How To Buy Section 8 Housing: The Landlord’s Playbook (2026 Edition)

Dec 01, 2025

Key Takeaways: How To Buy Section 8 Housing

- What: Buying rental properties specifically to lease to tenants with Housing Choice Vouchers (HCV).

- Why: You receive guaranteed rent payments directly from the government, recession-proofing your portfolio against economic downturns.

- How: Locate high-FMR (Fair Market Rent) zip codes, pass the strict 2026 NSPIRE inspection standards, and sign the HAP contract.

What You’ll Learn: The exact step-by-step process to find, approve, and manage Section 8 rentals for maximum cash flow.

Imagine a tenant who never loses their job. Even if the economy crashes, the stock market tanks, or a global pandemic shuts down the world, your rent check hits your bank account on the first of the month like clockwork.

That is the power of learning how to buy Section 8 housing.

For a long time, the investment community has largely misinterpreted the Housing Choice Voucher initiative, which most people simply call Section 8. They view it as a headache filled with red tape and bad tenants. In my experience, that reputation is exactly what makes it profitable. While other investors are fighting over short-term rentals or luxury flips, smart landlords are quietly building portfolios backed by the United States government.

However, this strategy is not passive. It requires navigating government inspections, understanding the new NSPIRE standards that replaced HQS in 2026, and mastering specific paperwork.

This guide focuses strictly on the mechanics of the Section 8 program. If you are brand new to real estate and need a blueprint for finding discounted properties to buy in the first place, you should start with our Ultimate Guide to Start Real Estate Investing. It covers the fundamental acquisition strategies that fuel this business model.

If you are ready to turn government vouchers into consistent cash flow, this is your playbook.

Here is what we will cover:

- What Is Section 8 Housing? (The "Free Rent" Myth)

- The Pros and Cons of Section 8 Investing

- Step 1: Finding The "Goldilocks" Property (Small Area FMRs)

- Step 2: The Approval Process (RFTA & Paperwork)

- Step 3: Passing the Inspection (HQS vs. NSPIRE)

- Step 4: The HAP Contract & Getting Paid

- Screening Section 8 Tenants (Legal Landmines)

- Frequently Asked Questions (FAQ)

If you want high returns on your Section 8 rentals, you can't pay retail prices. Our FREE Training walks you through the exact system we use to find discounted off-market properties perfect for the BRRRR method and long-term cash flow—without expensive marketing.

The government guarantees the rent, but YOU have to find the deal. Watch this FREE Training to learn how to acquire profitable rental assets fast.

What Is Section 8 Housing? (The "Free Rent" Myth vs. Reality)

When most new investors ask how to buy Section 8 housing, they often have a specific image in their mind: a dilapidated, government-owned high-rise complex filled with crime and red tape. This is the "Projects" myth, and it is completely wrong.

The "Projects" are Public Housing, properties owned and managed by the government. As a private investor, you cannot buy them.

Section 8 is different. Officially known as the Housing Choice Voucher (HCV) program, it is a government initiative that allows low-income families to rent private homes in the open market. The government doesn't own the house; you do. The tenant doesn't pay the full rent; the government pays the difference.

The Three-Way Partnership

To succeed, you must understand the triangle of relationships that powers this system. If one side fails, the money stops.

- 1. HUD (The Funder): The U.S. Department of Housing and Urban Development provides the federal funds.

- 2. The PHA (The Manager): The local Public Housing Authority (PHA) administers the program in your city. They issue the vouchers, inspect your property, and send you the monthly check.

- 3. The Landlord (You): You provide a safe, decent home in the private market.

How the Money Works: The "30% Rule"

A common misconception is that the government pays 100% of the rent. In reality, the tenant usually pays 30% of their adjusted monthly income toward rent and utilities, while the PHA pays the rest.

This structure is your safety net. If your tenant loses their job, their income drops to zero. In a normal rental, they would stop paying you. In Section 8, the tenant reports the income loss to the PHA, and the PHA increases its portion of the payment to cover the difference. Your cash flow remains stable even when the tenant is in a financial crisis.

What Are You Actually Buying? (Tenant-Based vs. Project-Based)

When you are looking for properties, it is vital to know the difference between the two types of vouchers:

- Tenant-Based Vouchers (Most Common): The voucher is tied to the family. They find your house, move in, and if they move out, they take the voucher with them. This is what 99% of private investors deal with.

- Project-Based Vouchers (PBV): The voucher is tied to the building. If the tenant moves out, the subsidy stays with the unit for the next tenant. These are rare and usually involve complex contracts with the PHA.

In this partnership, you are a private business owner. The tenant is your customer, not the government's ward. The tenant chooses your house. They sign your lease. If they break the rules, you evict them just like any other tenant. The only difference is that a large portion of your revenue comes from a deposit directly from the U.S. Treasury.

The Pros and Cons of Buying Section 8 Housing

Before you dive into buying Section 8 housing, you must understand that this is a trade-off. You are trading maximum upside potential (like luxury flips) for downside protection (guaranteed checks). It is not a charity project; it is a business model with specific operational realities.

Here is the honest breakdown of what you are signing up for:

| The Pros (Why We Do It) | The Cons (The Price We Pay) |

|---|---|

| Guaranteed Revenue: The government portion (usually 70-100%) is direct-deposited. It never bounces. If the tenant loses their job, the PHA increases their portion to cover the rent. | Rent Caps (FMR): You cannot simply "raise the rent" because the market is hot. Your rent is capped by HUD's "Fair Market Rent" limits for that zip code. |

| Zero Marketing Costs: Demand is virtually infinite. In many metros, the Section 8 waiting list is 2-5 years long. You list a property, and it fills immediately. | The "Exit Strategy" Problem: Selling a home with a Section 8 tenant in place is harder. You are generally limited to selling to other investors, not families who want to move in. |

| Long-Term Tenure (Stickiness): Section 8 tenants stay an average of 7-8 years. Moving is a bureaucratic nightmare for them, so once they are in, they stay. | Bureaucracy & Inspections: You face strict annual inspections. If you fail, payments stop. You also deal with slow initial lease-ups (30-45 days to get the first check). |

The "Recession Hedge": Why Smart Money Loves Section 8

The most significant value of this strategy isn't just the monthly check; it's the market insulation it provides. In a recession, market rents typically drop because tenants earn less. In the Section 8 world, Fair Market Rents (FMRs) are sticky—they rarely drop significantly. While your neighbors are lowering rents to fill vacancies during a downturn, your government contract remains stable. It is the ultimate portfolio stabilizer.

The Hidden "Inflation Hack"

Many investors assume Section 8 rents are fixed forever. They are not. You can (and should) request a Rent Increase every year. If HUD raises the Fair Market Rent for your zip code to match inflation, you can submit a request to the PHA to match that new rate. I know landlords who get a 3-5% "government raise" annually just by filing one piece of paper.

⚠️ Pro Tip: The Danger of "Rent Abatement"

- What It Is: If your property fails an annual inspection and you do not fix the issues within the PHA's deadline (usually 30 days), the housing authority triggers Abatement.

- The Risk: They stop paying the rent immediately.

- The "Gotcha": Unlike a delayed payment, abated rent is forfeited forever. If you fix the issue 15 days late, you lose those 15 days of income. This is the government's way of forcing compliance. Rule #1: Never ignore an inspection notice.

Step 1: Finding The "Goldilocks" Property (Small Area FMRs)

The single most important decision in learning how to buy Section 8 housing is not just where you buy, but what you buy. Unlike market rentals, where you can raise the rent because you added granite countertops, Section 8 rents are capped by the government based on bedroom count and zip code.

To win, you must understand the "Spread"—the gap between the purchase price of the home and what HUD is willing to pay in rent.

The Secret Weapon: Small Area FMRs (SAFMR)

Most novice investors look at the "Metro FMR"—the average rent for the entire city. This is a mistake that leaves money on the table.

In many metropolitan areas, HUD now uses Small Area FMRs (SAFMR). Instead of setting one price for the whole city, they set prices by Zip Code. This creates massive arbitrage opportunities:

- Zip Code A (The Trap): Homes cost $450,000. SAFMR pays $2,800/mo. (Terrible ROI).

- Zip Code B (The Goldilocks Zone): Homes cost $160,000. SAFMR pays $2,200/mo. (Incredible ROI).

Go to the HUD User website and download the 2026 Small Area FMR data for your county. Filter for zip codes with high payment standards but lower property values. These are often working-class neighborhoods on the edge of gentrification.

The "Sweet Spot" Property Profile

In my experience, not all houses perform equally in this program. I recommend targeting this specific profile for maximum efficiency:

- 3 Bedrooms / 1-1.5 Baths: This is the "Magic Number." There is a massive shortage of 3-bedroom vouchers because families need space. 2-bedroom units have more competition (apartments), and 4-bedroom units are often too expensive to buy.

- Single Family Homes: Tenants prefer them over apartments because they want a yard for their kids. They stay longer in houses.

- "Bulletproof" Finishes: Do not install carpet or high-end stone. Use Luxury Vinyl Plank (LVP) flooring and semi-gloss paint. You want durability, not luxury.

The Math Check: Does It Pass the 1% Rule?

Before you make an offer, run this simple test. Does the monthly Section 8 rent equal at least 1% of the total purchase price?

Example: If you buy a house for $150,000, the Section 8 rent needs to be at least $1,500/month. If the HUD FMR is only $1,200, walk away. The numbers won't work once you factor in maintenance and taxes.

The Fast Track: Why You Need A Proven System

Here is the hard truth about finding deals:

Identifying the right zip code is the easy part. Actually acquiring a house in that area for a low enough price to hit the "1% Rule" is the hard part.

If you buy a property off the MLS (Zillow/Redfin) at full retail price, your mortgage payment will likely be too high to cash flow. You cannot compete with homeowners who buy with emotion.

To make the Section 8 model work, you must buy at a discount.

We use a specific strategy to find on-market properties. This is how we acquire rental assets for pennies on the dollar.

If you want the exact marketing scripts, deal analysis calculators, and negotiation tactics we use to find these hidden deals, you need our Ultimate Guide to Start Real Estate Investing. It is the blueprint for finding the deal before you place the tenant.

Step 2: The Approval Process (RFTA & Paperwork)

A common mistake investors make when learning how to buy Section 8 housing is assuming they need to "certify" the property with the government before they can market it. They call the housing authority and ask, "Can you come inspect my vacant house?"

The answer is always no.

The Golden Rule: You do not approve the house; you approve the tenancy. The process only begins after a voucher holder applies to live in your property.

The "RFTA" Packet: Your First Test

Once you accept a Section 8 tenant, they will hand you a thick packet of paperwork called the Request for Tenancy Approval (RFTA). This document tells the PHA everything about the deal. It typically includes:

- Unit Specifications: Address, square footage, year built, and proposed rent amount.

- Utility Responsibility Matrix: A checklist defining exactly who pays for Water, Sewer, Trash, Electric, and Gas.

- Lead-Based Paint Disclosure: Mandatory for all homes built before 1978.

- W9 & Direct Deposit Form: So the government can pay you.

The "Silent Deal Killer": Utility Allowances

This is the concept that confuses most new landlords. The HUD Voucher covers "Rent + Utilities." It does not cover "Rent" plus extra utilities.

The PHA assigns a Utility Allowance based on your property's efficiency. They subtract this allowance from the total amount they are willing to pay you.

The Math Formula:

Payment Standard (Voucher Value) – Utility Allowance = Maximum Rent You Can Charge

Let's look at a real-world example.

Assume HUD sets the Payment Standard (Total Voucher Value) for your zip code at $2,000.

- Scenario A: You Pay All Utilities (All-Bills-Paid)

Since the tenant has no utility bills, the government deducts nothing.

💰 Your Rent Check: $2,000 / mo - Scenario B: Tenant Pays Gas & Electric

The PHA estimates these bills cost $300/mo. They subtract this money from the voucher so the tenant can afford the lights.

💰 Your Rent Check: $1,700 / mo

If you shift the utility costs to the tenant, you lower your guaranteed government deposit.

Before buying, check the heating fuel source. A drafty house with expensive oil heat will have a massive Utility Allowance deduction, significantly lowering your cash flow.

"Rent Reasonableness": How to Negotiate Your Price

When you submit the RFTA, you will write down your "Asking Rent." The Housing Authority runs a Rent Reasonableness test, comparing your unit to unassisted (market) units in the same neighborhood.

If their database says your block is cheap, they might offer you $1,400, even if you asked for $1,600.

Do not just accept their lowball offer. You have the right to appeal.

1. Go to Zillow or Rentometer.

2. Find 3 active rental listings within 1 mile that are similar to yours (same bed/bath count).

3. Print them out and submit them to your Caseworker as "Comparable Proof."

I have seen rents increased by $100-$200/month just because the landlord provided better data than the government had on file.

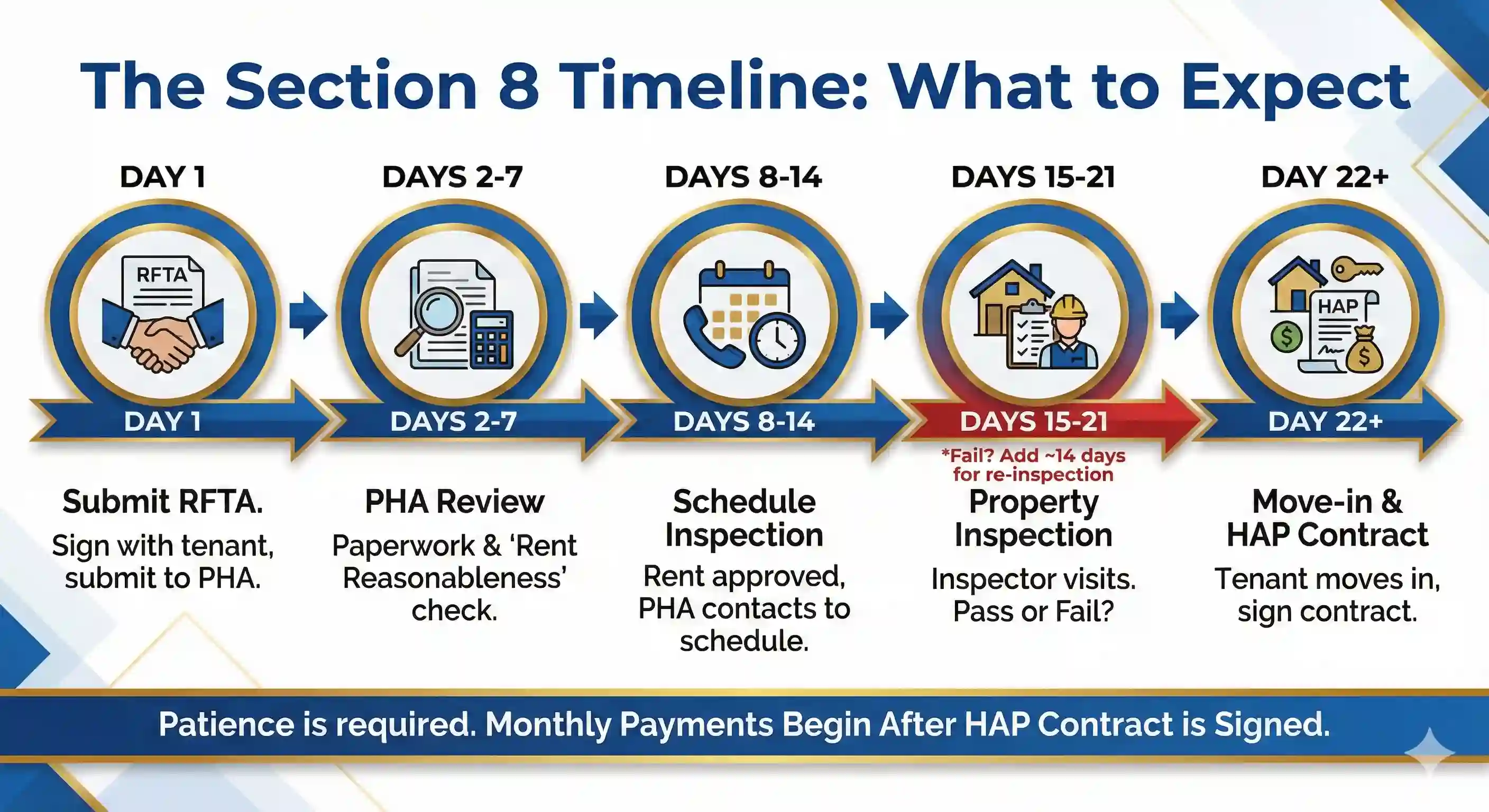

The Section 8 Timeline: What to Expect

Patience is required. Here is the typical sequence of events:

- Day 1: You and the tenant sign the RFTA and submit it to the PHA.

- Days 2-7: The Case Manager reviews the paperwork and checks Rent Reasonableness.

- Days 8-14: If the rent is approved, the PHA contacts you to schedule the inspection.

- Days 15-21: The inspector visits the property. (If you fail, add another 14 days for re-inspection).

- Day 22+: Move-in and HAP contract signing.

⚡ Pro Tip: The "Name Match" Error

- The Mistake: You bought the property in an LLC (e.g., "Main St Holdings LLC"), but you fill out the W9 with your personal name.

- The Result: The PHA will reject the entire packet, causing a 2-week delay.

- The Fix: Ensure the name on the Deed, the W9, and the Direct Deposit Voided Check match exactly. Bureaucracies do not tolerate typos.

Step 3: Passing the Inspection (HQS vs. NSPIRE)

This is the step where most investors fail when trying to buy Section 8 housing efficiently. In 2024/2025, HUD officially replaced the old "Housing Quality Standards" (HQS) with a stricter, data-driven system called NSPIRE (National Standards for the Physical Inspection of Real Estate).

If you are reading older guides that still mention HQS, they are outdated. The goal of NSPIRE is to prioritize safety over aesthetics. The inspector does not care if your paint color is ugly; they care if your smoke detector is 4 inches from the wall or if your outlet is ungrounded.

The "Automatic Fail" Checklist

Do not let the inspector find these issues. Fix them before you schedule the appointment to avoid a failed inspection:

- Smoke Detectors: Under NSPIRE standards, you generally need a hardwired or 10-year sealed lithium battery detector. You typically cannot use the cheap 9-volt ones anymore. They must be located:

- Inside every bedroom.

- Outside every sleeping area (within 21 feet of the door).

- On every level of the home (including basements).

- GFCI Outlets: You must have Ground Fault Circuit Interrupter (GFCI) outlets within 6 feet of any water source. This includes the kitchen sink, bathroom sink, and laundry tub. If they don't "trip" and "reset" when tested, you fail.

- Window Locks: Every ground-floor window must have a functioning lock. If a window is painted shut or the lock is broken, it is an automatic fail.

- Chipping Paint (Lead Hazard): If the house was built before 1978, any peeling or chipping paint (interior or exterior) is a "Lead-Based Paint Hazard." You must scrape, prime, and paint it properly. No bare wood allowed.

- Handrails: Any set of stairs with four or more risers must have a secure, graspable handrail.

The "24-Hour" vs. "30-Day" Rule

NSPIRE categorizes deficiencies by severity. You need to know the difference to manage your timeline:

- Life-Threatening (24-Hour Fix): Issues like a missing smoke detector, a gas leak, or a blocked exit door. You have exactly 24 hours to fix these, or the unit is disqualified.

- Severe/Moderate (30-Day Fix): Issues like a dripping faucet, a cracked window pane, or a missing light globe. You typically have 30 days to repair and prove it to the PHA.

⚡ Pro Tip: The Self-Inspection Hack

- The Problem: If you fail the initial inspection, you often have to wait 2-3 weeks for a re-inspection. That is 2-3 weeks of lost rent ($1,000+ gone).

- The Solution: Do not use the PHA inspector as your "Punch List" creator. Walk the property yourself with an outlet tester ($10 at Home Depot) and a window lock checklist before you submit the RFTA packet.

- The Payoff: Passing on the first try gets you paid a full month earlier than your competition.

Step 4: The HAP Contract & Getting Paid

Once you pass the inspection, you have officially learned how to buy Section 8 housing correctly. The final step is the paperwork that triggers the money: the Housing Assistance Payments (HAP) Contract.

This is a binding legal agreement between You (the Landlord) and the PHA (the Government). It runs concurrently with your lease. If the tenant breaks the lease, the HAP contract ends. If the HAP contract ends (due to failed inspections), the lease typically becomes voidable.

1. Signing the Deal (Watch the Math)

You will receive the HAP contract to sign. Do not just blindly autograph it. You must verify the numbers in Part A.

- Contract Rent: This is the total rent you are charging.

- Tenant Share: The amount the tenant pays you directly (usually 30% of their income).

- HAP Payment: The amount the government deposits into your account.

Double-check the utility breakdown here. If you agreed to pay for water but the contract says the tenant pays for it, the HAP payment will be calculated incorrectly. Fix this error before signing, or you will be stuck with a lower rent check for 12 months.

2. The Security Deposit: Who Pays?

This is the most common question I get: "Does the government pay the security deposit?" The answer: No.

The Section 8 voucher covers monthly rent only. It does not cover the security deposit. The tenant is 100% responsible for paying this upfront.

Many Section 8 tenants do not have $1,500 cash for a deposit. However, they often have access to local non-profit grants or "Homeless Prevention" funds that will issue a check on their behalf. Be patient, but do not hand over the keys until the full deposit is in your bank account.

⚡ Pro Tip: The "60-Day Drought"

- The Warning: Bureaucracy is slow. It often takes the PHA 30 to 60 days to process a new landlord into their system.

- The Result: You likely will not receive a rent check the first month the tenant moves in.

- The Good News: The payments are retroactive. In month 2 or 3, you will receive a large lump-sum deposit covering all previous months.

- The Strategy: Ensure you have enough cash reserves to pay the mortgage for 2 months without rental income. Do not rely on that first check to pay the bill.

Screening Section 8 Tenants (Legal Landmines)

There is a dangerous myth that if you decide to buy Section 8 housing, you are forced to accept any tenant the government sends you. This is false.

The Public Housing Authority (PHA) screens tenants for income eligibility (are they poor enough?) and lifetime sex offender status. That is it. They do not check if the tenant destroyed their last apartment or if they pay their bills on time. That is your job.

However, you must navigate a minefield called "Source of Income" (SOI) Discrimination. Depending on your state, saying "No Section 8" can either be perfectly legal or cost you a $50,000 lawsuit.

The "Source of Income" Map: Are You in a Protected State?

In the last 24 months, the legal landscape has shifted dramatically. You must know which list your state falls into:

🚫 The "Must Accept" States

In these areas, Source of Income is a protected class. You cannot deny an applicant because they use a voucher. You must treat the voucher exactly like a salary.

- California: Under the Fair Employment and Housing Act (FEHA), refusing Section 8 is illegal.

- New York: The State Human Rights Law bans SOI discrimination statewide. Fines can exceed $20,000.

- Illinois: The Human Rights Act (updated 2023) now protects vouchers statewide.

- Washington & D.C.: Strict enforcement with "Testers" who call landlords to catch them saying "No Section 8."

✅ The "Landlord Choice" States

In these areas, state law generally allows you to decide whether or not to participate in the voluntary Section 8 program.

- Texas: State law explicitly preempts cities from passing SOI bans (except for Veteran vouchers). You can legally say "No Section 8."

- Florida: No statewide ban on SOI discrimination (though some local counties like Miami-Dade have their own rules).

- Georgia & Arizona: Generally allow landlords to refuse vouchers without penalty.

The "Safe Screening" Matrix

Even in strict states like California or New York, you do not have to accept bad tenants. You just have to change why you deny them. Follow this matrix to stay out of court:

| Instead of saying... (Illegal) | Screen for this... (Legal) |

|---|---|

| "We don't take Section 8." | Credit Score: "We require a minimum 600 credit score for all applicants." |

| "We don't want to deal with the PHA inspection." | Rental History: "We require 3 years of positive landlord references with no prior evictions." |

| "You don't make enough money." | Income Ratio: "You must make 3x your portion of the rent." (Note: Do not ask them to make 3x the total rent, as the voucher covers the rest). |

Frequently Asked Questions (FAQ)

Here are the direct answers to the most common questions regarding how to buy Section 8 housing, calculate your guaranteed rent, and protect your asset in 2026.

Final Thoughts: Is Section 8 Right For You?

Learning how to buy Section 8 housing is not about finding a magic "passive income" button. It is about choosing a specific business model.

If you want a hands-off investment where you never speak to a soul, buy a REIT index fund. But if you are willing to navigate the initial bureaucracy, pass the inspections, and treat your tenants with respect, Section 8 offers something the stock market never can: predictability.

In a world where layoffs happen overnight and economies shift in weeks, having a contract with the United States government to pay your mortgage is the ultimate sleep aid.

If you want high returns on your Section 8 rentals, you can't pay retail prices. Our FREE Training walks you through the exact system we use to find discounted off-market properties perfect for the BRRRR method and long-term cash flow—without expensive marketing.

The government guarantees the rent, but YOU have to find the deal. Watch this FREE Training to learn how to acquire profitable rental assets fast.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.