How To Flip Houses In Georgia: 15-Step Home Renovation Guide

Oct 21, 2025

What: Flipping houses in Georgia involves purchasing undervalued properties, renovating them to boost their market appeal, and selling them for a profit. It’s a powerful real estate investment strategy that can generate both active and passive income opportunities.

Why: Georgia’s strong population growth, affordable housing, and expanding job market make it an attractive state for real estate investors. From Atlanta’s booming metro area to smaller, affordable cities, there are ample chances to profit from fix-and-flip projects.

How: Follow the steps outlined in this guide to succeed in Georgia’s market—research local neighborhoods, analyze potential deals, secure funding, manage renovations efficiently, and sell strategically. By mastering these fundamentals, you can confidently flip houses and build wealth in Georgia real estate.

Experienced real estate investors have proven that rehabbing and flipping are viable exit strategies in almost any economy. Even when the housing market is struggling in the wake of rapid appreciation and historical interest rate increases, home flippers have the potential to make impressive returns on their investments.

According to ATTOM Data Solutions’ first-quarter 2024 U.S. Home Flipping Report, the most recent report to document flipping returns, “Gross profits on typical flips around the country, meanwhile, increased to $72,000. That remained down from a high of about $80,000 reached in 2022. But it was up from $65,000 in the fourth quarter of 2023 and was about $10,000 above last year’s low point.”

Georgia, in particular, has seen the pursuit of profits lead to increased flipping activity. If you want to see what the housing market has in store, there’s no better time to learn how to flip houses in Georgia. This guide will teach you everything you need to know, including:

- What Is Flipping Houses?

- Why Flip Houses In Georgia?

- Georgia House Flipping Statistics

- How To Flip Houses In Georgia In 15 Steps

- How Much Do House Flippers Make In Georgia?

- How To Flip A House In Georgia With No Money?

- Is House Flipping Illegal In Georgia

- Do You Need A License To Flip Houses In Georgia?

- How Much Does It Cost To Flip A House In GA?

- What's The Best Place To Flip Houses In Georgia

- Is It Hard To Flip Houses In Georgia?

- How Do You Find Contractors For Flipping Houses In Georgia?

- Final Thoughts On Flipping Houses In Georgia

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Flipping Houses?

Otherwise known as rehabbing, flipping houses starts with buying a subject property under market value. In doing so, investors will emphasize homes that are either undervalued, in need of repair, outdated, or at risk of foreclosure. After all, the more of a discount the investor can receive on the subject property upfront, the better their profit margins will be on the investment.

Equally as important as choosing the right property is the method by which the deal is financed. Due to their relatively short duration (anywhere from a few months to a year) and the speed at which the market moves, flips don’t rely on conventional loans. Instead, house flippers use private and hard money loans. While they may coincide with higher interest rates (upwards of 12%) than their conventional counterparts, private and hard money loans give investors access to the money they need fast.

Once the property is purchased, the investor will make any necessary upgrades and repairs. The goal is to make the property more attractive to home buyers without going over budget. A general rule of thumb is to upgrade the property until it’s slightly more attractive to buyers than nearby comparable homes (comps). That way, profit margins remain attractive, and the home generates more attention than the local competition — both of which help the bottom line.

After improving the house, the investor will sell the property for more than their initial investment. Before too long, the investor will pay back their loan (with interest) and pocket anything left over.

Read Also: How To Find Off-Market Properties In Georgia (4 Methods)

Why Flip Houses In Georgia?

Flipping houses in Georgia presents a compelling opportunity for both novice and seasoned investors, driven by the state’s growing real estate market and attractive profit potential.

Georgia’s real estate market is thriving, with an increasing demand for housing fueled by a strong economy and population growth. According to data from RealtyTrac, Georgia currently has 3,015 properties in foreclosure, 111 bank owned properties, and 2,904 headed for auction. These figures indicate a healthy pipeline of distressed properties that are prime targets for house flippers seeking to capitalize on the state's dynamic market.

The potential for substantial profits in Georgia's house-flipping market is significant. ATTOM's latest Home Flipping Report Data Solutions' latest Home Flipping Report shows that the average gross flipping profit nationwide is $72,000, translating to a 29.6% return on investment. Although this is a national average, Georgia's robust housing market often yields even higher returns due to favorable market conditions and relatively lower property acquisition costs compared to other states.

Moreover, Georgia’s diverse economy and favorable business climate make it an ideal place for real estate investments. Cities like Atlanta, Augusta, and Savannah are experiencing rapid economic growth and urban development, which further boosts property values and the profitability of house-flipping ventures. This economic environment creates a fertile ground for investors looking to achieve significant returns on their investments.

Flipping houses in Georgia is a strategic move in today’s economy, offering a lucrative investment strategy that can potentially yield higher returns than traditional stock market investments. For those looking to learn how to invest in real estate in Georgia, the state's vibrant real estate market, combined with its economic growth and population influx, makes it an attractive option for house flippers aiming to maximize their profits.

If the idea of flipping houses in Georgia interests you, consider signing up for our free training below. This comprehensive training will provide you with essential house-flipping tips tailored to Georgia's unique market, helping you take full advantage of the opportunities available in the state's housing market.

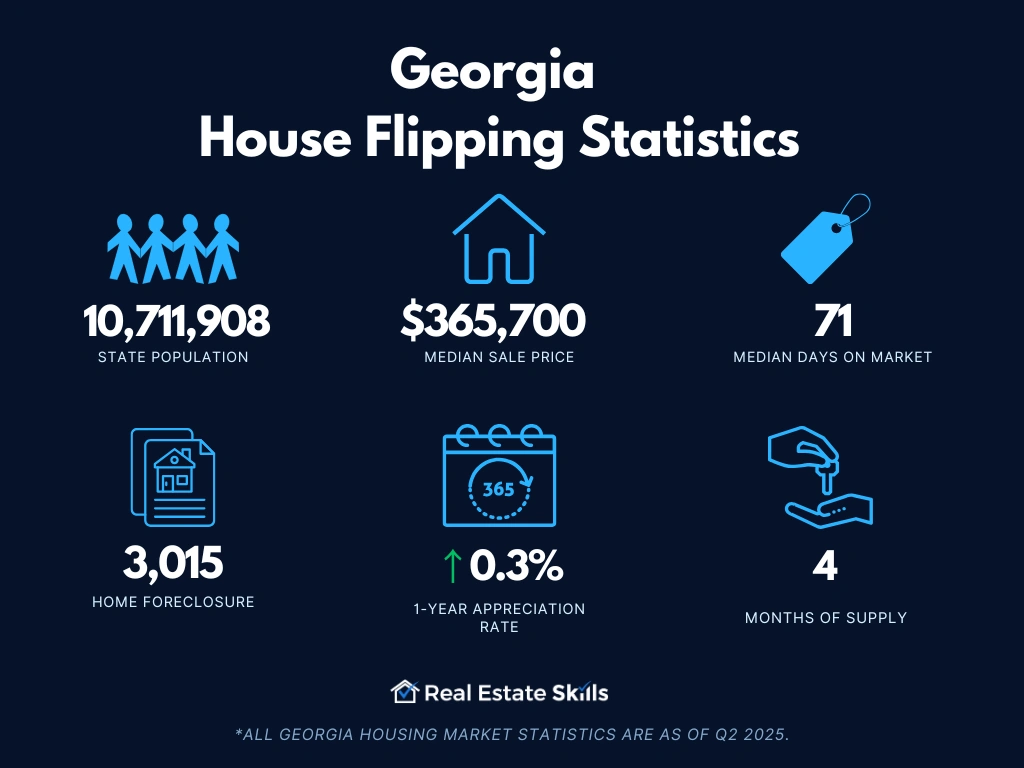

Georgia House Flipping Statistics

More and more beginners are flipping homes in the Georgia real estate market. Georgia had three of the top five metros with the highest flipping rates earlier this year. According to ATTOM Data, "the largest flipping rates during the first quarter of 2024 were in Warner Robins, GA (flips comprised 18.7 percent of all home sales); Macon, GA (17.1 percent); Fayetteville, NC (15.8 percent); Atlanta, GA (14.7 percent) and Memphis, TN (14.6 percent)."

Here are other dependable housing indicators you should prioritize when learning how to flip houses in Georgia (data provided by the U.S. Census Bureau, RedFin, and ATTOM Data Solutions):

- Population: 10,711,908

- Employment Rate: 60.6%

- Median Household Income: $74,632

- Median Sale Price: $365,700 (+1.5% Year-Over-Year)

- Number Of Homes Sold: 8,351 (-10.3% Year-Over-Year)

- Median Days On Market: 71 (+20 Year-Over-Year)

- Number Of Homes For Sale: 49,244 (+14.5% Year-Over-Year)

- Number Of Newly Listed Homes: 13,191 (-5.4% Year-Over-Year)

- Months Of Supply: 4 (+1 Year-Over-Year)

- Homes Sold Above List Price: 17.5% (-2.8 Points Year-Over-Year)

- Homes With Price Drops: 26.3% (+3.9 Points Year-Over-Year)

- Home Foreclosure: 3,015 Properties

*All Georgia housing market statistics are as of Q2 2025.

Similar to what you’d learn in a Flipping Houses 101 course, it's crucial to equip yourself with comprehensive market data, monitor economic trends, and understand the prices within the Georgia market. This knowledge will guide house-flipping strategies Georgia investors implement and assist them in learning how to flip houses in Georgia.

How To Flip Houses In Georgia In 15 Steps

If you are interested in learning how to flip houses in Georgia for the first time, start by familiarizing yourself with the following steps:

- Pick Your Market

- Find Your Money

- Find Three Contractors

- Find An Investor-Friendly Agent

- Find A House To Flip

- Make Discovery Calls To Listing Agents

- Analyze The Property

- Call Agents & Submit Written Offers

- Perform Due Diligence When The Offer Is Accepted

- Close On The Deal

- Renovate The House

- Prep & List The House On The MLS

- Field Offers & Negotiate

- Accept The Best Offer

- Sell The House & Get Paid

Pick Your Market

When flipping a house in Georgia, selecting the right market is a crucial first step that can significantly influence the success of your investment. The key factors to consider include local economic conditions, housing demand, and property values.

Proximity to your investment market can make a significant difference. While you don’t need to live in the same area where you’re flipping houses, being close to the market can simplify your operations. It facilitates easier coordination with contractors, real estate agents, and other professionals involved in the process. Additionally, being nearby allows you to gain a deeper understanding of the local neighborhoods, which is essential for making informed investment decisions.

If you choose to invest in a market far from where you live, you may encounter challenges such as managing renovations from a distance, coordinating with local professionals, and staying updated on market trends. Additionally, not being familiar with the area can hinder your ability to evaluate factors impacting property values, such as neighborhood amenities and potential issues.

By selecting a market that is close to home, you can more effectively assess aspects like school quality, proximity to major infrastructure (such as highways and public transportation), and local amenities. This local knowledge and convenience can set a solid foundation for a successful house-flipping venture in Georgia.

Find Your Money

Once you’ve pinpointed where to invest in Georgia, securing financing is your next crucial step. This involves finding a lender before you even start searching for a property. Having your funding lined up is essential, as it ensures you can act quickly on promising deals and avoid missing out on potentially lucrative opportunities.

There are two main types of lenders to consider: hard money lenders and private money lenders. Both types are critical for financing house flips, and understanding their roles will help you navigate the funding process effectively.

Hard money lenders provide short-term loans based primarily on the value of the property and its potential return rather than your creditworthiness. In Georgia, these lenders typically offer between 70% and 90% of the loan-to-cost (LTC), which includes the purchase price and renovation costs. This means you'll need to cover the remaining portion of the project cost yourself. While hard money loans come with higher interest rates and fees, their speed and ease of access make them a valuable resource for securing deals quickly.

Private money lenders are individuals who invest their own capital in exchange for higher returns compared to traditional investments. They offer flexibility and can cover the remaining balance of your project after hard money loans are secured. Private money lenders usually charge around 10% interest, but their terms can be more negotiable, providing another avenue to finance your flips without using your own cash.

Utilizing these types of lenders allows you to keep your own capital liquid and scale your flipping business more effectively. By leveraging other people’s money (OPM), you can manage multiple projects simultaneously and minimize personal financial risk. This approach supports faster growth and greater flexibility in Georgia’s dynamic real estate market.

Finding and securing the right financing is a key component of flipping houses in Georgia. With an array of lenders available, you can fund your projects efficiently and maximize your investment potential.

How to Find Private & Hard Money Lenders

Finding private and hard money lenders in Georgia requires a targeted approach, as these lenders differ from traditional financial institutions. Here’s how you can locate them effectively.

To find hard money lenders, start by attending local Real Estate Investor Association (REIA) meetings. These gatherings are valuable for networking with experienced investors and lenders who specialize in financing house flips. Additionally, a simple online search for "hard money lenders in Georgia" will yield a list of local and national lenders. This search can help you identify potential partners such as Kiavi and Lima One, who are known for their hard money lending services.

For private money lenders, the approach is more personal. Begin by reaching out to your network of friends, family, and acquaintances, as they might be interested in investing in real estate. Networking events, investment seminars, and local investment clubs are also excellent places to meet potential private lenders. Presenting a well-prepared investment plan and demonstrating the potential returns can attract their interest and secure their investment.

Securing financing through these methods also allows you to obtain a proof of funds (POF) letter, which is crucial for making competitive offers on properties. A POF letter shows sellers that you have the financial backing to close the deal, enhancing your credibility and increasing your chances of success.

By using these strategies, you can effectively find and work with private and hard money lenders in Georgia, setting the stage for successful house-flipping projects.

Find Three Contractors

Once you’ve secured financing, the next crucial step in flipping houses in Georgia is hiring the right contractors. While it's technically possible to handle renovations yourself, it’s generally not advisable due to potential pitfalls such as underestimated costs and extended timelines. Professional contractors bring expertise, efficiency, and high-quality results, all of which are essential for a successful flip. Plus, focusing on renovations can divert your attention from other critical aspects of your business, like sourcing additional deals.

To ensure you get the best results, aim to find and evaluate at least three general contractors. General contractors are skilled at managing entire renovation projects and coordinating with subcontractors, ensuring that every detail is handled professionally. By comparing different contractors, you can assess their capabilities, get multiple quotes, and select the best fit for your project. This approach helps you build a reliable team that can execute renovations efficiently, allowing you to concentrate on growing your real estate business.

How to Find a General Contractor

Finding a reliable general contractor is crucial when flipping houses in Georgia. Start by reaching out to at least three general contractors to obtain quotes and insights on your renovation project. This allows you to compare prices and select the best contractor for your budget and specific needs.

To find reputable contractors, consider attending local Real Estate Investor Association (REIA) meetings in Georgia. These gatherings are valuable for networking and often feature experienced investors who can recommend trustworthy contractors.

Additionally, explore neighborhoods with ongoing construction projects. Approach the workers or gather contact information from project signs posted outside the homes. Visiting local home improvement stores, such as Lowe’s or Home Depot, is another effective strategy. Contractors frequently visit these stores for supplies, and store employees may offer valuable recommendations.

By carefully selecting a qualified contractor, you ensure that your renovation projects are completed efficiently and to a high standard, enabling you to focus on growing your house-flipping business in Georgia.

Find an Investor-Friendly Agent

The next step in flipping houses in Georgia is to find and work with an investor-friendly real estate agent. A knowledgeable agent can greatly enhance your investment strategy by leveraging their local market expertise, extensive networks, and negotiation skills. They play a crucial role in securing better deals and navigating the real estate landscape effectively.

When searching for an agent, prioritize those who specialize in working with investors. Unlike traditional agents who might focus solely on high-end properties, investor-friendly agents are keen on finding and evaluating investment opportunities. They are comfortable handling multiple offers and understand the unique needs of house flippers.

Given that most homes are sold through agents, their expertise is invaluable. According to the National Association of Realtors, around 89% of sellers use an agent, making it essential to tap into this network. Investor-friendly agents have access to the MLS and can help you find and negotiate the best deals. While agents typically charge a commission of about 2.5% of the sale price, this cost is usually covered by the seller when selling the finished property, so you don’t need to worry about it until it’s time to sell your flipped home.

How to Find an Investor-Friendly Agent

Finding the right real estate agent is crucial for a successful house-flipping venture in Georgia. Start by attending local Real Estate Investor Association (REIA) meetings. These events are excellent for networking and connecting with agents who specialize in working with investors.

Another effective strategy is to look at listings on the MLS for distressed properties. The agents handling these listings are often investor-friendly and may be open to working with you on future deals. Reaching out to them can help you find a knowledgeable partner who understands the investment process.

Partnering with an investor-friendly agent in Georgia allows you to tap into their expertise and network, enhancing your ability to find and secure profitable deals efficiently.

Find a House to Flip

Finding a house to flip in Georgia can be approached through various methods, but the most efficient way is to leverage the Multiple Listing Service (MLS). The MLS is a comprehensive database where real estate agents list properties for sale, providing detailed information that can help you identify potential flips.

To maximize your search, look for properties that are undervalued, in need of repairs, or situated in high-demand areas. The MLS simplifies this process by allowing you to filter listings based on your specific criteria, such as price range, location, and property condition.

While direct mail campaigns, driving for dollars, and browsing public records are also viable options, accessing the MLS through a local real estate agent is often the most effective. Partnering with an investor-friendly agent can streamline your search, enabling you to find and evaluate properties more efficiently and focus on those with the greatest potential for profit.

Alternative Strategies to Find a House

When searching for houses to flip in Georgia, several alternative strategies can complement your use of the Multiple Listing Service (MLS). While the MLS is a valuable resource due to its extensive property listings and detailed information, exploring other methods can help you uncover additional opportunities.

To identify distressed properties, focus on homes that have been on the market for a long time or those listed "as is." These properties often indicate motivated sellers who may be willing to negotiate on price. Look for terms like "handyman special," "needs TLC," "fixer-upper," and "diamond in the rough" in your MLS search, as these keywords often signal homes requiring significant repairs and potentially available at a discount.

Here are three alternative strategies to find houses to flip in Georgia:

- The Day Zero Strategy: To find potential flips before the competition, focus on newly listed properties. By filtering the MLS for homes listed within the last 24 hours, you can identify fresh opportunities. Act quickly by having your agent contact the listing agent immediately to express your interest. Being among the first to reach out can increase your chances of securing a deal before others have a chance to bid.

- The Old Listing Strategy: Look for homes that have been on the market for 60 days or more. Properties with extended listing durations may indicate motivated sellers who are eager to close a deal. These homes might be priced lower due to prolonged market presence, and the sellers could be more willing to negotiate. Reaching out to these sellers can reveal opportunities for favorable purchase terms.

- The Wholesaler Strategy: Partnering with real estate wholesalers can also be an effective method. Wholesalers specialize in finding undervalued properties and then assign these deals to investors for a fee. To connect with wholesalers, attend local Real Estate Investor Association (REIA) meetings or join relevant real estate networks. This approach can help you access off-market deals that are not listed on the MLS, potentially uncovering hidden opportunities for profitable flips.

Having said that, some investors may not be able to gain access to the MLS for a variety of reasons. Fortunately, these strategies apply to alternative website listing platforms like RedFin, Zillow, and Realtor.com. Simply translate the strategies above to these listing websites when flipping homes inGeorgia. It is important to note, however, that the MLS is the preferred vehicle because of its more comprehensive data and contact information.

Make Discovery Calls To Listing Agents

Once you have identified potentially distressed properties in Georgia, the next step is to make discovery calls to the listing agents. These calls are essential for gathering detailed information about the properties and understanding their potential.

While you can make these calls yourself, having your real estate agent handle them might be more efficient. Listing agents are motivated to facilitate sales, so they are generally open to providing information to interested buyers.

During these calls, aim to uncover details about the property’s condition, the seller's motivations, and any issues that might impact the deal. Here are key questions to ask:

- Is the listing still active? Verify if the property is still available to avoid wasting time on homes that are already under contract. This ensures you are focusing on viable opportunities.

- Are the listing’s photos up to date? Check if the photos accurately reflect the property's current condition. This helps you assess the extent of needed repairs and estimate renovation costs more effectively.

- What is the current condition of the home? Inquire about the home's condition to confirm if it is distressed and to uncover any hidden issues. This information is crucial for evaluating repair costs and potential challenges.

- Are you willing to work with an investor? Determine if the listing agent is open to working with investors. This can foster a productive working relationship and might even lead to the agent representing you in the transaction.

- What is the owner’s reason for selling? Understanding the seller's motivation can provide valuable insights for negotiations. If the seller is in a hurry or facing specific circumstances, you might leverage this information to structure a more favorable offer.

- Is there a lot of competition for the property? Ask about the level of interest and competition for the property. Knowing if there are multiple offers can help you strategize and make a more competitive bid if needed.

Use these calls to gather as much information as possible without committing to an offer. After the call, inform the listing agent that you will consult with your team and follow up if you decide to proceed. This approach ensures a thorough and informed evaluation, setting the stage for successful property flips in Georgia.

Analyze the Property

The next critical step in flipping houses in Georgia is analyzing the property. This process involves evaluating key factors like the After-Repair Value (ARV), repair costs, and purchase price to determine if a property is a sound investment.

After-Repair Value (ARV)

The ARV is a crucial metric for assessing a property's potential profitability. It represents the estimated market value of the property once all repairs and renovations are completed. To calculate the ARV, you should review comparable sales, or "comps," which are recently sold properties similar in size, style, and location to the property you plan to flip.

To find accurate comps in Georgia, look for properties that meet these criteria:

- Similar number of bedrooms and bathrooms

- Within 20% of the subject property's square footage

- Located in the same neighborhood or nearby

- Sold within the past six months

- Recently renovated, if possible

Once you've identified suitable comps, calculate the average sale price of these properties. Add the total value of the comps and divide by the number of properties. This will give you a realistic estimate of the ARV, guiding your investment decisions and helping you gauge potential profitability.

Repair Costs

Accurately estimating repair costs is essential for a successful flip. Start by conducting a thorough property inspection to identify all necessary repairs and renovations. Obtain detailed quotes from several contractors to get a comprehensive view of labor and material costs. Additionally, include a contingency budget of around 10-15% of the total repair costs to cover unexpected expenses. Properly estimating these costs will help ensure that your flip remains profitable and on budget.

Purchase Price

With the ARV and repair costs in hand, you need to determine your maximum allowable offer (MAO) for the property. This is the highest price you can pay while still ensuring a profitable outcome. Here’s how to calculate your MAO:

- ARV: The estimated value of the property after renovations.

- Hard Money Loan Costs: Include interest rates (typically 10-15%), origination fees, points, and the anticipated loan duration.

- Private Money Loan Costs: Factor in interest and project duration.

- Front-End Closing & Holding Costs: Account for closing costs (around 2% of the purchase price) and holding costs such as insurance, utilities, and taxes.

- Backend Closing Costs: Usually about 1% of the ARV.

- Realtor Fees: Typically around 6% of the purchase price, but consider negotiating a lower fee with an investor-friendly agent.

- Projected Profit: Decide on your desired profit margin. Nationwide, investors often see returns around 27.5% on their flips, according to ATTOM Data Solutions.

Subtract these costs from the ARV to determine your MAO. This figure represents the highest price you can pay for the property while still achieving a profitable return. By carefully analyzing these factors, you can make informed decisions and maximize your success in flipping houses in Georgia.

Call Agents & Submit Written Offers

The next step in flipping houses in Georgia is to call the listing agent you’ve previously spoken with and inform them of your intention to submit a written offer. Ensure your offer aligns with the maximum allowable offer (MAO) you calculated. By submitting a well-informed written offer, you position yourself as a serious buyer and move closer to securing the property.

You want the agent representing you—whether it’s the listing agent or the investor-friendly agent you’ve aligned with earlier—to acknowledge your terms and submit a written offer on your behalf. Having the agent submit the offer appears more professional, as they’ll bring the appropriate contract and know exactly what to do. In Georgia, we use the Georgia Association of Realtors' Purchase and Sale Agreement contract.

Here’s what you need to provide to the agent who will prepare the contract:

- Purchaser Name: Identify the purchaser, whether it’s under your name or an LLC (Limited Liability Company). (We recommend forming an LLC for added asset protection). If buying under an LLC, include the articles of incorporation to show that you are a signer for your company.

- Offer Price: Include the offer price you determined above.

- Deposit Amount (Earnest Money Deposit): Include an earnest money deposit (usually 1% to 5% of the purchase price) to demonstrate that you are a serious buyer. Earnest money deposits are typically refundable, but to be safe, include a contingency (like the one below).

- Contingencies: Include a seven-day inspection contingency. This allows you to inspect the home and ensure there are no unexpected issues. If you find something concerning, you can back out of the deal and get your deposit back.

- Closing Timeline: Request a quick closing, ideally within 14 days or sooner. Using cash for the purchase can expedite the process compared to traditional financing, which is often appreciated by sellers.

- Seller to Deliver Free & Clear Title: Ensure the seller agrees to provide a property with a clear title, free from liens or other encumbrances.

- Buyer’s Agent Name: Specify the buyer’s agent so it’s clear who is representing you in the transaction.

- Proof of Funds: Attach proof of funds from your lender to demonstrate your financial capability to close the deal, making your offer more compelling and credible to the seller.

Calling agents and submitting written offers is a crucial step in flipping houses in Georgia. By having your agent acknowledge your terms and submit a professional, well-structured offer, you increase your chances of securing a profitable deal. Mastering this process is essential for successfully flipping houses and maximizing your investment potential. Remember, written offers lead to deals.

Perform Due Diligence When The Offer Is Accepted

Once your offer is accepted and the seller signs the contract, you’re not quite at the finish line yet. This is the point where the project starts to pick up real momentum, and due diligence becomes critical. While it’s an exciting time, you must be thorough to ensure you fully understand the property's condition and any potential issues. This step is crucial to successfully flipping houses in Georgia.

Act quickly, as several timelines will start running. The earnest money deposit is due within three days of offer acceptance, the inspection period begins, and you have promised a closing within 14 days or less. The inspection clause is your safeguard—if you discover any issues you’re uncomfortable with, you can use this clause to back out of the deal, but you only have about a week to make this decision.

After your offer is accepted, schedule a walkthrough with your contractor as soon as possible. The purpose of this walkthrough is to assess the necessary repairs and determine what needs to be done to bring the property up to the after-repair value (ARV) you estimated. Your contractor will help compile a detailed scope of work, listing all the renovation items needed. It's essential to have an experienced and reliable contractor by your side for this step.

Obtain detailed quotes from multiple contractors, and if needed, have them walk through the property to provide their estimates. Compare these quotes to ensure you’re getting a fair price and choose the contractor who best fits your needs and budget. A good contractor will offer valuable insights into the property’s condition and help you stay on track with your renovation plans.

In addition to your contractor, consider hiring a professional inspector to perform a comprehensive evaluation of the property. An inspection typically costs between $200 and $500 but can reveal hidden issues that might not be immediately obvious. Investing in a thorough inspection can save you from unexpected costs and help you avoid potential pitfalls, making it a worthwhile expense in your due diligence process.

Close On The Deal

The next crucial step in flipping houses in Georgia is to close on the property. This is the stage where you finalize the purchase and pay the seller, provided that everything checks out and you are confident in the investment’s profitability. If the inspection or other due diligence reveals issues that undermine the deal’s viability, you can use the contingencies outlined in your contract to back out. However, if the property meets your expectations and you are confident in your ability to generate a profit, proceed with closing the deal.

During the closing process, you will officially take ownership of the property, which allows you to start the rehabilitation work. The title company, escrow officer, and closing attorney will manage the final paperwork and ensure all conditions of the sale are met. They will also handle promissory notes related to your financing arrangements. These notes are legal agreements that require you to repay your private and hard money lenders, plus any interest, once the property is sold. These documents serve as collateral for the lenders, protecting their investment and securing their financial backing.

Promissory notes are essential for providing security to your lenders, ensuring they are repaid once the property is sold. This process helps establish trust and facilitates future financing opportunities.

Additionally, as part of the closing process, a title search will be conducted to ensure that the seller delivers a clear title. This search verifies that there are no liens, disputes, or discrepancies associated with the property’s title. A clear title is crucial for avoiding legal issues and ensuring a smooth resale process after the rehab is completed.

By carefully navigating the closing process, you protect your investment and set the stage for a successful flip. Understanding these steps and executing them properly is key to a smooth transaction and a profitable outcome in your house flipping venture in Georgia.

Renovate The House

The next step in flipping houses in Georgia is renovating the property to achieve your projected after-repair value (ARV) while aligning with the comparable sales you used for your analysis. It's crucial to avoid over-renovating; instead, focus on bringing the property up to or slightly above the standard set by comparable homes in the area. This approach helps you stay within budget and maximize profit margins while making your property the most attractive option in the neighborhood.

Before starting the renovation process, it's essential to protect yourself with six key documents. These documents will ensure that the project is legally sound, expectations are clear, and your investment is safeguarded:

- Independent Contractor Agreement: This legally binding document outlines the terms and conditions of the relationship between you and your contractor. It defines payment terms, timelines, and responsibilities, ensuring that both parties are aligned and protected throughout the renovation.

- Final Scope of Work: This detailed document specifies all tasks, materials, and timelines required for the renovation project. It serves as a blueprint for the contractor, helping to keep the project on track, within budget, and meeting quality standards.

- Payment Schedule: This document outlines the amounts and timelines for payments to the contractor throughout the project. By tying payments to the completion of defined milestones, it helps ensure that work progresses as planned and the contractor remains motivated.

- Insurance Indemnification Agreement: This agreement ensures that the contractor has the necessary insurance coverage and agrees to hold you harmless for any accidents or damages occurring on the property. It protects you from liability and financial loss resulting from incidents during the renovation.

- W-9 Form: This tax form collects the contractor's taxpayer identification information, necessary for reporting payments to the IRS. It ensures compliance with tax regulations and allows you to issue a 1099 form at the end of the year for any payments made to the contractor.

- Final Lien Waiver: This document, signed by the contractor, confirms that they have received full payment and relinquish any future claims against the property. It protects you from contractors seeking additional money after the renovation is complete, ensuring all financial obligations are settled.

Once these forms are completed, you can confidently proceed with the renovation, knowing that your investment is well-protected. With the proper documentation in place, you can focus on transforming the property into a valuable asset and moving closer to a successful flip.

This is a lot of information to take in, and navigating the complexities of flipping houses in Georgia can be challenging. If you're interested in learning how to flip houses in Georgia successfully, please enroll in our free training program. Our program will provide you with everything you need to confidently and profitably flip homes in Georgia.

Prep & List The House on the MLS

The next step in flipping houses in Georgia is preparing the house for listing and posting it on the MLS. This critical phase ensures the property is showcased effectively to attract potential buyers, maximizing its visibility and increasing the chances of a successful sale.

To get the house ready for the MLS, follow these three essential tasks:

- Final Punch List: A punch list is a document that outlines the final tasks and loose ends that need to be addressed before the home is ready to sell. This step is crucial for ensuring that all minor issues are resolved, leaving the property in pristine condition for potential buyers.

- Home Staging: Staging the home involves arranging furniture and decor to make the property more appealing. Staged homes often sell faster and for a higher price. According to the Real Estate Staging Association (RESA), investing approximately 1% of the sale price into staging can result in an ROI of 5% to 15% over the asking price.

- Professional Photos: High-quality photos are essential when listing a property on the MLS. Professional real estate photography can significantly impact the property's online presence. Studies have shown that homes with professional photos sell faster and for more money compared to those with amateur photos. Invest in high-performance DSLR photography to make your listing stand out.

Once the home is prepared, your real estate agent will handle the marketing. This includes listing the property on the MLS to ensure maximum exposure to potential buyers. A yard sign will attract local interest, while postings on popular online platforms like Zillow and Redfin will reach a broader audience. Hosting open houses allows potential buyers to view the property in person. Your agent will also leverage email lists and social media to target specific buyer groups and generate interest. By utilizing these marketing strategies, your agent will effectively promote the property and increase the likelihood of a quick and profitable sale.

Set an Enticing Asking Price

When flipping houses in Georgia, setting an appealing asking price is a crucial step in the selling process. To determine the right price, start with your after-repair value (ARV), based on all your calculations. A recommended strategy is to set the asking price within a range of approximately 5% above and below your target sale price.

This pricing approach offers several advantages. Firstly, it broadens the pool of potential buyers by including those who may have initially found the property slightly out of their budget. By listing at a price slightly lower than your ideal ARV, you encourage more offers and create an opportunity for competitive bidding. This can lead to multiple offers, allowing you to negotiate and potentially incite a bidding war. In many cases, this strategy can result in a final sale price that exceeds your initial ARV, maximizing your profit on the flip.

A strategic pricing plan is essential for a successful house flip in Georgia. It helps ensure a quicker sale while optimizing your return on investment. By effectively utilizing market dynamics and setting a well-considered asking price, you can achieve a profitable outcome for your renovation project.

Field Offers & Negotiate

Once your property is listed and effectively marketed in Georgia, you'll begin receiving offers from potential buyers. This stage involves evaluating these offers and negotiating terms to achieve the best possible return on your investment.

Start by reviewing all incoming offers with your real estate agent. Look beyond the offered price to assess the terms and contingencies of each bid. It’s essential to evaluate the financial qualifications of each buyer and their ability to close the deal. Offers may come in below your asking price, but these initial bids can serve as a starting point for negotiations.

Consider making counteroffers to bring buyers closer to your desired sale price. If you receive multiple offers, use this to your advantage by informing buyers of the competitive nature of the situation. This can stimulate a bidding war, potentially driving the final sale price above your initial expectations.

Effective negotiation involves more than just price; it includes factors such as closing timelines, inspection contingencies, and financing terms. By skillfully navigating these elements, you can secure a deal that aligns with your goals and maximizes your profit from the flip. Mastering this negotiation process is crucial for achieving a successful outcome in your Georgia real estate investment.

Accept The Best Offer

The next step in flipping houses in Georgia is to accept the best offer you receive. Carefully evaluate each offer, considering not just the price but also the terms and conditions. Select the offer that provides the best overall value and the highest likelihood of a successful closing. Once you accept an offer, the buyer's timelines and responsibilities begin, similar to when you first acquired the property.

The buyer will submit an earnest money deposit to demonstrate their commitment to the purchase. They will then perform their due diligence, which includes having the home inspected and appraised. The inspection allows the buyer to identify any potential issues, while the appraisal confirms that the property is worth the agreed-upon price. Based on the inspection findings, the buyer might request repairs or negotiate concessions.

After the due diligence phase, the buyer will schedule a final walkthrough of the property. This step ensures that any agreed-upon repairs have been completed and that the property meets their expectations before closing. The final walkthrough is a crucial checkpoint for the buyer to verify that everything is in order.

Effectively managing these steps helps ensure a smooth transition from accepting an offer to closing, securing a successful and profitable sale in your Georgia house-flipping venture.

Sell The House & Get Paid

The final step in flipping houses in Georgia is selling the house and receiving the proceeds. Once the buyer's due diligence is complete and any agreed-upon repairs have been addressed, you will move to the closing phase. In Georgia, this process is typically managed through an escrow account, where a neutral third party holds all funds and documents until all conditions of the sale are satisfied.

The escrow process begins with both parties signing the closing documents, which include the deed transfer and settlement statement. The buyer deposits the purchase funds into the escrow account, and if applicable, their lender funds the loan. The escrow agent then verifies that all contractual obligations, including any contingencies and required repairs, have been met.

After confirming that all conditions are fulfilled, the escrow agent disburses the funds. These proceeds will first be used to pay off any outstanding loans and accrued interest as specified in your promissory notes. Any remaining funds after settling these obligations will constitute your profit.

Collecting the proceeds signifies the successful completion of your house flip. This profit can then be reinvested into your next project, enabling you to continue expanding your real estate portfolio and capitalizing on new opportunities.

Read Also: How To Flip A House With No Experience: A First Timer's Guide

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

How Much Do House Flippers Make In Georgia?

The average gross flipping profit for house flippers in Georgia is impressive and shows significant potential for lucrative returns. According to ATTOM Data Solutions' latest Home Flipping Report, the average gross flipping profit in Georgia is $60,000, translating to a 25% return on investment. This figure, while slightly below the national average of $66,000, is still a substantial amount that underscores the profitability of flipping houses in the state.

Several cities in Georgia stand out for their exceptional profit margins in house flipping. Notably, three of Georgia’s cities are among the top five in the nation for the largest gross flipping profits on median-priced transactions:

- Atlanta, GA: Atlanta offers an average gross flipping profit of $75,000.

- Savannah, GA: Savannah boasts an average gross flipping profit of $68,000.

- Augusta, GA: The average gross flipping profit is $62,000.

The profitability of house flipping in Georgia is influenced by various factors, including location, renovation costs, and market conditions. Cities like Atlanta, Savannah, and Augusta provide lucrative opportunities due to their high demand for housing and robust property values.

To maximize profits when flipping houses in Georgia, it’s essential to understand local market trends and develop a comprehensive renovation plan. Securing properties at competitive prices and managing renovation costs efficiently can significantly enhance the net profit from each flip. With the right strategy and knowledge of the local market, house flipping in Georgia can be a highly rewarding investment opportunity.

Read Also: Best Places To Buy Rental Property In Georgia For 2025

Is House Flipping Illegal In Georgia?

House flipping is entirely legal in Georgia. However, it is important to understand that certain practices associated with house flipping can be illegal. The laws governing real estate transactions in Georgia are designed to protect both buyers and sellers from fraudulent activities. Therefore, it is crucial for investors to adhere to these regulations to ensure their house-flipping activities are legitimate and above board.

One of the most common illegal practices associated with house flipping is mortgage or loan fraud. Mortgage fraud involves manipulating the property’s appraisal to falsely inflate its value, thereby securing a larger loan amount than the property is worth. This type of fraud can occur when unscrupulous appraisers and mortgage brokers work together to overstate a property’s value. If the homeowner defaults on the loan, the bank may be unable to recover the full amount, leading to significant financial losses.

Another illegal practice is known as illegal property flipping. This involves selling a property at an inflated price using dishonest means. For example, the flipper might collaborate with an appraiser to artificially boost the property’s value and then sell it to an unsuspecting buyer at an inflated price. While it is not illegal to sell a property for more than its actual value, it becomes illegal when the price is falsely inflated through deception or misrepresentation.

To avoid these illegal practices, house flippers in Georgia must follow ethical guidelines and legal requirements. This includes working with reputable appraisers and mortgage brokers, providing accurate information about the property, and ensuring that all transactions are transparent and fair.

By adhering to these principles, investors can engage in legitimate house-flipping activities and contribute to a healthy and trustworthy real estate market in Georgia.

Read Also: Is Wholesaling Real Estate Legal In Georgia? A 2024 Guide For Investors

Do You Need A License To Flip Houses In Georgia?

No, you do not need a license to flip houses in Georgia. Investors may flip houses in Georgia without a license if they do not act as real estate brokers or agents.

That said, investors can get licensed if they want. Becoming a real estate agent has its advantages, like access to the MLS and a broad network of industry professionals.

Getting and maintaining a license can get expensive, so investors need to weigh whether it's better to get licensed or work with someone who already has one.

Read Also: How To Get MLS Access: The (Ultimate) Guide

How Much Does It Cost To Flip A House In GA?

The cost of flipping a house in Georgia will change depending on several variables. Everything from the subject property to interest rates and renovation expenses will impact how much it costs to flip a home in Georgia. Regardless, investors don’t need to budget for the costs out of their savings. Instead, investors can flip in Georgia using other people’s money.

Home Purchase Price

The first major cost in house flipping is the acquisition price of the property. As of 2024, the median home price in Georgia is approximately $334,819. However, prices can vary widely depending on the location and condition of the property. For example, distressed properties or foreclosures in some areas can be purchased for as low as $50,000, while homes in more desirable neighborhoods or larger cities like Atlanta may cost significantly more. Typically, flippers might need to put down 5-20% of the purchase price as a down payment if financing the property, while the remainder can be covered through a mortgage or other financing options.

Home Repair Costs

Renovation costs are another significant expense in house flipping. In Georgia, the cost to repair and renovate a home can range from $20 to $40 per square foot, depending on the extent of the repairs needed and the quality of materials used. For a standard three-bedroom, two-bathroom home, typical renovation costs might fall between $30,000 and $60,000. To get the most accurate estimate, it’s advisable to consult with multiple general contractors who can inspect the property before you make a purchase. They can provide detailed quotes based on the specific repairs and updates required.

Carrying Costs

Carrying costs are ongoing expenses that accrue while you own the property but before it is sold. These include property taxes, homeowners insurance, utilities, and general maintenance. Property taxes in Georgia vary by location but typically range from 0.87% to 1.07% of the property's assessed value annually. Homeowners insurance averages around $1,300 per year, and utilities such as gas, water, and electricity can add up to $200-$400 per month. Additionally, general maintenance costs for lawn care, cleaning, and other upkeep should also be factored in. Being mindful of these expenses is crucial, as they can significantly impact your overall profit if the property takes longer to sell than anticipated.

Closing, Marketing, and Sales Costs

When it’s time to sell the flipped house, there are additional costs to consider, including real estate agent commissions, closing costs, marketing expenses, and miscellaneous fees. Real estate agent commissions typically amount to 5-6% of the sale price, while closing costs, which can include title transfer fees, notary fees, and other legal expenses, generally range from 2-5% of the sale price. Marketing costs for listing the property, professional photography, and other efforts to attract buyers should also be included in your budget. Additionally, any other legal or consulting fees incurred during the sales process must be accounted for.

Understanding these costs and planning accordingly will help you create a comprehensive budget for your house-flipping project in Georgia. With careful financial planning and a solid understanding of the local market, flipping houses in Georgia can be a highly profitable venture.

Read Also: How Much Does It Cost to Build A House In Georgia? (2024)

How To Flip A House In Georgia With No Money?

Investors can use private lenders’ capital instead of their own. In fact, the loans listed below are investors’ preferred methods of funding:

- Private Money Loans: Private money loans originate from anyone with excess capital. As their names suggest, private money loans are not associated with traditional banking institutions and can come from anyone with money, like friends or family. Private money loans coincide with high interest rates, but their cost is well worth the benefits they provide.

- Hard Money Loans: Not unlike private money loans, hard money loans aren’t associated with conventional banks. However, they aren’t as informal as private money loans. Instead, they have found a middle ground to lend investors money. Hard money loans also have high rates, but their pros greatly outweigh their cons.

- Wholesaling: Wholesaling real estate is another investment strategy that doesn’t require investors to front their cash. The investor signs a contract with the owner, giving them the right to buy the property. The investor then sells their right to purchase the home to another buyer for a fee.

Read Also: How To Flip Houses With No Money & 10 Proven Methods In 2023

What's The Best Place To Flip Houses In Georgia?

Georgia offers a variety of promising locations for house flippers, each with unique advantages and opportunities. The following cities in Georgia are ideal for house-flipping ventures:

- Atlanta: Atlanta, Georgia's capital and largest city, boasts a median home value of $390,000. The city's strong economy and diverse industries drive demand for housing. House flippers can expect average profits of up to $70,000 per flip, with a range of price points and renovation opportunities across various neighborhoods.

- Savannah: Savannah, known for its historic charm and vibrant tourism industry, has a median home value of around $275,000. The city's growing population and appeal to both tourists and new residents make it a prime market for house flipping. Average profits in Savannah can reach approximately $55,000 per flip.

- Augusta: With a median home value of $180,000, Augusta offers an affordable entry point for investors. The city's steady economic growth and ongoing development projects have increased housing demand. House flippers in Augusta can achieve average profits of up to $50,000 per flip.

- Columbus: Columbus, Georgia's third-largest city, has a median home value of $160,000. The city's economic stability, supported by a strong military presence and diverse industries, fosters a growing real estate market. Flippers in Columbus can expect average profits of around $45,000 per flip.

- Macon: Macon presents an emerging market for house flippers, with a median home value of approximately $140,000. The city's revitalization efforts and economic development initiatives boost the local real estate market. House flippers in Macon can anticipate average profits of about $40,000 per flip.

Choosing the right city is crucial for the success of your house-flipping venture. Each of these Georgia cities offers unique advantages, from affordable entry points to high-profit potentials. Conduct thorough research and consider working with local real estate experts to maximize your investment opportunities and ensure successful flips in Georgia's dynamic housing market.

With this in mind, we invite you to join our FREE training on house flipping in Georgia. We'll guide you through the ins and outs of finding the perfect property, performing the right renovations, and, ultimately, flipping for a profit. Don't miss out on the chance to turn Georgia's real estate opportunities into your financial success story. Sign up for our free training today!

Is It Hard To Flip Houses In Georgia?

Flipping houses in Georgia offers a mix of challenges and opportunities, much like in other states. One of the primary challenges is the competitive real estate market, especially in cities like Atlanta and Savannah. Investors often face bidding wars, requiring quick decisions and sometimes higher offers to secure properties. This competition, however, can lead to higher sale prices for well-renovated homes, potentially increasing profits.

Another challenge is finding skilled laborers and contractors. With the growing number of renovation projects, securing reliable professionals can be difficult. Building a network of trusted contractors and planning for potential delays is crucial to keep your project on track and within budget.

On the positive side, Georgia's real estate market is robust, and renovated homes tend to sell quickly, especially in desirable neighborhoods. This fast-paced market can reduce holding costs and accelerate returns on investment, allowing you to move on to your next project sooner.

Navigating local regulations and understanding the costs involved in house flipping are also important. While Georgia generally has favorable real estate laws, specific codes and permit requirements can vary by city or county. Familiarizing yourself with these regulations and being aware of property taxes is essential to avoid legal issues and delays.

Flipping houses in Georgia presents both challenges and opportunities. By preparing for competition, securing reliable contractors, and staying informed about local regulations and market trends, you can successfully navigate the complexities and achieve success in your house-flipping endeavors.

*We also invite you to view our video on How To FLIP A HOUSE For Beginners (Step-by-Step). Host and CEO of Real Estate Skills, Alex Martinez, & Stan Gendlin share how to flip a house from start to finish as a beginner!

How Do You Find Contractors For Flipping Houses In Georgia?

Finding reliable contractors is a critical step in flipping houses, and Georgia offers several effective methods to connect with skilled professionals. Whether you're new to the area or just starting out, leveraging both online resources and local networks can help you find the right contractors for your projects.

- HomeAdvisor: One of the most popular platforms for finding contractors is HomeAdvisor. This website provides a comprehensive list of professionals for various aspects of your renovation project. You can view contractor profiles, read reviews from previous clients, and compare pricing. Many contractors on HomeAdvisor also offer fixed pricing, which helps you estimate your project costs more accurately.

- Thumbtack: Thumbtack is another valuable resource similar to HomeAdvisor. It connects you with local contractors and allows you to compare quotes and read reviews. Since not all contractors use both platforms, checking Thumbtack alongside HomeAdvisor increases your chances of finding the right match for your needs.

- Angi: For those looking to find specialized professionals, Angi (formerly Angie’s List) is a great option. This platform connects users with contractors based on the specific type of project, helping you find experts in areas like plumbing, electrical work, or general renovations.

- Houzz: Houzz offers a dual benefit: not only can you find contractors, but you can also explore design ideas and get inspiration for your renovation project. This platform features a wide range of professionals and includes an eCommerce store for purchasing materials and furnishings.

- Craigslist: While Craigslist may not be the first choice for many investors, it can still be a useful tool for finding local contractors who may not be active on other platforms. However, it’s crucial to vet contractors thoroughly to ensure their reliability and quality of work.

- Facebook: Lastly, consider using Facebook to ask for referrals from friends or local neighborhood groups. This method can yield recommendations from people you trust and often leads to finding reputable contractors with proven track records in your area.

By combining these online resources with local referrals and networking, you can effectively find and hire contractors for your house-flipping projects in Georgia.

Final Thoughts On Flipping Homes In Georgia

The convergence of pent-up demand and relative affordability creates the perfect storm for real estate investors in Georgia. In fact, there may be no better time to learn how to flip houses in Georgia than right now. The sooner you can secure your financial future in an uncertain economy, the better.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.