Best House Flipping Accounting Software & IRS Rules (2026 Guide)

Feb 02, 2026Key Takeaways: House Flipping Accounting Software

- The Reality: On the surface, flipping is more than just "investing". It's a system that can scale into a business, which—yes—requires diligent accounting to do well.

- The Risk: "Shoebox accounting" isn't enough to run a single flip, let alone a successful flipping business. Improper accounting can lead to lost deductions, tax nightmares, and even the inability to tell if a deal will be profitable or not.

- The Solution: You need specialized house flipping accounting software that integrates project management (budgets/timelines) with financial tracking (receipts/bank feeds).

In a Rush? Here is the "Cheat Sheet"

- 🏆 Best Overall for Flippers: FlipperForce (Best mix of project management + accounting)

- 📈 Best for Scaling/CPAs: QuickBooks Online Plus (Required for "Class Tracking")

- 💰 Best for Budget/Landlords: REI Hub (Cheaper, easier than QB)

Close your eyes and picture this: You just signed the papers and sold your first rehab project. Everything on your end looked great: the renovations stole the show, the buyer was happy with the end results, and the money is already in your account. On the back of a napkin, you scribble down a few numbers and quickly realize you made about $45,000 for about four months of work. Not too shabby.

But now the calendar turns to the new year, and tax season is looming.

Frantically, you start looking for all the receipts you compiled over the course of your flip: the $8,000 you spent on the HVAC, the $3,500 you logged in permit fees, and all the money you spent to make the house better than all the nearby comps. When you finally get your hands on the invoices you need, you either realize you don't have anything, or they are such a jumbled mess that your CPA is going ot have to work overtime.

In the end, that $45,000 profit was actually $25,000, and the IRS just took a massive chunk of what was left. This is the "Shoebox Nightmare," and it kills more flipping businesses than bad markets do.

Unfortunately, this made-up scenario is all too familiar for new investors. They treat flipping like a hobby, and not like a business. They have too much fun during the process that they forget that accounting is still very real and very necessary to run a successful flip.

⚠️ Critical Warning: Rentals vs. Flips

Do not use property management software for flipping. Tools like Buildium, DoorLoop, or AppFolio are designed for landlords. They excel at tracking tenant rent rolls and recurring monthly maintenance.

House flipping accounting software is completely different. It focuses on:

- Project Budgets: Tracking "Actual vs. Estimated" costs.

- Inventory Management: Treating the house as an asset to be sold, not a rental generating income.

- Capital Improvements: Knowing what adds to the "Cost Basis" versus what is an expense.

If you want to treat this like a real business, you need the right tools. Below, we break down the accounting rules you need to know and the best software to handle them.

- The "Hidden" IRS Rules

- Top 3 Software Contenders

- Step-by-Step Setup Guide

- Frequently Asked Questions

Before you decide on a software, make sure you know how to invest. Many beginners get stuck researching tools instead of finding deals. Our FREE Training walks you through the fundamentals of finding, funding, and flipping houses—so you actually have profits to track.

This FREE Training reveals the exact system our students use to build profitable flipping businesses. Watch it today to master the investing process first, then pick the tools to support it.

The "Hidden" Rules of Flip Accounting (What the IRS Wants)

Most generic house flipping accounting software fails because it treats every transaction like a standard business expense. But house flipping has a unique tax structure. If you treat a renovation like a simple write-off, you are raising a massive red flag for an audit.

Before you choose a tool, you must understand the three specific rules that your software needs to handle:

- You Are a "Dealer," Not an Investor: The IRS classifies active house flippers as "Dealers." This means the properties you buy are considered Inventory (like cans of soup in a grocery store), not Capital Assets (like a rental property). This puts you in the 'Dealer' bucket. Instead of the lower capital gains rates that long-term investors get, you’re stuck paying full self-employment tax on a Schedule C.

- Capitalizing vs. Expensing (The "Matching" Principle): This is the most common mistake beginners make. You generally cannot deduct renovation costs (like a new roof or flooring) in the year you pay for them. Instead, you must practice work-in-progress accounting. You "capitalize" these costs, adding them to the value of the asset on your Balance Sheet. You only get to deduct them as "Cost of Goods Sold" (COGS) in the exact year you sell the house. Your software must be able to track capitalizing improvements correctly, or your P&L will look wildly inaccurate.

- The "Bucket" Theory (Job Costing): Investors can't just list "Repairs: $100,000" when they file their Schedule C. Investors need to keep track of where every dollar goes and which house it was used on. As a result, a good software must support "Job Costing" or "Class Tracking"—creating a digital "bucket" for each property to keep track of every expense.

Related Reading: Taxes On Flipping Houses

Stop Using Your Accounting Software to Document a Loss

Accounting tools like QuickBooks are great for tracking where your money went, but they can't save you if you bought a bad deal to begin with. You need to validate your profit margins before you create a new project file. Download the professional Deal Calculator we use to stress-test our rehab budgets and ensure the numbers work before you ever scan a single receipt.

The Top 3 Contenders (Detailed Analysis)

There is no single "perfect" tool. The best accounting software for house flipping depends entirely on your business model. Are you a solo operator swinging a hammer? A CEO managing five projects at once? Or a landlord who flips occasionally?

Here are the three best options based on how you run your business.

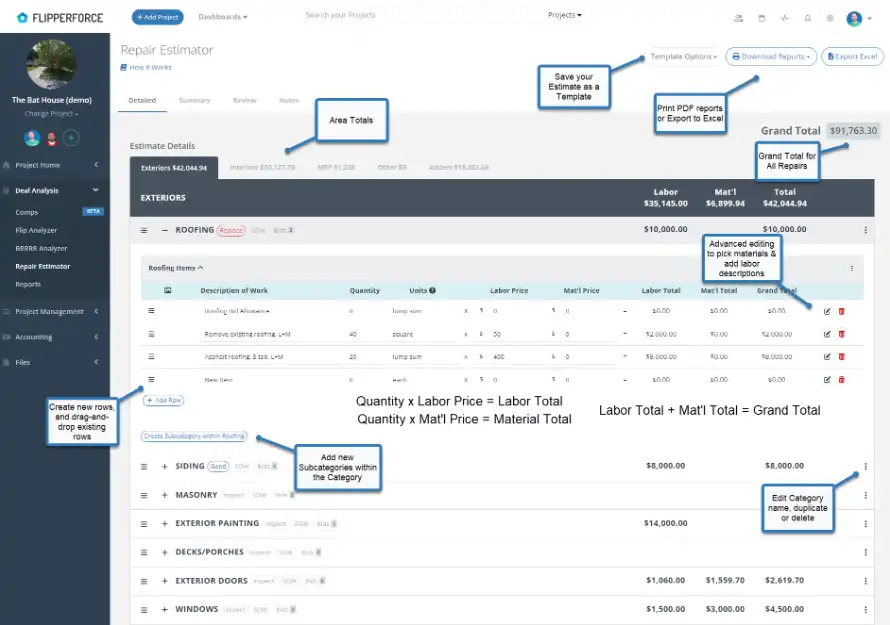

1. The "All-in-One" Specialist: FlipperForce

If you are tired of jumping between spreadsheets and random apps, FlipperForce is the answer. It is built specifically for house flippers, not generic small businesses.

New for 2026: FlipperForce just released its AI Receipt Analyzer. In our testing, this was a game-changer. Instead of manually typing in "Home Depot - $45.12," you just snap a photo. It reads the vendor, date, and total instantly, but the real time-saver is the auto-categorization. It knows to drop that expense right into your 'Paint' or 'Electrical' bucket without you touching it. They also rolled out DaveBot, an AI assistant that actually answers your technical questions on the spot.

- Pros:

- AI Bookkeeping: "Shoebox to spreadsheet" in seconds.

- Built-in project management (Gantt charts & timelines).

- IRS-compliant expense categorization specifically for flips.

- Cons:

- It is not a full-service payroll tool (you still need a separate solution for W-2 employees).

2. The "Gold Standard" Accountant: QuickBooks Online

If your goal is to scale into a massive operation with outside lenders and a dedicated CPA, QuickBooks for real estate flipping is the industry standard. It handles everything from contractor 1099s to complex balance sheets.

2026 Update: QuickBooks recently overhauled its interface with a "New View" and enhanced its own AI-auto categorization. While powerful, you must upgrade to the "Plus" or "Advanced" plan to unlock "Class Tracking"—the only way to track profitability by individual property address.

- Pros:

- Every CPA in the world knows how to use it.

- Direct bank feeds specifically designed for "Class Tracking."

- Scales infinitely (can handle 50+ projects at once).

- Cons:

- Expensive ($90+/month for the features flippers need).

- Steep learning curve (requires manual setup to handle "WIP" accounting correctly).

3. The "Budget" Hybrid: REI Hub & Stessa

This category is for the investor who holds a portfolio of rentals but flips 1-2 houses a year. REI Hub pricing is generally more affordable than QuickBooks, and it comes pre-configured with a real estate chart of accounts (unlike QuickBooks).

Alternatively, many investors ask about using Stessa for flips. While Stessa is fantastic (and mostly free) for rental tracking, it struggles with the nuances of heavy construction accounting. It is best used if your "flips" are light cosmetic updates (wholetailing) rather than full gut renovations.

- Pros:

- REI Hub: Pre-set template specifically for real estate investors.

- Stessa: excellent for tracking rental cash flow and basic expenses.

- More affordable and user-friendly than QuickBooks.

- Cons:

- Limited "Project Management" features (no timelines or Gantt charts).

- Stessa: Does not handle complex "Work in Progress" balance sheet accounting well.

Comparison Table: Best House Flipping Accounting Software

To help you make a quick decision, we have compiled a software comparison of the top three contenders. This table breaks down the best accounting software for real estate investors based on cost, features, and ease of use.

While the best accounting software for house flipping, like FlipperForce, handles the operational side (schedules and budgets), you may still need a tool like QuickBooks if you run a large payroll or have complex corporate taxes.

How to Set Up Your "Flow" (Step-by-Step)

Buying the best house flipping accounting software won't save you if your process is broken. Software is garbage in, garbage out. To protect your profits (and your sanity), you need a strict expense tracking workflow.

Here is the exact three-step system to keep your books bulletproof:

- Step 1: The "One House, One Account" Rule: The cardinal sin of real estate banking setup is "commingling" funds. Never pay for a contractor with your personal credit card. Ideally, you should open a separate checking account for each active flip.

If that feels like too much admin, you must at least have one dedicated "Flip Operations" business account. Every dime of funding goes into it, and every expense comes out of it. This creates a clean "paper trail" that makes end-of-year tax filing instant rather than a forensic investigation. - Step 2: Build Your "Chart of Accounts": You cannot just categorize everything as "Repairs." You need detailed data to know if you overspent on electrical or plumbing. When setting up your chart of accounts for flipping houses, use these specific parent categories:

- Acquisition Costs: Closing fees, title insurance, inspections.

- Direct Renovation Costs:

- Demolition & Haul Away

- HVAC / Plumbing / Electrical

- Framing & Drywall

- Finish Materials (Flooring, Paint, Cabinets)

- Holding Costs: Loan interest, property taxes, utilities, insurance.

- Selling Costs: Agent commissions, staging, and closing credits.

- Step 3: The "Friday 15" Routine: Procrastination is the enemy of accuracy. If you wait until tax season to log receipts, you will forget what that $400 Home Depot charge was for.

Commit to the "Friday 15." Every Friday afternoon at 4:00 PM, take 15 minutes to:- Log into your bank account.

- Snap photos of physical receipts using your software's mobile app.

- Tag every transaction to the correct property.

Frequently Asked Questions

Let's take a look at some of the most frequently asked questions investors have when thinking about house flipping accounting software:

Final Thoughts on House Flipping Accounting Software

Flipping houses is high-stakes manufacturing, not a side hobby. To last in this game, you need to know your exact profit margins at all times. It doesn't matter if you pick FlipperForce or QuickBooks—investing in solid house flipping accounting software is the only way to scale. Get rid of the shoebox, clean up your books, and start running your business on data instead of guesses.

Before you decide on a software, make sure you know how to invest. Many beginners get stuck researching tools instead of finding deals. Our FREE Training walks you through the fundamentals of finding, funding, and flipping houses—so you actually have profits to track.

This FREE Training reveals the exact system our students use to build profitable flipping businesses. Watch it today to master the investing process first, then pick the tools to support it.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.