Why Net Worth EXPLODES After $100K (& The STEP-BY-STEP Secret)!

Jul 11, 2025

You’ve probably heard it a hundred times—the wealthiest people don’t work for money; they make money work for them. But let’s be real: when does this actually start happening? And how much do you really need before your money starts working harder than you do?

Most people assume it takes millions before compounding starts making a difference. But what if I told you the real number is just $100,000?

That’s the tipping point—the moment when your net worth doesn’t just grow, it snowballs. And today, I’m going to show you exactly why your net worth explodes after $100,000 and how real estate can be the fastest way to get there.

This isn’t just theory—it’s math. Once you see the numbers, you won’t be asking if you should start investing. You’ll be wondering how fast you can make it happen.

And don’t worry, I’ll walk you through the process step-by-step, just like I do in my Getting Started in Real Estate guide, which you can actually get for free at the end. So let’s dive in.

In this blog, you'll learn about:

- The Power of Compounding Explained

- Why $100K Net Worth Is a Breakthrough

- How Real Estate Accelerates Wealth Building

- How To Build $100K Net Worth Step-by-Step

- Compounding Wealth Through Real Estate

- $100K as a Launchpad, Not Just a Goal

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

The Power of Compounding Explained

Reaching your first $100,000 can feel incredibly challenging. Imagine I give you two options: Option A—I hand you a million dollars today. Option B—I give you a single penny, but it doubles every day for 30 days.

Most people would jump at the million because it sounds like the obvious choice. But let’s look at what actually happens with the penny.

If the penny doubles every day, on Day 1, you have 1 cent. Day 2, 2 cents. Day 5, 16 cents. Day 10, $5.12. At this point, you might feel like you’ve made a huge mistake.

But here’s where it gets interesting:

- Day 15, $163.84.

- Day 20, $5,242.88.

- Day 25, $167,772.16.

By Day 28, you're over $1.3 million. And on Day 30, that single penny becomes $5.368 million.

That’s over $5 million from one single penny, just by letting compounding do its thing. But here’s the most important part: you had to push through the slow start. You had to trust the process even when it felt like nothing was happening.

Most people quit during this stage because they don’t see the results they expect. And that’s exactly what happens with wealth building.

Why $100K Net Worth Is a Breakthrough

Reaching a $100,000 net worth is kind of like hitting Day 20 in the penny example. At first, progress feels painfully slow. You’re grinding, saving, working extra hours—and it doesn’t feel exponential.

But if you stay the course, your wealth starts compounding in ways you never imagined. Once you hit that first $100,000, your money finally starts making money.

Now, your investments grow faster than the effort you’re putting in. And you stop asking, “How can I save more?” and start asking, “Where can I invest smarter?”

How Real Estate Accelerates Wealth Building

This is exactly where real estate can come in. Because time in the market is more important than trying to time the market.

Waiting for the perfect time to invest is how many people stay broke. The best time to start was yesterday. The second-best time is right now.

That’s what I love to teach—how to start investing the right way, no matter the market or economy. Because five years from now, you won’t wish you waited. You’ll wish you had started today.

Now I know what you might be thinking. “Real estate sounds great, but I don’t have the money or experience.” Here’s the truth—you don’t need any of that to get started.

What you actually need is a proven path and strategy. I don’t typically advise people to buy rental properties on day one. That’s the end goal.

At Real Estate Skills, we teach something called the Evolution of a Real Estate Investor. It’s a step-by-step process that lets you start wherever you are and begin building momentum.

How To Build $100K Net Worth Step-by-Step

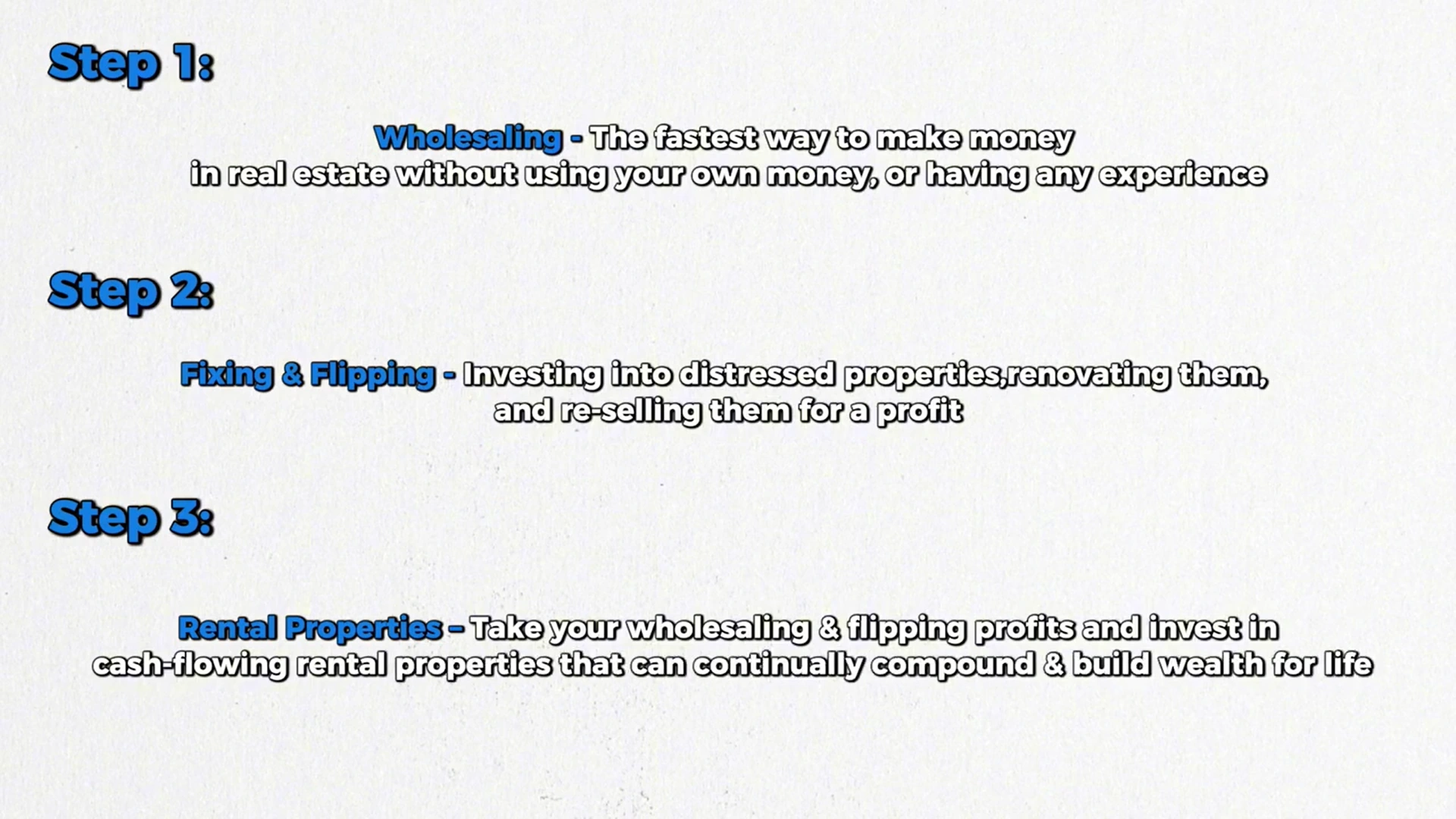

So here’s how the roadmap looks at a high level.

Step one is wholesaling. This is the fastest way to make money in real estate without using your own money or having experience.

Step two is fixing and flipping. You invest in distressed properties, renovate them, and sell them for a profit.

Step three is taking your profits from wholesaling, flipping, and investing them in cash-flowing rental properties that can continually compound and build long-term wealth.

Each step builds on the last, and every deal moves you closer to that $100,000 net worth—and well beyond. And yes, this is exactly what I cover in my Getting Started Guide linked in the description below, which you can get for free.

Remember the penny example? Early growth feels painfully slow—1 cent, then 2, then 4—but before you know it, it snowballs into over $5 million. Compounding in real estate works the same way. It doesn’t explode overnight, but once it starts stacking, it’s hard to stop.

Step 1: Wholesaling

Let’s break it down, starting with wholesaling. It’s like the early days of that penny doubling.

When you’re wholesaling houses, you’re not buying the house. You’re finding discounted deals, putting them under contract, and selling those contracts to investors for a wholesale fee.

Typical wholesale deals can earn a few thousand to even $25,000 or more. At Real Estate Skills, we aim for at least $10,000 per deal to make it worthwhile in terms of time.

At first, wholesaling might feel slow. You close a deal and say, “Great, I made some money—but I’m still actively working for it.” And you are.

But wholesaling is where you learn the game. It’s where you sharpen your skills and stack your capital with little to no risk. Just like the early days of compounding, growth has already begun—even if it doesn’t feel like it yet.

Step 2: Fixing And Flipping

Once you’ve closed a few deals, you’ve built a solid foundation. The next step is adding the next layer: fixing and flipping houses.

In addition to flipping contracts, you now start flipping properties. According to ATTOM Data, the average flip profit is around $72,000.

So instead of making $10,000 per wholesale deal, you can potentially make $72,000 per flip—and even six figures on higher-end projects.

Here’s where it gets exciting. You’re no longer limited to using just your own savings. You begin leveraging other people’s money—private lenders, hard money lenders, and funding partners who want to invest in your deals.

This means instead of saving up for just one project at a time, you can work on multiple flips—two, three, four, or even five at once.

This is where your income potential starts to multiply. You’re leveraging knowledge, relationships, and capital to scale. It’s no longer about just doing one deal at a time — you’re creating systems, growing a network, and really starting to see the power of momentum.

At this stage, the capital you’ve built from wholesaling becomes fuel. You’re no longer depending solely on your savings. Now, your focus shifts to managing projects and building a portfolio that creates bigger paydays and opens the door to true wealth accumulation.

Step 3: Rental Properties

Once you’ve made consistent income through wholesaling and fix and flips, the next step is building long-term wealth through cash-flowing rental properties. This is where your money starts working harder than you do.

Now, instead of trading time for money, you’re creating passive income. Rental properties generate monthly cash flow, build equity over time, and appreciate in value. And the best part? They offer incredible tax advantages and the ability to leverage your assets to buy even more.

This is when real estate becomes a true wealth-building machine. Every deal you close can fund the next investment, and as you scale, your income and net worth grow without you needing to work harder. This is compounding in action.

Compounding Wealth Through Real Estate

Just like in the penny example, compounding starts slow, but once it gains momentum, the results are exponential. Real estate is one of the best vehicles for this because it allows you to reinvest profits, use leverage, and benefit from appreciation and cash flow all at once.

At first, you might only see a few hundred or a few thousand dollars in returns. But stay consistent, and that snowball effect will kick in. The longer you’re in the game and the more you learn, the faster your wealth can grow.

$100K as a Launchpad, Not Just a Goal

Reaching $100,000 in net worth isn’t the finish line — it’s the launchpad. It’s the moment when your money finally has the power to work for you. You’ll find yourself asking smarter questions, making better decisions, and seeing opportunities everywhere.

That first $100K gives you confidence and clarity. It proves that you can do this, and that wealth building isn’t just for other people — it’s for you. And once you hit it, you realize: this isn’t just about money. It’s about freedom, security, and building a life on your own terms.

And if you want to follow a proven roadmap to hit that $100K faster with real estate, check out the free full training Real Estate Skills. It breaks down exactly how to start — even if you have no money, no credit, and no experience.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.