Real Estate Appraiser Salary (2026): The Truth About Fees, AMCs & Income

Dec 12, 2025

Key Takeaways: Real Estate Appraiser Salary

- The Role: Appraisers are the "Gatekeepers" of the industry. Agents determine price, but Appraisers determine value—and the bank only cares about value.

- The Salary Reality: While six-figure incomes are possible, the rise of Appraisal Management Companies (AMCs) has created a massive "fee squeeze," taking up to 50% of your gross fees.

- The Opportunity: How to bypass the residential grind by upgrading to Commercial (MAI) or using your valuation "superpower" to become a high-level investor.

What You’ll Learn: The honest breakdown of 2026 appraiser income, the "Trainee Bottleneck," and how to build a career that isn't dependent on low-fee AMC work.

The real estate appraiser salary is one of the most misunderstood numbers in the housing industry.

In a world full of sales agents hyping up listing prices and bidding wars, the Appraiser is the "Referee." You are the unbiased, data-driven expert who walks into a property and tells the bank what it is actually worth. It is a powerful position—nothing closes without you. But in 2026, that power doesn't always translate into a paycheck that reflects your value.

If you search "how much do appraisers make," you might see averages floating around $60,000 to $100,000. But those averages hide a harsh reality: The Fee Squeeze.

For many residential appraisers, the gross fee paid by the borrower (often $600+) is stripped down by Appraisal Management Companies (AMCs) before it ever hits your bank account. You might be doing $600 worth of work for a $300 split. This complex system has created a divide in the industry: those who are stuck on the "hamster wheel" of high-volume, low-fee work, and those who have cracked the code to earn a premium real estate appraiser income in 2026.

Is real estate appraisal a good career? Absolutely—if you know how to navigate the "Trainee Bottleneck" and position yourself in the right niche. In this guide, we will break down the difference between the residential grind and the commercial goldmine, and show you how to stop trading your time for half-priced reports.

Here is what we will cover:

- What Does a Real Estate Appraiser Do? (The Science of Value)

- Real Estate Appraiser Salary in 2026 (The Hard Numbers)

- The "AMC Trap": Gross Fee vs. Net Income

- The Barrier to Entry: The Trainee Bottleneck & PAREA

- How to Increase Your Income (Career Growth)

- The "Hidden Perk": Using Valuation Skills to Invest

- Frequently Asked Questions (FAQ)

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Does a Real Estate Appraiser Do? (The Science of Value)

To understand the salary, you first have to understand the job. Many people confuse appraisers with inspectors, but the difference is critical. An inspector looks for problems (broken pipes, bad wiring); an appraiser looks for value.

So, what does a real estate appraiser do exactly? They act as an unbiased, third-party expert hired to determine the "Fair Market Value" of a property. While an agent is an advocate for their client (trying to get the highest price), the appraiser is an advocate for the property (trying to find the true price).

The 4-Step Appraisal Process

It is not just about walking through a house for 20 minutes. The bulk of the work happens behind a desk. Here is the standard workflow:

- 1. Data Verification: Before leaving the office, the appraiser pulls tax records, flood maps, and zoning data to verify exactly what is legally sitting on the land.

- 2. The Inspection: The appraiser measures the square footage (GLA), takes photos of every room, and notes upgrades or deferred maintenance. Unlike a home inspector, they aren't testing every outlet; they are looking for "value-adds" and "value-detractors."

- 3. The Adjustment Grid (The Math): This is the core of the job. The appraiser selects 3-6 comparable sales ("comps") and makes dollar-value adjustments. If a comp has a pool and the subject property doesn't, they deduct value to level the playing field.

- 4. Reconciliation: Finally, they weigh the data to arrive at a single, defensible opinion of value.

The "Big Three" Comparison

If you are looking to enter the industry, you need to know where you fit in the ecosystem. Here is the breakdown of the three primary roles in a transaction:

| Professional | Determines... | Primary Goal |

|---|---|---|

| Real Estate Agent | Price (Marketing) | To get the highest possible price for the seller (or best deal for the buyer). |

| Home Inspector | Condition (Defects) | To identify safety issues and repairs needed (roof, HVAC, plumbing). |

| Real Estate Appraiser | Value (Collateral) | To protect the lender by ensuring the property is worth the loan amount. |

Real Estate Appraiser Salary in 2026 (The Hard Numbers)

When you look at salary aggregates from sites like Salary.com or Glassdoor, they often lump all appraisers into one bucket. This is misleading. A real estate appraiser's salary varies widely depending on your license level. In this industry, your license is your income cap.

The career path is a strict ladder: Trainee, Licensed Residential, Certified Residential, and Certified General. Each rung requires more education and experience, but unlocks significantly higher earning potential.

The Income Hierarchy

Here is a realistic breakdown of what you can expect to earn at each stage of your career in 2026:

| License Level | Avg Annual Income | The Reality |

|---|---|---|

| Trainee Appraiser | $30,000 - $45,000 | The "Apprenticeship." Often paid hourly or a small % of the supervisor's fee. Very hard to find a mentor. |

| Licensed Residential | $55,000 - $70,000 | Limited scope. Can only appraise non-complex homes under $1M. Often stuck doing low-fee AMC work. |

| Certified Residential | $75,000 - $100,000+ | The industry standard. Can value any residential property. High volume is required to break six figures. |

| Certified General (Commercial) | $100,000 - $175,000+ | The "PhD" level. Valuing shopping centers, hotels, and land. Fees are often 5x-10x higher than residential. |

Geography Matters: High-Fee vs. Low-Fee States

Just like real estate prices, appraisal fees are local. In states with complex terrain or high regulation (like Washington, Oregon, and Colorado), appraisal fees are typically higher because the reports take longer and liability is higher. In states with flat terrain and lower cost of living (like Alabama or Mississippi), fees—and subsequently annual incomes—tend to be lower.

However, regardless of where you live, the biggest threat to your income isn't the market; it is the middleman. To understand why a $100,000 gross income might only feel like $60,000, we need to look at the "AMC Trap."

The "AMC Trap": Gross Fee vs. Net Income

If you ask a veteran appraiser why the industry has changed, they will point to one specific turning point: The Dodd-Frank Act of 2010. Before this regulation, appraisers often had direct relationships with local lenders. They could negotiate their own fees and turnaround times.

To prevent conflicts of interest (like loan officers pressuring appraisers to hit a number), regulations effectively inserted a middleman: The Appraisal Management Company (AMC). While this created a buffer, it also created a massive "fee squeeze" that directly impacts your bottom line.

The "Fee Split" Reality

Here is the math that most aspiring appraisers don't see until they are licensed. When a borrower pays for an appraisal at closing, they might see a line item for $600 or $700. They assume that money goes to you. It does not.

The AMC typically collects the full fee, takes a "management fee" off the top (often 30% to 50%), and pays the appraiser the remainder. This is the AMC fee split.

The Breakdown of a $600 Order:

- Borrower Pays: $600

- AMC Keeps: $300 (Administrative Fee)

- Appraiser Earns: $300

You are doing 100% of the field work, liability, and analysis, but you are often receiving 50% of the market value of that report. To make a living on $300 orders, you are forced into a high-volume model, which leads to burnout.

The "Appraiser Burn Rate"

From that remaining $300, you still have to pay your own business overhead. Unlike real estate agents who often get tech stacks provided by their brokerage, independent fee appraisers pay for everything themselves.

Here are the non-negotiable appraiser overhead costs you must budget for:

The Cost of Doing Business

- Appraisal Software: You cannot write a compliant report in Word. You need specialized software like TOTAL by a la mode. Cost: $1,000 - $1,400+ per year (plus add-ons for sketching and flood maps).

- MLS Dues: You need data to pull comps. Appraisers typically pay the full "Realtor" dues to access the local MLS, even though they don't earn commissions. Cost: $800 - $1,500 per year.

- E&O Insurance: You carry significant liability. Errors & Omissions insurance is mandatory for most lender work. Cost: $800 - $1,200 per year.

- Gas & Vehicle Wear: Appraisers live in their cars. It is not uncommon to drive 20,000+ miles a year inspecting properties. Cost: $300 - $500+ per month in fuel and maintenance.

When you subtract the AMC split and the monthly overhead, the "hourly wage" of a residential appraiser can drop significantly. This is why the smartest appraisers don't just rely on AMC work—they look for ways to bypass the middleman entirely.

The Barrier to Entry: The Trainee Bottleneck & PAREA

If you search forums for "how to become an appraiser," you will see the same complaint over and over: "I have finished my classes, passed the exam, but I cannot find a supervisor."

This is the Trainee Bottleneck. To get licensed, you typically need 1,000 to 1,500 hours of field experience under a Certified Appraiser. The problem? Most experienced appraisers refuse to take on trainees.

From the supervisor's perspective, training you is a financial loss. It slows them down, increases their liability, and once you are trained, you become their direct competitor in the local market. For years, this "closed loop" system kept new blood out of the industry. But in 2026, the game has changed.

The Solution: PAREA (No Mentor Needed)

Recognizing this shortage, the Appraisal Foundation introduced a game-changing alternative called the Practical Applications of Real Estate Appraisal (PAREA). This program allows you to gain your required experience hours online, without ever needing to find a grumpy mentor to let you ride in their car.

PAREA: The New Fast-Track to Licensure

- What is it? PAREA is a digital, simulation-based training program. Instead of inspecting real houses with a supervisor, you inspect virtual properties using 3D models and VR technology.

- The Benefit: It completely eliminates the need to find a local appraisal trainee supervisor. You can log your experience hours on your own schedule from your home office.

- The Scope: Currently, PAREA is approved for the Licensed Residential and Certified Residential tracks. It is accepted in the majority of states (over 40 states have adopted it as of 2026).

- The Cost: While the program costs money (typically a few thousand dollars), it is often cheaper than working for free (or low split) for two years as a traditional trainee.

If you have been hitting a wall trying to figure out how to find an appraiser mentor, check your state board's website to see if they accept PAREA. It is the most reliable way to bypass the gatekeepers and start your career.

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

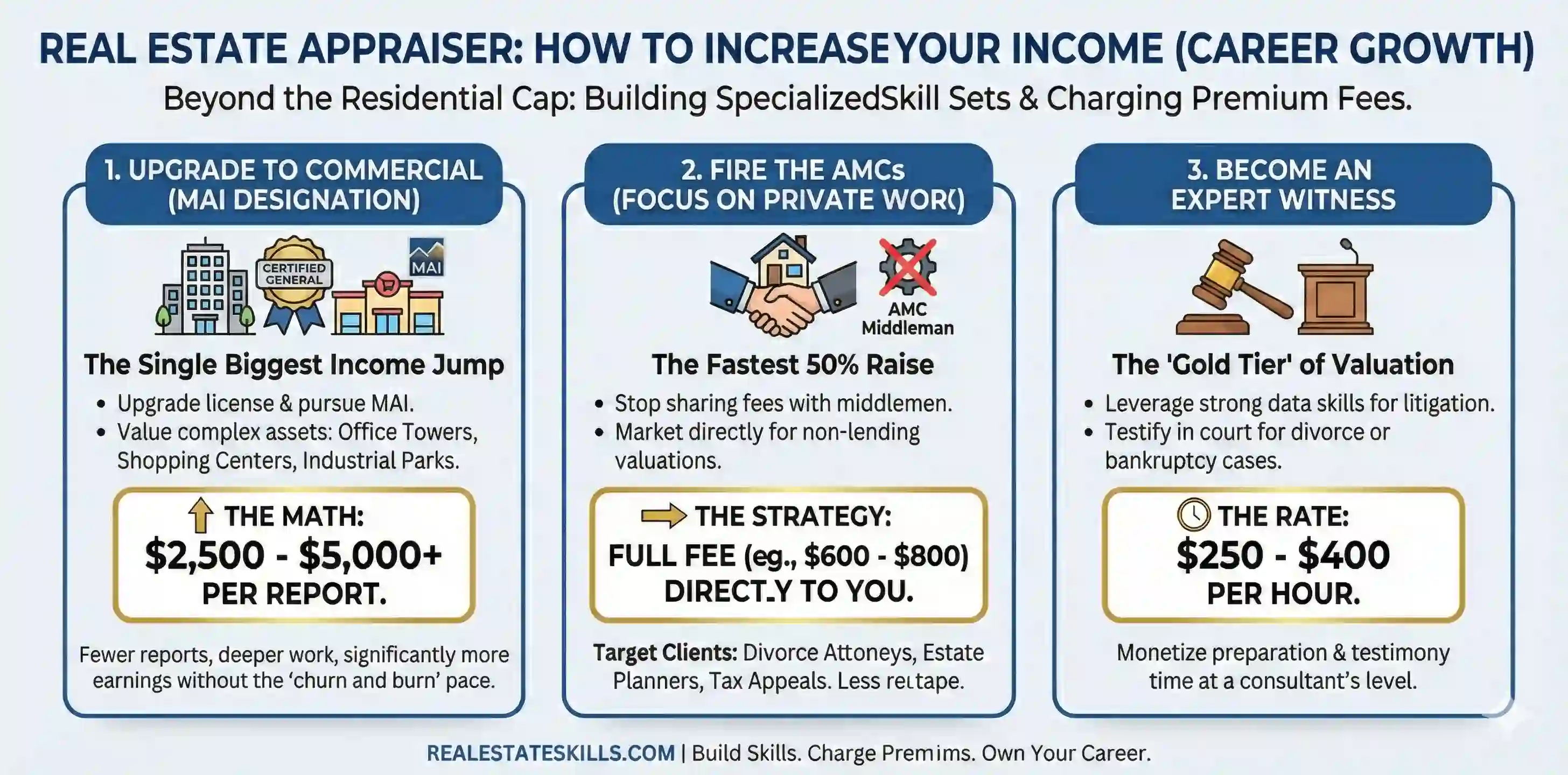

How to Increase Your Income (Career Growth)

If you look at the salary tables above and feel discouraged by the "Licensed Residential" cap, realize that this is just the floor. The highest-paid appraisers in the industry do not rely on AMCs. They build specialized skill sets that allow them to charge premium fees.

Here are the three most effective strategies to scale your earnings:

- 1. Upgrade to Commercial (The MAI Designation)

The single biggest income jump comes from upgrading your license to Certified General and pursuing the MAI designation (Member of the Appraisal Institute). While residential appraisers grind out 3-4 reports a week for $400 each, commercial appraisers value shopping centers, office towers, and industrial parks.

- The Math: Commercial appraisal fees typically range from $2,500 to $5,000+ per report. You can do fewer reports, work deeper on complex valuation problems, and earn significantly more without the "churn and burn" pace.

- 2. Fire the AMCs (Focus on Private Work)

The fastest way to give yourself a 50% raise is to stop sharing your fee with a middleman. Private appraisal work involves marketing directly to clients who need valuations for reasons other than a mortgage.

- The Strategy: Market your services to divorce attorneys, estate planners, and homeowners fighting property tax assessments. These clients pay full fee (e.g., $600 - $800) directly to you, with no AMC split and often less red tape than a lender-compliant report.

- 3. Become an Expert Witness

If you have strong data skills and can handle pressure, litigation support is the "gold tier" of residential appraisal. Attorneys frequently hire appraisers to testify in court regarding property values in contentious divorce or bankruptcy cases.

- The Rate: Real estate expert witness rates typically range from $250 to $400 per hour for preparation and testimony. This allows you to monetize your time at a consultant's level rather than a flat-fee level.

The "Hidden Perk": Using Valuation Skills to Invest

While the real estate appraiser's salary is capped by how many reports you can write, there is one aspect of the job that has uncapped potential: Your brain.

The number one reason real estate investors lose money on flips is that they overestimate the After Repair Value (ARV). They guess what a house will sell for. Appraisers don't guess; they prove it.

Real estate investing for appraisers is a natural pivot because you possess the specific skill set that investors are desperate for: calculating ARV with precision. Many savvy appraisers use their license to create a second stream of income:

- Spotting Deals: You are inside distressed properties every day (foreclosures, estate sales, divorces). While you cannot buy a property you are actively appraising (conflict of interest), you learn the neighborhoods and "pockets of value" better than any agent.

- Equity Partnerships: Instead of charging an investor $400 for a valuation, some appraisers partner with flippers. You provide the risk analysis and value projection in exchange for a percentage of the deal's profit, turning a flat fee into an equity check.

The Blueprint: Turn Data Into Dollars

Transitioning from a fee-based appraiser to an equity-based investor doesn't mean you have to quit your day job. It just means you need a new playbook. You already understand the math; now you need to master the mechanics of finding off-market deals and structuring contracts.

That is why we created the Ultimate Guide to Start Real Estate Investing. It fills the gap between "knowing what a house is worth" and "knowing how to profit from it."

Whether you want to build a rental portfolio to replace your AMC income or just flip one house a year for a bonus, this guide covers the A-to-Z of the investment process.

Ready to leverage your skillset? Click the image below to download your FREE copy of the Ultimate Guide now.

Frequently Asked Questions (FAQ)

Here are the direct answers to the most common questions regarding the real estate appraiser salary, career stability, and how it compares to other industry roles in 2026.

Final Thoughts: The Value is in the Skill, Not Just the Fee

Real estate appraisal is not a career for those seeking a "get-rich-quick" scheme; just look at the average real estate appraiser salary. It is a profession defined by precision, ethics, and stability. However, the barriers to entry—from finding a mentor to surviving the low-wage trainee years—are higher than in almost any other sector of real estate.

The takeaway is this: Don't view your license merely as a ticket to write reports for AMCs. View it as a masterclass in value. Whether you choose to upgrade to the commercial sector for higher fees or leverage your knowledge to build your own investment portfolio, the ability to determine true market value will always be in demand.

You have the data. Now you need the strategy to monetize it fully.

If you are ready to take your valuation skills and apply them to building real equity—not just collecting fees—we have the blueprint waiting for you.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.