Steadily Insurance Reviews (2026): The Landlord’s "Safe Harbor" or Risky Bet?

Dec 17, 2025Key Takeaways: Steadily Insurance Reviews

- What: A specialized "InsureTech" brokerage (MGA) focusing exclusively on landlord, short-term rental (Airbnb), and fix-and-flip properties.

- Why: They fill the coverage gap for "hard-to-place" properties—like older homes or high-risk coastal zones—that standard carriers (State Farm, Allstate) often reject.

- How: Steadily uses a network of both "Admitted" and "Non-Admitted" (Surplus Lines) carriers to generate quotes in minutes, not days.

What You’ll Learn: Whether the speed and flexibility of Steadily are worth the potential risks of using "Surplus Lines" coverage in the 2026 market.

If you are a real estate investor in 2026, you already know the painful truth: the insurance market is broken.

Premiums in key investment states like Florida, California, and Texas have surged, with some landlords seeing renewals jump 20-40% overnight. Worse, major carriers are exiting entire zip codes, leaving investors scrambling to find any coverage that satisfies their lender's requirements.

Enter Steadily Insurance reviews and the buzz surrounding this tech-forward brokerage. They claim to be the solution for the modern investor, offering rapid quotes for everything from standard rentals to high-risk Airbnbs. But are they a legitimate savior for your portfolio, or are they just a middleman with a slick app?

This is not a generic summary. We are going to audit their actual policy structures, explain the critical difference between "Admitted" and "Surplus" carriers (which most reviews ignore), and help you decide if Steadily is safe for your assets.

(Note: Insurance protects your downside, but you make your money on the upside. If you are still looking for deals with margins deep enough to absorb 2026 insurance hikes, make sure you download our Ultimate Guide to Start Real Estate Investing.)

Here is what we will cover:

- What Is Steadily? (Broker vs. Carrier)

- The "Surplus Lines" Risk Protocol

- Pricing & Coverage Analysis

- User Reviews & Audit Proofing

- Steadily vs. Obie & NREIG

- Frequently Asked Questions

Insurance is just a defense. Real estate investing requires offense.

You can have the best landlord policy in the world, but if you buy the wrong property at the wrong price, you still lose money. The cost of insurance is just one piece of the puzzle; the real profit is made when you buy.

We teach you how to buy right, so insurance spikes don't kill your cash flow. Watch this free training to learn the "offense" side of the business.

What Is Steadily Insurance? (The "Broker" vs. "Carrier" Distinction)

If you are looking for Steadily Insurance reviews, the first thing you must understand is that Steadily is not technically an "insurance company"—they are a specialized broker and Managing General Agent (MGA).

This is a critical distinction for your asset protection.

Unlike State Farm or Allstate, which hold your money and pay your claims directly, Steadily "holds the pen" for other insurance carriers. They use proprietary technology to assess your property's risk in minutes, and then they place your policy with one of their partner carriers (such as Obsidian Specialty or Main Street America).

Why does this matter?

Because it allows Steadily to insure properties that most big banks and standard insurers reject. By acting as a broker for multiple back-end carriers, they can find coverage for the "ugly ducklings" of real estate:

- Short-Term Rentals: Airbnbs and VRBOs (which many standard carriers strictly forbid).

- Vacant Homes: Properties sitting empty during a rehab or fix-and-flip project.

- Older Properties: Homes with roofs older than 15 years or outdated wiring.

- High-Risk Zones: Coastal properties in Florida or Texas that have been dropped by major insurers.

However, this flexibility comes with a specific trade-off that most investors overlook: the use of "Surplus Lines" carriers.

The "Surplus Lines" Risk Protocol (Read Before Buying)

This is the section that most Steadily Insurance reviews skip, but it is the most important part of your decision process.

To cover high-risk properties (like an Airbnb in a hurricane zone), Steadily often uses what are called "Non-Admitted" or "Surplus Lines" carriers. In states like California and Florida, where standard carriers are exiting the market in 2026, this is often the only way to get insured.

But you need to know the legal difference. "Admitted" carriers are backed by the state; "Surplus" carriers are not.

| Feature | Standard "Admitted" Carrier | Steadily "Surplus Lines" Carrier |

|---|---|---|

| State Guaranty Fund | YES. If the insurer goes bankrupt, the state pays your claim (up to a limit, usually $300k-$500k). | NO. If the underlying carrier (e.g., Canopius) goes bankrupt, you have zero recourse. |

| Rate Regulation | Strict. State must approve all rate hikes. | Flexible. Carriers can raise rates faster to match risk. |

| Taxes & Fees | Standard premium tax. | Higher. You pay additional "Surplus Lines Taxes" and "Stamping Fees" (often 5-10% extra). |

| Flexibility | Low. Strict underwriting guidelines. | High. Will insure vacant homes, knob & tube wiring, and old roofs. |

Experience Tip: The "Diligent Search" Rule

- The Law Changed: In the past, agents had to prove they were rejected by 3 standard carriers before selling you a Surplus Lines policy.

- The 2026 Reality: Recent legislation (like Florida's SB 1549) has repealed or relaxed these "Diligent Search" requirements to speed up the market.

- Our Advice: Do not just accept the first quote. Ask your Steadily agent: "Is this an admitted or non-admitted policy?" If it is non-admitted, ask if there were any admitted options available, even at a slightly higher price. The state guarantee is often worth the extra premium.

Steadily Pricing & Coverage Analysis: Are They Actually Cheaper?

When you see ads for Steadily insurance cost savings, usually claiming "rates 20% lower than the competition," you need to read the fine print. In the 2026 market, pricing is rarely about which brand you choose; it is about which risk bucket your property falls into.

Based on our analysis of quotes across multiple states (including FL, TX, and OH), here is the honest truth about their pricing model:

1. The "Vanilla" Rental (Single-Family, Long-Term Tenant):

If you own a standard rental property—built after 2000, good roof, long-term tenant—Steadily is rarely the cheapest option. In these scenarios, "Admitted" carriers like State Farm or local mutuals often beat them because they don't charge the extra taxes and fees associated with Surplus Lines brokers.

2. The "Complex" Rental (Airbnb, Vacant, Older Home):

This is where Steadily wins. If you try to insure a short-term rental with a standard carrier, they will either reject you or force you into a commercial "Hotel/Motel" policy that costs a fortune. Steadily compares that commercial rate against their specialized landlord product, and that is where the "20% cheaper" claim comes from. They are replacing an expensive commercial policy with a tailored residential one.

The Coverage "Gotchas" (Read Your Declarations Page)

Because Steadily often acts as a broker for Surplus Lines carriers, the policies they sell can be more restrictive than a standard homeowner's policy. When performing a landlord insurance quote comparison, you must look for these specific exclusions:

- Vacancy Clauses: Most Steadily policies have a strict "30-Day or 60-Day Vacancy Clause." If your renovation runs over schedule and the house sits empty, coverage for vandalism and glass breakage often automatically vanishes unless you buy a specific "Vacant Home" endorsement.

- Ordinance or Law: This covers the cost of bringing a damaged building up to current building codes during repairs. On many basic landlord policies, this is excluded by default. If your 1970s rental burns down, you might have to pay $20k+ out of pocket to upgrade the electrical to 2026 code.

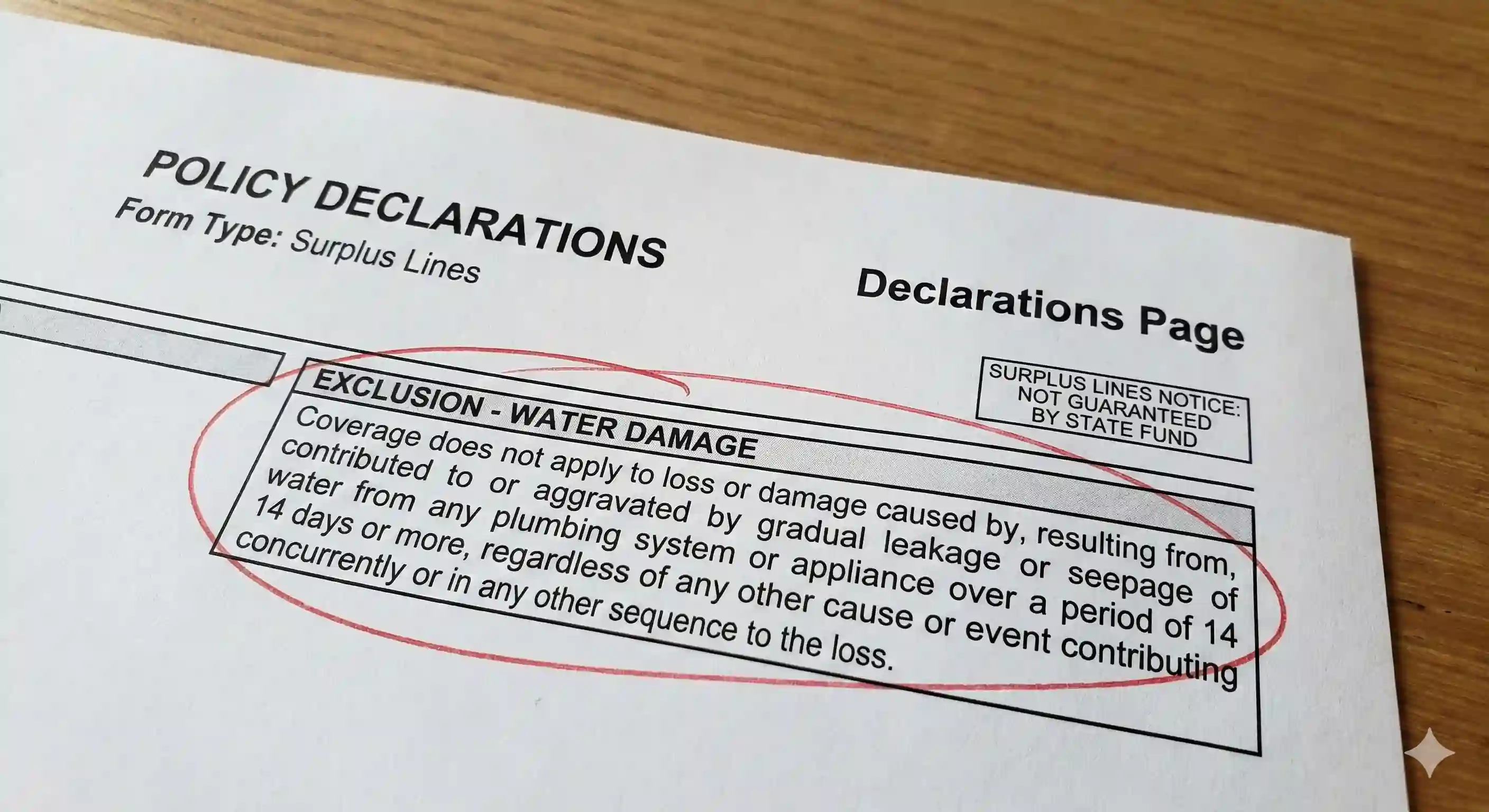

The "Water Damage Loophole" (Crucial Check)

- The Trap: Many budget landlord policies contain a water damage exclusion for "Gradual Damage."

- The Scenario: A pipe leaks slowly inside a wall for three months before you notice it.

- The Result: If your policy only covers "Sudden and Accidental" discharge, this claim will be denied because it was "gradual."

- The Fix: Check your Steadily quote for a specific endorsement called "Water Backup and Sump Pump Overflow" or language that explicitly covers "seepage and leakage." Do not assume it is included.

The Fast Track: Why You Need A Proven System

Here is the hard truth about Insurance Costs:

You cannot control the insurance market. In 2026, premiums are going up, and coverage is getting tighter.

If you buy a property off the MLS at full retail price, a sudden $500/year insurance hike can wipe out your entire cash flow.

To make this model work, you must buy with enough margin to absorb these costs.

We use a specific strategy to find properties before they hit the market. This allows us to acquire rental assets for pennies on the dollar, leaving plenty of room for insurance, repairs, and profit.

If you want the exact marketing scripts, deal analysis calculators, and negotiation tactics we use to secure these high-margin deals, you need our Ultimate Guide to Start Real Estate Investing. It is the blueprint for finding the deal before you place the tenant.

User Reviews & "Audit Proofing" Your Experience

If you research Steadily Insurance reviews on Reddit or the Better Business Bureau (BBB), you will notice a polarized trend. Users either love the speed (Trustpilot rating: 4.8/5) or they feel "scammed" by a sudden price hike.

The Most Common Complaint: The "Bait and Switch"

Multiple investors have reported a scenario where they receive a quote for $1,200/year, pay the deposit, and then receive a notice two weeks later that the premium has jumped to $1,800/year or the policy is being cancelled.

Why Does This Happen?

It is usually not malicious; it is mechanical. Steadily’s algorithm generates an instant quote based on public data. However, once a human underwriter reviews the file (often days later) or an inspection is performed, they may find risk factors the algorithm missed—like a roof older than 15 years or a tree overhanging the driveway. The premium is then "adjusted" to match the real risk.

How to Stop It: The "Binding Verification Protocol"

Do not let an automated system dictate your cash flow. Use this checklist to "audit-proof" your policy before you cancel your old insurance.

The Binding Verification Checklist

- 1. Demand the "Binder," Not Just the Quote: A quote is a guess. A "Binder" is a temporary legal contract. Do not consider yourself insured until you have a document explicitly titled "Insurance Binder" or "Evidence of Property Insurance."

- 2. The "Subject To" Review: Ask your agent specifically: "Is this binder 'Subject to Inspection'?" If yes, the price can still change. Ask to see the inspection requirements upfront (e.g., 4-point inspection) to avoid surprises.

- 3. Check the "Effective Date": Ensure the binder start date overlaps with your current policy by at least 24 hours. Never leave a gap.

- 4. Verify "Loss Settlement" Type: Confirm the binder lists "Replacement Cost" (New for Old) and not "Actual Cash Value" (Depreciated Value), which is common in cheaper quotes.

Steadily vs. The Competition (Obie, NREIG, Foremost)

Steadily is a powerful tool, but it is not the only option. Depending on your portfolio size and property type, one of these competitors might be a better fit.

| Provider | Best For... | The Pros | The Cons |

|---|---|---|---|

| Steadily | Difficult Properties (Airbnbs, Vacant, Coastal, Fix-and-Flip). | Will insure almost anything. Fast quotes. Excellent for short-term rentals. | Can be expensive for "vanilla" rentals. Heavy use of Surplus Lines. |

| Obie | Standard Rentals (Single-Family, Long-Term Tenants). | Often faster and cheaper for simple properties. Instant binding capability. | Less flexible with high-risk properties or unique situations. |

| NREIG | Large Portfolios (10+ Units). | "Master Policy" model simplifies billing (one monthly bill for all units). Easy to add/drop units. | Customer service can be slow. Reporting requirements are strict (monthly reporting). |

Frequently Asked Questions About Steadily Insurance

We analyzed the most common queries from real estate investors to give you direct, "no-fluff" answers.

Final Verdict: Is Steadily Right for You?

In the chaotic 2026 insurance market, Steadily serves a very specific purpose. They are not the cheapest option for the "perfect" landlord with a brand-new house and a 12-month tenant. For that person, a standard carrier is likely better.

However, if you are an investor buying "imperfect" properties—older homes, Airbnbs, coastal rentals, or fix-and-flips—Steadily is an essential tool in your belt. They provide speed and access to coverage that simply doesn't exist elsewhere.

Our Final Recommendation: Use Steadily for the "hard stuff." Just remember to audit your policy for the "Water Damage Loophole" and verify your binder before cancelling your old coverage. If you own a standard, new-construction single-family home with a long-term tenant, Steadily will likely be 15-20% more expensive than a local State Farm agent. Save your money.

Insurance is just a defense. Real estate investing requires offense.

You can have the best landlord policy in the world, but if you buy the wrong property at the wrong price, you still lose money. The cost of insurance is just one piece of the puzzle; the real profit is made when you buy.

We teach you how to buy right, so insurance spikes don't kill your cash flow. Watch this free training to learn the "offense" side of the business.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.