Can Real Estate Agents Flip Houses? The "Hybrid" Investor Strategy (2026)

Jan 30, 2026Key Takeaways: Can Real Estate Agents Flip Houses?

- The Answer: Yes, real estate agents and Realtors can flip houses. The hybrid model we will discuss here today is not only legal but also incredibly profitable.

- The Advantage: Agents with their ears to the ground can learn of deals before most competitors, and they can even skip past some additional costs.

- The Risk: There are rules agents need to follow when flipping houses. You must navigate the "Broker Blockade" and strict E&O insurance exclusions.

- The Rule: You cannot hide your license. Disclosure must happen in the first conversation, or you risk losing your credentials.

What You’ll Learn: How to build a "Hybrid" real estate business without getting sued, fired, or fined.

There is a myth that you have to choose.

You are either a "Realtor" driving clients around in a clean car, or you are an "Investor" in dusty boots ripping out drywall. People think these are two different jobs. They aren't.

If you are asking can real estate agents flip houses, the answer is yes. But that is the wrong question. The right question is: Should you?

The "Hybrid Model" (being both an agent and an investor) is the ultimate leverage. You get paid to find deals. You get paid to buy them. You get paid to sell them. But it comes with a target on your back.

When an unlicensed investor screws up a disclosure, it's a mistake. When you do it, it's negligence. You are a "professional." The courts hold you to a higher standard. If you want to play this game, you need to know the rules of engagement. Here is how to do it without losing your license.

- The "Unfair Advantage": Why Agents Win

- The "Broker Blockade" (And How to Beat It)

- Navigating the Ethics Minefield

- The 2026 "Pocket Listing" Trap

- Frequently Asked Questions

You don't need a license to start, but you do need a system. Whether you have a license or not, the principles of finding off-market deals remain the same. Our FREE Training breaks down the acquisition strategies that work in any market.

Watch The Debate: Pros vs. Cons of the Hybrid Model.

Alex and Stan break down the exact math of the "Commission Stack" and the risks of fiduciary duties in this 7-minute deep dive.

The "Unfair Advantage": Why Agents Win

Most people think the only reason to get a license is to "save the commission." That is amateur thinking. Saving 3% is nice, but it isn't life-changing. The real advantage of the "Hybrid Model" isn't about saving money; it's about speed and control.

When you are an agent-investor, you are playing a completely different game than the unlicensed competition. You have three distinct levers that they cannot pull.

1. The "Commission Stack" (The Math)

Let's look at a real scenario. A standard flipper and an agent-investor both identify the same property. It is listed for $400,000. It needs $50,000 in work. It will sell for $550,000.

The Unlicensed Flipper:

- Pays $400,000 for the house.

- Pays a buyer's agent $10,000 (2.5%) to write the offer.

- Pays a listing agent $16,500 (3%) to sell the flip on the back end.

- Total Costs: $26,500.

The Agent-Investor (You):

- Pays $400,000 for the house.

- Earns $10,000 (2.5%) commission on the buy.

- Pays $0 in listing commissions on the sale (Self-Represented).

- Total Costs: +$10,000 Profit.

That is a $36,500 swing in margin on a single deal. That margin is your safety net. It allows you to survive a market downturn or an unexpected repair that would bankrupt an unlicensed competitor.

💡 Pro Tip: The "Cash-to-Close" Hack

Many lenders allow you to apply your buyer's agent commission directly to your closing costs or down payment. On a $400k purchase, that $10,000 commission means you have to bring $10,000 less cash to the closing table. This preserves your liquidity for the renovation.

2. The "Speed to Lead" (The Feed)

In real estate, speed is the only currency that matters. If you are relying on Zillow, Redfin, or Realtor.com to find deals, you are already too late.

These sites are "aggregators." They pull data from the MLS via an IDX feed. This process can have a latency of 15 minutes to 24 hours. In a hot market, the best fixer-uppers are sold within hours.

As an agent, you have direct access to the MLS. You can set up "Instant Alerts" that ping your phone the second a property hits the market. Even better, you can see the "Coming Soon" status. This allows you to analyze the deal, drive the neighborhood, and draft your offer days before the public even knows the house is for sale.

3. The "Keypad" Access (The Control)

Imagine this scenario: A distressed property hits the market at 4:00 PM on a Friday.

The unlicensed investor calls the listing agent. It goes to voicemail. They text. No reply. They have to wait until Saturday morning to hopefully get a showing time approved.

You? You open your "Supra" or "SentriKey" app. You see the property is vacant and on a secure lockbox. You drive over at 4:30 PM, walk the property, estimate the repairs, and have a clean cash offer in the listing agent's inbox by 5:30 PM.

By the time the unlicensed investor gets a call back on Saturday morning, you are already under contract. Access is control.

License or Not, You Need a System to Find Deals

Most agents spend months studying for a state exam, yet spend zero hours learning how to actually find a profitable investment. This is backward. A license allows you to legally represent others, but it doesn't teach you how to analyze a flip, estimate repairs, or secure hard money.

Whether you want to be a "Hybrid Agent" or stay unlicensed, you need a proven blueprint to get started. You need to know how to identify assets that cash flow effectively, regardless of what credentials are on your business card. Download our Ultimate Guide to start investing the right way.

The "Broker Blockade" (And How to Beat It)

Picture this: You just locked up your first fixer-upper. The numbers work, the financing is ready, and you are excited to close. You take the file to your managing broker for the final signature, and they stop you cold.

They might demand you co-list the finished product with a senior agent, or worse, tell you that you can't buy it at all because of company policy. This is the Broker Blockade. It catches almost every new agent-investor off guard, and it all stems from one thing: the massive legal target on your back.

1. The Liability Nightmare (The "Deep Pockets" Theory)

In the eyes of the law, a real estate brokerage is responsible for the actions of its agents. When a standard homeowner sells a house and forgets to mention a leaky basement, it’s a mistake. When you—a licensed professional—sell a house you own and miss that same leak, a jury calls it fraud.

Plaintiffs' attorneys love suing agent-flippers because they don't just sue you; they sue your brokerage. They argue that because you are a "pro," you used your insider knowledge to take advantage of the buyer. Big-box brokerages know this. They have calculated the risk, and many have decided that your $15,000 commission split isn't worth the risk of a $500,000 lawsuit.

2. The E&O Insurance Trap

Every active agent must carry Errors & Omissions (E&O) insurance. It protects you if you get sued for negligence. However, take a magnifying glass to the fine print of a standard corporate policy.

Most standard policies contain an "Owned Property Exclusion."

This clause states that if the agent (or an entity that the agent owns more than 10% of) is a principal in the transaction, the insurance policy is void. If you flip a house under this policy and get sued, the insurance company will deny the claim. You will be paying for your legal defense out of your own pocket. If your broker knows this, they will not let you close the deal.

🛑 The "Listing" Conflict:

Some retail brokers will allow you to flip, but they demand their "pound of flesh." They may require you to list the finished flip with them and pay the full brokerage split (e.g., 20% to 50% of the commission) back to the house. This eats directly into your profit margin.

3. The Solution: The "Investor-Friendly" Brokerage

If you want to be a Hybrid Agent, you cannot hang your license just anywhere. You need a brokerage designed for operators.

You are looking for specific keywords: "100% Commission," "Flat Fee," or "Transaction Fee" brokerages. These firms operate differently. Instead of taking a percentage of your deal, they charge a flat monthly fee (e.g., $100/month) or a per-transaction fee (e.g., $500 per file). More importantly, their E&O policies usually have "riders" specifically purchased to cover agent-owned transactions.

The "Broker Interview" Protocol

Do not sign with a broker until you ask these three questions. Get the answers in writing.

- 1. "Does your E&O policy cover 'Agent-Owned' transactions?"

If the answer is no, ask if you can pay extra for a rider. If not, walk away. - 2. "Do you have any restrictions on me listing my own properties?"

Some brokers require you to co-list with a senior agent if it's your own deal. Avoid this. - 3. "What is the commission split on personal transactions?"

Ideally, you want a brokerage that charges a minimal transaction fee (e.g., $495), rather than taking a 30% cut of your hard-earned equity.

Navigating the Ethics Minefield

This is where the "Hybrid Model" gets dangerous. When you carry a real estate license, you are a fiduciary. That is a legal term that means you are obligated by law to put your client's financial interests above your own.

But as an investor, your goal is to buy low. Do you see the problem?

This creates a massive conflict of interest. If a seller invites you over to list their home, they are trusting you to give them expert advice. If you look at their house, realize it's a goldmine, and try to convince them to sell it to you cheaply without telling them what it's really worth, you aren't just a shark—you are breaking the law.

The "Predatory" Scenario (How Agents Get Sued)

Imagine you walk into a living room. The seller is tired, stressed, and just wants out. They say, "I don't know what it's worth... maybe $200,000?"

You know that with a little paint, it's worth $300,000. An unlicensed investor can simply say, "I'll give you $200,000 right now," and sign the deal. That is capitalism.

But you? You cannot do that. If you agree to the $200,000 price without disclosing the true market value, you are withholding material facts. Six months later, when that seller sees you sold the house for $350,000, they will hire a lawyer. They will claim you violated your fiduciary duty. And they will win.

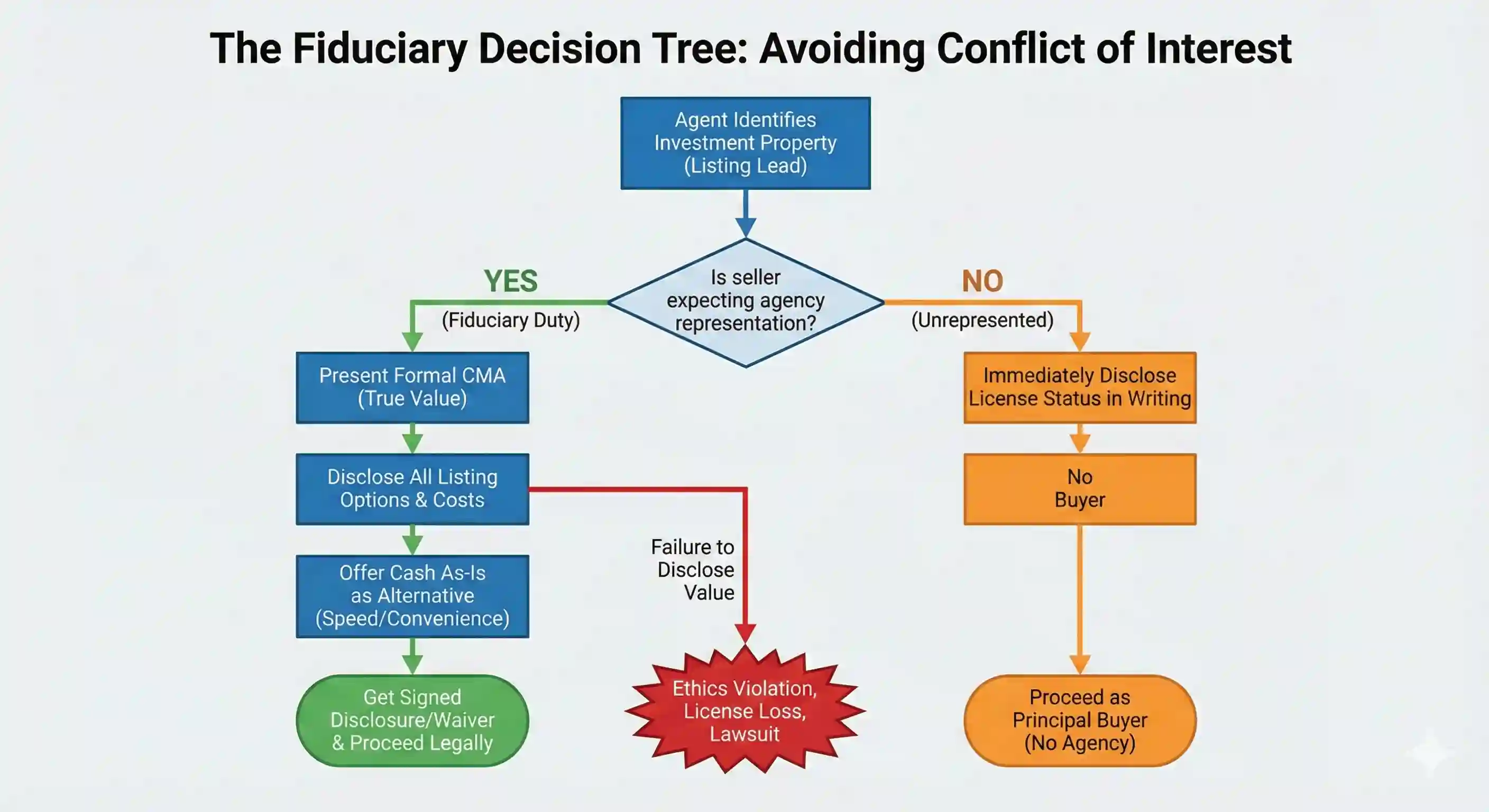

Don't guess on ethics. Follow the path to stay legal.

The Solution: The "CMA Defense" Protocol

You can still buy the house. You can still get a great deal. But you have to strip away the "information asymmetry." You must prove that the seller knew they were leaving money on the table and chose to do it anyway for the sake of speed.

Follow this exact sequence for every off-market listing appointment:

The "Two-Path" Presentation

When a seller asks "What should I do?", you present two clear options. This puts the power back in their hands and protects your license.

Path A: The Retail Listing (Top Dollar)

- Gross Price: $300,000 (Based on CMA)

- Commissions (6%): -$18,000

- Closing Costs (2%): -$6,000

- Repairs Required: -$5,000

- Timeline: 60-90 Days

- Net to Seller: ~$271,000

Path B: The Cash Offer (Top Speed)

- Gross Price: $240,000 (As-Is)

- Commissions: $0

- Closing Costs: $0 (You pay them)

- Repairs Required: None

- Timeline: 14 Days

- Net to Seller: $240,000

The Script: "Mr. Seller, if you list with me, you will walk away with roughly $30k more, but it will take 3 months and you have to deal with showings. If you sell to me, you get the money in 2 weeks, but you net less. Which path is more important to you right now?"

The "Veil Piercing" Warning

Some agents try to be clever. They think, "I won't tell them I'm an agent. I'll just buy it in my LLC's name."

Do not do this. It is called "undisclosed dual capacity." Courts can "pierce the corporate veil" of your LLC in seconds. If you have a license, you are held to the standard of a licensee, regardless of what entity is on the contract.

The Golden Rule: Always include this specific line in the Special Provisions of your Purchase Agreement:

"Seller acknowledges that Buyer is a licensed real estate agent in the state of [Your State] buying for profit and loss. Seller acknowledges they have been advised to seek independent legal and tax counsel."

The 2026 "Pocket Listing" Trap

In the old days of flipping, the "Pocket Listing" was your best friend. You would finish a rehab, tell the agents in your office about it, and try to sell it "off-market" to keep both sides of the commission.

That era is dead. The NAR Clear Cooperation Policy killed it.

The rule is simple but strict: "Within one business day of marketing a property to the public, the listing broker must submit the listing to the MLS."

This sounds easy to follow, but agent-investors get tripped up on the definition of "marketing."

The "Instagram" Trap

Here is how agents get fined $5,000 without realizing it. You finish your flip. It looks beautiful. You snap a photo of the kitchen and post it to your Instagram Story with the caption: "Coming to market next week! DM me for details."

You just broke the rule.

Social media counts as "public marketing." By posting that photo, you triggered the 24-hour clock. If that house isn't active on the MLS by the next business day, your local board can hit you with a massive fine and suspend your MLS access. Do not try to "get cute" with this policy. The local boards use scraping bots to find these violations.

🚫 The "Office Exclusive" Myth:

Yes, you can still sign an "Office Exclusive" (meaning only agents in your brokerage can see it). But if you do that, you cannot put a sign in the yard. You cannot post it on Facebook. You cannot put it on Zillow. It must remain 100% dark to the public. For a flipper, this is stupid. You want a bidding war, not a secret sale.

The Winning Strategy: The "Coming Soon" Campaign

So, how do you build hype without breaking the rules? You use the "Coming Soon" status (sometimes called "Delayed Showing").

This is the most powerful tool in the Agent-Investor arsenal. It allows you to list the property on the MLS (satisfying the Clear Cooperation Policy) while blocking showings for a specific period (usually up to 21 days, depending on your local board).

The "21-Day Pressure Cooker" Playbook:

- Day 1 (List It): Input the listing into the MLS as "Coming Soon." Upload only one photo (the exterior).

- Day 2-14 (Tease It): Now that it's in the MLS, you are legal. Blast it on social media. Put the sign in the yard with a "Coming Soon" rider. Run Facebook ads.

- The Result: The "Coming Soon" status Syndicates to Zillow and Redfin. Buyers see it, but they can't see the inside. They can't book a tour. It creates a "velvet rope" effect.

- Day 21 (Launch It): Flip the status to "Active" on a Thursday. By Friday, you have 50 buyers who have been waiting three weeks to get inside. You create an artificial frenzy that drives the price up.

Summary: The Rules of Engagement

If you are going to be a Hybrid Agent, you have to follow the rules of the road. It is better to use the system to your advantage than to try to sneak around it.

Frequently Asked Questions

Here are the specific tactical answers for operating as a Hybrid Agent in 2026.

Final Thoughts: The Best of Both Worlds

So, can real estate agents flip houses? Yes. And if you are serious about wealth, you should.

Being an agent is a treadmill. Being an investor is wealth. Combining them is the cheat code. Just remember: You are held to a higher standard. Don't hide your license. Don't cut corners. And don't represent the buyer on your own deal.

You don't need a license to start, but you do need a system. Whether you have a license or not, the principles of finding off-market deals remain the same. Our FREE Training breaks down the acquisition strategies that work in any market.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.