How To Flip Houses In Arkansas: 15-Step Home Renovation Guide

Oct 21, 2025

What: Flipping houses in Arkansas means buying undervalued or distressed properties, renovating them to boost their value, and selling for profit. It’s a proven strategy for generating income and building long-term wealth through real estate.

Why: Arkansas offers affordable property prices, steady population growth, and strong rental and resale demand—making it a great market for investors looking for profitable house flips with manageable competition.

How: Follow the steps in this guide—from researching Arkansas markets and securing financing to finding good deals, managing renovations, and selling for maximum return—to successfully flip houses in Arkansas and grow your investing portfolio.

Flipping houses in Arkansas is a great way for anyone to create wealth and earn impressive returns. With a population of just over 3 million and 1.4 million units of housing, there is ample opportunity to flip houses in Arkansas.

While you don't need formal education or a background in real estate to be a successful house flipper, you need to understand the basics and do thorough research to ensure you're well-equipped to handle the potential challenges. So, to help you prepare, here is the complete guide to flipping houses in Arkansas.

- What Is Flipping Houses?

- Why Flip Houses In Arkansas?

- Arkansas House Flipping Statistics

- How To Flip Houses In Arkansas In 15 Steps?

- How Much Do House Flippers Make In Arkansas?

- Is House Flipping Illegal In Arkansas?

- Do You Need A License To Flip Houses In Arkansas?

- How Much Does It Cost To Flip A House In Arkansas?

- How To Flip A House In Arkansas With No Money

- What's The Best Place To Flip Houses In Arkansas?

- Is It Hard To Flip Houses In Arkansas?

- How Do You Find Contractors For Flipping Houses In Arkansas?

- Final Thoughts On Flipping Houses In Arkansas

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Flipping houses is a real estate investing strategy that involves purchasing a home for less than market value, putting money into renovating it, and selling the property for a higher value. House flippers typically buy homes from motivated sellers who are likely facing foreclosure and need to sell quickly.

They will analyze the market, determine what features and upgrades are necessary to command a higher cost, and then finance and oversee the construction.

When the work is complete, they will sell the home to another buyer and collect the difference between the final purchase price and the amount they put into the property.

While property flipping has grown tremendously in popularity with the countless house-flipping shows on mainstream television, there’s much more to profitably investing in real estate. Before flipping your first house, research the business model in depth, including local market statistics.

Why Flip Houses In Arkansas?

Flipping houses in Arkansas presents a compelling opportunity for both new and experienced investors, thanks to the state's affordable housing market and potential for substantial returns.

Despite concerns about competition, Arkansas offers ample opportunities for house flippers. According to RealtyTrac, Arkansas currently has 783 properties in foreclosure, 174 bank owned properties, and 609 headed for auction. These numbers highlight the abundance of opportunities available for those looking to dive into the market of flipping houses in Arkansas.

Even more enticing is the potential for significant profits. According to ATTOM Data Solutions' latest Home Flipping Report, the average gross flipping profit nationwide is $70,000, translating to a 27.5% return on investment. While these figures represent national averages, Arkansas often provides opportunities for higher returns due to its lower property acquisition costs and growing housing demand. The state's housing market allows for more favorable entry points, enabling investors to capitalize on higher profit margins.

Moreover, Arkansas boasts a growing economy with expanding job markets in various sectors, including healthcare, education, and manufacturing. This economic growth fuels demand for housing, making it an ideal environment for house flippers to invest and see profitable returns. The cost of living in Arkansas is also relatively low, making it an attractive option for potential homebuyers, which further boosts the resale potential of flipped properties.

Therefore, flipping houses in Arkansas offers a lucrative investment strategy with the potential for higher returns compared to traditional stock market investments. By learning how to start flipping houses in Arkansas, investors can tap into a promising market that combines affordability, economic growth, and increasing housing demand.

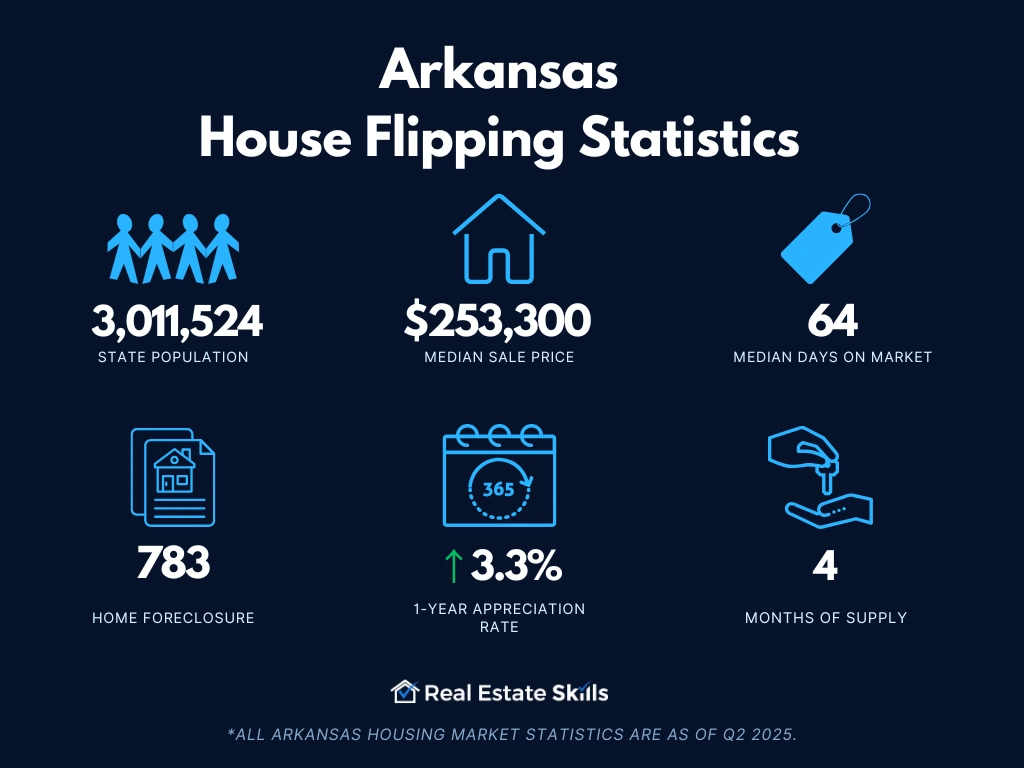

Arkansas House Flipping Statistics

Anyone learning how to flip houses in Arkansas should also prioritize recent and dependable housing indicators. It is important to consider several key statistics as listed below (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 3,011,524

- Employment Rate: 56.1%

- Median Household Income: $58,700

- Median Sale Price: $253,300 (+5.4% Year-Over-Year)

- Number Of Homes Sold: 2,344 (-5.8% Year-Over-Year)

- Median Days On Market: 64 (+11 Year-Over-Year)

- Number Of Homes For Sale: 13,934 (+10.3% Year-Over-Year)

- Number Of Newly Listed Homes: 3,390 (-8.7% Year-Over-Year)

- Months Of Supply: 4 (+0 Year-Over-Year)

- Homes Sold Above List Price: 11.9% (-3.0 Points Year-Over-Year)

- Homes With Price Drops: 19.9%(+0.7 Points Year-Over-Year)

- Foreclosure: 783

*All Arkansas housing market statistics are as of Q2 2025

The average days on the market (DOM) for a listed property in Arkansas is around 40 days, which signals a healthy supply and demand dynamic. Anything less than 30 days on the market is typically considered a seller’s market, and a buyer's market as it increases above 30 DOM.

Similar to what you’d learn in a Flipping Houses 101 course, it's crucial to equip yourself with comprehensive market data, monitor economic trends, and understand the prices within the Arkansas market. This knowledge will guide house-flipping strategies Arkansas investors implement and assist them in learning how to flip houses in Arkansas.

Read Also: Arkansas Real Estate Classes

How To Flip Houses In Arkansas In 15 Steps

If you're eager to learn how to flip houses in Arkansas, you're in the right place. In this home renovation guide, we'll provide step-by-step instructions to navigate the entire process of flipping properties in Arkansas with our comprehensive approach. This guide isn't your average tutorial; it's a detailed breakdown of everything you need to do to successfully rehab a house and sell it for a profit in the Arkansas market. Just commit to the process and follow the steps outlined below to achieve success in your house-flipping endeavors.

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

Flipping a house in Arkansas starts with selecting the right market, which is crucial for your investment's success. Key factors include local economic conditions, housing demand, and property values.

One important consideration is the proximity to where you live. While it's not essential to be located near your investment market, doing so can significantly ease the process for new investors. Being close to the market allows for more convenient interactions with contractors, real estate agents, and other professionals. It also helps you better understand individual neighborhoods, which is vital for making informed decisions.

Suppose you invest in a market far from where you live. In that case, you may encounter challenges such as coordinating renovations remotely, managing contractors from a distance, and staying updated on local market trends. Additionally, unfamiliar with the area can make it difficult to assess factors impacting property values, like neighborhood amenities and potential issues.

By choosing a market within a manageable distance, you can better evaluate the home’s value, such as the quality of schools, proximity to major roads, and local amenities. Picking the right market is the first crucial step in learning how to flip houses in Arkansas and sets the foundation for a successful and profitable investment.

Find Your Money

Once you've chosen your market in Arkansas, the next crucial step is securing financing; this involves finding a lender or funding source to support your house-flipping venture. Having your financing in place before you find and contract a property is essential because cash is required to close deals. Without secured funding, you risk missing out on valuable opportunities, so it’s important to determine your financial resources early on.

House flippers use two common types of lenders: hard money lenders and private money lenders. Hard money lenders provide asset-based loans, typically covering 70% to 90% of the project's loan-to-cost (LTC), including purchase and renovation costs. They have higher interest rates and fees but offer the speed needed to secure deals quickly.

Private money lenders, on the other hand, are individuals who invest their capital for better returns than traditional investments. They usually charge around 10% interest but offer more flexibility, making them a valuable resource for covering the remaining project costs after hard money lenders have been exhausted.

Leveraging these lenders allows investors to conserve their capital, enabling them to take on multiple projects and scale their flipping business more efficiently. Using other people's money (OPM) can minimize personal financial risk and maximize returns, making these lenders a vital part of the house-flipping process in Arkansas.

How to Find Private & Hard Money Lenders

Finding private and hard money lenders in Arkansas involves a different approach than traditional financing, but it is manageable with the right strategies. Both types of lenders are available and can be found using several effective methods.

To locate hard money lenders, attend local Real Estate Investor Association (REIA) meetings in Arkansas. These gatherings are excellent for networking with experienced investors and lenders actively seeking financing opportunities. Additionally, conducting a simple online search for "hard money lenders in [your city]" will yield a list of both local and national lenders, including their contact information. In Arkansas, you might come across lenders such as Kiavi and Lima One, which have been reliable in the past.

Finding private money lenders involves a slightly different approach. These lenders usually seek to invest their capital for higher returns than traditional investments. Begin by contacting your personal network—friends, family, and acquaintances—who may be interested in real estate opportunities. Attending local networking events, investment seminars, and real estate clubs can also help you connect with potential private lenders. Presenting a solid investment plan and demonstrating potential returns can attract their interest.

Securing financing early on is crucial as it allows you to obtain a proof of funds (POF) letter. This document is essential for making competitive offers on properties, as it shows sellers you have the financial backing to close the deal, enhancing your credibility in the Arkansas real estate market.

Find Three Contractors

The next step in flipping houses in Arkansas is hiring a contractor. While tackling a rehab project yourself is possible, it's generally not advisable due to potential pitfalls such as underestimated costs and extended timelines caused by unforeseen issues. Professional contractors bring efficiency, skill, and high-quality workmanship to your project, allowing you to avoid these common problems. As an investor, your time is better spent on activities that drive growth and profitability, such as finding new deals and expanding your business.

To streamline your renovation process, finding at least three general contractors is crucial. These professionals are adept at managing the entire project and coordinating with subcontractors, ensuring that every aspect of the renovation is completed efficiently and to a high standard. By comparing quotes and capabilities from multiple contractors, you can select the best fit for your needs and maintain a smooth and successful house-flipping venture in Arkansas.

How to Find a General Contractor

Finding a general contractor is a crucial step in flipping houses in Arkansas. Contact at least three general contractors to obtain different quotes and perspectives on your renovation project; this will help you compare prices and select the best option that fits your budget and project needs.

To find reliable contractors, consider attending local Real Estate Investor Association (REIA) meetings in Arkansas, where you can network with experienced investors who may recommend reputable contractors. Additionally, driving through neighborhoods to observe homes under renovation can provide leads. Approach the workers or check project signs for contact information. Another effective method is visiting local home improvement stores, such as Lowe's or Home Depot. Contractors often shop there; you can connect with them directly or ask store staff for recommendations.

Hiring skilled contractors ensures that your renovation projects are completed efficiently and to a high standard, allowing you to focus on expanding your real estate flipping business in Arkansas.

Find An Investor-Friendly Agent

The fourth step in flipping houses in Arkansas is finding an investor-friendly real estate agent. Agents with experience working with investors are invaluable due to their local knowledge, extensive networks, and strong negotiation skills. Their expertise can turn a mediocre deal into a highly profitable one.

Choosing an investor-friendly agent is essential, as not all real estate agents cater to investors. Some may focus on high-end residential properties or multimillion-dollar homes, while you need an agent who is enthusiastic about working with investors and experienced in handling multiple offers.

An investor-friendly agent is crucial because most homes are sold through real estate agents. According to the National Association of Realtors, "89% of sellers were assisted by a real estate agent when selling their home." Since most properties are listed on the MLS, having an agent who understands the market and can navigate it effectively will give you a significant advantage. While agent services typically cost around 2.5% of the sale price, this commission is generally paid by the seller, meaning you won't need to worry about it until it’s time to sell your finished property.

How to Find an Investor-Friendly Agent

Finding an investor-friendly real estate agent in Arkansas is a key step in flipping houses. Start by attending local Real Estate Investment Association (REIA) meetings. These events offer great networking opportunities and allow you to connect with agents with experience working with investors.

Another effective method is to search the MLS for distressed properties. Agents who list these types of homes are often investor-friendly and accustomed to working with buyers looking for rehab projects. Reach out to these agents to gauge their interest in partnering with you on future deals.

Partnering with an agent who understands the investor's perspective can greatly enhance your ability to find and secure profitable properties, streamlining the house-flipping process in Arkansas.

Find A House To Flip

Finding houses to flip in Arkansas involves leveraging effective strategies tailored to the local market dynamics. While there are various methods, such as driving for dollars and browsing public records, the most reliable way to find properties is through the Multiple Listing Service (MLS). The MLS is a centralized database used by real estate agents to list properties for sale, providing detailed information crucial for identifying potential investment opportunities.

Utilizing the MLS allows investors to access listings from motivated sellers actively seeking to sell their properties. Working with a real estate agent familiar with the Arkansas market is essential, as they can provide customized searches based on your criteria, such as property condition, location, and price range. This partnership streamlines the process of identifying undervalued homes needing renovation or located in high-demand areas, optimizing your chances of securing profitable flips in Arkansas.

Alternative Strategies to Find a House

There are several effective methods to find houses to flip in Arkansas. The Multiple Listing Service (MLS) is a favored source due to its zero marketing costs and comprehensive property information. This platform is invaluable for identifying distressed homes, prime candidates for flipping.

To locate distressed properties, focus on homes on the market for an extended period. These listings often indicate motivated sellers eager to close a deal, providing prime opportunities for flips. Additionally, search for homes needing repair or those listed "as is." Such properties typically require significant work but can be purchased at a lower price, allowing for higher profit margins post-renovation.

Utilize specific keywords in your MLS search to pinpoint distressed properties. Terms like "handyman special," "needs TLC," "diamond in the rough," and "fixer-upper" indicate homes in less-than-ideal condition. These properties are often listed below market value, offering substantial value-add potential through renovations.

Here are three strategies to find houses to flip in Arkansas:

- The Day Zero Strategy: Investors can access the MLS and filter for homes listed in the last 24 hours. List those that appear distressed from these new listings and have your agent contact the listing agent. The goal is to be the first to contact the listing, potentially securing a deal immediately and beating the competition.

- The Old Listing Strategy: Use the MLS to filter for homes that have been listed for 60 days or more. While these homes haven’t sold for many reasons, they all share one common factor: the seller is likely more eager to sell, which means they could be more willing to lower their asking price. It's possible that these homes just haven't found the right buyer yet. You might uncover a great deal that others have overlooked by reaching out.

- The Wholesaler Strategy: Is wholesaling legal in Arkansas? Wholesaling real estate is legal in Arkansas, which means investors can find distressed homes by teaming up with wholesalers. Wholesalers find and contract undervalued properties and then assign these contracts to investors for a fee. You can find wholesalers at local Real Estate Investment Association (REIA) meetings or by signing up for programs that connect you with a network of wholesalers.

By learning how to buy foreclosed homes in Arkansas, investors create win-win scenarios for sellers, helping them avoid distressed situations while securing profitable deals. This approach benefits all parties involved, making the process of flipping houses in Arkansas both efficient and lucrative.

Having said that, some investors may not be able to gain access to the MLS for a variety of reasons. Fortunately, these strategies apply to alternative website listing platforms like RedFin, Zillow, and Realtor.com. Simply translate the strategies above to these listing websites when flipping homes in Arkansas. It is important to note, however, that the MLS is the preferred vehicle because of its more comprehensive data and contact information.

Make Discovery Calls To Listing Agents

After identifying potential distressed properties, the next step in flipping houses in Arkansas is making discovery calls to listing agents. These calls are essential for gathering detailed information about the properties and assessing their suitability for your flip. You can either make these calls yourself or have your real estate agent handle them.

These calls are not cold calls; listing agents are motivated to sell and typically welcome inquiries from serious buyers. During these conversations, focus on gathering crucial information about the property's condition, the seller’s motivations, and any issues that might impact the deal. Here are some key questions to ask:

- Is the listing still active? Confirm that the property is still on the market to avoid wasting time on no longer available deals.

- Are the listing’s photos up to date? Ensure that the photos accurately reflect the property's current condition to better estimate repair needs and costs.

- What is the current condition of the home? Understand the state of the property to identify any hidden issues and assess the extent of repairs needed.

- Are you willing to work with an investor? Gauging the listing agent's openness to working with investors can help build a productive relationship and potentially secure better deals.

- What is the owner’s reason for selling? Learn about the seller’s motivations, which can provide valuable insights for negotiating a favorable offer.

- Is there a lot of competition for the property? Find out if there are multiple offers or high interest, which can influence your bidding strategy and help you avoid overpaying.

Remember, these calls aim to gather information, not to make an immediate offer. Keep the lines of communication open by suggesting that you’ll follow up after consulting with your team. This thorough approach will help you make informed decisions and enhance your chances of success in flipping houses in Arkansas.

Analyze The Property

The next step in flipping houses in Arkansas is analyzing the property. This involves evaluating key metrics to determine if a property is a viable investment. Focus on the "big three": the after-repair value (ARV), repair costs, and purchase price.

After-Repair Value (ARV)

The ARV is a critical metric that represents the estimated value of a property after all repairs and renovations are completed. To calculate the ARV, use comparable sales, or "comps," which are recently sold properties similar to the one you are considering. For accurate comps, look for properties that:

- Have the same number of bedrooms and bathrooms

- Are within 20% of the subject property's square footage

- Are located in the same neighborhood

- Are within half a mile of the subject property

- Have sold within the last six months

- Have been recently renovated

Average the sale prices of these comps to estimate the ARV; this helps you gauge the potential selling price of the property post-renovation and guides your investment decisions.

Repair Costs

Estimating repair costs accurately is essential. Start with a detailed property inspection and consult experienced contractors. Create a list of necessary repairs and obtain multiple quotes for labor and materials. Also, a 10-15% contingency budget should be allocated for unexpected expenses. This thorough planning ensures you have a realistic estimate of repair costs, contributing to a profitable flip.

Purchase Price

To determine your maximum allowable offer (MAO), use the ARV and repair costs along with other expenses:

- ARV: The expected value of the home after repairs.

- Hard Money Loan Costs: Include interest rates (10-15%), origination fees, and points.

- Private Money Loan Costs: Account for interest and project duration.

- Front-End Closing & Holding Costs: Typically around 2% of the purchase price plus ongoing expenses like insurance, utilities, and taxes.

- Backend Closing Costs: Usually 1% of the ARV.

- Realtor Fees: Generally around 6% of the purchase price, but a lower fee might be negotiable with an investor-friendly agent.

- Projected Profit: Based on the desired return, which is often around 27.5% as reported by ATTOM Data Solutions.

Subtract these costs from the ARV to calculate your MAO, which is the maximum price you can pay while ensuring a profitable investment.

Call Agents & Submit Written Offers

The next step in flipping houses in Arkansas is to call the listing agent you previously contacted and let them know you intend to submit a written offer. Make sure your offer aligns with the maximum allowable offer you calculated. By presenting a well-informed written offer, you demonstrate that you're a serious buyer and advance your position in securing the property.

If you're working with an investor-friendly agent or the listing agent, have them draft and submit the written offer on your behalf. This approach adds a layer of professionalism to your bid, as the agent will handle the paperwork and follow the proper procedures. The standard form used in Arkansas is the Arkansas Real Estate Commission's Purchase Agreement.

Here’s a checklist of the contact details and components you need to provide for the representing agent to complete the contract:

- Purchaser Name: Indicate who is purchasing the property, whether it's in your name or an LLC (Limited Liability Company). Forming an LLC is recommended for added asset protection. If buying under an LLC, include the articles of incorporation to prove your authorization to act on behalf of the company.

- Offer Price: Specify the offer price you’ve determined.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit (typically 1% to 5% of the purchase price) to demonstrate your seriousness as a buyer. Note that earnest money deposits are generally refundable but include a contingency clause to ensure protection.

- Contingencies: Include a seven-day inspection contingency to allow for a property inspection. This clause provides an opportunity to back out of the deal and retrieve your deposit if significant issues are found.

- 14-Day (Or Sooner) Closing: Request a quick closing to appeal to the seller. Cash offers typically close faster than those requiring traditional financing, which can be advantageous in a competitive market.

- Seller To Deliver Free & Clear Title: Ensure the seller provides a clear title to avoid issues like liens or other encumbrances.

- Buyer’s Agent Name: Clearly state the buyer's agent to confirm representation in the transaction.

- Proof Of Funds: Include proof of funds from your lender to validate your financial capability to complete the purchase; this strengthens your offer and makes it more attractive to the seller.

Calling agents and submitting written offers is a vital step in flipping houses in Arkansas. Ensuring your agent acknowledges your terms and submits a thorough, professional offer will enhance your chances of securing a profitable deal. This process is key to mastering the art of flipping houses and achieving investment success in Arkansas. Remember, a well-structured written offer is crucial for sealing the deal.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted and the seller has signed the contract, you’re not yet the property owner, but the process is well underway; this is the moment when things start to gain real momentum, and performing due diligence becomes crucial. Ensuring you fully understand the property's condition and any potential issues is vital for a successful flip in Arkansas.

Act promptly, as several timelines will kick in. The earnest money deposit is due within three days of offer acceptance, the inspection period starts, and the countdown to closing day begins, which you promised would happen in 14 days or less. The inspection clause is your safeguard; if significant issues are discovered, you can use it to back out of the deal, but you’ll only have a week to do so. Therefore, acting quickly is essential.

Here’s what you need to do once your offer is accepted:

- Conduct a Walkthrough with Your Contractor: Arrange for a detailed property walkthrough with your contractor. The goal is to identify all necessary repairs to align the home with the after-repair value (ARV) you estimated. During this walkthrough, create a comprehensive work scope outlining all required renovations. This step is crucial for accurate budgeting and scheduling.

- Obtain Multiple Contractor Quotes: Get detailed quotes from several contractors to compare costs and services. If needed, walk through the property with each contractor to ensure their estimates align with your scope of work. Select the contractor with the best experience, reliability, and cost-effectiveness. A good contractor will provide valuable insights and help ensure the project stays within budget and on schedule.

- Hire a Professional Inspector: It’s wise to hire a professional inspector to thoroughly evaluate the property. Inspectors can uncover hidden issues that might not be apparent during your initial walkthrough. Spending $200 to $500 on an inspection can save you from potential costly surprises and offer you a chance to back out of a deal if necessary.

You set a solid foundation for a successful flip by diligently managing these steps. Proper due diligence will help you avoid unexpected problems and ensure that your investment in Arkansas proceeds smoothly.

Close On The Deal

The next step in flipping houses in Arkansas is to close on the property and complete the purchase. This stage is critical and should only proceed if everything checks out and you’re confident in the potential profitability of the deal. If the inspection or any due diligence reveals issues that render the investment unviable, utilize the contingencies in your contract to withdraw from the deal. However, if you're satisfied with the property's condition and its investment potential, proceed to finalize the purchase.

Closing involves handling all the financial and legal aspects of the transaction. You will work with a title company, escrow agent, and possibly a real estate attorney to ensure that all elements are in place. During this process, you’ll finalize the payment to the seller, and if you have private or hard money lenders, you will need to adhere to the terms outlined in your promissory notes. These notes will specify the loan amount and interest rates, serving as collateral for the lenders and ensuring that their investments are protected.

A key part of closing is conducting a title search to verify that the property has a clear title. This search ensures that there are no outstanding liens, disputes, or other issues with the property's title, allowing you to secure clean ownership. A clear title is essential for avoiding potential legal problems and facilitating a smooth resale process after the renovation is complete.

Once the closing is finalized, you’ll receive the keys to the property, signifying that you are now the owner. This marks the beginning of the renovation phase, where you can start implementing your plans to enhance the property. Ensuring all these steps are carefully managed will help you navigate the closing process effectively, safeguard your investment, and move forward confidently with your flipping project in Arkansas.

Renovate The House

The next step in flipping houses in Arkansas is to begin the renovation process, transforming the property to meet your projected after-repair value (ARV) while aligning with local market comparables. It’s essential to avoid over-renovating; instead, aim to bring the property up to par with, or slightly better than, the comparable homes in the area. This approach ensures you create an attractive property without exceeding your budget, thereby optimizing your profit margins.

Before diving into the renovation, safeguard your project with six key documents to ensure a smooth and legally sound process:

- Independent Contractor Agreement: This agreement outlines the terms of your relationship with the contractor, including payment terms, timelines, and responsibilities. Setting clear expectations and protecting both parties throughout the renovation is crucial.

- Final Scope of Work: This detailed document specifies all tasks, materials, and timelines for the renovation. It provides a clear blueprint for the contractor, helping to ensure the project stays on track, within budget, and meets your quality standards.

- Payment Schedule: This document details the amounts and timing of payments to the contractor, tied to specific milestones in the renovation process. It helps manage the contractor’s performance and ensures that payments are made only when agreed-upon work is completed.

- Insurance Indemnification Agreement: This agreement verifies that the contractor has the necessary insurance coverage and agrees to protect you from liability for any accidents or damages that occur during the renovation. It shields you from financial loss related to incidents on the property.

- W-9 Form: This tax form collects the contractor’s taxpayer identification information, which is necessary for reporting payments to the IRS. It ensures compliance with tax regulations and allows you to issue a 1099 form at the end of the year.

- Final Lien Waiver: This document, signed by the contractor, confirms that they have received full payment and relinquished any future claims against the property. It protects you from contractors seeking additional money after the renovation is completed.

With these documents in place, you can confidently proceed with the renovation, knowing that your investment is well-protected and your project is set for success.

This is a lot of information to take in, and navigating the complexities of flipping houses in Arkansas can be challenging. If you want to learn how to flip houses in Arkansas successfully, please enroll in our free training program. Our program will provide you with everything you need to confidently and profitably flip homes in Arkansas.

Prep & List The House On The MLS

The next step in flipping houses in Arkansas is to prepare the property for listing and post it on the MLS. This phase is crucial for showcasing the home effectively to attract potential buyers and maximize its visibility, ultimately increasing the likelihood of a successful sale.

To get the house ready for the MLS, you should focus on three key tasks:

- Final Punchlist: This is a document that outlines the last tasks and minor issues that need addressing before the home is ready to sell. Completing the punch list ensures that all small details are resolved, making the property as appealing as possible to potential buyers.

- Home Staging: Staging involves arranging furniture and decor to enhance the property's appeal. Proper staging can significantly boost the home's resale value. According to the Real Estate Staging Association (RESA), an investment of about 1% of the sale price in staging can result in a return of 5% to 15% over the asking price.

- Professional Photos: High-quality photos are essential for a successful listing. Professional real estate photos can make a big difference in attracting buyers. Studies show that homes with high-performance DSLR photos sell faster and for more money compared to those with amateur shots. Investing in professional photography improves the home's online presence and can lead to quicker and higher offers.

Once the home is prepared, your real estate agent will handle the marketing strategy. This includes listing the property on the MLS for maximum exposure, placing a yard sign to attract local interest, and posting on popular online platforms like Zillow and Redfin to reach a broader audience. Additionally, hosting open houses allows potential buyers to view the property in person. Your agent will also use email lists and social media to target specific buyer groups and generate interest. By leveraging these marketing channels, your agent can effectively promote the property, increasing the chances of a quick and profitable sale.

Set An Enticing Asking Price

Setting an effective asking price is a crucial step in flipping houses in Arkansas. To optimize your sale, aim to list the property within a price range around your calculated after-repair value (ARV). Generally, setting the asking price about 5% above and below your target sale price can be advantageous.

This pricing strategy offers several benefits. Firstly, it attracts a broader range of potential buyers, including those who might otherwise consider the property out of their budget. By setting a range, you invite offers from a wider audience and create an opportunity for multiple bids. This can foster a competitive bidding environment, potentially leading to higher offers and a sale price that exceeds your initial ARV.

Additionally, a well-calculated pricing strategy can generate more interest and viewings, leading to quicker sales. It leverages market dynamics to your advantage, increasing the likelihood of receiving competitive offers and maximizing your return on investment.

Setting an enticing asking price is essential for flipping houses in Arkansas. By strategically positioning the price, you enhance the property's appeal, attract more buyers, and improve your chances of achieving a profitable sale.

Field Offers & Negotiate

The next step in flipping houses in Arkansas involves fielding offers and negotiating with potential buyers. After effectively listing and marketing your property, you’ll start receiving offers, each varying in terms of price and conditions. As an investor, your goal is to evaluate these offers carefully and negotiate to maximize your return.

Start by reviewing all offers with your real estate agent. Pay attention not only to the offered price but also to the terms and contingencies attached. It's important to assess each buyer’s financial qualifications and their readiness to close the deal. While you might receive offers below your asking price, these can serve as valuable starting points for negotiation.

Counteroffers are a common tactic to bring buyers closer to your target price. If multiple offers are on the table, use this to your advantage by informing buyers of the competitive situation. This approach can sometimes spark a bidding war, potentially raising the final sale price above your initial expectations.

Negotiation isn’t solely about price; it also involves other factors like closing timelines, inspection contingencies, and financing terms. By skillfully navigating these aspects, you can secure the best possible deal for your property and ensure a profitable outcome for your flipping project. Mastering this process is essential for successfully flipping houses in Arkansas and achieving your investment goals.

Accept The Best Offer

The next step in flipping houses in Arkansas is to accept the best offer you receive. Carefully review all offers, considering not just the price but also the terms and conditions to choose the one that offers the best overall value and is most likely to close successfully. Once you accept an offer, the buyer's timelines will begin, similar to when you first purchased the house.

The buyer will provide an earnest money deposit to show their commitment to the purchase. Following this, they will conduct their own due diligence, which includes inspecting and appraising the home. The inspection allows the buyer to identify any issues that might need addressing, while the appraisal ensures that the property is worth the agreed-upon price. The buyer might request repairs or negotiate concessions based on the inspection results.

After the due diligence phase, the buyer will schedule a final property walkthrough. This walkthrough ensures that any agreed-upon repairs have been completed and that the property is in the expected condition before closing. It’s a critical step for the buyer to verify that everything is in order.

By managing these steps effectively, you can ensure a smooth transition from offer acceptance to closing, leading to a successful and profitable sale in your house-flipping venture in Arkansas.

Sell The House & Get Paid

The final step in flipping houses in Arkansas is to sell the house and collect the proceeds. You'll move to the closing phase once the buyer's due diligence is complete and any agreed-upon repairs are made. In Arkansas, this typically involves an escrow process, where a neutral third party holds all funds and documents until the transaction's terms are satisfied.

The closing process starts with both parties signing the necessary documents, including the deed transfer and settlement statement. The buyer deposits the purchase funds into the escrow account, and if there's a mortgage involved, their lender will also provide the loan amount. The escrow agent will then ensure that all contractual obligations, such as contingencies and repairs, have been met.

After confirming that everything is in order, the escrow agent will disburse the funds. These proceeds will first be used to repay any lenders, including interest, as specified in your promissory notes. Any remaining funds after settling these obligations represent your profit.

Collecting the proceeds signifies the successful conclusion of your house flip. This profit can be reinvested into your next project, helping you to continue expanding your real estate portfolio and building on your success in the Arkansas housing market.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How To Find Houses To Flip In Arkansas

Real estate investors can use a variety of different methods for finding houses to flip. You could hire a real estate agent that has MLS access and can search for properties in foreclosure. You could attend property auctions or check the public records for foreclosures and delinquent payments.

You could also partner with a wholesaler who will scout properties on your behalf or send direct mailers to distressed properties in the area. Marketing is essential to your business, so you'll have to find an effective strategy that makes sense for your business as well as your budget.

Read Also: MLS Real Estate: Multiple Listing Service (ULTIMATE) Guide

How Much Do House Flippers Make In Arkansas?

House flippers in Arkansas have the potential to earn substantial profits, driven by the state's affordable housing market and growing demand. According to ATTOM Data Solutions, the average gross flipping profit nationwide is $66,000, with a 27.5% return on investment. Arkansas, with its lower property acquisition costs, tends to offer lower net profits. That said, margins are just as impressive.

The state's housing market is buoyed by its economic growth and expanding job markets, which contribute to increased housing demand. This environment creates ideal conditions for house flippers to find profitable opportunities. The average gross profit from flipping houses in Arkansas can vary significantly based on factors such as location, renovation costs, and market conditions. However, Arkansas presents a favorable landscape for achieving high returns due to its affordability and growth potential.

Arkansas features cities with some of the best profit opportunities in the country. According to the Home Flipping Report by ATTOM Data Solutions, three of the top five cities with the nation's largest gross flipping profits on median-priced transactions are:

- Little Rock, AR: $82,000 average gross flipping profit

- Fayetteville, AR: $75,000 average gross flipping profit

- Fort Smith, AR: $70,000 average gross flipping profit

These cities offer lucrative opportunities due to their affordable property values, strong demand, and growing economies. Understanding local market trends and having a solid renovation plan are key to maximizing profits when flipping houses in Arkansas. Additionally, securing properties at lower purchase prices and effectively managing renovation costs can significantly impact the net profit from each flip.

House flippers in Arkansas can expect to make impressive returns on their investments, particularly in cities like Little Rock, Fayetteville, and Fort Smith. The state's favorable economic conditions and affordable housing market make it an attractive destination for real estate investors looking to achieve substantial profits.

Is House Flipping Illegal In Arkansas?

House flipping is entirely legal in Arkansas. However, as with any real estate transaction, there are laws and regulations designed to protect both buyers and sellers from fraudulent practices. The legality of house flipping hinges on adhering to these laws and conducting business ethically.

One common concern in the realm of house flipping is mortgage or loan fraud. This type of fraud occurs when an appraiser overestimates a property's value to increase the loan amount, often with the collusion of a dishonest mortgage broker or appraiser. If homeowners default on their loans, the bank may be unable to recoup its costs due to the inflated property value.

Illegal property flipping, a form of mortgage fraud, involves artificially inflating a property's price and then selling it to an unsuspecting buyer. This often includes the use of a dishonest appraiser to misrepresent the property's actual value. It is not illegal to sell a property at a high price, but it is unlawful to misrepresent the value through fraudulent appraisals or other deceptive practices.

Arkansas, like many states, has laws in place to prevent such fraudulent activities. Real estate transactions are governed by state and federal regulations aimed at ensuring transparency and fairness. Violations of these laws can lead to severe penalties, including fines and imprisonment.

For house flippers in Arkansas, it is crucial to operate within the legal framework. This includes:

- Ensuring all appraisals are conducted by licensed and reputable professionals.

- Accurately representing the property's condition and value to potential buyers.

- Avoiding any practices that could be construed as deceptive or fraudulent.

By adhering to these principles, house flippers can operate legally and ethically, contributing to a healthy and transparent real estate market in Arkansas.

Do You Need A License To Flip Houses In Arkansas?

No, a real estate license is not required to flip houses. Anyone can buy and sell property on their own behalf in the state of Arkansas, which is what you'll be doing as a home flipper.

A real estate license is required is only required if you plan on performing brokerage services in exchange for a fee, which includes negotiating on behalf of a seller or buyer or marketing someone else's property to homeowners. You should review § 17-42-107 of the Arkansas Real Estate License Law to determine what other activities require licensure.

Do You Need A Contractor's License To Flip Houses In Arkansas

No, you do not need a contractor's license to flip houses in Arkansas. However, any contractor you hire to perform more than $2000 worth of work, should have a license according to the Arkansas Contractors Licensing Board.

Read Also: Red Flags Before Hiring a Contractor

How Much Does It Cost To Flip A House In Arkansas?

Flipping houses in Arkansas can be a profitable endeavor, but it's essential to understand the various costs involved to accurately predict potential profits and ensure a successful project. In this section, we'll delve into the primary costs associated with flipping a house in Arkansas.

Acquisition Costs

The first major expense in house flipping is the acquisition cost, which includes the purchase price of the property and any associated fees such as closing costs, inspection fees, and title insurance. In Arkansas, the median home price is relatively low compared to the national average, making it an attractive market for investors. According to Zillow, the median home value in Arkansas is approximately $363,438, but this can vary significantly depending on the location and condition of the property.

Renovation Costs

Renovation costs are a significant part of any house-flipping project and can vary widely based on the property's condition and the scope of the improvements needed. On average, renovation costs in Arkansas can range from $20,000 to $70,000 or more. This includes expenses for labor, materials, permits, and any unforeseen repairs that may arise during the renovation process. Common renovations include updating kitchens and bathrooms, replacing flooring, painting, and addressing structural issues.

Carrying Costs

Carrying costs, also known as holding costs, are the expenses incurred while the property is being renovated and prepared for sale. These costs can include property taxes, insurance, utilities, and loan interest payments. In Arkansas, the average property tax rate is relatively low, at about 0.63%, which helps reduce carrying costs compared to states with higher tax rates. However, it's important to factor in these costs to ensure they don't eat into your potential profits.

Selling Expenses

Once the renovation is complete, there are costs associated with selling the property. These can include real estate agent commissions, closing costs, and marketing expenses. In Arkansas, real estate agent commissions typically range from 5% to 6% of the selling price. Additionally, sellers may need to cover closing costs, which can amount to 2% to 5% of the sale price.

Total Costs

When all these costs are combined, the total cost to flip a house in Arkansas can range from $200,000 to $300,000 or more, depending on the property's initial purchase price, the extent of renovations needed, and the duration of the holding period. By carefully budgeting and managing these expenses, investors can maximize their potential profits and achieve successful flips in the Arkansas real estate market.

Understanding the costs involved in flipping a house in Arkansas is crucial for predicting potential profits and ensuring a successful investment. With relatively low acquisition and carrying costs, Arkansas offers a favorable environment for house flippers looking to capitalize on the state's affordable housing market and growing demand.

How To Flip A House In Arkansas With No Money

Although it can be challenging, there are ways to flip houses with no money. Hard money lenders often don't have strict income requirements because they can always sell the home if the deal falls through, so you may be able to get approved without verifiable income.

Private money lenders also offer more flexible requirements, especially if you know them personally. So, if you have any friends or colleagues who may be interested in becoming silent investors, this is a solid strategy. You could also get started as a wholesaler and scout properties on behalf of the investor, then try to take an active role in the flip to gain experience.

Some investors have also found success in crowdsourcing deals online amongst a group of smaller investors and then distributing the funds evenly.

What's The Best Place To Flip Houses In Arkansas?

Choosing the right location is crucial for the success of your house-flipping venture. In Arkansas, several areas stand out for their growth potential, affordability, and demand, making them prime spots for house flippers. Here are some of the best places to flip houses in Arkansas:

- Little Rock, AR: Little Rock, the capital city, offers a dynamic real estate market with a median home value of around $180,000. The city's diverse economy supports a steady housing demand, presenting numerous opportunities for profitable flips.

- Fayetteville, AR: Fayetteville, part of the rapidly growing Northwest Arkansas region, has a median home value of approximately $250,000. The presence of the University of Arkansas and major corporations like Tyson Foods and Walmart drives strong demand, making it an excellent spot for flipping houses.

- Fort Smith, AR: Fort Smith, known for its affordability, has a median home value of about $150,000. Its stable economy, supported by manufacturing, healthcare, and retail sectors, offers a budget-friendly market with potential for real estate appreciation.

- Hot Springs, AR: Hot Springs, with a median home value of around $200,000, attracts buyers due to its natural thermal springs and tourism industry. Flipping houses in popular neighborhoods and historic districts can yield profitable returns.

- Bentonville, AR: Bentonville, home to Walmart's headquarters, has a median home value of approximately $300,000. The city's rapid growth and strong economy provide a competitive yet promising market for house flippers.

The best places to flip houses in Arkansas are those with strong economic foundations, affordable housing markets, and growing demand. Cities like Little Rock, Fayetteville, Fort Smith, Hot Springs, and Bentonville offer promising opportunities for house flippers looking to maximize their returns on investment. By understanding the local market dynamics and targeting areas with high growth potential, investors can achieve successful flips and profitable outcomes in the Arkansas real estate market.

With this in mind, we invite you to join our FREE training on house flipping in Arkansas. We'll guide you through the ins and outs of finding the perfect property, performing the right renovations, and, ultimately, flipping for a profit. Don't miss out on the chance to turn Arkansas' real estate opportunities into your financial success story. Sign up for our free training today!

Is It Hard To Flip Houses In Arkansas?

Flipping houses in Arkansas presents its own set of challenges, but it's not inherently difficult. The competition for properties can be significant, especially in desirable areas, which may drive up prices and require quick decision-making. Additionally, finding reliable and skilled contractors can be challenging, particularly in smaller towns and rural regions. Building a network of trustworthy professionals is essential to complete renovations on time and within budget.

Despite these challenges, Arkansas' growing economy and affordable housing market offer favorable conditions for house flippers. The demand for renovated homes is strong, particularly in urban areas like Little Rock and Fayetteville. While the market may not be as fast-paced as in states like California, a well-renovated property in a good location can still attract competitive offers, making house flipping in Arkansas a potentially profitable venture.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In Arkansas?

Having connections with reliable contractors is essential for successful house flipping, especially if you're new to Arkansas or the house flipping business. While personal referrals are invaluable, there are several online resources that can help you find skilled professionals for your projects.

- HomeAdvisor: This platform connects you with professionals for every aspect of your fix-and-flip project. You can read reviews, compare pricing, and book contractors directly. Some professionals offer fixed prices, making it easier to estimate renovation costs.

- Thumbtack: Similar to HomeAdvisor, Thumbtack provides access to a wide range of contractors. It's worth checking both sites, as some contractors may only be listed on one.

- Angi: Formerly Angie's List, Angi specializes in connecting users with contractors based on the type of project. It's a reliable resource for finding vetted professionals.

- Houzz: Beyond offering design inspiration, Houzz connects users with renovation professionals and provides an eCommerce store for purchasing materials and fixtures.

- Craigslist: While it may seem unconventional, Craigslist can be a good source for finding experienced contractors who prefer traditional advertising methods. Be sure to vet any contractor thoroughly to ensure reliability and quality.

- Facebook: Use Facebook to ask for referrals in local groups or to search for recommendations from neighbors and community members. Many contractors also maintain business pages where you can read reviews and see their work.

By leveraging these online resources and thoroughly vetting potential contractors, you can build a reliable network of professionals to help you successfully flip houses in Arkansas.

Final Thoughts On Flipping Houses In Arkansas

Ultimately, flipping houses in Arkansas may seem intimidating initially, but it's quite simple once you break down the fundamentals.

However, you must be willing to research, carefully analyze properties, and work hard to succeed.

Follow these simple tips, and you'll be well on your way to becoming the best house flipper in Arkansas.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.