Real Estate Developer Salary (2026): The Truth About Fees, Equity & Income

Dec 12, 2025

Key Takeaways: Real Estate Developer Salary

- Salary vs. Promote: Why the base salary is just the tip of the iceberg, and how "The Promote" (profit share) creates exponential wealth.

- The Conductor Role: Developers don't lay bricks or draw blueprints; they manage the capital and the risk.

- Corporate vs. Independent: The income difference between climbing the ladder at a firm (Analyst to VP) versus becoming a "Sponsor" yourself.

What You’ll Learn: A complete breakdown of the 2026 developer compensation structure, from entry-level W-2 jobs to the multi-million dollar payouts of deal sponsors.

The real estate developer salary is often the most misunderstood number in the entire industry.

In the hierarchy of real estate, everyone ultimately works for the Developer. The agents sell their inventory, the architects draw their vision, and the contractors build their structures. The Developer is the conductor of the orchestra. They don't play the instruments, but they own the concert.

However, if you are searching for "how much do real estate developers make," you need to understand that there are two completely different answers.

First, there is the Corporate Path. This is the W-2 real estate development career path where you climb the ladder from Analyst to Vice President, earning a high six-figure salary plus bonuses. Second, there is the Independent Path (The Sponsor). These developers might pay themselves zero salary, but they take home millions in "Back-End Profit" when a project sells.

In 2026, the gap between these two paths is widening. Whether you are looking for a stable job at a development firm or planning to build your own empire, you must understand the difference between "Fees" and "Equity."

Here is what we will cover:

- What Does a Real Estate Developer Do? (The Quarterback Role)

- Real Estate Developer Salary in 2026 (The Corporate Ladder)

- The "Promote": How Developers REALLY Get Rich

- The "Developer Tax": Risks & Burn Rate

- Residential vs. Commercial: Which Pays More?

- How to Become a Developer (The Career Path)

- Frequently Asked Questions (FAQ)

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Does a Real Estate Developer Do? (The "Quarterback" Role)

To understand the salary, you have to understand the job. A real estate developer's job description is less about hammers and nails and more about spreadsheets, contracts, and vision. Think of the Developer as the NFL Quarterback. They call the plays, they hand off the ball to the experts (Architects/Contractors), but if the team loses, the Developer takes the hit.

Fundamentally, a developer takes raw land or an underutilized asset and creates value through a four-step process:

- 1. Land Acquisition: Finding the dirt. This involves deep market analysis and negotiation to buy the property at a price that makes the math work.

- 2. Entitlements (The Hardest Part): This is the "paper game." The developer must convince the city, the neighbors, and the zoning board to legally allow the project. In my experience, this is where projects die. If you can't get the permit, the land is worthless.

- 3. Construction: Once approved, the developer hires a General Contractor (GC) to build it. The developer manages the budget and the timeline, not the construction crew.

- 4. Disposition / Lease-Up: The exit. Selling the building for a profit or leasing it up to generate long-term cash flow.

Developer vs. General Contractor vs. Architect

Newcomers often confuse these roles. Here is who does what in the steps of real estate development:

| Role | Primary Responsibility | The Risk Profile |

|---|---|---|

| The Developer | Vision & Capital. Owns the project, raises the money, and hires the team. | High. If the project fails, the developer loses their equity and time. |

| General Contractor (GC) | Execution. Manages labor, materials, and physical construction. | Low/Medium. They get paid a fee to build, regardless of whether the building sells. |

| The Architect | Design. Creates the aesthetics and ensures code compliance. | Low. They are paid a service fee for their drawings. |

Real Estate Developer Salary in 2026 (The Corporate Ladder)

If you want to work for a major firm (like a Trammell Crow, Hines, or Related), your compensation will follow a structured W-2 path. Unlike agents who eat what they kill, corporate developers get a steady paycheck, benefits, and substantial bonuses.

The real estate developer salary varies heavily based on experience and market. An analyst in New York City will earn significantly more than one in Phoenix, but the cost of living adjustment often levels the playing field.

The Corporate Income Hierarchy

Here is a breakdown of the typical base salary and bonus structure for 2026:

| Job Title | Avg Base Salary | Avg Annual Cash Bonus |

|---|---|---|

| Development Analyst | $85,000 - $110,000 | 10% - 20% ($10k - $20k) |

| Development Associate | $110,000 - $140,000 | 20% - 30% ($25k - $40k) |

| Development Manager | $140,000 - $180,000 | 30% - 50% ($50k - $90k) |

| VP / Director of Development | $200,000 - $350,000+ | 50% - 100%+ (Often includes equity) |

As you can see, the entry-level real estate developer salary starts strong compared to other industries, but the real jump happens at the Manager and Director level. Once you reach the VP level, your bonus structure often shifts from cash to "carry" (a small slice of the project's equity), which is where the real wealth building begins.

However, even a VP salary pales in comparison to what the owner of the company makes. To understand that number, we have to talk about "The Promote."

*For in-depth training on real estate investing, Real Estate Skills offers extensive courses to get you ready to make your first investment! Attend our FREE Webinar Training and gain insider knowledge, expert strategies, and essential skills to make the most of every real estate opportunity that comes your way!

The "Promote": How Developers REALLY Get Rich

If you only remember one thing from this article, let it be this: Wealthy developers do not get rich from their salary. They get rich from "The Promote."

In the corporate world, your bonus is capped. In real estate development, your bonus is theoretically uncapped because it is based on the performance of the asset. This is called the developer promote structure, and it is the mechanism that allows a developer to put in 5% of the money but take home 30% (or more) of the profit.

The Two Buckets of Income

To understand the waterfall, you must distinguish between the two ways a developer gets paid during a project:

- 1. The Developer Fee (Guaranteed Income): This is a standard fee charged to the project to cover the developer's overhead (office, staff, lights).

The Norm: real estate developer fees typically range from 3% to 5% of the total project costs. On a $10M build, that is a $300k-$500k fee paid out over the 2-year construction period. This pays the bills. - 2. The Promote (Performance Income): This is the "Carried Interest." It is a disproportionate share of the profits paid to the General Partner real estate sponsor for putting the deal together and exceeding return expectations.

Trading Risk for Equity

Why would investors allow a developer to take 30% of the profit if they only invested 5% of the cash? Because the developer takes 100% of the risk.

Investors (Limited Partners) usually get a "Preferred Return" (e.g., 8%). This means they get paid their 8% profit first before the developer sees a dime of profit. If the project underperforms, the developer works for free. But if the project hits a home run, the "Waterfall" spills over, and the developer's share explodes.

The Waterfall Calculation: A $10M Deal Example

Let's look at a simplified example of how a "Promote" creates exponential wealth compared to a salary.

- The Project: A $10M Apartment Complex Development.

- The Capital Stack: $3M Equity Required.

- Investors (LPs): Put in 90% ($2.7M).

- Developer (GP): Puts in 10% ($300k).

- The Exit: The building sells for $14M. After paying off the bank ($7M) and returning original capital ($3M), there is $4M in pure profit.

The Payout Split (The Waterfall):

- Tier 1 (Preferred Return): Investors get their guaranteed 8% return first.

- Tier 2 (The Promote): Because the project did so well, the split shifts. Instead of a 90/10 split based on cash invested, the remaining profit is split 70% to Investors / 30% to Developer.

- The Result: The Developer invested only 10% of the cash ($300k) but walked away with roughly $1.2M of the profit plus their original capital.

- ROI: The Investors made a solid return. The Developer made a 400% return.

The "Developer Tax": Risks & Burn Rate

After reading about 400% returns, you might be wondering: "Why doesn't everyone do this?"

The answer is risk. Development is the highest-paid profession in real estate because it carries the highest risk of total ruin. As a developer, you are the first money in and the last money out. If the project fails, the bank gets the land, the contractors get paid from the foreclosure, and you get zero.

If you are considering becoming an independent sponsor, you must understand the specific risks of real estate development that can wipe you out before you ever break ground:

The "Kill Switch" Risks

- Pre-Development Capital (The Burn): You will spend $100,000 to $500,000+ on architects, engineers, land use attorneys, and soil tests before you even get a permit. If the city council votes "No" on your zoning change, that money is gone forever. You cannot return a blueprint for a refund.

- Recourse Debt (Personal Guarantees): Most construction loans for new developers are "recourse." This means you are personally signing for the debt. If the project fails and the land value doesn't cover the loan, the bank can come after your personal house, your car, and your savings to cover the difference.

- Market Timing Risk: Development is slow. You buy the land in 2026, break ground in 2026, and deliver the building in 2027. If the economy crashes in 2026, you are delivering a new product into a recession. You cannot "day trade" a construction site; you are locked in.

- Construction Cost Volatility: You budget for lumber at today's prices. If a supply chain crisis hits (like in 2021) and material costs spike 30%, that overage comes directly out of your profit margin. The bank does not increase your loan just because wood got expensive.

This "Developer Tax" is why many professionals choose to stay on the corporate path. They trade the unlimited upside of the "Promote" for the safety of a salary and a 401(k). But for those with the stomach for it, the risk is the toll road to wealth.

Residential vs. Commercial: Which Pays More?

One of the first decisions you must make in this career is choosing a product type. The skill sets for building a 200-home subdivision (Residential) versus a 40-story office tower (Commercial) are vastly different, and so are the paychecks.

Generally speaking, a commercial real estate developer salary is higher at the corporate level. Commercial projects are more complex, require more sophisticated financing (capital stacks), and take longer to complete. Because the barrier to entry is higher, the talent pool is smaller, driving up wages for experienced Development Managers and VPs.

However, residential land developer income often offers a faster path to independence. It is easier to raise money for a small townhome project than a skyscraper, allowing residential developers to capture the "Promote" sooner in their careers.

Sector Comparison: The Trade-Offs

Here is a breakdown of how the money works in the two main sectors:

| Metric | Residential (Homebuilding / Land) | Commercial (Multifamily / Industrial) |

|---|---|---|

| Corporate Base Salary | $90,000 - $150,000 | $120,000 - $250,000+ |

| Deal Cycle (Speed) | Fast (12-24 Months). Build and sell inventory quickly to recycle capital. | Slow (3-5 Years). Long entitlements and construction periods delay the payday. |

| Barrier to Entry | Medium. You can start with a single spec home or a small 4-lot subdivision. | High. Requires institutional equity and complex zoning knowledge. |

| The Payday Model | Volume. Make smaller margins on many units (e.g., $40k profit per house x 50 houses). | The Exit. Develop for cash flow, then sell the stabilized asset for a massive 7-figure check. |

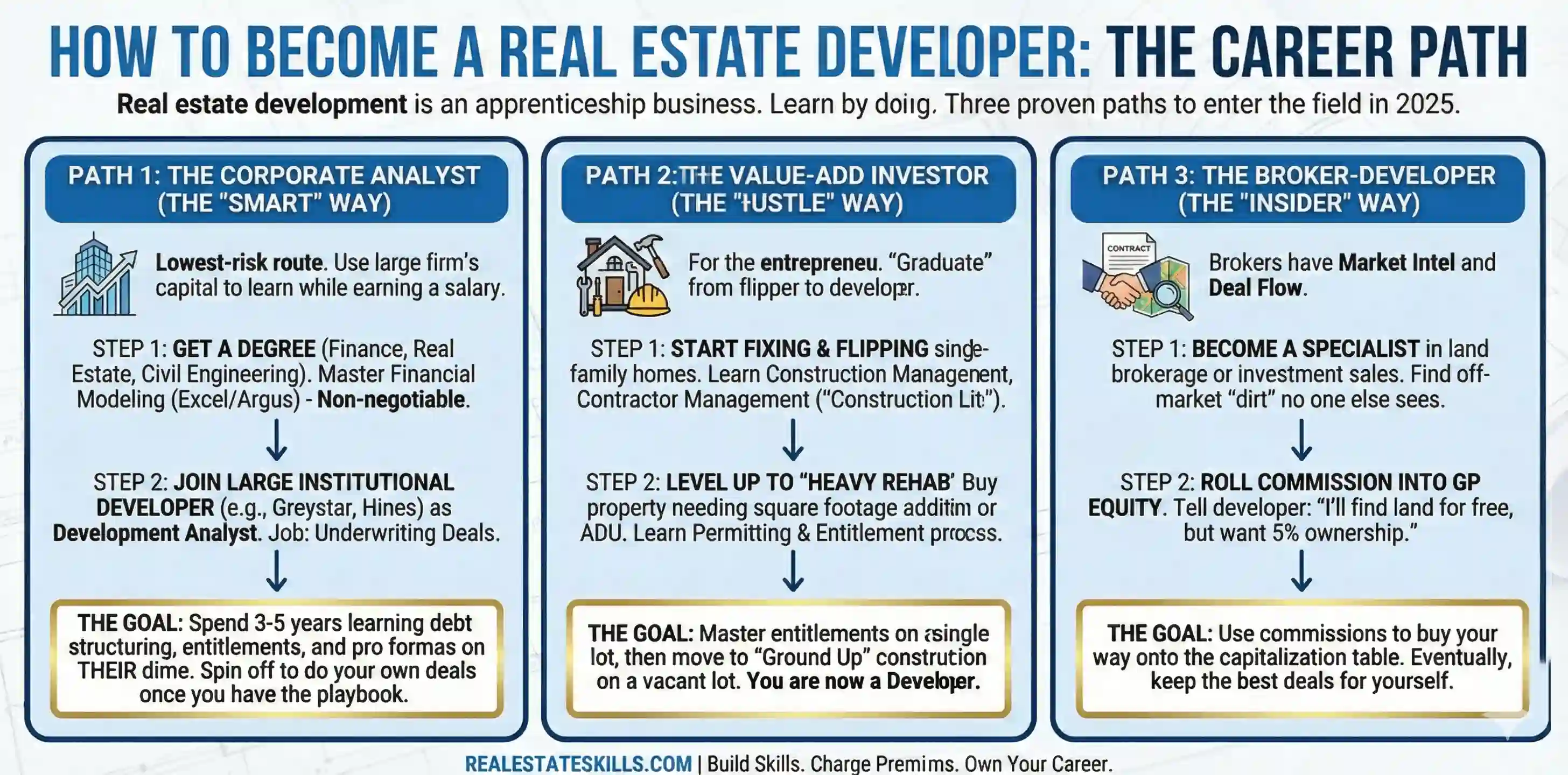

How to Become a Developer (The Career Path)

Real estate development is an apprenticeship business. You cannot learn it from a textbook; you learn it by losing sleep over a project. However, you need a way to get into the game before you can start playing.

Here are the three most proven paths to entering the field in 2026:

- Path 1: The Corporate Analyst (The "Smart" Way)

This is the lowest-risk route. You use a large firm's capital to learn the business while earning a salary.

Step 1: Get a degree in Finance, Real Estate, or Civil Engineering. In 2026, financial modeling skills (Excel/Argus) are non-negotiable.

Step 2: Join a large institutional developer (like Greystar, Hines, or Related) as a Development Analyst. Your job will be underwriting deals.

The Goal: Spend 3-5 years learning how to structure debt, manage entitlements, and run a pro forma on their dime. Once you have the playbook (and the network), you can spin off to do your own smaller deals. - Path 2: The Value-Add Investor (The "Hustle" Way)

This is for the entrepreneur who wants to start today. You essentially "graduate" from flipper to developer.

Step 1: Start by Fixing and Flipping single-family homes. This teaches you construction management, budgeting, and managing contractors on a small scale ("Construction Lite").

Step 2: Level up to "Heavy Rehab." Buy a property that needs a square footage addition or an ADU (Accessory Dwelling Unit). This forces you to learn the permitting and entitlement process.

The Goal: Once you master entitlements on a single lot, you move to "Ground Up" construction on a vacant lot. You have now become a developer. - Path 3: The Broker-Developer (The "Insider" Way)

Brokers have two things developers need: Market Intel and Deal Flow.

Step 1: Become a specialist in land brokerage or investment sales. Find the off-market dirt that no one else sees.

Step 2: Instead of taking a commission, roll your commission into the deal as GP Equity. Tell the developer: "I'll find you the land for free, but I want 5% ownership in the project."

The Goal: Use your commissions to buy your way onto the capitalization table. Eventually, you stop bringing the deals to other developers and start keeping the best ones for yourself.

The Blueprint: Stop Building Someone Else's Dream

Transitioning from a corporate real estate developer salary to owning your own projects doesn't happen overnight. It requires a shift in strategy. You already understand the construction and the capital; now you need to master the mechanics of finding the deal and structuring the acquisition.

That is why we created the Ultimate Guide to Start Real Estate Investing. It fills the critical gap between "managing the process" and "owning the asset."

Whether you want to start with a quick fix-and-flip to build your capital reserves (Path 2) or build a rental portfolio to replace your W-2 income, this guide covers the A-to-Z of the investment process.

Ready to break ground on your own terms? Click the image below to download your FREE copy of the Ultimate Guide now.

Frequently Asked Questions (FAQ)

Here are the direct answers to the most common questions regarding the real estate developer salary, compensation structures, and career requirements in 2026.

Final Thoughts: The Salary is Just the Starting Line

At this point, you should have a clear picture of the landscape. A high six-figure real estate developer salary is achievable on the corporate ladder, and for many, that stability is the ultimate goal. There is no shame in earning $250,000 a year to manage someone else's capital.

But if you entered this game to build generational wealth, the W-2 paycheck is just the starting line. The true titans of the industry don't measure their success in annual salary; they measure it in equity, cash flow, and the "Promote."

The "Developer Tax" of risk and stress is high, but it is the price of admission for unlimited upside. Whether you start as an analyst to learn on someone else's dime or jump straight into your first flip to learn by fire, the goal remains the same: Stop trading time for money and start trading vision for equity.

You have the roadmap. The only question left is whether you want to play it safe or play to win.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.