover potential issues that might not be immediately apparent.

Additionally, verify the property’s legal standing by examining public records for any liens, disputes, or other encumbrances that could impact the transaction. Ensure that the title is clear and free from any legal complications that might complicate the sale or affect your ownership. Reviewing these details carefully helps to mitigate risks and confirms that the property meets your investment criteria before proceeding with the purchase. This step is essential for securing a successful flip and maximizing your investment potential in the competitive New Jersey real estate market.

Close On The Deal

Closing the deal is the final and critical step in the house-flipping process in New Jersey. Once all the due diligence is complete and you are satisfied with the property's condition and legal status, you move forward with the closing process. This involves finalizing the purchase agreement and transferring ownership of the property from the seller to you. Coordinate with your real estate attorney, title company, and lender to ensure all necessary documents and funds are in place for a smooth closing.

During closing, you will review and sign several documents, including the settlement statement, which details all the financial aspects of the transaction. You’ll also provide the remaining funds for the purchase, which usually includes the balance of the purchase price, any closing costs, and additional fees. The title company will then record the deed with the county, officially transferring ownership to you. After closing, you’ll receive the keys to the property and can begin your renovation and flipping process.

Successfully closing on the deal is crucial for progressing to the renovation phase of your house flip. Ensuring that all aspects of the closing are handled accurately and promptly will set the stage for a successful flip and help you move forward with confidence in the New Jersey real estate market.

Renovate The House

Renovating the house is a pivotal step in flipping homes in New Jersey. This process involves transforming the property to align with your projected after-repair value (ARV) and ensuring it meets or slightly exceeds the standard set by comparable properties in the area. The goal is to enhance the property’s appeal while avoiding over-renovation, which can strain your budget and erode profit margins. By strategically targeting updates that offer the best return on investment, such as kitchen and bathroom remodels, flooring upgrades, and fresh paint, you can increase the property's market value and attract potential buyers.

Before you begin the renovation work, it’s crucial to establish clear and protective documentation to safeguard your project. Essential documents include:

- Independent Contractor Agreement: This legally binding document outlines the terms and conditions of your agreement with the contractor, including payment terms, project timelines, and specific responsibilities. It ensures that both parties have a clear understanding of their obligations and helps prevent disputes during the renovation.

- Final Scope of Work: This document details all tasks, materials, and timelines for the renovation. It serves as a comprehensive guide for the contractor, ensuring that the project stays on schedule and within budget while meeting the quality standards you expect.

- Payment Schedule: This outlines the payment amounts and timing linked to specific milestones in the renovation process. It helps manage the contractor’s progress and ensures that payments are made as work is completed, promoting accountability and timely completion.

- Insurance Indemnification Agreement: This agreement verifies that the contractor has adequate insurance coverage and agrees to hold you harmless for any accidents or damages occurring on the property. It protects you from liability and potential financial losses during the renovation.

- W-9: This tax form collects the contractor’s taxpayer identification information, which is necessary for IRS reporting and issuing a 1099 form for payments made throughout the year. It ensures compliance with tax regulations.

- Final Lien Waiver: This document is signed by the contractor to confirm that they have been paid in full and relinquish any future claims against the property. It protects you from additional financial demands after the renovation is complete.

With these documents in place, you can proceed with confidence, knowing your renovation project is protected and poised to enhance the property's value effectively.

Prep & List The House On The MLS

Once the renovations are complete, the next crucial step in flipping houses in New Jersey is preparing and listing the property on the Multiple Listing Service (MLS). This process involves ensuring the house is in pristine condition, showcasing its best features, and creating an appealing listing that will attract potential buyers. To achieve this, focus on three key tasks: final punch list, home staging, and professional photos.

-

Final Punchlist: Before listing the house, complete a final punchlist to address any remaining details or minor issues. This list should include tasks like fixing small cosmetic flaws, touching up paint, and ensuring that all repairs are completed to a high standard. This final inspection helps ensure that the property is in perfect condition, making it more appealing to buyers and avoiding potential objections during showings.

-

Home Staging: Staging the home is an essential step in presenting the property in the best possible light. This involves arranging furniture and decor to highlight the home's strengths and create an inviting atmosphere. Effective staging can help buyers visualize themselves living in the space and make the home more appealing compared to similar properties on the market. Consider hiring a professional stager if needed, as they can provide valuable expertise in creating a look that resonates with potential buyers.

-

Professional Photos: High-quality, professional photos are critical for making a strong first impression in the competitive New Jersey real estate market. Invest in a professional photographer to capture the property's best angles and features, including both interior and exterior shots. Good photography can significantly impact the attractiveness of your listing and help it stand out online.

Set An Enticing Asking Price

Setting an enticing asking price is a vital component of a successful home sale. An effective price strategy balances competitiveness with profitability. Start by analyzing recent sales data for comparable properties in the area to establish a competitive price range. Consider the property’s ARV, the current market conditions, and the overall quality of your renovation work.

Pricing too high can deter potential buyers, while pricing too low might not maximize your return. Aim for a price that reflects the value of the home, accounts for your investment in renovations, and aligns with the current market trends. By setting a well-researched and attractive asking price, you increase your chances of a quicker sale and a more favorable return on your investment.

Field Offers & Negotiate

Once your property is listed on the MLS, you’ll start receiving offers from potential buyers. The process of fielding and negotiating these offers is a critical step in flipping houses in New Jersey. It involves reviewing each offer carefully, understanding the terms, and negotiating to achieve the best possible outcome for your investment.

Begin by evaluating each offer based on several key factors, including the offered price, the buyer’s financing situation, and any contingencies. An offer with a higher price might be attractive, but it’s essential to consider how solid the buyer’s financing is and any conditions they may have attached, such as home inspection or appraisal contingencies. Strong offers typically come from buyers who have been pre-approved for a mortgage or are making a cash offer, which can make the transaction smoother and less likely to fall through.

Once you have a good understanding of the offers, engage in negotiations to refine terms and maximize your profit. This might involve counteroffers to adjust the price or alter the terms to better suit your needs. Effective negotiation requires balancing the urgency of closing the deal with obtaining the best terms. Communicate clearly and promptly with potential buyers, and be prepared to make strategic concessions if it means securing a favorable deal. Skilled negotiation can significantly impact your final sale price and ensure a successful flip.

Accept The Best Offer

After navigating through offers and engaging in negotiations, the final step is to accept the best offer. This decision is pivotal as it directly affects your return on investment and the overall success of your flip. To ensure you choose the best offer, evaluate it against your initial goals and criteria.

Begin by considering the offer price and how it aligns with your projected after-repair value (ARV) and desired profit margins. A higher offer might be appealing, but it's also crucial to assess the buyer's ability to close the deal. Offers from well-qualified buyers, such as those with pre-approved financing or cash offers, generally present a lower risk of falling through. Additionally, review any contingencies attached to the offer, such as home inspections or appraisal conditions, as these can impact the sale timeline and potential for unexpected issues.

Once you've selected the offer that best meets your criteria, work closely with your real estate agent to finalize the details. This includes signing the purchase agreement, coordinating with legal and financial advisors, and preparing for the closing process. Accepting the best offer not only maximizes your profitability but also ensures a smoother transaction, leading to a successful flip and a satisfying return on your investment.

Sell The House & Get Paid

The final step in flipping houses in New Jersey is to sell the house and secure your payment. This stage marks the culmination of your hard work and investment, making it essential to handle it with precision to ensure a smooth transaction.

Once the sale is finalized, your real estate agent will coordinate the closing process, where all necessary paperwork is completed, and the financial transactions are processed. At closing, you'll review and sign the final documents, including the deed transfer, closing disclosure, and settlement statement. Ensure all conditions of the sale are met and that any outstanding issues are resolved before this step.

After the closing, the proceeds from the sale will be disbursed according to the terms of the sale agreement. This typically involves paying off any remaining loans or liens on the property, covering closing costs, and receiving the remaining profit. Once you’ve received your payment, take the time to review the financial results of the flip to evaluate your overall return on investment. Selling the house and getting paid is not just about completing the transaction but also reflecting on the profitability and success of your flipping venture.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In New Jersey?

In recent years, house flippers in New Jersey have seen impressive returns, with the average gross flipping profit reaching approximately $88,000 in 2024, according to ATTOM Data Solutions. However, this figure can vary significantly depending on several factors, including location, the scope of renovations, and the current market conditions. While some flippers might see lower profits, others who strategically choose their properties and manage costs effectively can achieve much higher returns.

New Jersey offers some of the most lucrative markets for house flippers, ranking among the top states for gross flipping profits. Notably, the state boasts three of the top five cities in the nation with the largest gross flipping profits on median-priced transactions (according to the previously mentioned Home Flipping Report by ATTOM Data Solutions):

- Jersey City, NJ: $120,000 average gross flipping profit

- Newark, NJ: $110,000 average gross flipping profit

- Paterson, NJ: $105,000 average gross flipping profit

These cities are particularly attractive for flippers due to their proximity to major metropolitan areas, high demand for renovated homes, and ongoing urban revitalization efforts. This combination of factors makes New Jersey a prime location for investors aiming to maximize their profits in the house-flipping market.

To succeed in New Jersey’s competitive real estate market, flippers must stay informed about local trends, carefully select properties, and manage renovation budgets efficiently. By doing so, they can capitalize on the state's profitable opportunities and potentially exceed the average gross flipping profit.

Is House Flipping Illegal In New Jersey?

House flipping is not illegal in New Jersey, but it is subject to various regulations that investors must follow to ensure compliance with state laws. These regulations are primarily aimed at protecting consumers and maintaining the integrity of the real estate market. For example, New Jersey has strict disclosure requirements that mandate sellers to provide accurate information about the property's condition, including any defects or renovations made. Failure to comply with these disclosure laws can lead to legal penalties, so it's crucial for house flippers to be thorough and transparent in their transactions.

Additionally, New Jersey's anti-predatory lending laws and other consumer protection regulations are designed to prevent fraudulent or unethical practices in the real estate market. Investors should also be aware of zoning laws, permit requirements, and any local ordinances that may impact their projects. By understanding and adhering to these legal requirements, house flippers can operate successfully and avoid potential legal issues while capitalizing on New Jersey’s lucrative real estate opportunities.

Do You Need A License To Flip Houses In NJ?

No, you do not need a license to flip houses in New Jersey. However, it might be a good idea to get one.

If you plan on flipping a number of houses within the state, you’ll end up paying a pretty penny to your real estate agent when they market and sell the asset. To avoid these costs, consider getting a license and self-listing your flipped properties.

You’ll not only save money, but you’ll also get access to the MLS and other resources not readily available to other investors.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How Much Does It Cost To Flip A House In New Jersey?

Flipping a house in New Jersey involves several key expenses that can significantly impact your overall profitability. Understanding these costs is essential for creating an accurate budget and ensuring a successful flip. In this section, we'll break down the primary expenses associated with house flipping in New Jersey.

The Home Purchase Price

In New Jersey, the median home price as of 2024 is approximately $435,000, but prices can vary widely depending on the location. For example, properties in cities like Hoboken or Jersey City may command significantly higher prices, while more rural areas might offer more affordable options. Typically, you’ll need to make a down payment of 5-20% of the purchase price, with the remainder financed through a mortgage or hard money loan. Cash buyers can avoid financing costs but need substantial upfront capital.

The Home Repair Costs

Renovation costs in New Jersey can range from $20 to $60 per square foot, depending on the scope of work and the property’s condition. A standard three-bedroom, one-bathroom home may require anywhere from $30,000 to $70,000 for a complete rehab, which can include updates to kitchens, bathrooms, flooring, and roofing. Higher-end flips in desirable neighborhoods may involve more extensive renovations and, therefore, higher costs. To get the most accurate estimate, it’s advisable to consult multiple contractors before purchasing a property.

The Carrying Costs

Carrying costs in New Jersey typically include property taxes, insurance, utilities, and maintenance. Given New Jersey's relatively high property taxes, this can be a significant expense, ranging from 2% to 3% of the property's value annually. Insurance costs vary but are essential to protect your investment. Additionally, ongoing expenses like utilities and lawn care should be factored into your budget, especially if the property sits on the market for an extended period.

Closing, Marketing, & Sales Costs

Selling a flipped house in New Jersey involves closing costs, real estate agent commissions (typically 5-6% of the sale price), and marketing expenses. These costs can add up, often accounting for 8-10% of the final sale price. Legal fees, title transfer costs, and potential notary fees should also be considered when calculating your total expenses. Proper budgeting for these costs is crucial to ensure you maximize your profits when the property is sold.

Read Also: How To Flip Houses With No Money: Top 10 Expert Strategies

How Much Money Do I Need To Flip My First House?

The amount of money you need for a flip will largely depend on the size of the property, the scope of work it needs, and the intended exit strategy. As mentioned earlier, the MAO formula can help you determine how much you should pay for your pre-flipped house.

Then, once you work with your contractor and scope out the New Jersey market, you’ll get a better sense of how much money you should raise for your flip.

According to the New Jersey census, the median price for an owner-occupied housing unit is roughly $355,000. Though it’ll depend on the specific market you’d like to invest in, expect to purchase a home in the $200,000 to $275,000 range and spend at least $25,000 - $50,000 on your renovation. That way, you’ll give yourself some breathing room when you look to sell your house for approximately $350,000.

How To Flip A House In New Jersey With No Money?

Not everyone has the money to flip a house, especially in New Jersey, where housing prices can be pretty high. Rest assured, though, that shouldn’t deter you from raising capital and getting into the flipping business.

If you don’t have the cash to do the flip on your own, consider private money lenders, hard money lenders, wholesaling, and crowdfunding. Each of these strategies is unique and can help you secure the right financing for your project.

Read Also: How To Wholesale Real Estate In New Jersey: Step By Step

What's The Best Place To Flip Houses In New Jersey?

New Jersey offers several prime locations for house flipping, each with unique advantages based on property trends, population growth, and economic conditions. Here are five cities in New Jersey that are currently considered some of the best places to flip houses:

- Jersey City: Jersey City, with its proximity to New York City, has seen a steady increase in demand for housing. The city's population grew by 3.5% over the past year, and the median home value has risen by 7.8%, making it an attractive market for house flippers. The ongoing development and gentrification efforts in various neighborhoods add to its appeal, offering opportunities for significant appreciation.

- Newark: Newark, the largest city in New Jersey, is experiencing a revitalization, particularly in its downtown and Ironbound districts. The median home price in Newark has increased by 6.2% over the past year, driven by growing interest from investors and first-time homebuyers. The city's improving infrastructure and proximity to major highways make it a promising location for flipping houses.

- Paterson: Paterson is another city with strong potential for house flippers, thanks to its affordable property prices and steady population growth of 2.9% last year. The city is undergoing various redevelopment projects, particularly in its historic districts, which has contributed to a 5.4% increase in home values. These factors make Paterson an attractive option for investors looking to enter the New Jersey market.

- Trenton: Trenton, the state capital, offers a more budget-friendly entry point for house flippers. The median home value in Trenton has increased by 4.3% over the past year, and the city is benefiting from efforts to revitalize its downtown area. With ongoing economic development and an increasing population, Trenton presents a solid opportunity for those looking to flip houses in New Jersey.

- Camden: Camden is undergoing significant redevelopment and investment, particularly along its waterfront. The city has seen a 6.5% rise in median home values over the past year, fueled by new construction projects and improved safety measures. For investors looking for an emerging market with the potential for high returns, Camden is a location worth considering.

These cities represent some of the best opportunities for house flippers in New Jersey, offering a combination of rising property values, population growth, and economic development.

Is It Hard To Flip Houses In New Jersey?

Flipping houses in New Jersey can present challenges due to the state's competitive real estate market and relatively high property taxes. The demand for homes, especially in desirable areas near New York City, often drives up prices, making it harder to find undervalued properties. Additionally, New Jersey has some of the highest property taxes in the country, averaging around 2.2% of a home's assessed value, which can significantly impact your carrying costs during the flip.

However, despite these challenges, New Jersey offers substantial rewards for those who can navigate its market effectively. The state’s diverse cities, ongoing development projects, and strong demand for housing create opportunities for profitable flips. With the right strategy, including thorough market research and careful financial planning, house flipping in New Jersey can be a successful and lucrative venture.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In New Jersey?

Finding reliable contractors is crucial when flipping houses in New Jersey. With the state's competitive real estate market, working with skilled and dependable professionals can make or break your project. To ensure your renovation goes smoothly and stays on budget, it's important to thoroughly vet contractors and utilize trusted platforms to find them. Here are some of the best websites to find contractors in New Jersey:

- HomeAdvisor is a widely used platform where you can search for contractors based on your specific project needs. The site provides detailed reviews, cost estimates, and the ability to request quotes from multiple contractors in New Jersey. This allows you to compare options and select the best professional for your house-flipping project.

- Thumbtack connects you with local professionals in New Jersey who can handle everything from small repairs to full-scale renovations. The platform allows you to outline your project details and receive bids from contractors, making it easier to find someone who fits your budget and timeline.

- Angi, Formerly known as Angie’s List, Angi is a trusted platform where you can find top-rated contractors in New Jersey. The site offers a robust directory of service providers, complete with customer reviews, ratings, and cost guides. This makes it easier to find a contractor with a proven track record in the New Jersey market.

- While Craigslist is known for its classifieds, it's also a valuable resource for finding contractors in New Jersey. The site allows you to post your project and receive responses from local contractors, though it’s essential to thoroughly vet anyone you hire from this platform.

- Facebook Marketplace and local community groups can be excellent resources for finding contractors in New Jersey. By posting in community groups or browsing marketplace listings, you can find recommendations and connect with contractors who have experience in house flipping.

By leveraging these platforms, you can find experienced contractors in New Jersey who can help you complete your house-flipping project efficiently and effectively. Always check references, verify licenses, and review past work to ensure you’re hiring the right professional for the job.

Final Thoughts On Flipping Homes In New Jersey

Flipping houses is a great investment strategy to consider. New Jersey, specifically, has a lot to offer investors when it comes to attractively priced houses, engaging residents, and desirable neighborhoods. Be sure to do your research, engage in open dialogue with a mentor, and analyze every deal that comes across your desk. With the right preparation, before you know it, you’ll already know how to flip houses in New Jersey, generating thousands of dollars in income. Good luck!

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.