How To Sell A House Fast For Profit When Fixing & Flipping!

Jul 14, 2025

When it comes to flipping houses, the final steps can make or break your profit. In this guide, we’re walking you through exactly how to sell a house fast once the renovation is done, so you can avoid last-minute setbacks and walk away with the most money possible. From prepping the property and working with agents to handling inspections and closing the deal, we’ll cover everything you need to finish strong.

Here’s what you’ll learn:

- Final steps before listing: cleaning, landscaping, staging

- How to choose an investor-friendly agent and negotiate commissions

- Why a 90-day listing agreement is smarter than 6 months

- How to price your flip using your ARV (after repair value)

- How different loan types (FHA, VA, USDA, conventional, cash) impact your sale

- Handling buyer inspections and repair requests

- What to do on closing day—utilities, wire transfers, and more

- How to protect your profits by structuring your LLC and bank accounts

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

Final Steps Before Listing: Cleaning, Landscaping, Staging

Now that we’ve renovated the property and brought it up to current market trends, it’s time to get it ready to sell and maximize our return.

The last two steps before listing are typically a final clean and landscaping. These are the finishing touches that make the inside and outside look beautiful. You want to work your way out of the house, just like in construction. On the exterior, go from top down. On the inside, finish from the outer walls toward the center.

When it comes to finishing the renovation, it’s back to the street. That way, you minimize the number of people walking or driving on your freshly cleaned property.

And for some reason, no matter how big the driveway is, contractors love parking on the lawn, which is exactly why landscaping should always come last.

How To Choose An Investor-Friendly Agent And Negotiate Commissions

Once the home is cleaned up and landscaped, that’s when you connect with your real estate agent and talk strategy.

It’s important to work with a real estate agent who understands investors. You don’t want a retail-focused agent who’s never worked on a flip.

One major advantage of using investor-friendly agents is the ability to negotiate commissions. On many of my flips, instead of the standard 2.5% commission (especially in California), I’ve negotiated it down to 1.5%. Why? Because I’m bringing them multiple deals and doing a lot of the work for them.

It also helps to understand the agent’s brokerage model.

Agents working with flat-fee brokerages often keep a higher portion of the commission, which means they’re more open to negotiation. In contrast, agents splitting 60/40 with traditional brokerages might be harder to negotiate with.

Why A 90-Day Listing Agreement Is Smarter Than 6 Months

When you’re ready to list, you’ll likely price the property at the ARV (after repair value) you originally calculated. In most markets, we recommend a 90-day listing agreement. Some agents may push for a six-month exclusive, but if the property isn’t selling within 90 days, something is off.

It could be the price, the agent, or the marketing strategy—but either way, you’ll want the flexibility to make changes.

Before the 2008 housing crash, six-month listings were the norm due to high inventory levels. But now, with historically low inventory, homes should move much faster. The U.S. will need decades to fix its inventory crisis, so buyers are out there and ready to make offers.

How To Price Your Flip Using Your ARV (After Repair Value)

When pricing your flip, your ARV should be your guide. If you did your analysis properly from the start, you’ve already factored in rehab costs, comps, and projected value. That number is your target listing price.

But pricing alone isn’t enough—you need buyer traffic.

Read Also: Free ARV Calculator: After Repair Value Calculation

Getting The Most Buyer Traffic With Open Houses

As soon as you list, you want your agent to hold open houses immediately. More traffic means more eyes, more excitement, and more potential offers.

You’ve just delivered a new product to the neighborhood, and you want people to experience it. Open houses create momentum and show off the value you’ve added to the community.

One of the first homes I flipped gave me this incredible sense of pride. Neighbors came by saying “thank you,” and I realized I wasn’t just making money—I was reducing crime and increasing neighborhood value. That was an unexpected and powerful feeling.

In fact, I once flipped six homes on the same street. I bought them all, renovated each one, and essentially picked my own neighbors. This kind of strategy—sometimes called the “Buy The Block” strategy—can boost your own property values and lift the entire neighborhood.

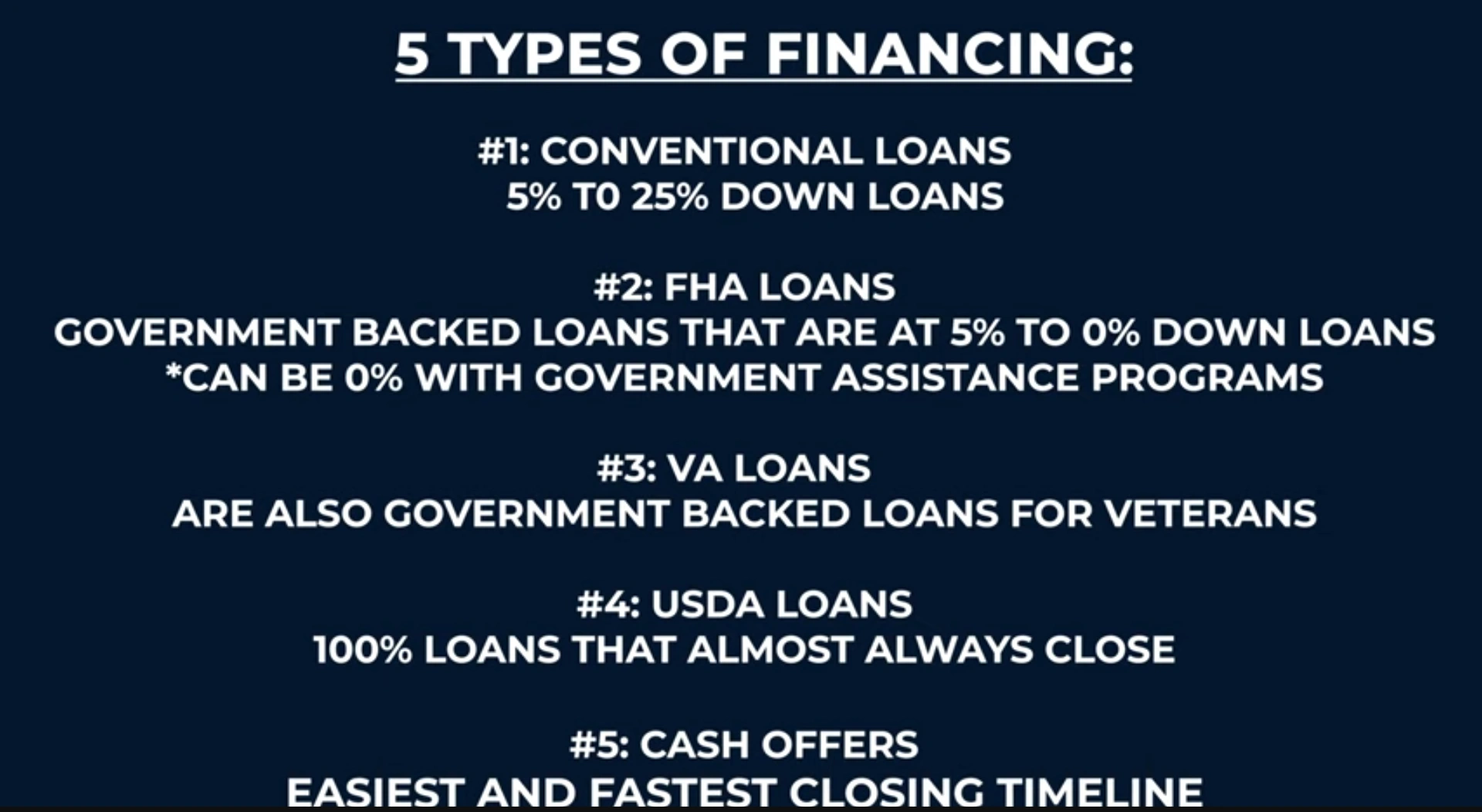

How Different Loan Types Impact Your Sale (FHA, VA, USDA, Conventional, Cash)

If you're trying to figure out how to sell a house fast, it helps to know what kind of offers you’re likely to get—and what they really mean for your timeline. Different types of financing can speed things up or slow things down. Here are five common ones to look out for:

1. Conventional Loans:

These are the most common and usually come from buyers with solid credit and decent down payments, anywhere from 5% to 20%. They tend to move quicker than government-backed loans and involve fewer surprises. Here’s how to find buyers like this.

2. FHA Loans:

FHA loans are popular with first-time buyers. They’re backed by the government but come with stricter appraisal and repair standards. Be ready to cover some closing costs or take care of repairs—usually in the $5K to $6K range. These deals can still close fairly quickly, but there’s more red tape.

3. VA Loans:

VA loans are for active-duty military members and veterans. They often cover 100% of the purchase price and don’t require mortgage insurance. They usually close without a hitch, though timelines can vary depending on the lender.

4. USDA Loans:

These loans are for rural properties and also offer 100% financing. They’re solid but slower—expect 45 to 60 days to close. If you're flipping in a qualifying area, they’re worth considering, just not ideal if you're on a tight timeline.

5. Cash Offers:

If speed is your top priority, this is what you want. Cash buyers can close fast, sometimes in as little as two weeks. There’s no lender involved, no appraisal to wait on, and way less paperwork. Inspections still happen, but overall, this is the cleanest and quickest way to sell a house fast.

Read Also: Fix & Flip Loans: A Beginner's Guide To Funding A House Flip

Handling Buyer Inspections And Repair Requests

After you accept an offer, the buyer will conduct their home inspection. Sometimes, the inspector is overly nitpicky, and you’ll get requests for repairs. In that case, we recommend handling it in one of three ways:

Offer a credit to the buyer instead of doing the repairs. This saves time and headaches.

If the buyer has a contractor who provides a fair quote, and it’s reasonable, still offer the credit and let their team handle it after closing.

Fix the issues yourself if it makes sense and time allows.

In most cases, the credit option is the simplest and most efficient.

What To Do On Closing Day: Utilities, Wire Transfers, And More

You’ve passed inspections, repairs are complete, and it’s finally closing day—your favorite day.

If you bought the property in an LLC, make sure that LLC has a bank account. That’s where the wire transfer or check must go. You can't deposit funds made out to the LLC into your personal account—even if you’re the sole owner.

Also, remember to cancel your utilities and insurance. Don’t assume the buyer will transfer them. Many times, sellers forget, and a month later, they’re stuck with unexpected water or electricity bills.

If you’re closing on a Friday, schedule your utilities to shut off on Monday, since most utility companies are closed on weekends. That gives the buyer a smoother transition and protects you from paying extra.

How To Protect Your Profits By Structuring Your LLC And Bank Accounts

Protecting your profits begins long before the sale. From day one, we recommend placing the property in an LLC. This offers legal protection and simplifies the process for receiving sale proceeds.

Have a dedicated bank account for that LLC so there’s no confusion at closing. That way, the money goes exactly where it’s supposed to, and you stay compliant with your lender, accountant, and the IRS.

Also, double check that all bills and recurring payments—utilities, insurance, etc.—are either cancelled or transferred to avoid unnecessary charges.

Read Also: Flip Funding LLC: Hard Money Lender Review (2024)

Final Thoughts

As you can see, flipping houses involves a lot of moving parts. From funding, to finding, to analyzing, to fixing and selling—it all builds toward one goal: profitable exits and long-term wealth.

At Real Estate Skills, we believe in teaching a step-by-step system that’s worked for us and for thousands of students. Whether you’re wholesaling, fixing and flipping, or building a rental portfolio, the skills compound over time.

If you want to build a hyper-profitable wholesaling and flipping business, check out our free in-depth training at RealEstateSkills.com/watch. We’ll walk you through the exact strategies that have helped us grow and scale.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.