How To Become A Real Estate Investor: 8-Step Guide For Beginners

Sep 21, 2023

In the dynamic world of wealth-building, few avenues have stood the test of time quite like real estate investing. From legendary tycoons to the captivating dramas of Million Dollar Listing, Selling Sunset, Flip or Flop, and Love It or List It, the realm of real estate has shaped fortunes for centuries.

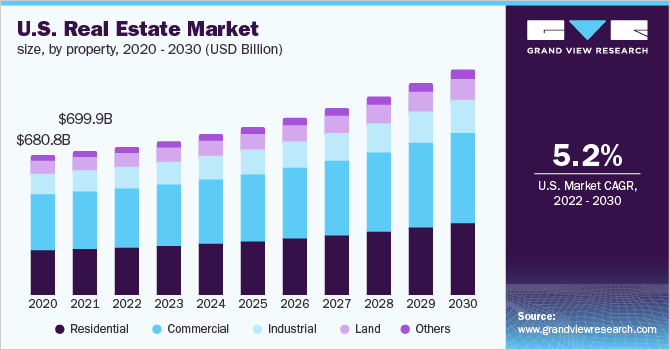

According to Grand View Research, the global real estate market size in 2021 was valued at $3.69 trillion and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030.

Source: GrandViewResearch.com

There's no better moment to explore how to become a real estate investor. The real estate industry encompasses economics, creativity, home improvement, marketing, and design, offering the best pathway to financial freedom.

Whether you're an investment beginner, seasoned entrepreneur, pragmatic economist, or a skilled tradesperson, you can harness the vast opportunities in real estate investing. In this comprehensive guide, we'll not only reveal how to become a real estate investor but also unveil five distinct strategies to thrive in this multifaceted industry.

Remember, real estate isn't just bricks and mortar; it's the cornerstone of wealth, the backbone of cities, and a proven opportunity to achieve your financial dreams.

Our journey into the world of real estate begins here, where we'll equip you with the knowledge, skills, and strategies to embark on your path to becoming a successful real estate investor:

- What Is A Real Estate Investor?

- What Does A Real Estate Investor Do?

- How To Become A Real Estate Investor Step-By-Step

- 6 Best Ways To Become A Real Estate Investor

- How To Become A Real Estate Investor With No Money Or Bad Credit

- Do You Need To Become A Full-Time Real Estate Investor?

- Do You Need A License To Become A Real Estate Investor?

- Final Thoughts

*Before we begin our guide on how to become a real estate investor, we invite you to view our video on How To Get Into Real Estate With No Money! Host and CEO of Real Estate Skills, Alex Martinez, provides the perfect guide for beginners to invest in real estate using no capital of their own!

Join Alex Martinez at his FREE training to learn how to get started with house flipping and wholesaling!

What Is A Real Estate Investor?

In the most simple terms, a real estate investor is someone who buys property to generate capital. They do this by earning rental income from their investment properties or by selling a property after it has appreciated in value.

Real estate investors can choose to actively manage their properties or take a more passive approach by using property management companies or real estate investment trusts (REITs). Ultimately, all real estate investors seek to get the most profit from purchasing, managing, or selling properties.

Similar to other forms of investment, real estate investors provide the necessary capital for owning, co-owning, or managing real estate properties. Their motivations, backgrounds, and financing options vary widely, making the world of real estate investment as diverse as the properties themselves.

Within this vast domain, real estate investors wear many hats. Some are visionary entrepreneurs, others skilled tradespersons, and some are seasoned professional investors. Depending on their unique skill sets, investment objectives, and financial resources, they may choose from a spectrum of investment avenues.

Generally, real estate investors fall under two main categories: active investors and passive investors:

-

Active Real Estate Investment: Active real estate investors thrive on hands-on involvement. They may acquire investment properties and actively manage them. This can encompass renting out properties, engaging in house flipping ventures, or acquiring rental properties that require their diligent oversight.

-

Passive Real Estate Investment: On the other side of the spectrum, some investors prefer a more hands-off approach. They invest their capital in real estate partnerships or trusts, allowing them to tap into the world of real estate without the day-to-day responsibilities of property management. This passive approach grants them the benefits of cash flow and property appreciation while leaving the development, renovation, and operational aspects to others.

The world of real estate investment is not one-size-fits-all; it's a dynamic landscape where investors can sculpt their path to financial success.

Whether it's residential, commercial, industrial properties, or even vacant land, real estate investors navigate this landscape with a clear vision: to profit from the acquisition, management, or sale of properties.

They are the architects of wealth, shaping their financial futures one property at a time.

Read Also: How To Invest In Real Estate: 10 Best Ways To Start Building Wealth

What Does A Real Estate Investor Do?

A typical day-to-day for a real estate investor can vary widely depending on their chosen niche within the real estate market. Some may focus on property management, while others may be immersed in property flipping or portfolio management.

The key to success lies in a combination of strategic planning, adaptability, and a deep understanding of the real estate landscape. By mastering these skills and approaches, real estate investors aim to achieve financial growth and build wealth through property investments.

Real estate investors encompass a range of investment strategies, and their day-to-day activities often involve:

-

Property Acquisition: Real estate investors are constantly on the lookout for promising properties. This includes researching potential investments, attending property auctions, and networking with real estate agents to discover hidden gems.

-

Due Diligence: Before making a purchase, investors conduct thorough due diligence. This involves assessing the property's condition, evaluating its potential for improvement or renovation, and analyzing market trends to determine its potential return on investment.

-

Financing: Securing financing is a crucial aspect of real estate investing. Investors may work with lenders, mortgage brokers, or investors to arrange the necessary funds for property acquisition.

-

Property Management: For those who choose to rent out their properties, daily responsibilities often include managing tenant relationships, collecting rent, handling maintenance requests, and ensuring properties are in good condition.

-

Renovation and Improvement: Investors involved in property flipping may oversee renovations and improvements. This can entail hiring contractors, managing construction schedules, and monitoring budgets.

-

Market Research: Keeping a finger on the pulse of the real estate market is essential. Investors monitor market trends, property values, and economic indicators to make informed decisions.

-

Networking: Building and maintaining relationships with other real estate professionals, such as realtors, contractors, and property managers, is vital for success. Networking can lead to valuable insights and opportunities.

-

Financial Analysis: Regularly reviewing financial performance, calculating returns, and adjusting investment strategies is part of the ongoing process. Investors assess whether properties are meeting their income and growth targets.

-

Education and Continuous Learning: Real estate is an evolving field, and successful investors dedicate time to staying informed about industry developments, changes in regulations, and new investment strategies.

-

Problem Solving: Challenges often arise in real estate investing, from dealing with difficult tenants to unexpected property issues. Problem-solving skills are essential for navigating these situations effectively.

Read Also: 10 Real Estate Entry-Level Jobs For Beginners With No Experience

How To Become A Real Estate Investor Step-By-Step

If you've ever envisioned yourself as a real estate investor, navigating the path to success might initially seem like a daunting journey. Real estate offers lucrative opportunities, but it's a field that demands knowledge, strategy, and a strong foundation. Whether you're starting with a degree or not, there are key characteristics and steps that top real estate investors commonly embrace.

Real estate is a dynamic and competitive business that requires a blend of expertise, organization, networking, and unwavering perseverance. While formal education can certainly help, true mastery in this field often extends beyond the classroom. Understanding risks, seeking expert guidance, building a robust network, and making informed decisions are all integral aspects of becoming a successful real estate investor.

Now, let’s guide you through a step-by-step process on how to become a real estate investor, breaking down the essential components that can lead you to your goals in the realm of real estate investments:

-

Educate Yourself With A Real Estate Mentor

-

Decide On Your Investment Strategy

-

Research Your Market

-

Network With Real Estate Investors

-

Secure Your Funding

-

Make Your First Real Estate Investment

-

Track Performance & Adjust Accordingly

-

Diversify Your Portfolio

1. Educate Yourself With A Real Estate Mentor

Becoming a successful real estate investor begins with a strong foundation of knowledge and expertise. A real estate mentor is an invaluable asset to help you start this rewarding journey.

Real estate mentors are seasoned professionals within the real estate industry who serves as valuable guides and a support system for beginners embarking on their journey in the field.

These mentors leverage their extensive knowledge and firsthand experiences to share valuable insights and wisdom, helping new investors navigate the intricate landscape of real estate. More than just information providers, exceptional real estate mentors play a pivotal role in laying a strong foundation for success by offering personalized advice, profound insights, and practical investment strategies tailored to the specific goals of their mentees.

Real estate mentors can take on various forms, including coaches, seasoned investors who provide periodic guidance, or structured mentorship programs that offer comprehensive training and resources.

Ultimately, the foundation of any successful real estate investor begins with education, and to help embark on this journey, consider the invaluable guidance of a real estate mentor.

Before you decide on the right mentor for you, here's how to get started educating yourself in becoming a real estate investor:

-

Learn The Basics: As a new investor, it's essential to grasp the fundamentals of real estate. Online real estate classes can familiarize you with the industry's ins and outs. These courses can equip you with the knowledge needed to identify promising investment opportunities and avoid less favorable ventures.

-

Gather Information: Start by immersing yourself in the world of real estate. Conduct thorough research to understand the nuances of past and current real estate markets. Explore how individuals have generated wealth through real estate investments. Reputable online sources can provide preliminary information but consider going deeper.

-

Attend Real Estate Seminars: Take your education a step further by attending real estate investing seminars. These events offer detailed insights into the intricacies of real estate investment. You'll gain a comprehensive understanding of the process, time commitments, financial risks and rewards, and the daily routines of successful real estate investors.

-

Continual Learning: Education is an ongoing process in real estate investing. Keep yourself updated on market trends, property valuation techniques, and financing options. Read books, attend seminars, and stay connected with the ever-evolving industry.

Ready to take the next step in your real estate investing journey? Join us for our FREE Real Estate Investing Training led by CEO of Real Estate Skills, Alex Martinez! Don't miss this opportunity to gain valuable knowledge and insights from seasoned experts.

2. Decide On Your Investment Strategy

Once you've begun your real estate education journey and sought guidance from a mentor, the next pivotal step is to define your investment strategy.

Before you embark, define your financial goals and the strategy that aligns with them. Are you aiming to generate passive income, build long-term wealth, or both? Consider your risk tolerance, time horizon, and the amount of capital you're willing to invest.

Continue by researching the potential benefits and drawbacks of various active and passive real estate investing strategies. Understanding the intricacies of these strategies will empower you to make an informed choice. Several strategies exist, each catering to different skill sets, financial positions, and investment preferences.

Active Investment Strategies

If you possess skills like tradesmanship, design, and sufficient capital, you may consider active strategies like house flipping. House flipping involves purchasing properties in need of improvement and quickly reselling them for profit. Alternatively, those with construction expertise and access to bank funding might find success in the rental property market, where income is generated through property leasing.

Passive Investment Strategies

If you seek recurring cash flow and long-term property appreciation with a less hands-on approach, explore mostly passive strategies. These may include partnering with other investors or investing in professionally managed rental properties. Property management can be handled by experts, reducing the day-to-day involvement required.

And for those who prefer an even more hands-off approach, fully passive strategies include investing in real estate through crowdfunding platforms or Real Estate Investment Trusts (REITs). In these cases, you become a shareholder in a property or property portfolio, with professional management overseeing the investment.

No matter what you choose, your strategy should align with your unique strengths, resources, and aspirations, setting the stage for your journey toward financial success in the real estate market.

Your choice will ultimately shape your path as a real estate investor—so take your time and remain focused on what you want!

3. Research Your Market

Before diving into real estate investments, it's crucial to gain a comprehensive understanding of the market you intend to operate in. Market research will be the compass guiding your investment decisions.

Below are 5 expert tips for becoming a successful real estate investor with effective research:

-

Location Matters: Whether you're buying, renting, or investing in real estate, location is paramount. Understand that buyers and renters often have specific preferences, such as proximity to amenities, transportation, or the desire for more secluded environments. If your focus is on flipping or renting homes, your choice of location becomes even more critical.

-

Know Your Target Audience: To make informed decisions about location, research your target audience. Consider the demographics and preferences of potential buyers or tenants. Families with children, students, and young professionals, for example, may have varying location requirements. Investigate factors like school districts, proximity to nightlife, access to public transportation, and distance to colleges or universities to tailor your investments accordingly.

-

Understand the Local Market: To gauge whether you're getting a good deal, it's essential to grasp the dynamics of your local real estate market. Determine if property values are trending upward or downward. This insight helps you assess the potential for property appreciation. Next, understand the prevailing rental rates to evaluate the income potential of a property. Ensuring positive cash flow is vital. Finally, remember that success in real estate often hinges on the purchase price—avoid overpaying, as profitability is determined when you buy, not when you sell.

-

Stay Informed: Continuously conduct due diligence on the local market. Stay updated on housing market forecasts and real estate investment news. If you're interested in residential real estate, monitor up-and-coming neighborhoods, study what's available for sale, and pay attention to rental trends. For commercial real estate, assess factors like foot traffic and neighborhood profiles.

-

Learn Local Laws: Familiarize yourself with the local and state laws that govern real estate. Understanding these regulations is vital, especially if you plan to rent properties to the public. Consider aspects such as eviction processes, background checks on tenants, rental security deposit limits, and insurance coverage specific to rental properties. Complying with these laws can help you avoid potential problems and ensure smooth operations.

-

Leverage Resources: Use a variety of resources for market research, including real estate websites, local news outlets, government reports, and industry publications. Additionally, consider networking with local real estate professionals who have intimate knowledge of the market.

4. Network With Real Estate Investors

Building a robust network within the real estate industry is a crucial step toward your success as an investor. Networking isn't just about building relationships; it's about fostering a community that supports your growth as a real estate investor.

Through collaboration and shared expertise, you can navigate the complexities of real estate investment with greater confidence and success.

Here's how to effectively network with fellow investors:

-

Network With Experienced Investors: Initiate conversations with seasoned investors who can share their wealth of knowledge and experience. Engaging with successful investors can educate you on the best practices for your real estate investment strategy. They may provide practical tips for property management, share valuable insights into building an investment portfolio, and offer advice on diversification. Additionally, these interactions might lead to potential partnerships for future investment ventures.

-

Build Your Own Real Estate Network: Recognize the importance of creating a professional network that supports and challenges you. Your network can include mentors, business partners, clients, or members of real estate-focused organizations. This network serves as a valuable resource for seeking advice, sharing experiences, and exploring new opportunities. Real estate investment often involves experiential learning, and a well-established network can provide crucial guidance.

-

Continuously Expand Your Network: The world of real estate is dynamic, and staying connected with industry developments is essential. Continuously expand your network by attending industry events, participating in real estate investment clubs, and engaging in online forums. These platforms offer opportunities to connect with other investors, professionals, and mentors. By sharing experiences, knowledge, and insights, you can discover emerging opportunities, stay informed about the latest trends, and refine your skills.

Read Also: 11 Best Platforms For Your Real Estate Social Network

5. Secure Your Funding

Securing adequate funding is a crucial aspect of real estate investing. It ensures you have the financial resources needed to acquire and maintain properties effectively.

While renowned real estate investors may have capital readily available, most investors need to plan carefully to secure funding. It's essential to ensure you have access to plenty of working capital, especially because real estate investments can require more cash than initially anticipated.

Traditional loans, government loans, hard money lenders, and private money lenders are all commonly used options among investors.

Here are some key considerations before you secure your funding:

-

Plan on allocating at least 20% of the property's purchase price as a down payment, particularly for rental properties.

-

Set up a separate capital reserve account to cover repair and maintenance costs. This account helps you address unforeseen property expenses.

-

Consider the impact of vacancies on your cash flow. Factor in the time required to find new tenants when calculating your investment returns.

There are several ways beginning investors can gain capital for real estate and start investing without any money out-of-pocket!

Read Also: How To Get Investors For Real Estate: 10 Proven Strategies (2023)

6. Make Your First Real Estate Investment

After thorough preparation and securing funding, you're now ready to take the exciting step of making your first real estate investment. Begin by implementing the investment plan you've carefully developed. Ensure that your chosen real estate investment strategies align with your target audience's preferences and your location of choice. Whether you decide to invest in a trust, acquire a property for management or resale, or pursue other strategies, ensure that it's a reflection of your comprehensive business plan.

Actively seek out suitable investment opportunities. You can explore multiple avenues to identify potential investment properties. Leverage online platforms, collaborate with a trusted real estate agent, or tap into your professional network to discover lucrative real estate deals. When evaluating these properties, consider essential factors that profoundly impact their investment potential. These include their potential for appreciation over time, their cash flow potential, and the overall return on investment (ROI).

Once you've identified a promising property that aligns with your investment goals, it's time to make an informed offer. Collaborate closely with your real estate agent to craft a competitive offer that respects the interests of all parties involved. Negotiate terms that work in your favor while ensuring a fair transaction.

Conducting due diligence is a crucial part of the process. It involves thorough inspections, title searches, and financial analyses to confirm that the property meets your expectations and that there are no hidden issues or encumbrances. If the property successfully passes your due diligence, proceed to close the deal. This entails signing the necessary legal documents and transferring ownership to your name or the entity you've established for the investment. Be prepared to fulfill any financial requirements, such as down payments or closing costs.

With your first real estate investment successfully completed, you're officially on your way to building your investment portfolio. As you gain experience and expand your investments, continue to refine your strategies and adapt to the evolving real estate market. Each successful investment brings you one step closer to achieving your financial goals!

7. Track Performance & Adjust Accordingly

Once your real estate investment is up and running, it's essential to continuously monitor its performance and be prepared to make strategic adjustments as necessary. This ongoing assessment allows you to ensure that your investments align with your financial goals and adapt to the ever-evolving real estate landscape.

Start by calculating your earnings to gain a clear understanding of your investment's financial performance. This involves summing up your gross profits, which can encompass realized gains, unrealized gains, rental income, or proceeds from property sales. Then, subtract your total costs, which encompass initial investment expenses, repair and maintenance costs, advertising expenses, real estate fees, inspection fees, and any other financial outlays associated with acquiring or maintaining your investment properties.

Regularly reviewing the performance of your investment properties is crucial. Analyze key metrics such as cash flow, property appreciation, and overall return on investment (ROI). Evaluate whether your investments are meeting your financial objectives and consider whether adjustments are warranted. Stay vigilant about market trends and be ready to fine-tune your approach to seize new opportunities or mitigate potential risks. The real estate investing landscape is dynamic, and your ability to adapt your strategy is central to achieving long-term success in this rewarding field.

8. Diversify Your Portfolio

As your investments grow, it becomes increasingly important to embrace diversification as a strategic approach. Diversifying your investments entails spreading your capital across various property types, locations, and real estate investment strategies. By doing so, you can effectively mitigate risk and enhance your potential for favorable returns.

Diversification offers protection against market fluctuations and economic uncertainties, safeguarding your wealth. It also facilitates the creation of multiple income streams, enhancing the stability and resilience of your real estate portfolio.

Through prudent diversification, you can achieve a balanced investment portfolio that not only generates income but also strengthens your financial position over time.

Read Also: How to Start & Grow A Real Estate Business In 12 Steps

6 Best Ways To Become A Real Estate Investor

The real estate industry offers numerous entry points, each with its own set of advantages and considerations. Whether you're interested in low start-up costs, short timeframes, or substantial returns, exploring various strategies can help you find the right path.

Along with the short explanations you’ll find below, be sure to also review our in-depth articles that will fully explain how to invest in real estate using your chosen strategy.

Now, let’s dive into the best ways to become a real estate investor today:

-

Real estate wholesaling

-

Flipping houses

-

Investing in rental properties

-

Real estate investment trusts (REITs)

-

Commercial real estate

-

Real estate crowdfunding

Real Estate Wholesaling

Wholesaling real estate is an excellent method to not only acquaint yourself with a specific market but also generate income along the way.

Wholesaling involves the purchase of properties, typically foreclosures, at prices below market value and swiftly reselling them to eager buyers at a higher price point. The wholesaler achieves this by exerting control over the property through a Purchase and Sale Agreement, facilitating connections between motivated buyers and available properties, all without physically entering the premises.

This approach serves as an invaluable means to gain hands-on industry expertise and cultivate a network of willing cash buyers and sellers. Real estate wholesaling opens doors to opportunities for both learning and financial gain, making it an attractive entry point for aspiring investors.

Read Also: How To Wholesale Real Estate With No Money (2023)

Flipping Houses

House flipping presents a dynamic opportunity to swiftly generate substantial profits from an investment property. These strategies often yield impressive returns, typically ranging from 30% to 50%, in a mere 3 to 6 months, exclusive of closing costs.

The fix-and-flip approach involves an investor, aptly named a “flipper,” acquiring a distressed property, commonly a foreclosure, and revitalizing it for a quick and profitable resale. In this realm, the paramount factors contributing to successful real estate flipping are time and capital.

Flipping houses revolves around real estate investors securing the property at a discounted price, expeditiously completing the necessary renovations, and selling the property either at or above market value.

Subsequently, the flipper can embark on the next project, repeating this cycle. It's entirely plausible to purchase a $50,000 residence, invest $50,000 in renovations, and achieve a sale price of $150,000, all within a mere six-month timeframe!

Read Also: How To Flip Houses With No Money: 10 Proven Methods In 2023

Investing In Rental Property

Investing in rental property offers a compelling opportunity to establish a consistent stream of monthly income, even with limited upfront capital.

While some investors opt for short-term tenant arrangements through platforms like Airbnb and VRBO, the most prevalent and widely embraced method in this real estate niche is acquiring single-family homes and leasing them to long-term tenants. Leveraging a mortgage from a financial institution, investors can anticipate annual returns on investment (ROI) ranging from 6% to 12%. The core principle of this strategy lies in ensuring that the property's annual net operating income (NOI) surpasses all expenditures and accounts for potential vacancies throughout the year.

By adopting this approach, investors can create a reliable income stream while optimizing their ROI in the rental property market.

Read Also: Rental Property Calculator: How To Calculate Your ROI

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are another great way to break into the real estate industry, especially for beginners.

Multi-billion dollar companies led by experienced investors raise money in the capital markets to source various deals across the world. These companies buy, sell, and hold real estate in various trusts that trade on the stock market like any other stock at prices typically below $100 a share.

Any small-time investor looking to get exposure to a particular real estate sector, geography, or investment style can buy into one of these companies and participate in the company’s future growth. Some REIT operators are phenomenal asset allocators with industry experience and provide an easy opportunity to amass exceptional wealth while riding behind them.

As an added bonus, REITs are required to pay out a majority of their income to investors as dividends. Not only can you participate in the growing share price of these companies, but you can also enjoy a 5% to 15% dividend while you wait.

Commercial Real Estate

Commercial real estate encompasses a diverse range of property types, including multi-family units, industrial facilities, retail spaces, and office buildings. While these properties typically come with larger price tags compared to single-family homes, they offer substantial prospects for ambitious investors.

Even individuals with limited prior experience can tap into the world of commercial real estate by exploring various Triple Net Leases (NNN), especially in the Midwest region. NNN leases place the responsibility for covering all building-related expenses, including taxes, maintenance, and insurance, squarely on the tenant's shoulders, while the property owner enjoys a steady stream of rental income.

Though these properties are perceived as lower-risk investments, they often yield slightly lower returns. Nevertheless, with a down payment as modest as $50,000 to $60,000, investors can acquire cash-flowing properties boasting robust market values and high-caliber tenants, such as national restaurant chains or specialty retailers, translating to annual returns in the range of 6% to 8%.

Real Estate Crowdfunding

Crowdfunding stands out as an excellent avenue for acquiring passive exposure to real estate investment endeavors, minus the hands-on involvement.

Thanks to the passage of the JOBS Act during the Obama Administration, even unaccredited investors, those with less than a million in assets, gained access to crowdsourced investment opportunities.

Enterprises like Fundrise, Realty Mogul, and Holdfolio diligently scout for investment prospects, predominantly in the domains of commercial real estate investment and lending. They then extend an invitation to external investors to partake in these ventures, offering them a slice of the action. Now, any investor keen on diversification can secure a stake in a venture and assume a hands-off role while the property's performance unfolds.

Although specifics may vary across companies, the typical minimum investment requirement hovers around $500. With a mere $500 investment, one can become a partner in significant undertakings, such as a 100-unit multifamily project, an impressive self-storage complex, or even an extensive shopping mall renovation.

The possibilities are boundless, as are the potential returns; according to Fundrise, real estate crowdfunding has averaged 8.7% to 12.4% returns each year!

How To Become A Real Estate Investor With No Money Or Bad Credit

There are plenty of ways to develop an investment strategy in the real estate industry and achieve financial freedom despite having little to no money or bad credit.

One such investment strategy would be to form a partnership strictly designed for real estate investing using what’s called sweat equity.

A sweat equity partnership includes two or more partners investing in a real estate deal. Typically, one partner puts down the money for the investment and the other “pays” his or her share by managing the property to achieve the desired return.

Depending on the agreed-upon structure, the manager will typically get 25%-50% of the profits in exchange for their sweat equity - i.e. the work they put into the investment.

Another great way to invest in real estate with no money down is to work in wholesaling.

As mentioned above, real estate wholesaling is connecting buyers and sellers of real estate and pocketing the price difference.

It is a great way to build a network and learn a particular market, all while building up a strong cash reserve for the next opportunity.

Read Also: How To Start Investing In Real Estate With No Money (2023)

Do You Need To Become A Full-Time Real Estate Investor?

You don’t have to own a real estate business and become a full-time investor to be a successful real estate investor. The beauty of wholesaling, fixing and flipping, and managing rentals is that they can be done on the side - with limited time commitments.

By hiring an exceptional team around you, including property management companies, general contractors, and experienced real estate brokers, and utilizing smart systems and software, your real estate investing ventures can be part-time and hands-off.

Yes, if you want to maximize the amount of cash generated from real estate, full-time is the way to go. But, if you want to manage 3-5 rentals, work on 1-2 flips a year, and wholesale a few properties here and there you don’t need to be a full-time investor.

The beautiful thing about real estate is that you can grow it as large or small as you want, to meet your own personal financial and lifestyle goals.

Read Also: 10 Best Real Estate Side Hustles To Make Money Part-Time

Do You Need A License To Become A Real Estate Investor?

A licensed real estate individual typically refers to a real estate agent who can help investors buy and sell both residential and commercial properties.

While a noble pursuit, getting a real estate license is not required to invest in real estate.

Real estate licenses and certifications are a great way to gain access to real estate market information, trends, and prices. However, unless you want to simply broker a deal, work for a brokerage firm, gain a commission for your work, and walk away, being a real estate agent is not the way to go.

The only thing an aspiring investor needs to crack into the industry is some will, determination, and some basic algebra. Ask yourself:

- How much money will it take to purchase this property and get it leased up?

- If I renovate this building, what is the expected price it can achieve if I were to sell it?

- What are my expenses and month-to-month cash flow?

By answering these questions you’ll already be halfway there. You don’t need a license to be a titan in the industry.

Final Thoughts On Becoming A Real Estate Investor

Real estate has proven to be a tremendously enriching industry to tap into. Wholesaling, fix and flips, rentals, REITs, and crowdfunding are all good investments and great ways to get involved and generate financial freedom.

There are a tremendous amount of resources available to you through coaching, mentoring, podcasts, articles, and courses.

If you want to jumpstart your career today, attend our FREE training course on real estate investing! Take the plunge. You’ll be happy you did, you’ll hit your financial goals, and you could even turn into the best real estate investor out there.